Last year, the Diamondback Energy subsidiary closed 88 deals for an aggregate purchase price of about $615 million growing Viper Energy Partners’ asset base by over 5,000 net royalty acres. (Source: Hart Energy/Shutterstock.com)

The royalty business of Permian Basin powerhouse Diamondback Energy Corp. (NASDAQ: FANG) launched an upsized equity offering on Feb. 26 to pay down debt after a year of roughly $615 million worth of minerals deal making.

Viper Energy Partners LP (NASDAQ: VNOM) priced its public offering of 9.5 million common units with a roughly 1.4 million-unit greenshoe at $32 per unit. The offer had originally been for 8 million units with a 1.2 million-unit shoe.

The company expects roughly $304 million in gross proceeds from the offering to be used to repay a portion of outstanding borrowings under Viper’s revolving credit facility. Proceeds from the offering’s greenshoe option could also go to funding additional acquisitions.

The offering by Viper comes when public investors have been largely drying up the capital markets for acquisitions from upstream oil and gas producers.

“Not the usual release that we see in tandem with mineral acreage additions, but the company’s revolver balance reached an all-time high of $411 million at year-end 2018,” analysts with Tudor, Pickering, Holt & Co. (TPH) said in a research note on Feb. 27.

TPH estimates the offering was priced at a roughly 5.4% discount to Viper’s stock price of $33.84 at close Feb. 26.

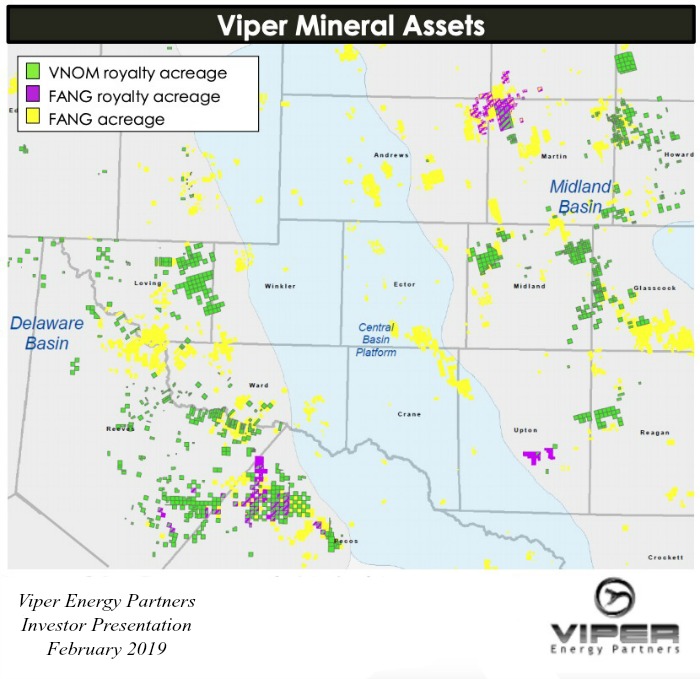

Viper is a limited partnership formed by Diamondback to own, acquire and exploit oil and natural gas properties in North America, with a focus on oil-weighted basins, primarily the Permian Basin and the Eagle Ford Shale.

Last year, the company closed 88 deals for an aggregate purchase price of about $615 million. The acquisitions correspondingly grew Viper’s asset base by over 5,000 net royalty acres throughout the year, according to Travis Stice, Diamondback’s CEO who also serves as the head of Viper’s general partner.

“Our acquisition machine continued to consolidate Tier 1 properties as represented by Viper,” Stice said in a statement earlier this month.

Viper’s footprint of mineral interests at year-end totaled 14,841 net royalty acres. The company said it had funded these acquisitions with cash on hand and borrowings under its revolving credit facility.

The company also ended the year with a cash balance of $22.7 million and $144 million available under its $555 million revolving credit facility, Viper reported on Feb. 5.

“Still looking to later in the year for a sizable transaction to potentially incorporate an incremental issuance, though likely to [Diamondback] and to come with a sizable mineral acreage acquisition,” the TPH analysts said.

For context, TPH noted Diamondback’s earnings conference call where the company quantified roughly 2,000 net mineral acres it owned with another $60 million to $80 million of minerals-driven cash flow Diamondback acquired through its purchase of Energen last year.

Credit Suisse is the book-running manager for Viper’s equity offering.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

API’s Multi-Pronged Approach to Lower Carbon Operations

2025-01-28 - API has published nearly 100 standards addressing environmental performance and emissions reduction, which are constantly reviewed to support low carbon operations without compromising U.S. energy security.

Baker Hughes, Hanwha Partner to Develop Small Ammonia Turbines

2025-02-03 - Baker Hughes, in partnership with Hanwha Power Systems and Hanwha Ocean, aim to complete a full engine test with ammonia by year-end 2027, Baker Hughes says.

NorthWestern Signs LOI to Power Montana Data Centers

2024-12-17 - NorthWestern Energy expects to generate 50 megawatts for datacenters beginning in 2027.

Energy Transition in Motion (Week of Jan. 10, 2025)

2025-01-10 - Here is a look at some of this week’s renewable energy news, including guidance on technology-neutral clean electricity credits.

Plug Power CEO Sees Hydrogen as Part of US Energy Dominance

2025-01-29 - Plug Power CEO Andy Marsh says the U.S., with renewable energy resources, should be the world’s leading exporter of hydrogen as it competes globally, including with China.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.