Since finding backing from Quantum Energy Partners, Bison Oil & Gas IV has built an 83% HBP position in the Denver-Julesburg Basin, including more than 400 net locations and an average 20,000 boe/d, says CEO Austin Akers. (Source: Hart Energy)

DENVER —A lot has happened since the days when Bison Oil & Gas went looking for an entry into the Denver-Julesburg Basin (D-J Basin) but found little interest from private equity firms wary of Colorado’s reputation for regulatory hassles.

But CEO Austin Akers said that was one of the reasons that made the D-J— Bison’s old stomping grounds for three past iterations of the company— so alluring.

“While the regulatory environment was difficult, we saw that as more of an opportunity than we did as an impediment,” Akers said at EnerCom Denver.

As it turned out, Quantum Energy Partners had made a corporate decision to enter the D-J, as well — and they wanted to partner with Bison. Quantum backed the company with a $500 million equity commitment.

“In just 20 months, Bison has gone from a thought to the second largest private operator in the D-J,” Akers said. “Not surprisingly, of late, we've seen competition heating up and we've seen a lot of those larger PE [private equity] Quantum peers poking around the basin looking to jump on the bandwagon.”

Indeed, Bison has been busy.

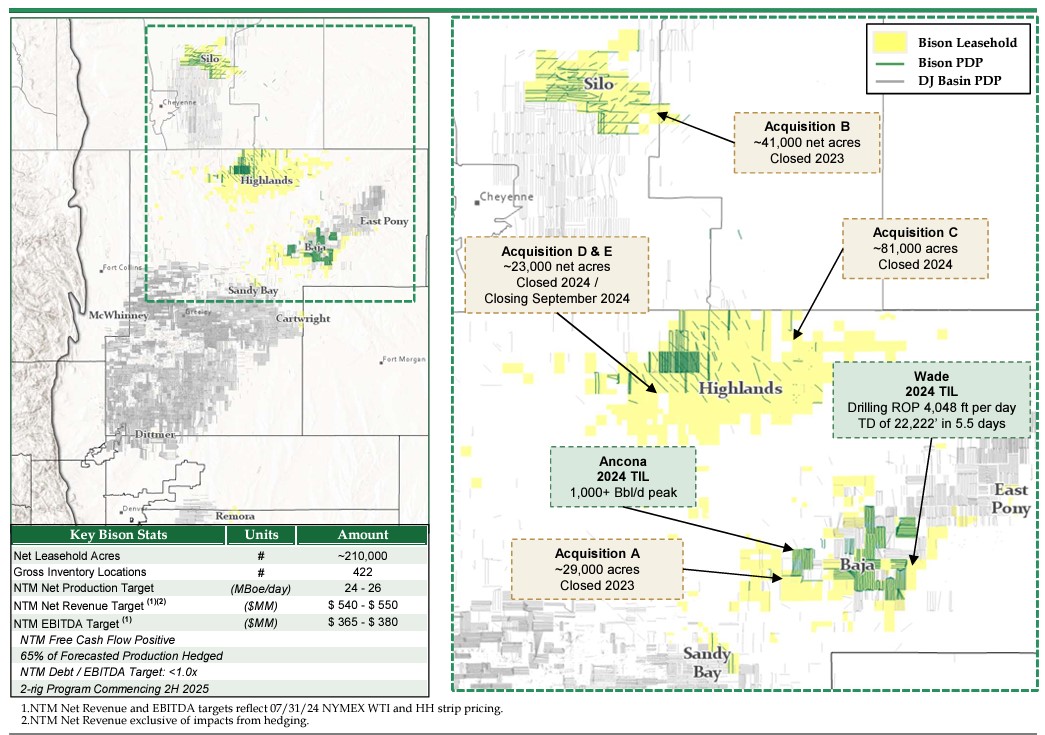

In the 20 months since the inception of Bison IV, the company has executed five acquisitions and multiple acreage swap and farm-out deals. The result: a 210,000-net-acre position, 83% HBP, with more than 400 net inventory locations.

The company averages more than 20,000 net boe/d, 80% liquids. Akers said the company anticipates next 12 month (NTM) EBITDA of $375 million and its NTM activity is 100% permitted — in Colorado.

“Our premise when we founded Bison IV with Quantum was that we know the D-J and that, in spite of the consolidation that has occurred over the last five years, there were still opportunities available,” Akers said.

Akers said the team knew that with a focus on creative and aggressive dealmaking, Bison could build another D-J company, “but frankly, Bison IV's ability to put such a position together in such a short timeframe has surpassed even my greatest expectations.”

Akers said Bison’s D-J well economics are impressive compared to other American shale basins. During the past year, Bison averaged $580/ft of completed lateral, with the last three months of its TILs “showing closer to $530/ft with the impact of longer laterals and larger pads, which is a very specific focus for Bison moving forward,” Akers said.

In 2025, Bison will average lateral wells at lengths of nearly 2.5 miles. Those low well costs come paired with strong and consistent production, resulting in “some of the best single well IRRs in the country,” Akers said. More than 50% of Bison’s current inventory results 55% IRRs at a $75/bbl and $2.50/Mcf prices. More than 90% of its inventory has 35% IRRs at the same price deck.

Bison, the D-J’s second biggest operator, has also produced the second best six-month cumulative production of any private operator in the basin, Akers said.

“Over the coming year, as we continue to add inventory via leasing and look for more acquisitions across the D-J, as well add rigs to accelerate production growth, Bison expects to become the largest private operator in the D-J Basin,” he said.

Bison has also built out complementary subsidiaries Zen Midstream and Red Fox Minerals.

Red Fox Minerals holds more than 38,000-net-royalty acres under 430 wells in the D-J, 180 of which are operated by Bison.

“This royalty position generates huge amounts of cash and enhances economics across many of our upcoming development locations,” Akers said.

Zen Midstream operates approximately 75 miles of three-stream gathering across the company’s Highlands position. Zen is also optimizing and constructing more than 16,500 hp of compression, allowing for the pressurization of over 70 MMcf/d to ensure “industry leading runtimes, pressures and operational control,” Akers said. The company is targeting an online date of late 2024 or early 2025 for the compression.

As for the dreaded regulatory reputation of Colorado, Bison already had an in with the state, Akers said.

“Our team has been part of every major rulemaking in Colorado over the past decade, and we strive to strike the appropriate balance that allows Colorado to excel in the most responsible oil and gas production in the world and allows bison to excel in Colorado,” he said.

Bison’s operational footprint is also almost entirely in sparsely populated areas of the basin, with nearly all of its inventory further than 2000 ft from any residence, based on rigorous internal permitting procedures and proactive location assessments, he said.

The company said it reaped the benefits with the Colorado Energy and Carbon Management Commission (ECMS).

“Bison's submission to approval time for ECMC location permits sits at just 121 days versus our peers’ average of 361 days,” Akers said.

The company’s well permits average a 50-day wait versus an industry average of 70 days, he said.

The company has also drilled nearly all of its wells in 2024 with electric rigs, resulting in saving more than $20,000 per well, along with emissions reductions.

Bison is not a new company. The company is in its fourth iteration and has, during the past nine years, executed nearly $2 billion of A&D and drilled more than 100 D-J Basin wells.

All of that work has set Bison’s core team to drill its 200th D-J well sometime in 2025, “on top of closing dozens of acquisitions and divestitures over the past decade,” Akers said.

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

Chevron Completes Farm-In Offshore Namibia

2025-02-11 - Chevron now has operatorship and 80% participating interest in Petroleum Exploration License 82 offshore Namibia.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.