Hydrogen Council CEO Ivana Jemelkova discusses the state of hydrogen Sept. 17 at the Gastech conference in Houston. (Source: Velda Addison/Hart Energy)

Incentives, industrial policy and demand-side visibility have pushed the amount of capital committed to hydrogen projects up sevenfold to $75 billion in the past four years, according to a report released this week by the Hydrogen Council.

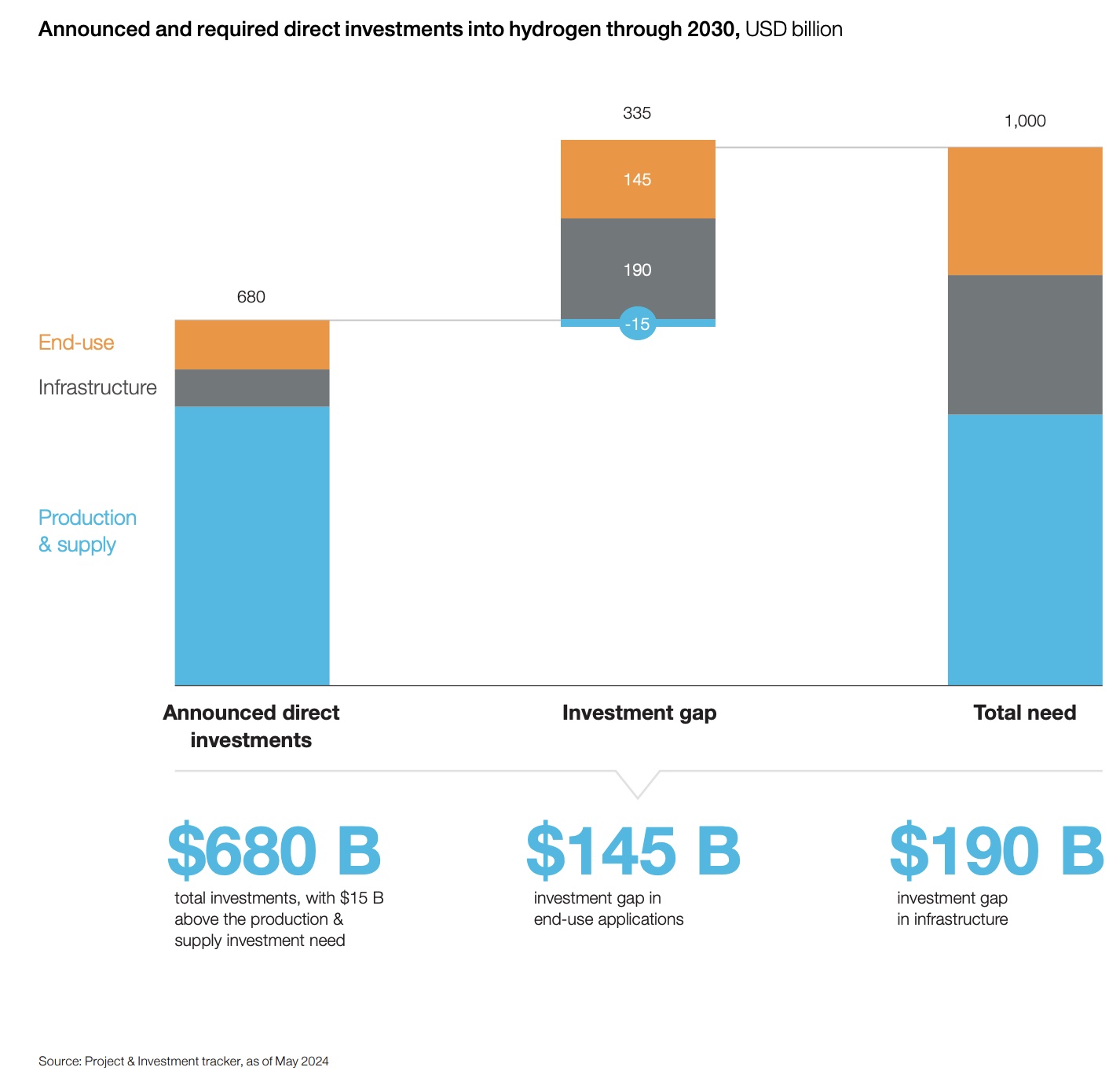

However, a $335 billion investment gap may put 2030 targets toward net-zero ambitions in jeopardy.

