Just as oilfield-services firms played a significant role in solving for shale economics, they’re solving for 2021 and beyond.

SPEAKER(S):

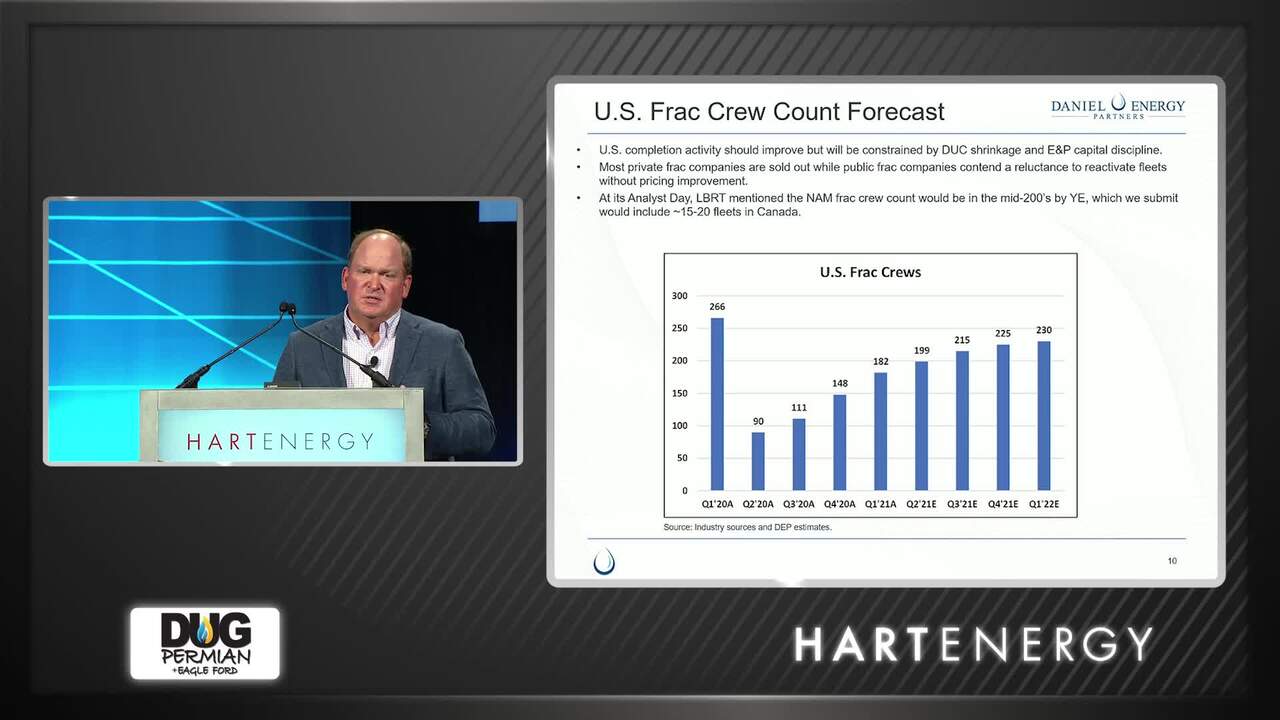

Sean Mitchell, Managing Partner, Daniel Energy Partners

Recommended Reading

INEOS Buys CNOOC’s Gulf Assets, Bringing US Deals Total to $3B

2025-04-02 - INEOS Energy closed an acquisition of U.S. Gulf assets held by a CNOOC subsidiary. Combined with a previous LNG agreement and acquisition of Eagle Ford Shale assets, the British company has spent $3 billion in the U.S.

ConocoPhillips Shopping Marathon’s Anadarko Assets for $1B— Source

2025-04-02 - ConocoPhillips is marketing Anadarko Basin assets it picked up through a $22.5 billion acquisition of Marathon Oil last year, Hart Energy has learned.

Diamondback Energy Closes $4.1B Double Eagle IV Acquisition

2025-04-02 - Diamondback Energy Inc. closed on its approximately $4.1 billion deal to buy EnCap Investments’ Double Eagle IV, adding approximately 40,000 net acres in the Midland Basin to its portfolio.

CenterPoint Energy Completes NatGas Pipeline Sale to Bernhard

2025-04-01 - CenterPoint Energy Inc. has closed on a sale of natural gas distribution utilities in Louisiana and Mississippi to Bernhard Capital Partners.

Ring Energy Closes Central Basin Platform M&A from Lime Rock

2025-04-01 - Ring Energy added 17,700 net acres and 2,300 boe/d of production in the Central Basin Platform through an acquisition from Lime Rock Resources IV.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.