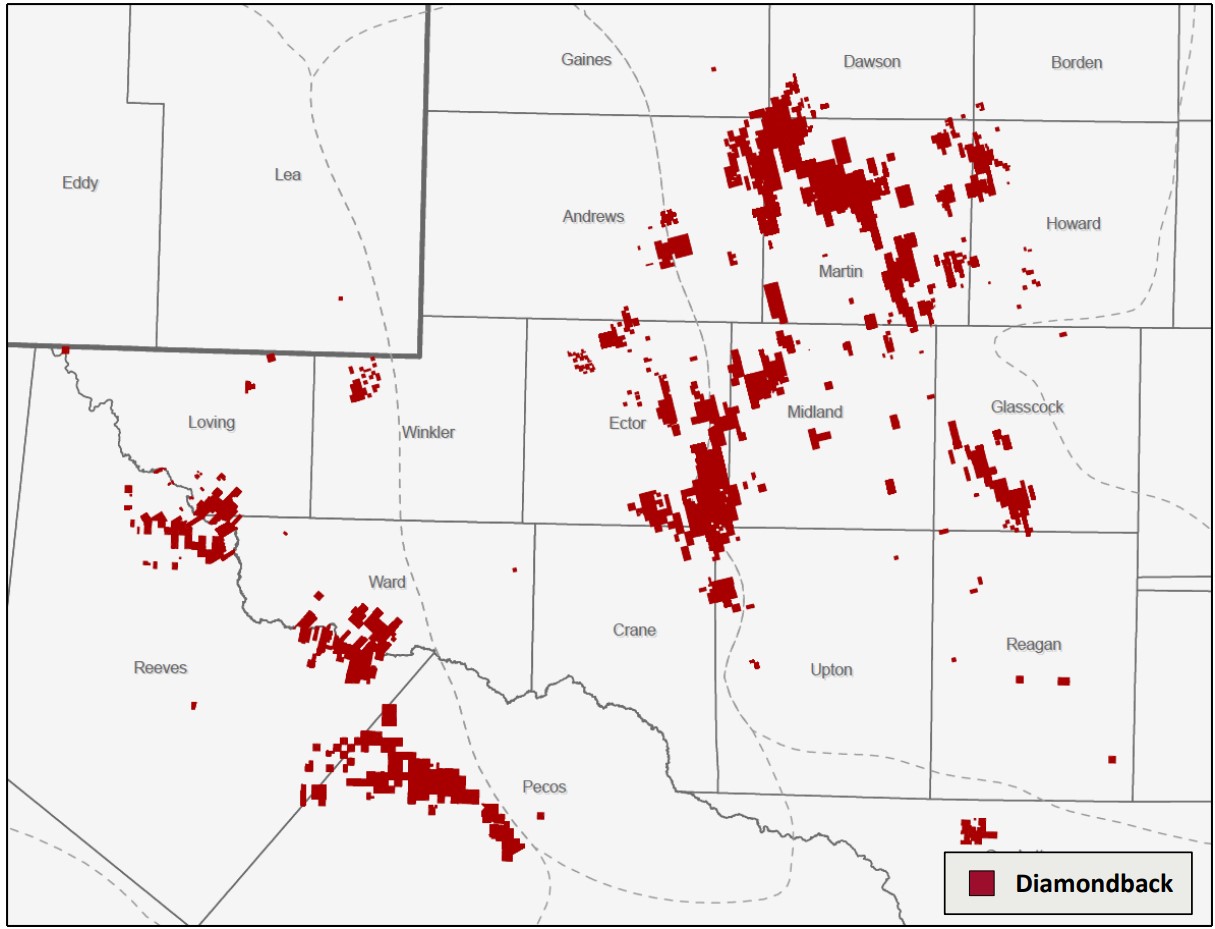

Diamondback Energy, based in Midland, Texas (pictured), curtailed some of its Permian oil output in the second quarter as natural gas prices hovered near record lows. (Source: Shutterstock.com/ Diamondback Energy)

Diamondback Energy cut some Permian Basin oil production to limit its natural gas output in the oversupplied shale basin.

Midland, Texas-based Diamondback “curtailed a little bit of oil” during the second quarter and into the third quarter to bring down associated gas production, CEO Travis Stice said during the company’s second-quarter earnings call on Aug. 6.

