DNO said it would capitalize on Sval Energi’s extensive portfolio, which includes interests in hubs and existing tiebacks that provide potential development synergies with DNO discoveries. (Source: Shutterstock)

Norway’s DNO ASA has reached an agreement to acquire 100% of Sval Energi Group AS’ shares from European private equity firm HitecVision for $450 million cash, which DNO said is based on an enterprise value of $1.6 billion.

DNO said March 7 that the acquisition would quadruple its North Sea production to about 80,000 boe/d, “propelling the Company to the upper ranks of Norwegian Continental Shelf [NCS] players.”

Post-closing, DNO said its proven and probable (2P) reserves will increase by 50% to 423 MMboe. In the North Sea, its 2P reserves will grow to 189 MMboe from 48 MMboe.

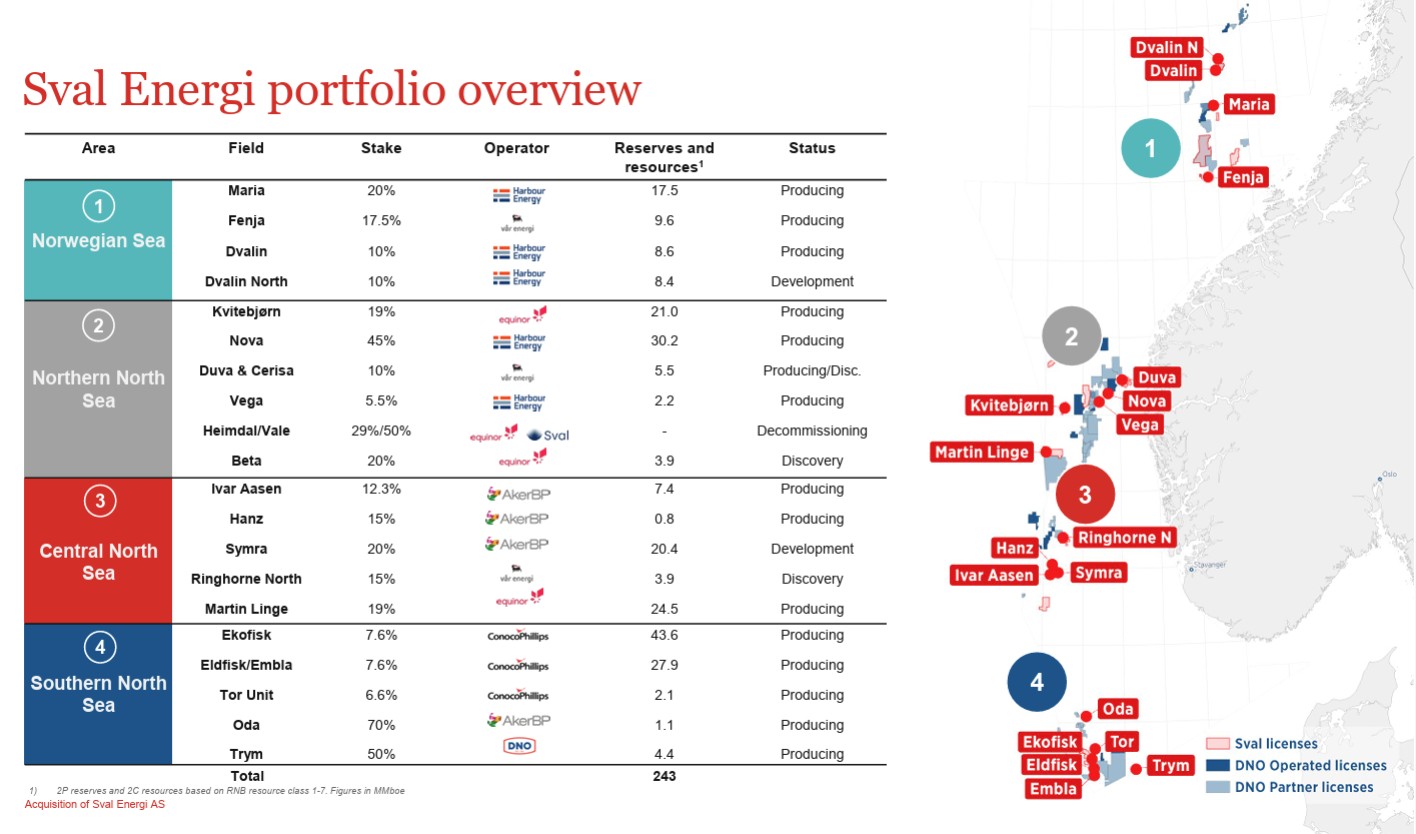

The Sval Energi assets are complementary to DNO’s North Sea portfolio and include non-operated interest in 16 producing fields offshore Norway, with net production of 64,100 boe/d in 2024. The assets include 141 MMboe in net 2P reserves.

