The original cotillion was an 18th century social dance that involved four couples dancing simultaneously, often changing partners throughout the song. As commodity prices change, a modern day market dance has investors examining how movements affect MLPs.

While MLPs with a toll-road business model (tariff X volume) or take-or-pay contracts are insulated from direct exposure to commodity prices, MLPs can be affected by a sustained price move in either direction.

At very low prices, producers will shut in current production and delay drilling new wells, reducing volumes moving through infrastructure assets. This scenario, which lowers revenues on those assets or raises future recontracting risk, has played out in the Haynesville and Fayetteville, which are primarily dry gas fields.

At very high prices, consumers will begin to cut back on consumption, reducing volumes to demand centers. Both of these are mitigated to some extent: Mineral rights land leases often include minimum production requirements, pushing producers to operate at prices below marginal cost over the short term. And U.S. energy demand has a floor based on the necessity to heat northern homes in the winter, cool southern homes in the summer, turn the lights on and drive to work, regardless of how high prices go. Both phenomena should also be self-correcting over the long term: Lower prices reduce production volumes, curbing supply and creating an imbalance corrected by higher prices. Higher prices have the exact opposite effect.

But cash flow streams are a different matter entirely than stock prices, as the latter are decided by the market.

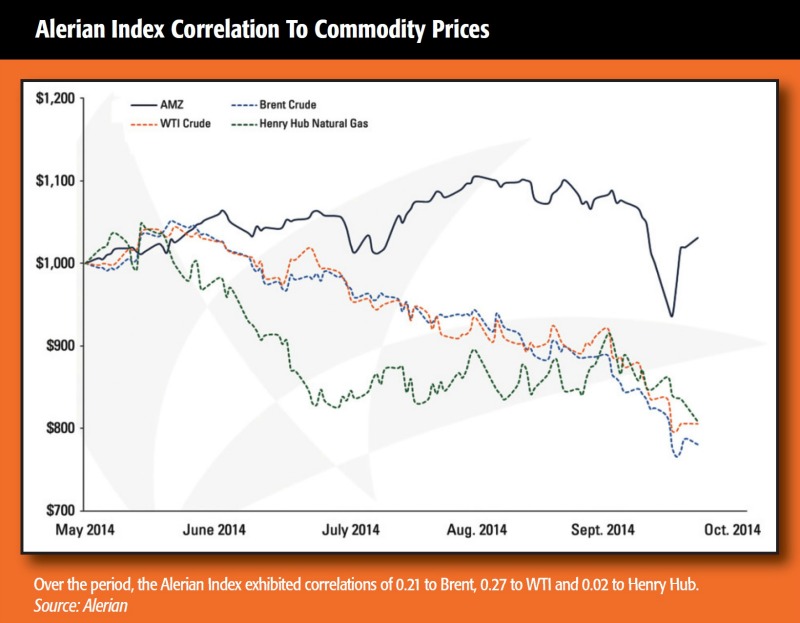

In an efficient market, prices are informed by the fundamentals of the underlying businesses. In reality, investor psychology, cognitive and emotional biases and broader market contagion also play a role. Shorter-term investors may trade MLPs based on fear of headline risk of moving commodity prices. That certainly appeared to be the case during the first two weeks of October, when West Texas Intermediate (WTI) fell 10% and MLPs, as represented by the Alerian MLP Index, tumbled 14%.

But over even slightly longer periods, like the five-month window represented in the graph that begins with crude’s current slide, MLPs exhibit a weak correlation to WTI, as well as to Brent and Henry Hub. Also noteworthy is the sharp bounce in MLPs following their drop despite little additional movement in commodity prices.

Producers and oil field service companies are dancing with commodity prices. Where commodities lead, they follow. MLPs, on the other hand, are the band, and they provide the music regardless of whether the dancers waltz or cha-cha. If energy be the soul of industry, play on!

Recommended Reading

Dividends Declared Week of Feb. 17

2025-02-21 - 2024 year-end earnings season is underway. Here is a compilation of dividends declared from select upstream, midstream, downstream and service and supply companies.

Viper Makes Leadership Changes Alongside Diamondback CEO Shakeup

2025-02-21 - Viper Energy is making leadership changes alongside a similar shake-up underway at its parent company Diamondback Energy.

Diamondback’s Stice to Step Down as CEO, Van’t Hof to Succeed

2025-02-20 - Diamondback CEO Travis Stice, who led the company through an IPO in 2012 and a $26 billion acquisition last year, will step down as CEO later this year.

SM Energy Restructures Leadership Team

2025-02-20 - SM Energy Co. has made several officer appointments and announced the retirement of Jennifer Martin Samuels, the company’s vice president of investor relations and ESG stewardship.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.