On Oct. 7, Viper bolstered its third-quarter deal-making with the announcement that it had closed an additional 25 acquisitions for about $193.6 million. (Source: Shutterstock.com)

Diamondback Energy Inc.’s acquisition machine in the mineral space seems to be running at a breathtaking pace so far this year.

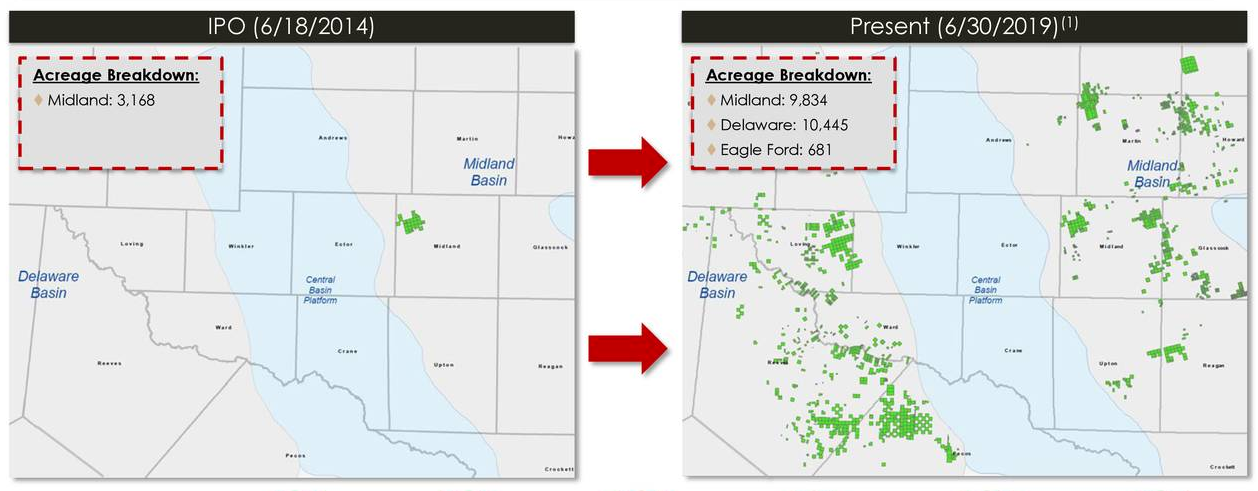

In the third quarter alone, deal-making by Viper Energy Partners LP, subsidiary of Diamondback, totaled over $1 billion of closed or committed acquisitions. Pro forma for all recent transactions, Viper’s acreage position now represents 23,990 net royalty acres, up from 15,870 net royalty acres as of June 30. About half of the acreage is operated by Diamondback.

“To date in 2019, our acquisition machine has now acquired over 9,000 net royalty acres for approximately $1.2 billion across more than 100 transactions, and importantly, we have more than doubled our exposure to Diamondback-operated properties,” Diamondback CEO Travis Stice said in a statement on Oct. 7.

Viper kicked off the third quarter with a roughly $700 million dropdown acquisition of about 5,000 net royalty acres from Diamondback in July. In September, the company followed that up with a $150 million all-equity transaction to acquire 1,358 net royalty acres from private-equity backed Santa Elena Minerals LP.

Then, on Oct. 7, Viper bolstered its deal-making for the quarter with the announcement that it had closed an additional 25 acquisitions for an aggregate purchase price of about $193.6 million in third-quarter 2019. In total, the company added about 1,272 net royalty acres.

According to Viper, the two notable acquisitions of these was a $100 million deal for 682 net royalty acres across the Midland Basin and a $68 million deal for 363 net royalty acres concentrated in southeast Lea County, N.M.

“The acquisitions closed during the third quarter, along with the previously announced drop down and the pending acquisition of assets from Santa Elena, highlight Viper’s unique ability to leverage our scale to aggressively consolidate the fragmented private minerals market in the Permian Basin,” Stice said in his statement.

1) Pro forma to include dropdown; all other acreage data as of June 30, 2019

(Source: Viper Energy Partners LP July 2019 Investor Presentation)

The dropdown closed on Oct. 1 and the acquisition from Santa Elena is expected to close later during the fourth quarter. Viper intends to finance the cash portion of the recent acquisitions with cash on hand and borrowings under its revolving credit facility, according to the company press release.

On Oct. 7, Viper also launched a $400 million senior notes offering intended to refinance outstanding borrowings on its credit facility. Moody’s and Fitch Ratings assigned B1 and BB-, respectively, to the Viper notes with a rating outlook of stable, according to a research note by Capital One Securities Inc.

The Capital One analysts also noted that Viper’s production in the third quarter of about 21,300 barrels of oil equivalent per day (boe/d) was generally in line with expectations, though the 64% oil mix was lower than expected. However, assuming all closed and committed acquisitions were owned for the entire quarter, Viper estimated that its third-quarter production would have reached roughly 27,900 boe/d (65% oil).

Recommended Reading

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Williams to Invest $1.6B for On-Site Power Project with Mystery Company

2025-03-07 - Williams Cos. did not name the customer or the location of the power project in a regulatory filing.

Energy Transition in Motion (Week of March 7, 2025)

2025-03-07 - Here is a look at some of this week’s renewable energy news, including Tesla’s plans to build a battery storage megafactory near Houston.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-03-07 - Baker Hughes said this week's decline puts the total rig count down 30, or 5% below this time last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.