After a smaller-than-expected build to the nation’s natural gas storage and news of snow in some parts of the country, natural gas futures jumped 7% on Oct. 25.

But analysts say the picture for natural gas this winter is unchanged: overall U.S. storage levels will remain above the five-year average and prices should remain stable heading into spring. The Henry Hub natural gas price opened on Oct. 31 at $3.36 per MMBtu.

U.S. natural gas production is at an all-time high, and there does not appear to be any imminent threats to the level of gas storage over the winter, Andrew Fletcher, senior vice president of commodity derivatives at KeyBank National Association, told Hart Energy.

On Oct. 25, the U.S. Energy Information Administration released the natural gas storage report for the week ending Oct 20. Week-over-week, inventories rose 74 Bcf to 3,700 Bcf.

The net result came in 6 Bcf shy of a Bloomberg Survey forecasting an 80 Bcf build. The miss — and forecasts for colder temperatures in the U.S. over the next two weeks — caused front-month futures to rise $0.204 to $3.214 per MMBtu, a two-week high.

But Fletcher said those monitoring the state of the natural gas market should focus not on the weekly results but on the average over time. The current level of storage of 3,700 Bcf is 323 Bcf higher than at the same time last year and higher than the five-year average of 3,517 Bcf.

According to the American Gas Association (AGA), the gas storage situation is also positive in all five sub-U.S. regions the organization tracks.

“Not only is gas storage above average nationally, but every area of the country is above average,” said Richard Meyer, AGA’s vice president for Energy Markets, analysis and standards.

The storage numbers are just part of the overall picture of a strong natural gas production cycle, he said. At the release of its Winter Heating Outlook for 2023, AGA reported the industry is seeing record-high numbers in production, demand, exports and consumers.

Elevated natural gas demand doesn’t seem to be on the horizon, analysts said. LNG exports are close to maximum levels, Fletcher said, and despite some regional cold snaps, the current weather forecast calls for a warmer-than-average winter in the areas that rely mostly on natural gas for heating.

“A lot of people will roll their eyes to the back of their heads when we talk about El Niño, but it is the information we have,” Fletcher said.

The National Oceanic and Atmospheric Administration published an El Niño advisory on Oct. 23.

Every El Niño is different, but the effect is generally drier and warmer than normal for the northern half of the continental U.S. and stormier in the southern half, said Jack Weixel, senior director at East Daley Analytics, who focuses on natural gas commodities. Heavy gas consuming areas in the U.S. include the Pacific Northwest, the Midwest and New England as far down as New York City.

“Those areas could very well be warmer than normal this winter,” Weixel said. A warm season will keep gas supplies up and prices level, for the near term.

Several other factors besides weather may also affect the natural gas market for the winter. For the last few years, shuttering coal-fired power plants has increased the demand for natural gas to produce electricity. This winter, U.S. coal supplies are at their highest levels in over a decade. Utilities will therefore have more options to choose from for power generation.

“Some of the constraints may be removed for gas/coal switching,” Meyer said.

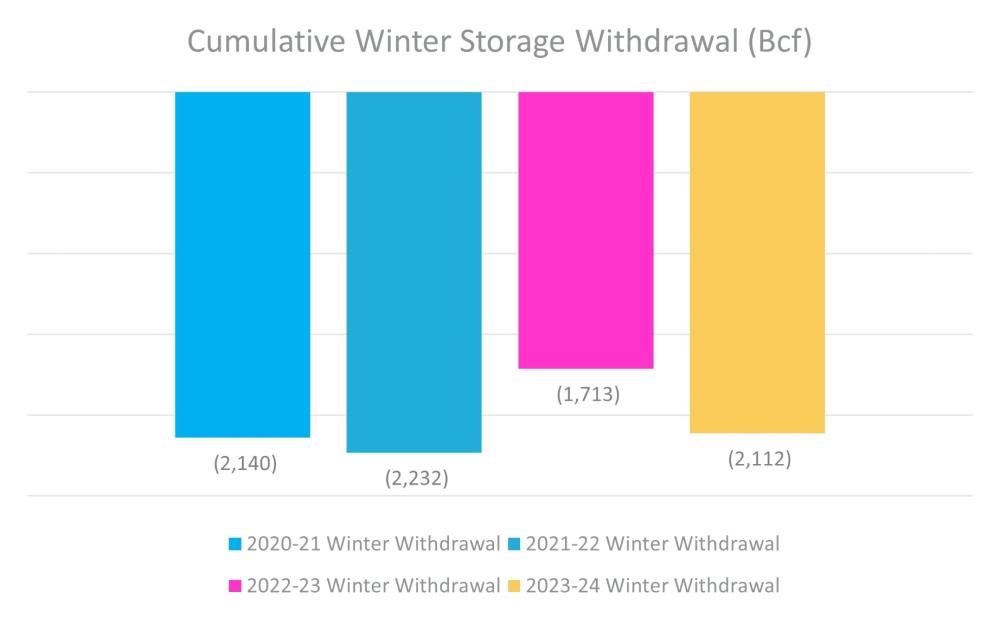

According to EDA’s analysis, an average of 2.1 Bcf/d was pulled out of storage during the winters of 2020-21 and 2021-22. During last year’s warmer-than-average cold season, 1.7 Bcf/d of natural gas was removed from storage.

If the warmer forecast is correct, Weixel said he expects production to gradually fall off from the all-time highs of the last year to stabilize prices.

“It will definitely be a different type of environment from fiscal year 2023,” he said.

On the commercial level, residential natural gas consumers may also see lower utility bills. The AGA surveyed utility bill charges for natural gas and found a general drop in prices as commodity prices retreated.

“We’re seeing that bills could be lowered by 21% this winter,” said Brandan O’Brien, director of energy markets for the AGA. “So that could be some good news for consumers.”

Recommended Reading

Crescent Energy Closes $905MM Acquisition in Central Eagle Ford

2025-01-31 - Crescent Energy’s cash-and-stock acquisition of Carnelian Energy Capital Management-backed Ridgemar Energy includes potential contingency payments of up to $170 million through 2027.

Petro-Victory Buys Oil Fields in Brazil’s Potiguar Basin

2025-02-10 - Petro-Victory Energy is growing its footprint in Brazil’s onshore Potiguar Basin with 13 new blocks, the company said Feb. 10.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Apollo Funds Acquires NatGas Treatment Provider Bold Production Services

2025-02-12 - Funds managed by Apollo Global Management Inc. have acquired a majority interest in Bold Production Services LLC, a provider of natural gas treatment solutions.

DNO to Buy Sval Energi for $450MM, Quadruple North Sea Output

2025-03-07 - Norwegian oil and gas producer DNO ASA will acquire Sval Energi Group AS’ shares from private equity firm HitecVision.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.