“Some will see the glass half full and some will see the glass half empty. It’s not an easy time,” Hydrogen Council CEO Ivana Jemelkova said Sept. 17 during the Gastech conference in Houston. “Both things can be true. Some things are going well, and some things are not going well.”

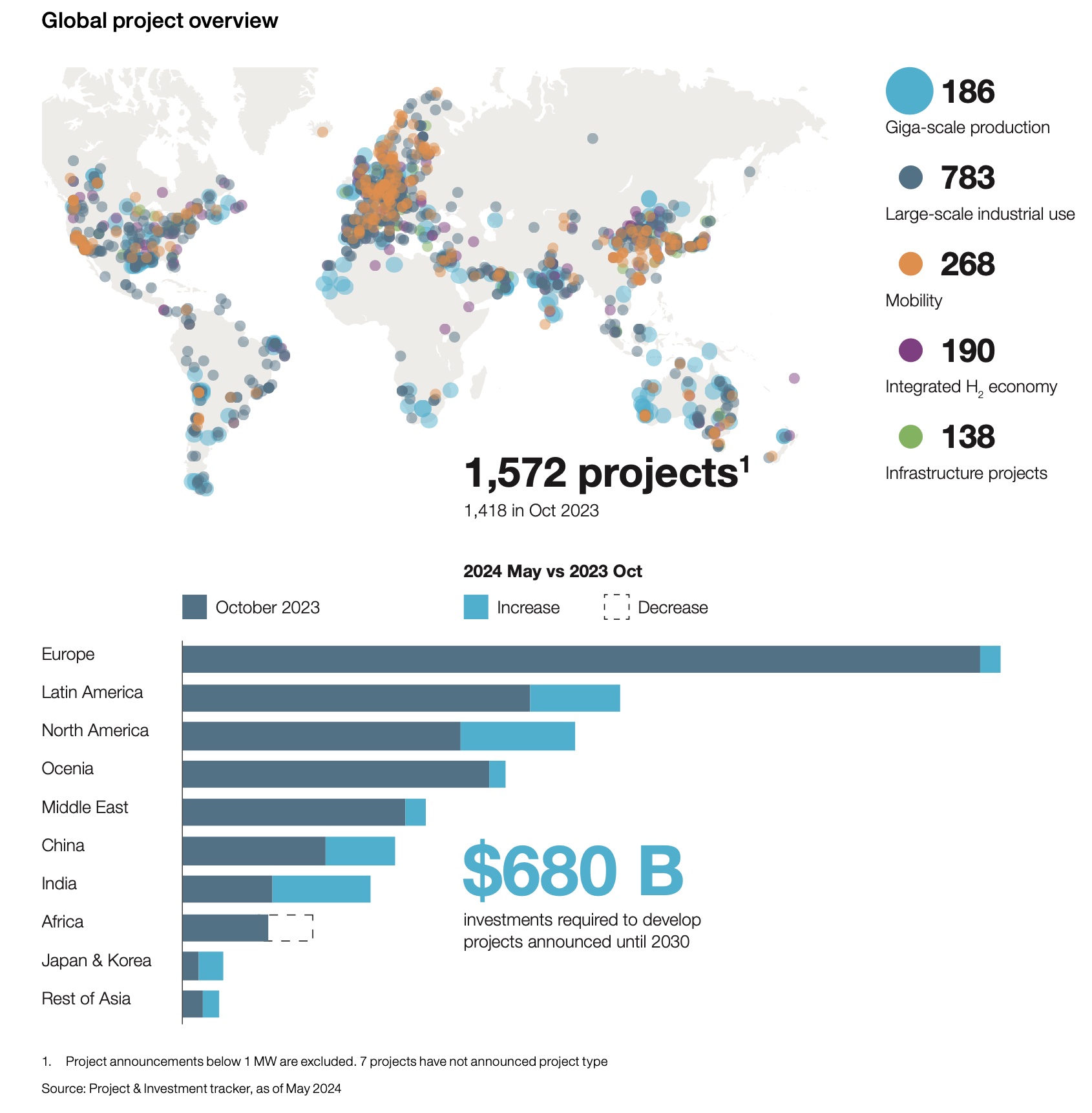

The latest Hydrogen Insights report, co-authored by McKinsey & Co., showed companies have shifted gears since last fall, moving from project planning into implementation. The number of projects with committed final investment decision (FID), under construction or operational, increased 90% to 75 between October 2023 and May 2024. The increase was reported alongside a 30% jump in projects in the FEED stage as the global project pipeline climbed to 1,572.

“That is significant. That is showing us that projects are moving forward. But I will add a caveat here. Strong projects are moving forward. All of this is obviously coupled with natural attrition. Not every project will survive from idea, concept, announcement, all the way to execution,” Jemelkova said. “And that’s important to say. But there’s nothing dramatic here. The success rates of projects are very comparable to other clean energy technologies at this stage of maturity. So, when we look back at the trajectories taken by solar and wind, the story is very familiar.”

Hydrogen is viewed as a promising way to decarbonize hard-to-abate sectors, such as steel and cement, while also serving as a low-emissions alternative in other areas such as transportation and energy storage. Its environmental positives and versatility as an energy source are among its appeal to companies and countries aiming to reach net-zero emissions targets. But it has headwinds to overcome.

‘Sobering realities’

The sector is facing some sobering realities, Jemelkova said, noting some are not only specific to hydrogen.

“It’s a complex time for the energy transition because we are facing all kinds of headwinds, macroeconomic headwinds,” she said. “Clean energy [is] being affected by inflation, interest rates, geopolitics, supply chain constraints, you name it. There are many.”

For hydrogen, there are regulatory uncertainties. In the U.S., for example, hydrogen players are still awaiting finalized rules for the Inflation Reduction Act’s hydrogen production credit known as 45V. Several companies are hesitant to move forward with billion-dollar hydrogen projects without clarity. Stimulating demand for hydrogen when less expensive options are available is also of concern.

