DUG Midcontinent roundtable discussing events within the oil and gas industry.

Sometimes not listening to the experts can pay off. Take Todd Dutton and Dallas-based Longfellow Energy LP, for example. Had he listened to the experts who proclaimed in a 1973 AAPG paper that “at least 90% of the recoverable primary oil has been produced from the Sooner Trend,” the company would be working elsewhere. Instead, he finds himself leading the privately held operator into success with its Nemaha project in the eastern and northeastern portion of that very trend, now widely known for putting the “S” and the “T” in the larger Stack play.

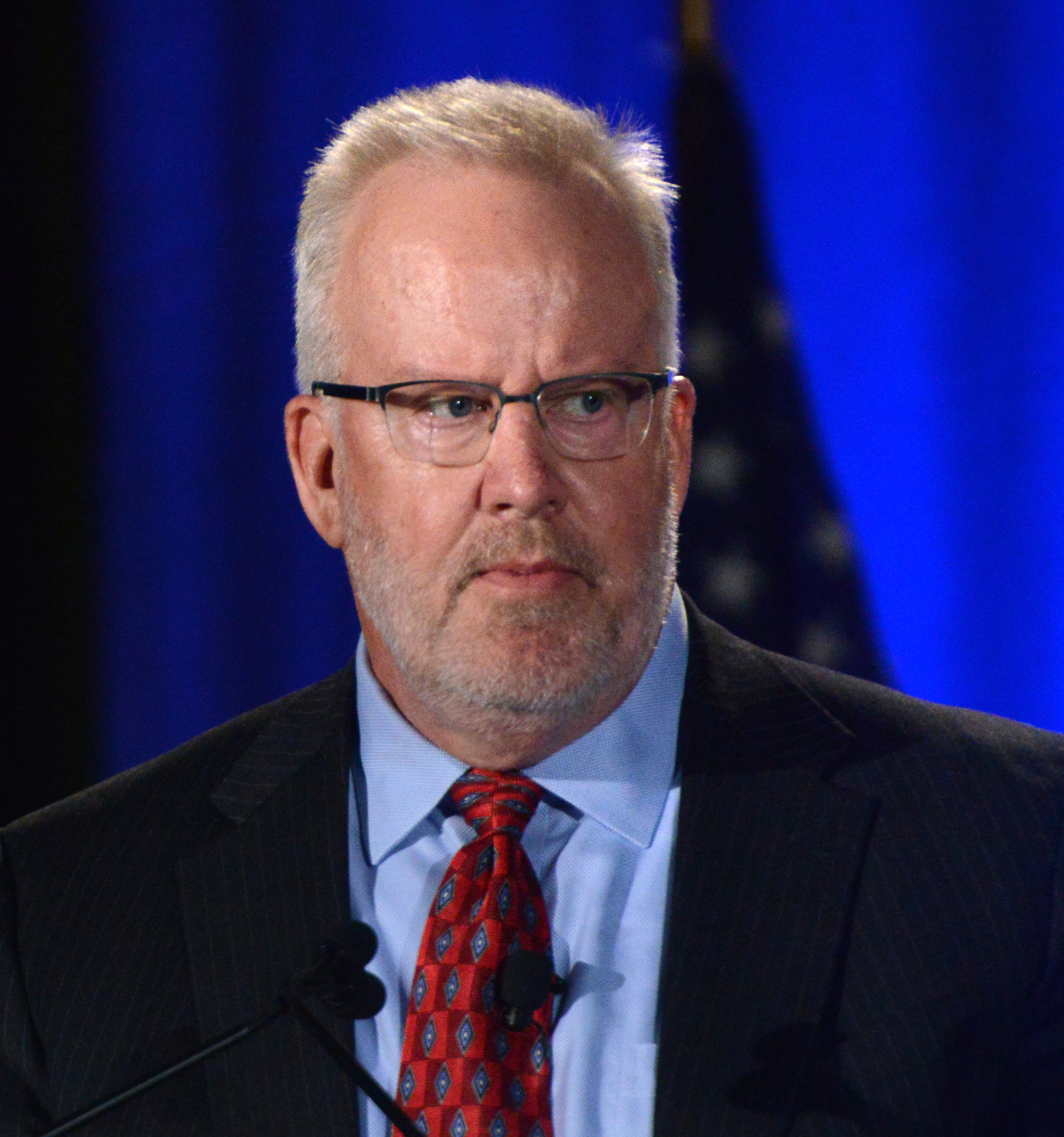

“It’s a good thing that I didn’t listen to what the experts were saying about the future oil recovery in the Sooner Trend fields,” he told attendees at Hart Energy’s DUG Midcontinent conference held in in Oklahoma City. “Just shows how much the thinking and [understanding of] the geology and unconventional resources has changed.”

