Data center contracted capacity for Dominion Energy Virginia jumped by 88%, or 19 GW, in December 2024, compared to July 2024, the company said. (Source: Shutterstock/ Dominion Energy)

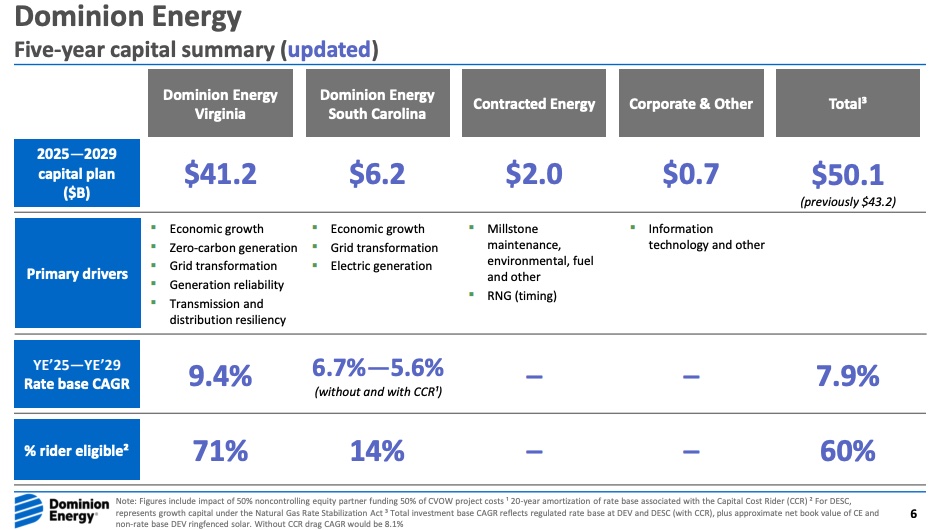

Dominion Energy raised its five-year spending plan through 2029 by 16% to about $50.1 billion to meet growing power demand driven by more electrification, economic growth and an expected surge in data center electricity needs, the company said.

“We’re seeing the need for incremental investment across distribution, transmission and generation to ensure reliability amid continuing growing demand in our service areas,” Dominion Energy CFO Steven Ridge said Feb. 12 on the company’s latest earnings call.

The utility is headquartered in the world’s most populous area for data centers—Virginia—and has connected about 450 data centers representing about 9 gigawatts (GW) of capacity in the state, according to Dominion Energy CEO Bob Blue.

Energy providers across the U.S. have been positioning themselves to seize potential business opportunities with Big Tech and others needing power boosts. Tech companies are commanding more electricity to power and cool equipment storing massive amounts of data for artificial intelligence (AI) and other applications.

Dominion Energy’s territory in the PJM electric transmission system, for example, is forecast to see summer peak annual load growth of about 6.3% for the next 10 years.

“To put that into perspective, the resulting peak load projected for 2034 has increased from 26.1 GW as of the 2022 PJM estimate to 41.5 GW as of this year’s estimate, an increase of nearly 60%,” Blue said.

Getting ahead

To address the demand, Dominion said it has advanced new electric transmission projects and upgraded infrastructure to connect more data center customers.

“This work has included reconnecting lines, expanding substation infrastructure as well as building a 500-kV transmission line that we expect to complete on schedule by the end of 2025,” Blue said. “Further, just last week, the SCC [Virginia State Corporation Commission] approved another 500-kV line in eastern Loudoun County, and we expect to be in service by year-end 2027. That will allow us to stay ahead of the region’s rapidly growing electricity needs.”

Data center contracted capacity for Dominion Energy Virginia jumped by 88%, or 19 GW, in December 2024, compared to July 2024, the company said. The contracts include substation engineering letters of authorization, construction letters of authorization and electrical service agreements.

“We’re currently studying over 26 GW of datacenter demand within the substation engineering letters of authorization stage, which means a customer has requested the company to begin the necessary engineering for new infrastructure required to serve the customer,” Blue said. “This compares to approximately 8 gigawatts as of July 2024 and represents a remarkable 245% increase.”

The increase was attributed in part to a new batch system for handling new delivery point requests to connect to Dominion’s systems, which better organized load requests.

“Data center growth in Virginia is not slowing down. In fact, it’s accelerating and we’re taking every step to meet this opportunity,” Blue said.

As Dominion carries out transmission projects, it also continues to make progress on the largest offshore wind development in the U.S.