Although some countries have hydrogen strategies in place, “not all of them have translated into real and workable and practical regulations. And that is a dangerous place to be because, you know, on paper it’s all there,” Jemelkova said. “But in reality, we are missing some of the key building blocks, and that is a real obstacle. So, addressing that will be absolutely key to the success of hydrogen going forward.”

The cost of renewables is also impacting the pace of development for electrolytic hydrogen projects. Low carbon hydrogen projects are picking up, while renewable hydrogen projects have not crossed the line to FID, Jemelkova said, calling the 45V an example of a missing basic building block. “That is a big challenge.”

Not on track

Still, investments through 2030 announced by companies increased to $680 billion, up from $570 billion. However, more projects are needed to get in line with a net-zero scenario, according to the report.

The investment gap of $335 billion is 10% lower than the report’s previous publication in December 2023.

“Growth in announced hydrogen supply projects continues to outpace end-use and infrastructure investments, accounting for more than 75% of total announced investments (growth of about USD 70 billion since previous publication),” according to the report. “This means that for the first time announced investments in a category surpass their 2030 target. Production and supply investments are USD 15 billion above estimated net-zero requirements, assuming that all announced projects become operational.”

A 60% investment gap of $145 billion was reported for end-use applications, while a 75% investment gap of $190 billion was reported for hydrogen infrastructure.

“Despite that undeniable progress, seven times growth, … we’re not on track to deliver on our climate goals. Again, that is not true just for hydrogen. That is true for the energy transition as a whole,” Jemelkova said. “In fact, to get there, we would need another eight times jump. So remember, we just did it seven times in three years that we would need another eight times until 2030. That is not completely out of question. But unless something changes, we don’t quite see the dynamic …to make it happen.”

The call to action included: joint efforts by governments and industry within the next two years to address issues holding back project execution, finding ways to better align supply and demand and enabling infrastructure.

The analysis showed that 12 million tonnes per annum to 18 million tonnes per annum of clean hydrogen production will likely be operational by 2030.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.