Dutton, president, shared how the company—since beginning the project in 2011—has increased its understanding of the geology of the Updip Oil Leg of the Osage Reservoir and how that knowledge has helped it increase production and returns through improvements in its completions design. The project is located along the Nemaha Fault in Garfield and Kingfisher counties and spread out over 81,000 gross acres (60,500 net), covering 128 contiguous governmental sections, according to Dutton.

The company first focused its development efforts on understanding the unique geology of the Osage. Wedged in between the Woodford and Meramec shales, the Osage and its low gas-oil ratio (GOR) offers Longfellow the ability to “stack a lot of wells.”

“The Woodford is the source of the oil, and Osage sits right on top of that,” he said. “That means that all the oil that’s in the Meramec had to pass through the Osage [from the Woodford] to get to the Meramec.”

Oil in the Osage is trapped in a micro-darcy rock matrix, Dutton added, and is “sealed by the Meramec above and the Chester [truncation] above that. Both of which are more ductal rocks and have a higher clay content and less natural fracture. Oil saturation occurs over the whole Osage section with gas in solution; there is no free gas in the rock matrix. The Osage is composed of alternating layers of lime dominated and then quartz dominated, with quartz-dominated layers having the higher proxy,” he said.

“The important point here is that the low clay content of Osage means that it is much more brittle than the Meramec and has a central vertical natural fracture. This causes a lot higher leak-off during your fracture treatment.”

Gas-oil ratio

Understanding the fracture network of the Osage is one part of the equation. The other is the reservoir’s GOR.

“We believe you have to break new rock in order to produce the oil. The oil won’t travel fast through the micro-pore system from the matrix to the fracture. Matter of fact, it moves millimeters or an inch or two per year, maximum. In rock, your fracture geometry determines the oil and gas ultimate recovery in the Stack play,” he said.

“The producing GOR reflects your fracture geometries, the intensity of the stimulation. We like to call it ‘your stimulated reservoir bottom.’ It tells you how efficiently your frack has broken new matrix rock, rather than just connecting the natural fractures,” he explained.

“In a solution gas reservoir, the GOR rises in all the wells over time. In the Stack play in the Osage, that rise is a function of the stimulation of efficiency, or complexity, and not the saturation of the rock itself.

“Remember, with no free gas in the matrix, the produced gas that comes out of all the wells comes from breaking out the oil, leaving oil in the matrix. Therefore, to have a fast increase in GOR is not a desirable, as it indicates poor fracture geometry and that there’s a large pressure drop. The gas breaks out, and the oil stays in.

“If your completion can achieve a low GOR production, then it means that you can stack more wells in a section and get where the oil recovery is,” he said. “And that’s really important to us for future infill development.”

The company’s Generation 3 completions design builds on the data and lessons learned in the early days of the project.

“Our drilling in 2012, 2015 resulted in a lot of data that we were able to analyze during 2016,” he said. “We were able to see what our frack treatments were doing, to see what we’re doing right and what we’re doing wrong. From that we were able to develop our Generation 3 frack design that we used in the drilling of our 2017 wells.”

The company has 104 horizontal lateral wells drilled and producing, with seven planned for the Osage and one for the Oswego reservoir to be drilled in 2017, he said. The average number of rig days for the Osage wells is 17.

As for its Generation 3 completions design, the company has performed six plug and perf completions using swellable packers and a high-viscosity slickwater paired with a proppant mesh size of 100 meters and 30/50w loaded at 1,730 pounds per feet. Average lateral length is 4,475 feet with 31 stages spaced out 141 feet, according to Dutton’s presentation slides.

“We believe that ramping proppant quickly to a higher concentration is critical to divert out of, and away from, the natural fracture system, so that you can build net pressure and break new rock,” he said. “Breaking the new rock is the key to success. We also use a higher viscosity friction producer so that we can build pressure in the rock and not lose it to friction in the pipe and the fractures.

“We like to see increasing net pressure throughout the pumping at each stage. We don’t pump the same volume and concentration at every stage. We let the rate and pressure data tell us the outcome and amount of proppant to use.”

Longfellow is seeing lower GORs for its 2017 operated and completed wells.

“At 70 days, the GOR from our 2017 drilling is about 25% of what it was from the same period of time on our earlier 10 best wells from 2012 to 2015,” he said.

"If your completion can achieve a low GOR production, then it means that you can stack more wells in a section and get where the oil recovery is," said Longfellow Energy LP president Todd Dutton.

According to Dutton, the data collected from the company’s efforts in the Osage demonstrate that it is a solid oil resource.

“The Updip Oil Leg of the Osage is a great place to drill oil wells. We get more oil with less gas, and we believe that we’ve just only begun the oil recovery evolution that will make estimated recoveries and economics better in the future,” said Dutton.

Plans for 2018 include drilling 18 parent wells and four infill pilot wells in the Osage, along with four infill wells in the Oswego, he said. The company also plans to look at incorporating smaller proppant size and different chemical diverters in its wells.

