Operators see ways to untangle the U.S. oil and gas industry from regulatory red tape under a second Trump administration, according to the Dallas Fed Energy Survey. (Source: Shutterstock.com)

U.S. oil and gas firms are encouraged by President-elect Donald Trump’s election victory, according to the Dallas Fed’s latest survey findings. But they’re also being realistic about what could be a bumpy 2025 for oil and gas prices.

While operators see opportunities to untangle regulatory red tape during a second Trump administration, the commander in chief has less sway over global oil and gas prices. Commodity prices, ruled by a broad mix of economics, geopolitics, the weather and other nations—China and OPEC members—have producers fretting. Natural gas’ lackluster 2024 performance remains a particular sore point for both gas- and oil-focused E&Ps.

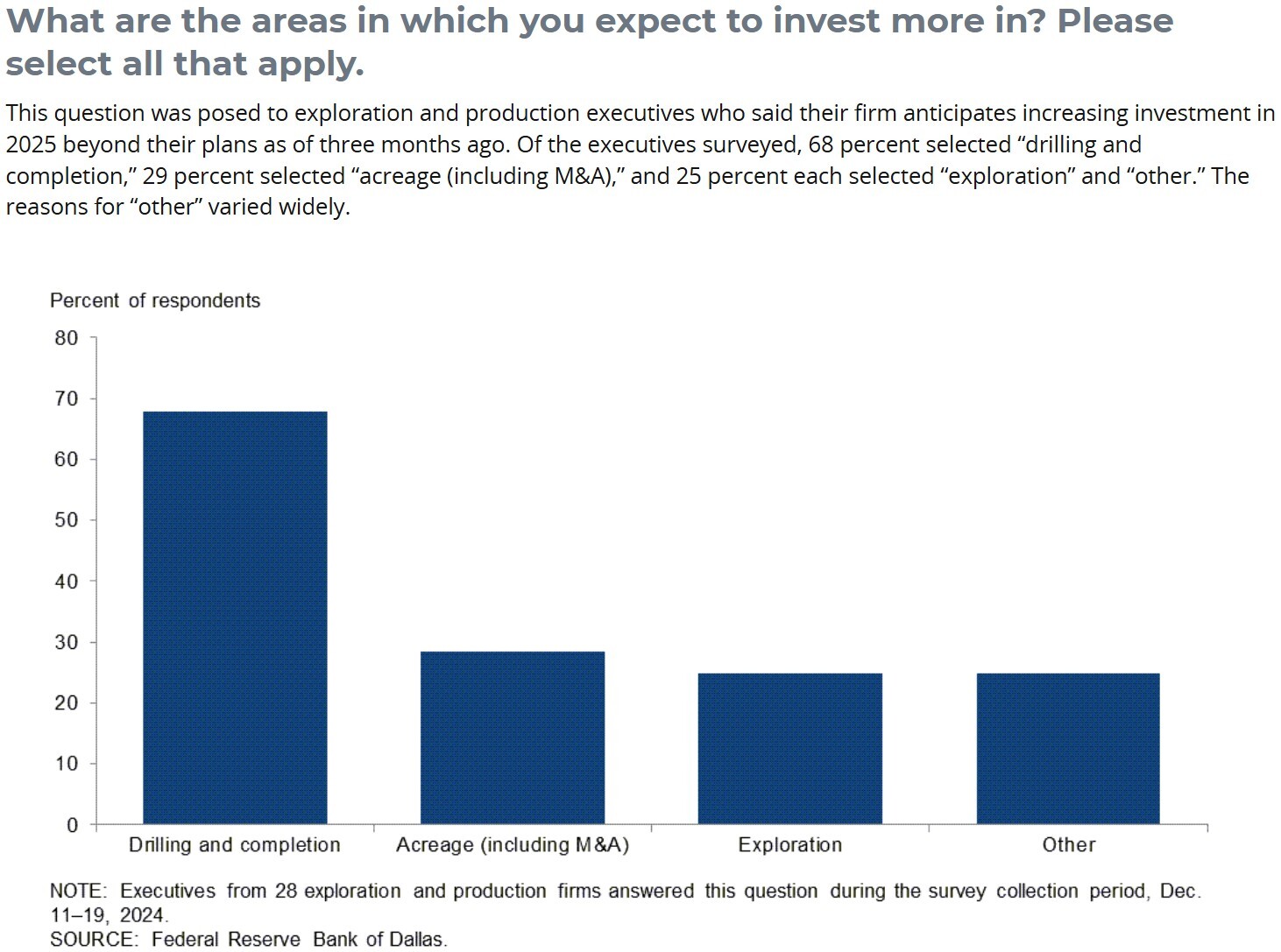

The Federal Reserve Bank of Dallas’ quarterly energy survey is a broad measurement of sentiments across a large swath of the U.S. oil and gas sector. The Dallas Fed’s fourth-quarter survey, published Jan. 2, includes responses from 134 E&Ps and service company executives based in Texas, southern New Mexico and northern Louisiana. Survey responses were collected between Dec. 11 and 19.

Overall sector activity increased slightly in the fourth quarter: The survey’s broadest measurement, the business activity index, increased from -5.9 in the third quarter to 6.0 in the fourth quarter.

The increasing sentiment can be attributed in part to the changing political landscape, E&P executives told the survey.

“The new administration should have a positive effect on the economy, thus lifting the oil industry,” one executive said.

By and large, survey respondents believe a second Trump presidency will eliminate regulatory compliance hurdles and encourage development of new oil and gas projects.

Most executives expect permitting times to drill wells on federal lands to improve over the next four years; 33% of respondents expect to see significantly faster federal permitting timelines.

