Weatherford reported a softer North America market but strong overseas growth, leading the company’s board to authorize its first share buyback program and first quarterly dividend. (Source: Shutterstock)

Weatherford continued to benefit from international and offshore momentum despite a general slowdown in North American activity, according to company executives and analysts’ commentary.

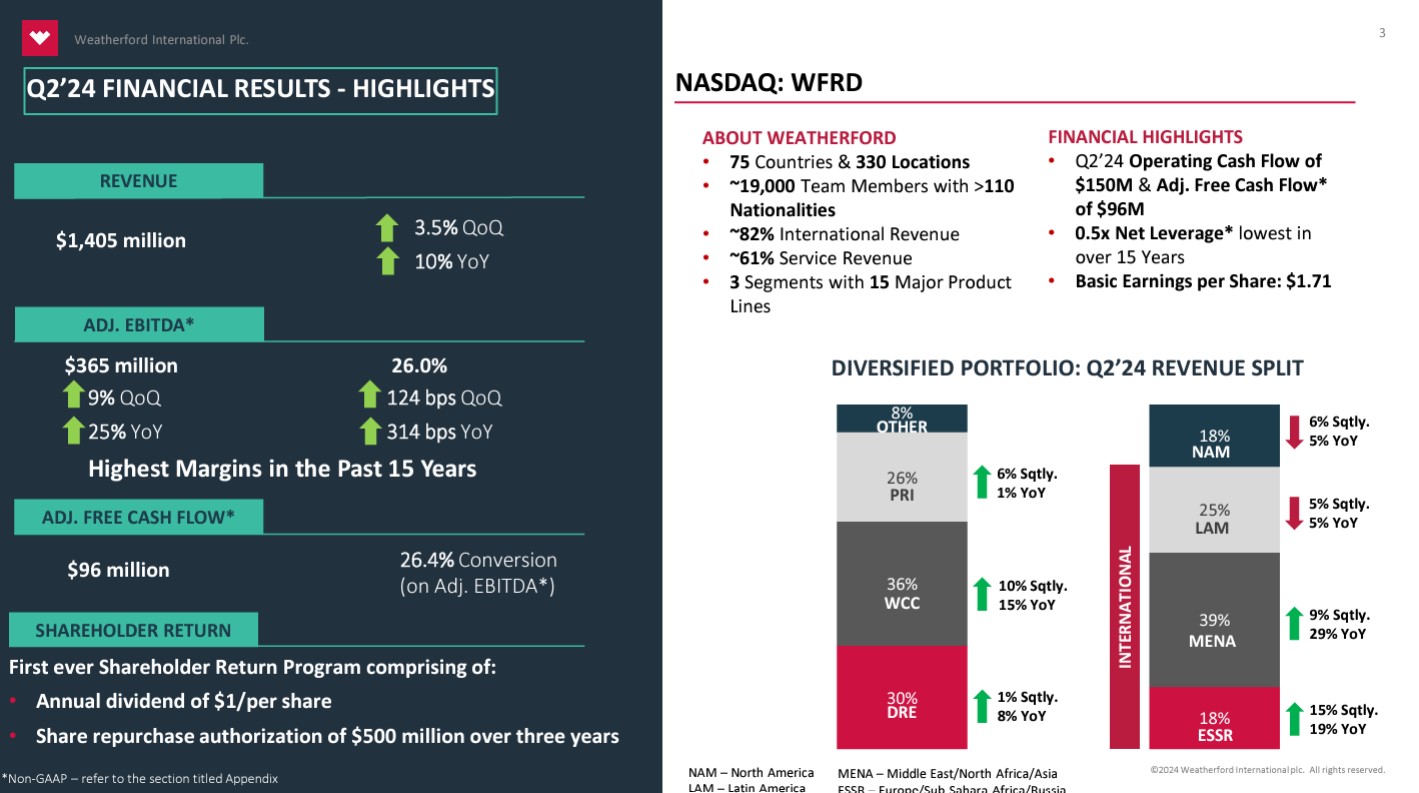

Weatherford trumpeted its financial results on July 24, which executives said included a 26% increase in adjusted EBITDA margins compared to the first quarter—the company’s “highest margins in the past 15 years.

For a company threatened by a second bankruptcy in late 2020, President and CEO Girish Saligram called the company quarterly showing a “remarkable turnaround.”