“We also have plans to drill a 2-mile lateral,” he said. “And we’re looking forward to achieving even better results with our 2018 drilling campaign.”

Jones’ year of the Merge

Activity in the Merge play in the Anadarko Basin is taking off and Jones Energy Inc. is all in. Chairman and CEO Jonny Jones says that for the Austin-based company, “2016 is the year of the Merge.”

Speaking at the DUG Midcontinent conference, Jones said, “The Merge play is developing rapidly, with 23 rigs running there, more than in the Scoop, so the industry obviously believes in the potential of the Woodford and Meramec in the Merge.

“We believe the Merge is unique and can be distinguished from other plays. The Woodford is the primary reason we got into the play. I believe we’ve only scratched the surface there.”

Jones Energy has pivoted from its longstanding operations in the Cleveland Sands in the western Anadarko Basin to a Merge focus. It entered the Merge in 2016 by acquisition. It now has 21,000 net acres on 35 operated sections. “Our production is mostly out of the Cleveland, but going forward we are going to be a pure-play Merge operator. We just finished our first 10,000-foot lateral, and we’ve tested five Meramec benches already.”

"The Woodford is the primary reason we got into the play. I believe we've only scratched the surface there," said Jones Energy Inc. CEO Jonny Jones.

Jones said the Merge combines the best of both worlds. He defined it as being the Meramec extension from the Stack area to the north meeting the upper Woodford Formation extension from the Scoop to the south. It primarily encompasses southern Canadian and northern Grady counties.

“Merge Meramec is an extension of Stack, but the net-to-gross pay is higher than in Stack. Only five Meramec wells have been drilled in the Merge.”

Multiple benches and high reservoir quality are the reasons Jones has two rigs in the play, adding a third later this year. In addition, Jones said Marathon Oil Corp. has four rigs running; Citizen Energy and Cimarex Energy Co. have three each; and Linn Energy Inc. and Newfield Exploration Co. have two each.

Jones said that operators are trading acreage and sharing information to propel development.

In the second quarter, Jones drilled its first two Meramec wells. The first, the Bomhoff 20-12-7 2H, reached a peak rate of 650 barrels of oil per day (bbl/d) and 6.3 million cubic feet per day (MMcf/d) from upper Meramec. This well was among the top decile of wells drilled to date in the Merge, Jones said.

Jones’ first Woodford Generation 3 frack, the nearby Bomhoff 20-12-7 1H, was drilled from the same pad, and it achieved a peak rate of 278 bbl/d and 3.6 MMcf/d. The company’s second Meramec well, the Garrett 4-11-6 1H, was drilled to an upper Meramec target. It tested 672 bbl/d and 1.58 MMcf/d and has exceeded oil rates of the best-in-class Bomhoff 2H well, the company said.

Next to the Bomhoff pad, Jones is drilling its first three-well pad, the Rosewood, with both Meramec and Woodford targets.

Generation 3 fracks, completion design and optimization of the landing zones will be Jones’ operational focus for the rest of this year and in 2018. Already Jones has reduced its drilling times to about 20 days, and the drill time for its last nine wells decreased by 30% over its first four wells, he said. If time is reduced by a day, that translates to a savings of about $45,000 per well.

In the Merge, Jones claims 1,100 gross locations in the Meramec and about 1,800 in the Woodford, with another 300 or so in the conventional Hunton and Sycamore zones. He said 2019 will be full of spacing tests, and he expects full-scale development to begin by 2020. “We are just getting started.”

“I think we can do at least 16 wells per section (that’s eight upper Woodford, four lower Meramec and four upper Meramec), although some in the industry think they can do much more, up to 31 a section,” Jones said.

‘Something spectacular’

No one should expect to get something for nothing, but that doesn’t mean you can’t make something from nothing. After all, Rumpelstiltskin spun gold riches from straw, right?

Producers in the Anadarko Basin aren’t able to magically spin out gold coins, of course, but many have found a way to turn the Stack into one of the top shale plays in the world, particularly during this shale renaissance. Newfield Exploration Co., founder of the Stack play, has led the charge in moving from concept in the region to full-field development.

Trevor Reuben, vice president of corporate development at Newfield, told the audience at the DUG Midcontinent conference that the last decade has seen his company truly transform from a diverse offshore entity to a U.S. onshore resource player focused on the Anadarko. Two-thirds of its production and reserves and 80% of its capital are focused in the basin.

“In the Meramec and Woodford alone, we see 2.5 billion barrels of oil equivalent gross unrisked resource, which will provide us with decades of economic drilling locations for the future,” he said during the second day opening keynote address. “[The Anadarko] really has gone from nothing to something spectacular.”

