The disconnect between technology innovation and technology deployment is long-standing but perhaps comes into sharper focus in the context of low oil prices. As the availability of “easy oil” becomes scarcer, there is broad consensus that technology must be pivotal in increasing recoverable oil in existing areas, helping identify and harvest oil in less accessible areas and driving down costs in general.

The oil price downturn has impacted spend on R&D and innovation projects. As well as absolute R&D spend, return on R&D/technology investment is being questioned across the industry. A key area under the spotlight is deployment and commercialization. Whereas companies tolerated underperformance during the good times, they are now coming under fire, and greater efficiency and effectiveness are being demanded.

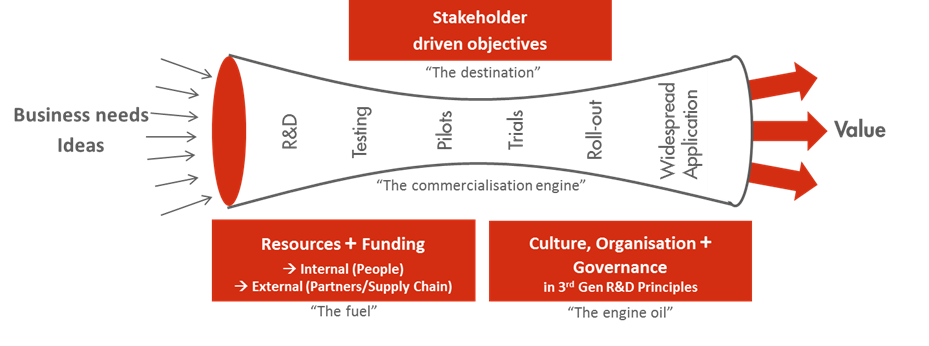

Figure 1 shows the key to being a highly successful commercialization organization. It tackles the right R&D and technology that satisfies its key stakeholders; it ideates, innovates and develops, maturing through R&D funnel de-risking technically and commercially in a timely fashion. It then flawlessly and rapidly monetizes through trials and widespread application and has the right internal capabilities combined with adequate and consistent funding as well as the right external partners aligned and incentivized to innovate.

And gluing everything together, it has culture and governance that creates partnerships, optimizes value, creates the right horizon view and delivers the appropriate appetite for innovation risk aligned to the company’s objectives.

It will come as no surprise that obtaining simultaneous excellence across all these areas is incredibly hard to achieve. And failures become more apparent in times of greater scrutiny and demand for clearly demonstrated value.

Three key areas that need to be tackled within the industry are highlighted, potentially with game-changing solutions, all under the theme of aligning horizons where time and value-creation horizons in portfolios are considered, corporate objective horizons are identified in first deployments and aligned end-game horizons with external partners are optimized.

Aligning horizons in R&D portfolios

Questions are rightly being asked about what it means to operate in a long-term low oil-price environment in terms of R&D and long-term innovation. OTM’s research indicates that technological leaders seldom are the most efficient operationally; more typically, leaders are pushing industry boundaries in terms of resource access (which in itself is often more expensive to develop).

While technology has a role to play in short-term cost reduction, for example, data analytics for operational efficiency and accelerating learning curves (see BP’s Technology Outlook, November 2015), its impact in the short term will be smaller than supply chain efficiencies. Understanding the future business scenarios and aligning enabling R&D/technology is instead where companies should be focusing rather than shifting portfolios to short-term fixes.

Aligning horizons in corporate drive

Technology early-application “valleys of death” are being exacerbated, resulting in delayed and slowed innovation. The cost and risk associated with being the first asset manager to apply or trial a new technology in his/her well/field is often too high to be taken in isolation. In fact, it is the corporation as a whole that will benefit from successfully proven technologies that can be leveraged over a global asset base.

Companies need to find new ways (or revisit old ways) of motivating the early uptake of technology and instilling a culture of innovation, particularly when the full benefit of the technology will be realized in subsequent applications and ultimately from applying it throughout the organization. By correctly understanding value generation early in development, companies are then able to ensure it is secured through commercialization as well as deployment.

The commercialization engine drives a highly successful commercialization organization. It tackles the right R&D and technology that satisfies its key stakeholders. (Source: OTM Consulting)

The commercialization engine drives a highly successful commercialization organization. It tackles the right R&D and technology that satisfies its key stakeholders. (Source: OTM Consulting)

Aligning horizons in external relationships

In a downturn, particularly an anticipated long, deep one, the pressure always comes to outsource more R&D and technology development. Indeed, we’ve seen an upturn in technology and research strategic alliances between oil companies and service companies in the last 12 months as an indicator of this. However, a simple corporate mandate can become increasingly difficult to implement effectively to deliver significant value back to the company via innovation in a timely manner.

Strategic bridging roles within procurement departments are now appearing; these are needed to be able to implement effectively as it is often now too complex for R&D to handle on its own. The critical component to success is to think strategically about relationships and about how the “end game” with external relationships will play out.

With R&D and technology considered invaluable for future success and yet under pressure to deliver increased value, aligning horizons in 2016 across R&D organizations will be the key to successful commercialization and widespread deployment. That is the only way for R&D and technology investments to actually realize their value.

Recommended Reading

Crescent Energy Closes $905MM Acquisition in Central Eagle Ford

2025-01-31 - Crescent Energy’s cash-and-stock acquisition of Carnelian Energy Capital Management-backed Ridgemar Energy includes potential contingency payments of up to $170 million through 2027.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Elk Range Acquires Permian, Eagle Ford Minerals and Royalties

2025-01-29 - Elk Range Royalties is purchasing the mineral and royalty interests of Newton Financial Corp., Concord Oil Co. and Mission Oil Co.

M&A Target Double Eagle Ups Midland Oil Output 114% YOY

2025-01-27 - Double Eagle IV ramped up oil and gas production to more than 120,000 boe/d in November 2024, Texas data shows. The E&P is one of the most attractive private equity-backed M&A targets left in the Permian Basin.

Apollo Funds Acquires NatGas Treatment Provider Bold Production Services

2025-02-12 - Funds managed by Apollo Global Management Inc. have acquired a majority interest in Bold Production Services LLC, a provider of natural gas treatment solutions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.