Producers across the basin are seeing record volumes of associated gas from their Permian oil wells.

“We did take a couple of our highest [gas-oil ratio] wells down for a month or two to ease that pressure,” Stice said during the call. “I think even in the face of that, the gas curve continues to outperform expectations.”

Diamondback produced an average of 474,670 boe/d during the second quarter, including 276,143 bbl/d of oil output.

Second-quarter gas volumes, totaling 51.31 Bcf, averaged approximately 563.85 MMcf/d, up 1.4% quarter-over-quarter; NGL volumes averaged 104,549 bbl/d, up nearly 10% from the first quarter.

Diamondback has worked to move greater NGL volumes out of the basin as natural gas prices languish, Stice said.

“We just have a lot of gas production out of this basin, and that's kind of why we have such a focus now on trying to generate more value for the gas that we're producing, whether that be in basin or out of basin,” Stice said.

Gas pipeline capacity out of the basin is also severely bottlenecked. The expected startup of the Matterhorn Express pipeline in September should provide some pricing relief.

RELATED

EnLink Expects Matterhorn Line Operational by September

Diamondback CFO Kaes Van’t Hof said the company has secured “a little bit of gas” transport capacity on the Matterhorn pipeline.

The company is also thinking about new applications for natural gas within the Permian Basin.

That includes in-basin power needs, Van’t Hof said. He cited the company’s plans alongside Verde Clean Fuels Inc. to explore building a gas-to-gasoline project in the Permian, using Diamondback’s associated gas volumes as feedstock to produce commodity-grade gasoline.

Other producers see potential to send gas to power-hungry data centers as artificial intelligence (AI) computing capacity grows.

Permian landowner LandBridge Co., which went public on the New York Stock Exchange in late June, has a land-lease agreement with a data center developer in the Delaware Basin. Construction could potentially begin in two years, according to LandBridge.

In the Permian Basin, data centers could eventually take up to 2 Bcf/d of Permian gas production off of oil producers’ hands, according to LandBridge estimates.