Reuben said Newfield is “upward of 90,000 barrels of equivalent production and 330 million barrels for reserves.” In 2016, Newfield was the top oil producer in Oklahoma.

For the audience, it was a rare glimpse into how Newfield came to discover the Stack. The company actually started in the Arkoma to the east, which was where it made its first onshore U.S. resource play. From there, it moved to drilling the Blevins 3H-9, a horizontal Woodford gas discovery.

“Soon we were on to focusing on the liquids window in the Arkoma,” he said.

However, the company ended up making its first horizontal oil discovery in the Woodford in 2009. But it wasn’t until 2012 when, using geological mapping and an engineering study, Newfield struck oil in the first Woodford/Stack horizontal oil well, the Rock Island 1H-14.

“It was successful. We took a core on that well, and we used that to accelerate our next assessment,” he said.

Less than a year later, Newfield drilled the first Stack/Meramec horizontal oil well, State 1H-16.

“Today, we’ve grown our position from 100,000 net acres to over 350,000,” Reuben said. “We’re really excited about the Anadarko because we consider it absolutely world-class.”

“It’s one of the largest and deepest onshore U.S. basins, with significant total organic content, low clay content, excellent seals and, as everyone knows, there have been literally thousands of wells drilled into it, all validating the potential,” he continued.

Only the beginning

Like other speakers at DUG Midcontinent, Reuben pointed out that the industry has only begun to scratch the surface in the Anadarko, which has more than 10 productive horizons.

Reuben also said the economics of the play “really are top tier.” Even at around $50 per barrel, the Stack and Scoop are competitive, he said. “They are going to be a focus of industry attention for a long time to come.”

He cited low lease operating expenses and finding and development costs “because of the prolific nature of these wells relative to the capital cost required for investment.” In addition, water-oil ratios remain one-to-one, which is significantly less than other basins that are getting attention at the moment.

“The superior economics of these plays just speaks to the fact that we’ve seen a tremendous amount of activity sustained through the cycle,” he said.

Two distinct price cycles have coincided with the evolution of the Stack and Scoop.

From 2011 to 2014, which was more the assessment phase, there was unprecedented price stability. “That supported continued investment,” Reuben said, referring to the price correction in mid-2014, “which led to the ultimate ramp-up which would seem like at an inopportune time.”

But while volatility increased 3x at that time, so too, did activity and production in the Scoop and Stack, he said. The continued investment has led to an expansion of the fairways over the past couple of years.

In particular, he pointed to last year, which saw a flurry of 10 deals approaching $10,000 per acre. “There’s been rapid valuation improvement despite the fact that commodity prices have been fairly weak,” he said.

Most of those deals were by new entrants, “because legacy positions were taken by the bigger companies.” Those deals have helped stretch the boundaries of the Stack, something that Reuben said is justified by well results.

Expanding the play

Reuben said Newfield is focusing on a new comprehensive pilot program on the Meramec. “This doesn’t even scratch the surface of what I think the next exciting opportunities are, which are actually going back in the Woodford and doing higher density tests, as well as in the Osage and down in the Scoop,” he said.

“What we’re trying to do is unlock the Rubik’s Cube and understand vertical and horizontal spacing as well as what the optimal completion design is,” he continued. “We’re using all kinds of science to maximize value out of a section so that we don’t find ourselves in five or 10 years having missed a tremendous amount of resource.”

Reuben closed out his address by discussing Newfield’s Score program, which is the Sycamore, Caney, Osage resource expansion. “We are out there hunting right now for the next Stack,” he said. “There’s tremendous opportunity right under our old footprint.”

Trevor Reuben, vice president of corporate development at Newfield Exploration Co., said the Scoop and Stack are "going to be a focus of industry attention for a long time to come."

The company plans to spend about $100 million this year to test the potential. “We think we’re assessing over a billion barrels of equivalent of resource potential,” he said.

Reuben revealed that the early results have been encouraging, and the company expects to have about 10 wells online by the end of the year. Some will drift into 2018, he said.

Recommended Reading

Texas GulfLink Port Wins Approval from U.S. Maritime Administration

2025-02-18 - Sentinel Midstream’s Texas GulfLink crude loading platform is the second Gulf Coast project to receive a permit.

Guyana Exported a Total of 225 Crude Cargoes in 2024

2025-01-14 - Guyana, Latin America's newest oil producer, is now the region's fifth largest crude exporter after Brazil, Mexico, Venezuela and Colombia.

What's Affecting Oil Prices This Week? (Feb. 18, 2025)

2025-02-18 - The price of Brent crude oil did reach $77 on Feb. 18 before falling back with news that members of the Trump Administration were holding talks with their Russian counterparts.

Trump Ambiguous Whether Canadian-Mexico Tariffs to Include Oil

2025-01-31 - At a news conference, President Trump said that he would exclude oil from tariffs before backtracking to say that he “may or may not” impose duties on crude.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.