Viper Energy is spending $1.1 billion on a series of Permian Basin mineral and royalty acquisitions from Tumbleweed Royalty, which was formed by the executives behind Double Eagle Energy. (Source: Shutterstock.com)

Mineral and royalty player Viper Energy Inc. will pay more than $1.1 billion for three Midland Basin acquisitions, the Diamondback Energy subsidiary said on Sept. 11.

Viper’s operating subsidiary, Viper Energy Partners LLC, agreed to acquire mineral and royalty-owning subsidiaries of Tumbleweed Royalty IV LLC for $461 million in cash and 10.1 million Viper units, the company announced after markets closed Sept. 11.

RELATED

Why Buying Double Eagle Does (and Doesn’t) Make Sense for Ovintiv

Based on the $45.13 closing price of Viper units on Sept. 11, the equity portion of the deal is valued at approximately $456 million.

Tumbleweed Royalty was founded in 2014 by Cody Campbell and John Sellers, the co-executives behind Permian E&P Double Eagle Energy. Double Eagle IV is one of the largest private producers left in the Midland Basin and a major target for acquisitions, analyst have said.

Viper expects to fund the cash portion of the deal through a combination of cash on hand, borrowings under its credit facility and proceeds from one or more capital markets transactions.

The deal with Tumbleweed IV also includes a potential additional payment of up to $41 million in cash in first-quarter 2026, based on the average 2025 WTI oil prices.

Viper also announced closing two other Permian Basin acquisitions from Tumbleweed-Q Royalty Partners LLC and MC Tumbleweed Royalty LLC for a combined cash consideration of $189 million.

Those deals also include a potential additional cash payment of up to $9 million in first-quarter 2026, based on 2025 WTI oil prices.

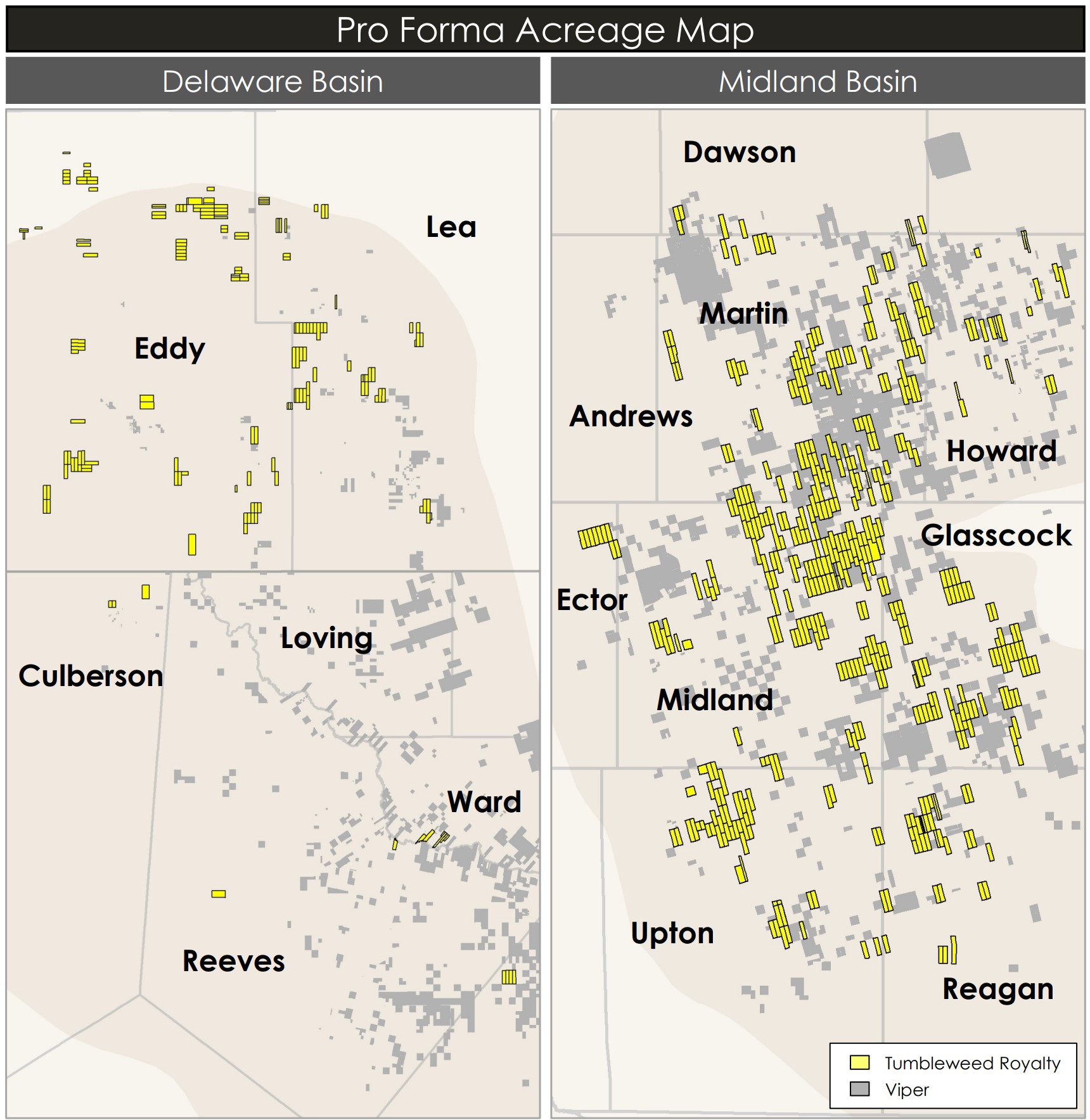

Combined, the acquisitions represent approximately 3,727 net royalty acres in the Permian Basin—3,237 in the Midland Basin and 490 in the Delaware Basin.

Current production from the acquired assets averages 2,500 bbl/d (4,000 boe/d). Viper anticipates output growing to about 4,500 bbl/d in full-year 2025, based on current producing wells, DUCs, permits and Diamondback Energy’s development plans.

Viper is a Diamondback subsidiary but is publicly traded separately.

Viper expects Diamondback to complete between 120 and 140 gross locations beyond existing DUCs and permits on the acquired properties through the end of 2026 at an average ~3% net royalty interest (NRI).

The deals are expected to boost Viper’s Diamondback-operated production from an average of 1,000 bbl/d in 2025 to 3,000 bbl/d in 2026.

“Viper was able to uniquely execute on this differentiated acquisition opportunity given its overall size and scale, but also due to the visibility we have into Diamondback’s expected multi-year development plan,” said Viper CEO Travis Stice—who also serves as CEO of Diamondback Energy.

This week, Diamondback closed a blockbuster $26 billion acquisition of Midland Basin E&P Endeavor Energy Partners, creating what an analyst called “the last and best oil sandbox” in the basin.

Intrepid Partners, LLC is serving as financial adviser to Viper. Akin Gump Strauss Hauer & Feld LLP and Wachtell, Lipton, Rosen & Katz are serving as its legal advisers.

Vinson & Elkins LLP and Kirkland & Ellis LLP are serving as the sellers' legal advisers.

RELATED

Diamondback Closes $26B Endeavor Deal, Forming Last Permian ‘Sandbox’

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.