Overall, the transaction will boost DNO’s global net production by two-thirds to about 140,000 boe/d on a 2024 pro forma basis.

“This is a rare opportunity to acquire a portfolio of high-quality oil and gas assets on the Norwegian Continental Shelf,” said DNO Executive Chairman Bijan Mossavar-Rahmani, “and we have moved fast to capture it.”

“Given low unit production costs and limited near-term investment requirements, the Sval Energi portfolio is highly cash generative and will help underpin development of the numerous discoveries we have made in Norway recently,” he said.

The deal adds scale and diversifies the company’s position as a leading listed European independent oil and gas company, DNO said in a press release. DNO said it will also capture tax synergies, G&A savings and will lower its borrowing costs with the acquisition. A team of 93 employees will be integrated into the DNO organization.

Sval Energi portfolio

Sval Energi’s largest assets (measured by net 2P reserves) are Nova, Martin Linge, Kvitebjørn, Eldfisk, Maria, Symra and Ekofisk. DNO said the portfolio is highly cash generative, with 2024 cash flow from operations totaling $565 million. Last year’s production costs were $14/boe.

DNO said it would capitalize on Sval Energi’s extensive portfolio, which includes interests in hubs and existing tiebacks that provide potential development synergies with DNO discoveries.

Since 2020, DNO had made 14 discoveries in the NCS, including Bergknapp/Åre, Bergknapp, Carmen, Cuvette, Heisenberg, Kveikje, Mistral, Norma, Ofelia, Othello, Overly, Ringand, Røver Nord and Røver Sør, together adding contingent resources (2C) of around 100 MMboe net to DNO.

Sval Energi’s assets also add potential upside and production from organic growth in producing assets, fields under development—Maria Revitalization, Symra, Dvalin North— as well as its Cerisa, Ringhorne North and Beta discoveries.

Sval Energi’s MLK wind farm will be carved out prior to closing and is not part of the transaction.

Deal financing

DNO said the acquisition will be financed with existing cash and other debt financing facilities. At year-end 2024, the company held $900 million in cash and $100 million liquidity under its reserve-based lending (RBL) facility. Additional funding sources include new bond and RBL debt as well as offtake-based financing.

The effective date of the transaction is Jan. 1. The deal is expected to close by mid-year 2025, subject to customary regulatory approvals from the Norwegian Ministry of Energy, the Norwegian Ministry of Finance and competition authorities.

Pareto Securities is acting as financial adviser to DNO and Advokatfirmaet Thommessen as legal counsel.

Recommended Reading

Amplify Updates $142MM Juniper Deal, Divests in East Texas Haynesville

2025-03-06 - Amplify Energy Corp. is moving forward on a deal to buy Juniper Capital portfolio companies North Peak Oil & Gas Holdings LLC and Century Oil and Gas Holdings LLC in the Denver-Julesburg and Powder River basins for $275.7 million, including debt.

Surge Closes on Divestment of Alberta Non-Core Gas Assets

2024-12-20 - Surge Energy said it has focused on developing its core Sparky and southeast Saskatchewan crude oil assets, leaving the Alberta non-core assets undercapitalized.

Diversified Bolts-On Appalachia Gas Production, Midstream Assets

2025-01-06 - Diversified Energy will buy Summit Natural Resources’ assets, including producing wells and coal mine methane wells, in the southern part of the Appalachian Basin.

DNO, OKEA Trade Prospect Interests in Norwegian Sea

2024-12-19 - DNO picked up shares in the Mistral prospect of the Norwegian Sea while reducing its stake in the Horatio prospect.

Obsidian to Sell Cardium Assets to InPlay Oil for US$225MM

2025-02-19 - Calgary, Alberta-based Obsidian Energy is divesting operated assets in the Cardium to InPlay Oil for CA$320 million in cash, equity and asset interests. The company will retain its non-operated holdings in the Pembina Cardium Unit #11.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.