Offshore wind

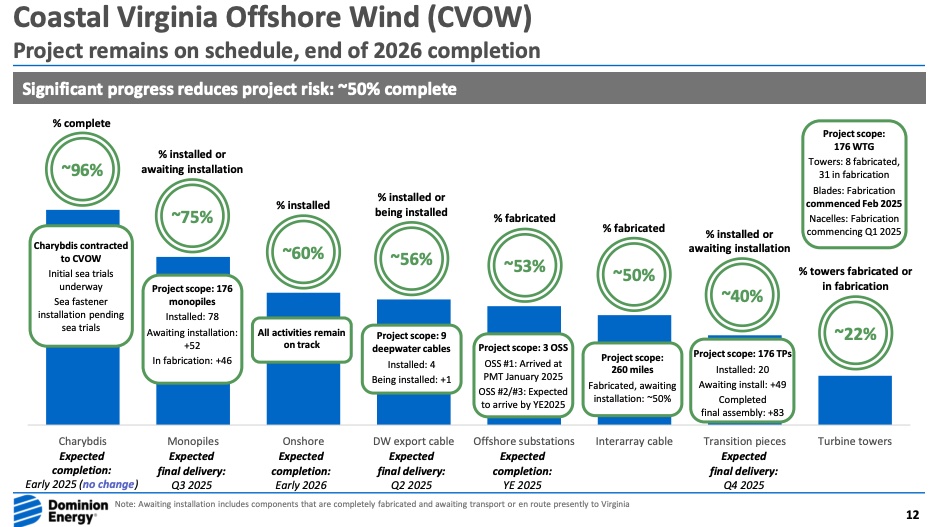

The 2.6-GW Coastal Virginia Offshore Wind (CVOW) project is 50% complete and remains on schedule for completion in 2026, though costs are higher than original estimates. Dominion Energy said last week that costs for the project, which features more than 170 turbines, increased by 9% to $10.7 billion.

RELATED

Costs for Dominion’s 2.6-GW Offshore Wind Project Swell to $10.7B

Speaking to analysts, Blue said he understands that investors are focused on the probability of future cost increases, but the company is committed to delivering the project in line with the updated cost estimate.

“We don’t have perfect insight into the information that PJM will use to finalize costs by midyear. But we’ve done a significant amount of analysis around the most recent estimate, which informs our updated cost estimate,” Blue said. “I’m confident in our updated estimate and believe that if there is a revision up or down with respect to PJM network upgrades come July, it would not be of a similar magnitude.”

There was no change in the $715 million cost of Charybdis, the vessel being built to install wind turbines for the project. The vessel is now 96% complete with sea trials underway. It will be the first vessel compliant with the Jones Act, which requires vessels moving cargo to be U.S. built, U.S.-citizen owned and U.S. registered.

Executives also addressed concerns about the potential impact of the presidential executive order concerning offshore wind on CVOW. The project has all required permits and meets important energy objectives of the current administration, Blue said.

“Stopping it would be the most inflationary action that could be taken with respect to energy in Virginia,” he said. “It’s home grown. It helps promote American energy dominance. It’s needed to power that growing data center market we’ve been talking about, critical to continuing U.S. superiority in AI and technology. It’s creating American jobs—2,000 at last count.”

Financial highlights

Dominion said it incurred a $103 million charge, among others, for Virginia Power’s share of costs not expected to be recovered from customers on the CVOW project.

The company reported operating earnings of $504 million for the fourth quarter of 2024, compared to $260 million a year ago. Dominion ended the year with a net income of $2.1 billion, up from $2 billion in 2023. Its operating income for 2024 was $2.4 billion, up from $1.7 billion.

“We’re pleased with our 2024 financial performance, but it’s really all about how we execute going forward. Since the March 1st meeting, we’ve seen tailwinds like increased regulated capital investment opportunities and we've seen headwinds like higher interest rates,” Ridge said. “But what hasn’t changed is our confidence in the plan, which has been built to be appropriately but also not unreasonably conservative.”

Dominion lowered its operating earnings forecast for 2025 to between $3.28 per share and $3.52 per share, down from the $3.25 to $3.54 guided in third-quarter 2024. The guidance midpoint of $3.40 was unchanged.

Recommended Reading

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: March 31, 2025

2025-03-31 - Here’s a roundup of the latest E&P headlines, from a big CNOOC discovery in the South China Sea to Shell’s development offshore Brazil.

E&P Highlights: March 17, 2025

2025-03-17 - Here’s a roundup of the latest E&P headlines, from Shell’s divestment to refocus its Nigeria strategy to a new sustainability designation for Exxon Mobil’s first FPSO off Guyana.

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.