For the quarter, Weatherford’s generated adjusted EBITDA of $365 million, a 9% increase sequentially and 25% year-over-year (yoy).

Based on its financial success, Weatherford instituted the first share repurchase program in company history and its first quarterly dividend.

While the company’s EBTIDA margins were lifted by asset sales, the results show the viability of an increased pricing thesis on continued margin expansion, Saligram said during the company’s July 24 earnings call.

“We want to make sure that we don't sacrifice margins for the sake of volume,” Saligram said.

“We remain committed to pricing discipline and margin expansion. Given our margin performance, I believe we are making the correct trade-offs for longer-term value creation.”

Saligram said a judicious approach to capital allocation has enabled the company to pay down approximately $1 billion in gross debt during the past three years. As a result, Weatherford realized reduced interest costs of $100 million. The company has $1.6 billion in long-term 2030 notes outstanding, he said.

While Saligram was reluctant to give specific guidance for 2025, he allowed that “our market outlook remains unchanged.” The company will continue to emphasize technologies to support “predictable cost and competitive production, while ensuring security of supply for our customers.”

For the remainder of 2024, Saligram said he expects “fairly significant” North American revenue declines.

“Clearly there has been a weakening of North America expectations relative to our initial guidance in February,” he said.

Saligram’s comments align with recent views expressed by Halliburton and Liberty Energy executives, who see lagging E&P activity in the Lower 48 and Canada.

“We are cognizant that revenue came in at the lower end of expectations,” Saligram said. He noted, among other challenges, social unrest in Colombia, activity shifts in Mexico and weather events in Houston.

Evercore ISI analysts noted that despite lower activity in North America, Weatherford continued to benefit from international and offshore momentum.

“Gains were in the Middle East, North Africa and Asia, which were enhanced by improved execution,” Evercore analyst James West wrote in a July 24 commentary.

The company anticipates continued growth in international land and offshore, particularly driven by the Middle East and supported by pockets of double-digit growth in Europe, Sub-Sahara, Africa and Asia, Saligram said.

Saudi Arabia has been a big driver in showcasing Weatherford’s continued strength in the Middle East.

“The kingdom is the third country in our portfolio to be over 10% of company revenue,” he said.

Revenue in Saudi Arabia has grown more than 35% yoy in first-half 2024, and Saligram said he was optimistic about future growth potential for the company.

“Our international business demonstrated continued strength up 6% sequentially and 14% yoy led by 29% yoy growth in the Middle East, North Africa and Asia,” Saligram said. “We have now had 13 consecutive quarters of yoy international revenue growth” in those regions.

Saligram reflected on Weatherford’s notable recovery in the past four years. The company’s management team inherited a company that was “teetering on the edge of a second bankruptcy; one that never delivered two consecutive years of free cash flow and with single digit EBITDA,” he said.

“Today we have EBITDA margins of 26% in the fifth consecutive year of strong free cashflow generation.”

West said Weatherford’s results bode well for its stock. The company “reported total revenue of $1.41 billion, which was on target with our estimates of $1.43 billion, up 3.5% [quarter-over-quarter] and 10.3% yoy.”

Weatherford also announced the board authorized $500 million for the company’s first share buyback program, Saligram said. The board also declared Weatherford’s first quarterly dividend of $0.25 per share to be paid on Sept. 12 to shareholders of record on Aug.13.

“Few would have predicted this scenario just a couple of years ago, but it is a testament to the dedication, commitment and passion of our 19,000 people across 75 countries and my utmost gratitude goes out to them for their relentless focus and execution,” Saligram said in an earnings release.

Recommended Reading

Enbridge Appoints Steven Williams to Chair of the Board

2025-03-12 - Enbridge has appointed Steven Williams to lead the board of directors following Pamela Carter’s retirement as chair.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Baker Hughes to Supply Equipment for NextDecade’s Rio Grande LNG

2025-03-11 - Baker Hughes will provide turbine and compression for NextDecade’s trains at Rio Grande LNG.

Pearl Backs Haynesville Mineral and Royalties Firm Wild Basin

2025-03-10 - Equity commitments from Pearl Energy Investments and others have put $75 million of backing behind Haynesville Shale minerals and royalties company Wild Basin Energy.

Expand Energy Picked to Join S&P 500

2025-03-10 - Gas pureplay Expand Energy will be elevated on March 24 from its position in the S&P MidCap 400 index.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.