Industry experts also say the new administration will likely lift a federal pause on approving new LNG export projects.

President Joe Biden formally paused approvals for new LNG export projects in January 2024, slamming the brakes on billions of dollars of investment by energy companies.

When announcing the pause, the Department of Energy (DOE) called for an updated analysis of the environmental, economic and national security implications of new LNG export authorizations.

When the long-awaited report was published in December, the DOE said that the “astounding” ramp-up in U.S. LNG exports would increase domestic natural gas prices and greenhouse gas emissions. But the report stopped short of saying new projects were not in the best interest of the public—a key consideration in greenlighting a project to move forward.

U.S. producers are looking at LNG as a profitable outlet for bountiful natural gas output. An oversupply of gas production, elevated storage inventories and weaker-than-expected demand have kept commodity prices depressed since early 2023.

“We need restrictions to be lifted for selling LNG to overseas buyers so that demand for natural gas will increase the prices we receive,” one executive said.

RELATED

DOE: ‘Astounding’ US LNG Growth Will Raise Prices, GHG Emissions

Price movement

Producers see greater regulatory stability on the horizon, but their outlook for commodity prices is a little shakier.

“The change in political landscape is helpful insofar as regulations, but it appears that crude oil prices are headed down,” one executive said.

Executives are using an average WTI price of $68/bbl ($70/bbl median) as they plan out 2025 budgets.

That’s slightly below the average price of $71/bbl respondents used to set their 2024 budgets, the Dallas Fed said.

WTI spot prices averaged $76.63/bbl during full-year 2024, down from $77.58/bbl in 2023 and $94.90/bbl in 2022, according to U.S. Energy Information Administration data.

U.S. crude prices averaged $70.12/bbl in December.

Longer term, producers are more optimistic. Executives expect WTI to average $74/bbl in 2027 and $80/bbl in 2030.

