During day one of the DUG Midcontinent Virtual Conference, Continental Resources founder and executive chairman Harold Hamm said oil and gas investors have been “slow to pick up on the fact that demand recovery is happening.” (Source: Hart Energy)

If there was one theme to take away from the first day of Hart Energy’s DUG Midcontinent Virtual Conference it is: As bad as things seem right now, the light at the end of the tunnel is already starting to show, if you care to look for it.

The double whammy of COVID-19 and the oil price crash brought on after ill-timed muscle flexing by Russia and Saudi Arabia created headwinds for the industry that haven’t been seen in maybe ever, according to Tom Petrie, chairman of Petrie Partners.

“Unprecedented truly understates it. It’s some combination of the tripling of prices after the Yom Kippur war of 1973, the price collapse of 1986 when OPEC overreached, the invasion of Kuwait by Iraq and various inside the industry combinations that occurred in the last decade and a half,” Petrie said.

Petrie, the longtime industry analyst and advisor, offered a macro view of the madness of 2020 including the effects of production cut decisions by OPEC+ and the demand loss brought on by COVID-19.

COVID-19 has certainly taken its toll on demand. However, Continental Resources founder and executive chairman Harold Hamm said oil and gas investors have been “slow to pick up on the fact that demand recovery is happening.” The Oklahoma-based shale pioneer and noted industry advocate made his remarks in a fire-side chat with Oil and Gas Investor’s Nissa Darbonne.

“We’re back to about 90% of pre-COVID demand. Refineries today are operating at about 80%. Historically they were at about 85%,” Hamm said. “More people are flying. I heard a report that at times there were about 67,000 planes in the air in the U.S. Normally there are about 100,000. So, we’re getting there. It’s happening, but it’s been slow in happening.”

He added that there’s good news value creation, at least as it pertains to Continental.

“From here forward, from $42.50 [per barrel] forward, the next $10 goes to the bottom line,” he said. “That’s where the value creation will happen, and I think investors are starting to pick up on that.”

Hamm and Brook Simmons, president of The Petroleum Alliance of Oklahoma, both weighed in on the recent U.S. Supreme Court ruling concerning McGirt vs Oklahoma.

“I want to stress, that it does not mean chaos,” Simmons said about the ruling, which although in context of a criminal case, reaffirms the established reservations in eastern Oklahoma and could have lasting effect on oil and gas land leasing.

While the case created headlines during the summer, Simmons said oil and gas and the Five Tribes have a long history of working together. While he doesn’t doubt some will seek to take advantage of the ruling he reiterated that all parties involved “had been laboring under the assumption that the reservations were gone, since statehood.”

“This is new ground for all of us,” Simmons said. “But, part of the fact that we have been well assimilated and living together for so long, we see ourselves as Oklahomans first.”

“The tribal governments has some exceptional people,” he continued. “They are business savvy, understand the critical role of oil and gas in the state, and I feel rather confident that we’re going to have productive conversations with tribal leaders.”

Improved Outlook

Clearly, the question on everyone’s mind as they logged-in was, when will things get better? It’s a tough question with no easy answer, but Raymond James Managing Director Marshall Adkins said that the outlook for oil has “improved meaningfully over the past few months.”

He listed four changes since the April doldrums to illustrate his point.

- April demand destruction is substantially less than consensus models;

- OPEC+ cuts were greater than expected;

- Oil demand recovery has been stronger and faster than expected; and

- Global inventories have already started falling.

On inventories, Adkins said, “As best we can see they are down about 2 million barrels a day since mid-May. I think that puts us on the path to normalizing inventories sometime in early 2021.”

“The near-term for me is somewhat bullish,” he said. “The long term always was bullish because of the demand [destruction] being inflicted upon the industry today.”

Adkins said he thinks there still needs to be much higher oil prices to squeeze demand out of the system to have a chance to rebalance in 20210, 2022 and 2023. “Doesn’t save us this year,” he lamented, adding that U.S. drilling activity still looks ugly in 2020.