RELATED

LandBridge Chair: In-basin Data Centers Coming for Permian NatGas

Endeavor M&A

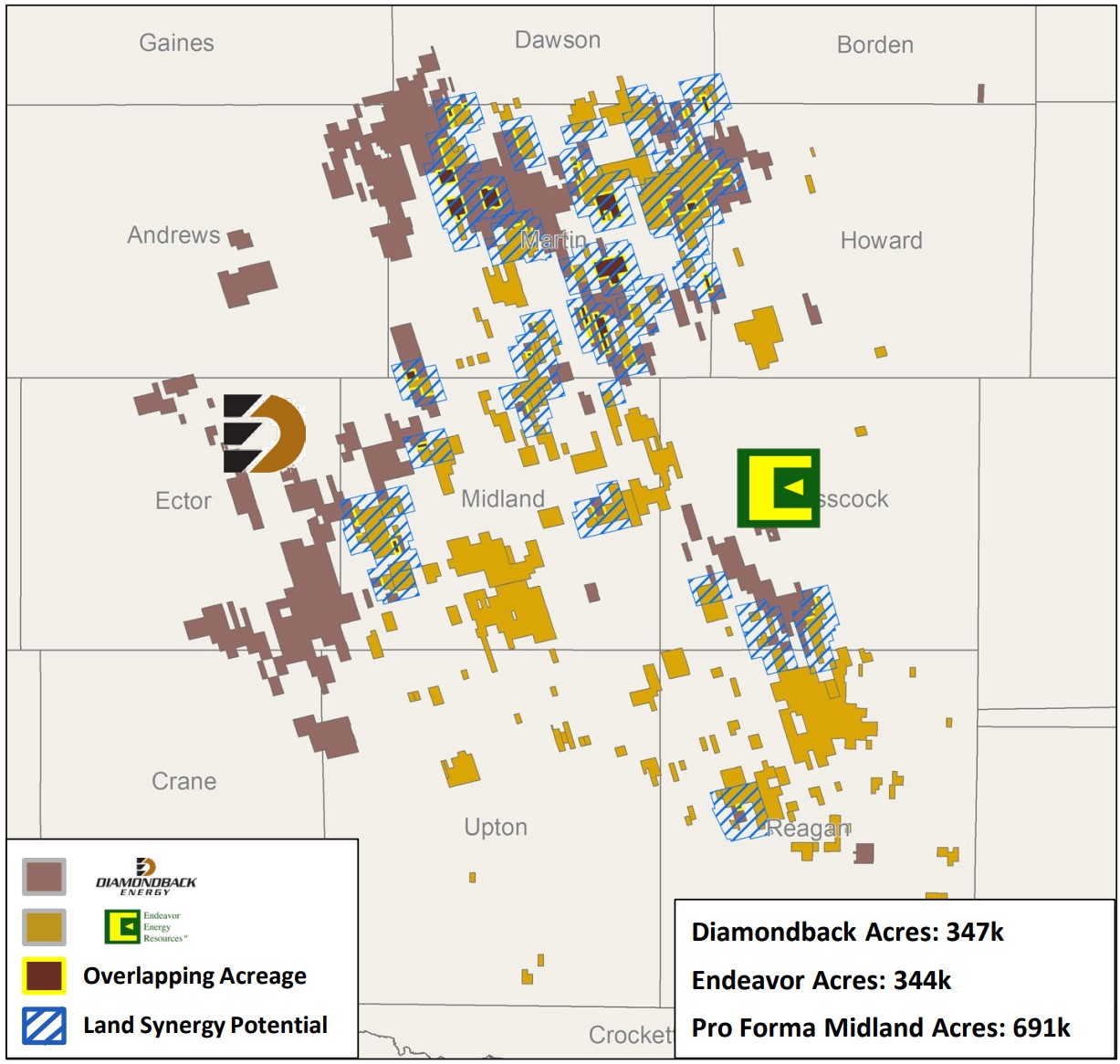

Diamondback continues to work toward closing a blockbuster $26 billion acquisition of Endeavor Energy Resources LP, the largest buyout of a private U.S. E&P ever, according to Enverus research.

The company received stockholder approval to move forward with the transaction in April. Later that month, Diamondback and Endeavor received a “second request” from the U.S. Federal Trade Commission (FTC) seeking more information about the proposed combination.

Diamondback continues to work cooperatively with the FTC to comply with its requests, and the company anticipates closing the Endeavor acquisition during the third or fourth quarter.

The deal will yield one of the largest landowners and producers in the Midland Basin.

As Diamondback waits to close the transformational deal, the company is making moves in other parts of its portfolio.

During the second quarter, Diamondback sold non-operated properties in the Delaware Basin for approximately $95 million.

Diamondback also sold interests in WTG Midstream to Energy Transfer LP for pre-tax consideration of approximately $375 million.

Those divestitures, layered on top of free cash flow generation since the start of the year, will reduce the cash outflow burden for the Endeavor deal, Van’t Hof said.

“I think we planned on looking at the deal as a de-levering process through free cash flow, but the asset sales are a kicker that accelerates that,” he said.

RELATED

Diamondback, on Hold for Endeavor Deal, Divests in Delaware Basin

Recommended Reading

Chevron Buys 15.4MM Shares of Hess Stock on Open Market

2025-03-17 - Chevron Corp. reported that between January and March 2025 it purchased about 5% of Hess Corp. shares, according to a Securities and Exchange Commission filing.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Abu Dhabi’s Mubadala Buys Stake in Kimmeridge Shale Gas, LNG Ventures

2025-04-10 - Mubadala Energy, owned by Abu Dhabi’s sovereign wealth fund, is buying a stake in Kimmeridge Texas Gas (KTG) and Commonwealth LNG as the United Arab Emirates company makes an entry into U.S. shale.

Oxy, Looking to Cut Debt, Sells D-J Minerals to Elk for $905MM

2025-03-23 - Elk Range Royalties bought 250,000 net royalty acres in the Denver-Julesburg Basin for $905 million from Occidental Petroleum, which is looking to shed debt after last year's acquisition of CrownRock.

Will TG Natural Resources Be the Next Haynesville M&A Buyer?

2025-03-23 - TG Natural Resources, majority owned by Tokyo Gas, is looking to add Haynesville locations as inventory grows scarce, CEO Craig Jarchow said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.