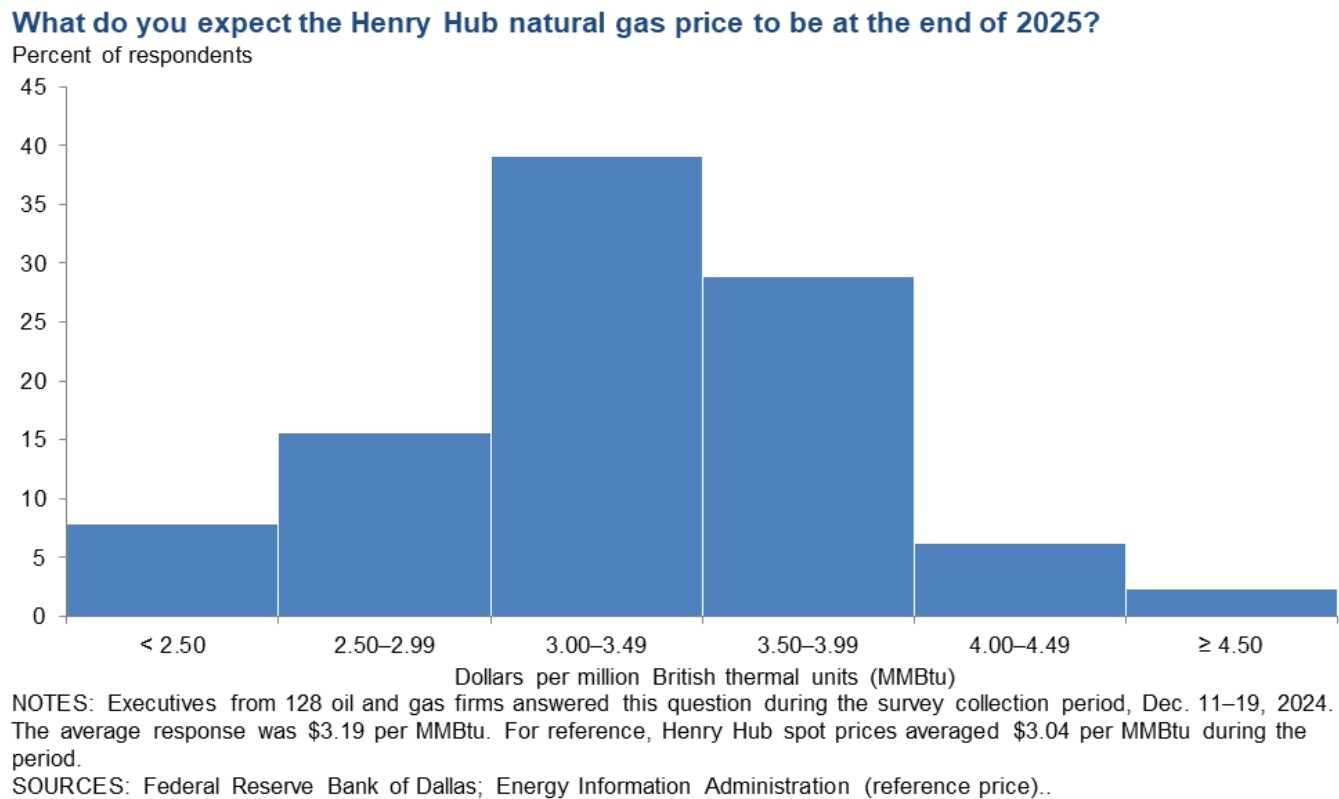

On natural gas, respondents predicted Henry Hub spot prices would average $3.19/MMBtu by year-end 2025.

Henry Hub averaged $2.19/MMBtu in 2024, down from $2.53/MMBtu in 2023 and $6.45/MMBtu in 2022, per EIA figures. Prices have recently spiked as markets have reacted to expected freezing weather, sending prices to $4/MMBtu on Dec. 30.

Executives continued to lament the state of U.S. natural gas in the Dallas Fed’s fourth-quarter survey:

“The continued weak natural gas market in areas of primary production is a significant drag on revenue,” one said. “Negative gas charges (gas disposal fees) are as high as 15 percent of oil revenue on one lease in New Mexico.”

“The low price for natural gas is crushing current cash flow,” said another. “For smaller independents, cash flow is what feeds future investment.”

Producers in gas-heavy regions, like the Appalachian Basin and the Haynesville Shale, have been curtailing dry gas output and deferring well completions as prices have bottomed out.

But in the Permian Basin, associated gas output continues to grow, pressuring a market already oversupplied and frequently in 2024 sending natural gas prices at the West Texas Waha Hub into negative territory.

RELATED

Recommended Reading

Baker Hughes: US Drillers Keep Oil and NatGas Rigs Unchanged for Third Week

2024-12-27 - U.S. energy firms this week operated the same number of oil and natural gas rigs for third week in a row.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-01-10 - The oil and gas rig count fell by five to 584 in the week to Jan. 10, the lowest since November.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

US Oil and Gas Rig Count Rises to Highest Since June, Says Baker Hughes

2025-02-21 - Despite this week's rig increase, Baker Hughes said the total count was still down 34, or 5% below this time last year.

US Drillers Cut Oil, Gas Rigs to Lowest Since December 2021, Baker Hughes Says

2025-01-17 - The oil and gas rig count fell by four to 580 in the week to Jan. 17.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.