Optimistic Operators

The day features top Midcontinent operators sharing their successes, challenges and growth plans in the basin.

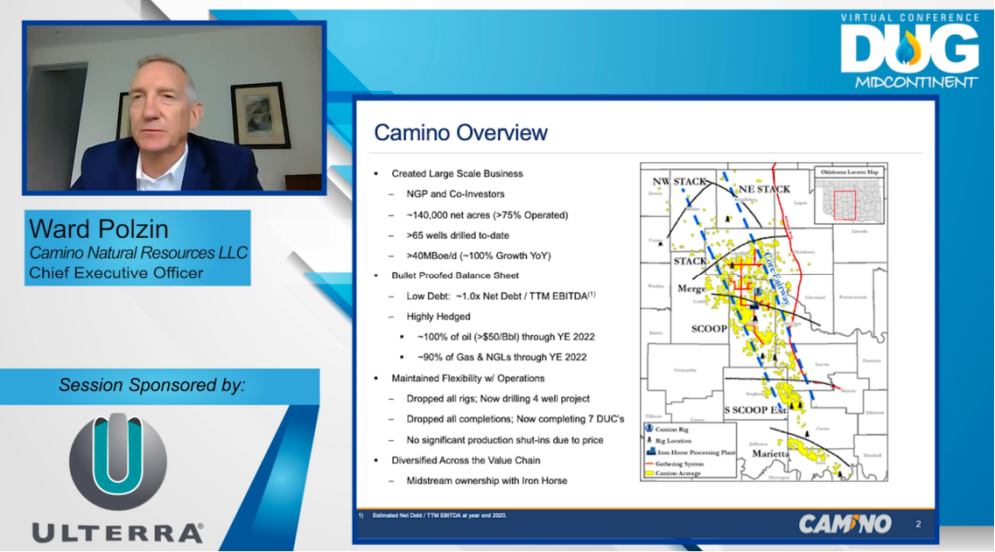

Ward Polzin, CEO of Camino Natural Resources, outlined four tenets of his company’s goals: scale, a conservative balance sheet, operational flexibility and diversification. The NGP Energy Capital-backed private operator is now up to about 140,000 net acres. Polzin said 75% is operated and the company is up to about 40,000 net boe/d.

Camino is also highly hedged. “Because of these hedges our EBITDA and cash flow will be better in 2020 actually than they were in 2019,” Polzin said.

Calvin Cahill, president and CEO of Calyx Energy III LLC, set out to answer a simple question: how is it still up and running in this price environment? The company has one of the 10 rigs still running in Oklahoma, specifically in the Arkoma Basin.

“We believe the things that keep us there are … we got a play that’s economical because of our low cost in both drilling and completions as well as our production results to date,” Cahill said.

Calyx Energy III has drilled 21 wells and its exit is supposed to be 29 to 32 wells. “We have also used drillcos as part of this to keep the crews together and achieve better economics,” Cahill added.

Recommended Reading

Diamondback Energy Closes $4.1B Double Eagle IV Acquisition

2025-04-02 - Diamondback Energy Inc. closed on its approximately $4.1 billion deal to buy EnCap Investments’ Double Eagle IV, adding approximately 40,000 net acres in the Midland Basin to its portfolio.

CenterPoint Energy Completes NatGas Pipeline Sale to Bernhard

2025-04-01 - CenterPoint Energy Inc. has closed on a sale of natural gas distribution utilities in Louisiana and Mississippi to Bernhard Capital Partners.

Ring Energy Closes Central Basin Platform M&A from Lime Rock

2025-04-01 - Ring Energy added 17,700 net acres and 2,300 boe/d of production in the Central Basin Platform through an acquisition from Lime Rock Resources IV.

Boaz Energy Completes Sale of PermRock Properties to T2S

2025-04-01 - Boaz Energy II has completed the sale of PermRock Royalty Trust’s underlying oil and gas properties to T2S Permian Acquisition II LLC.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.