Earthstone Energy agreed to acquire EnCap-backed Sabalo, which is expected to more than double the company’s Midland Basin footprint. (Source: Hart Energy)

[Editor's note: This story was updated at 1:28 p.m. CST Oct. 18.]

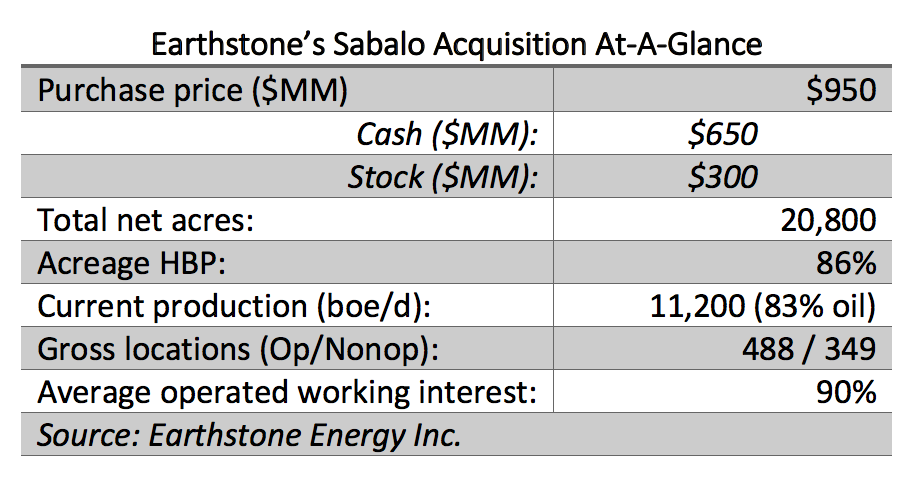

Earthstone Energy Inc. (NYSE: ESTE) said Oct. 17 it will more than double its footprint in the Midland Basin with an agreement to acquire the asset base of Sabalo Holdings LLC in a cash-and-stock transaction worth roughly $950 million.

Sabalo is a privately held oil and gas company based in Corpus Christi, Texas, and backed by EnCap Investments LP. The transaction with Earthstone will include Sabalo’s interests in Sabalo Energy LLC and Sabalo Energy Inc., whose assets comprise producing and non-producing oil and gas assets in the northern Midland Basin.

Earthstone President Robert J. Anderson said the purchase continues the company’s transformation into a premier Midland Basin-focused operator, which began in 2017 with its acquisition of Bold Energy III LLC for $324 million.

“We have delivered on our goal, as stated after our 2017 acquisition of Bold, to significantly increase our operated acreage and inventory of highly economic locations,” Anderson said in a statement. “With the addition of this especially attractive contiguous acreage to our existing Midland Basin assets, we have positioned Earthstone to capitalize on increased scale and strong asset quality in order to generate significant returns.”

Sabalo’s asset base is comprised of a contiguous acreage block in “the heart of the northern Midland Basin with a deep inventory of high-return drilling locations provides an exciting foundation for growth,” Anderson said.

In total, Earthstone expects to acquire 20,800 net acres, largely in Howard County, Texas, with roughly 11,200 barrels of oil equivalent per day (boe/d) of associated production, 83% of which is oil.

Earthstone paid about $24,000 per acre for the Sabalo acquisition assuming $40,000 per boe/d on existing production, according to estimates by John Aschenbeck, senior analyst for Seaport Global Securities LLC.

Aschenbeck’s estimated price tag for the deal compares favorably to the average acquisition price, per Earthstone, of recent offset Northern Midland transactions inked at roughly $35,000 per acre. The company plans to fund the $650 million cash portion of the Sabalo acquisition through a preferred stock offering, notes issuance and with borrowings under its revolver.

“We’re fans of this deal as it addresses Earthstone’s primary weakness as a Midland Basin operator—scale—and does so while also high-grading its overall inventory quality at a favorable $24,000 per acre price tag without over-levering the balance sheet,” he said in a research note on Oct. 18.

Sabalo’s footprint is about 85% operated, and the company holds an average 90% working interest for operated units. The position is roughly 86% HBP and has been significantly de-risked for the Wolfcamp A and Lower Spraberry formations. Horizontal delineation efforts are also currently in progress for the Wolfcamp B and Middle Spraberry, though a number of vertical wells have already partially de-risked the property for those zones, according to Aschenbeck.

Additionally, Earthstone estimates 488 gross operated and 349 gross nonop locations across the Sabalo acreage. The position also possesses extensive midstream infrastructure including oil and gas transportation plus water sourcing and disposal that will help facilitate accelerated development, Aschenbeck said.

“Subsequently, Earthstone can now reap the benefits of such size and transition into manufacturing mode,” he said. “In addition, we believe the added scale—along with our estimated $15,000 per acre valuation for the pro-forma entity—should position Earthstone as an attractive takeout candidate for larger operators down the road.”

Combined with Sabalo, Earthstone’s position in the Midland Basin is expected to increase by 69% to about 50,800 net acres, predominately located in Howard, Reagan, Upton and Midland counties, Texas. In addition, the company’s total production is expected to more than double and its rig count in the Midland Basin will grow from one rig to three, which Aschenbeck said will allow for a full-time frack crew.

Pro-forma production for the Sabalo acquisition is about 21,850 boe/d, comprised of 75% oil and 89% liquids. Earthstone’s drilling locations will also increase by 97% to an estimated 990 gross operated locations.

Anderson said Earthstone’s larger scale of operations should drive a number of additional benefits as the company focuses on further improving corporate and field-level operating efficiency.

“We have a clear line of sight toward being cash flow positive in 2020,” he said.

Sabalo is currently operating a two-rig drilling program on its position. Earthstone expects to maintain one rig full time in the Midland Basin until the closing of the Sabalo acquisition, expected on Jan. 1.

“Sabalo’s continuing two rig development program has created significant momentum and driven over a 300% increase in its oil production over the last 12 months,” Anderson said. “We expect production to continue to increase and our plan is to maintain those two rigs and the single rig we have been operating on our southern Midland Basin acreage since May 2017. We have a clear line of sight toward being cash flow positive in 2020.”

Based on an assumed closing of the Sabalo acquisition, Earthstone expects full-year 2019 production to range from 25,000 to 29,000 boe/d (about 70% oil) with a capex between $425 million and $500. million.

RBC Capital Markets LLC is financial adviser to Earthstone for the Sabalo acquisition. Stephens Inc. is independent financial adviser and provided a fairness opinion to the special committee. Jefferies LLC is Earthstone’s sole placement agent in connection with the preferred stock. Jefferies is also the sole financial adviser to Sabalo. Legal advisers included Jones & Keller PC for Earthstone, Richards, Layton & Finger PA for the special committee and Bracewell LLP for Sabalo.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

What's Affecting Oil Prices This Week? (Jan. 27, 2025)

2025-01-27 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will threaten $75.

What's Affecting Oil Prices This Week? (March 3, 2025)

2025-03-03 - For the upcoming week, Stratas Advisors expects oil prices to continue bouncing around but overall trend upward.

Dallas Fed: Trump Can Cut Red Tape, but Raising Prices Trickier

2025-01-02 - U.S. oil and gas executives expect fewer regulatory headaches under Trump but some see oil prices sliding, according to the fourth-quarter Dallas Fed Energy Survey.

Enbridge Plans $2B Upgrade for Mainline Crude Pipeline Network

2025-03-05 - New tariffs imposed by President Trump are unlikely to affect Enbridge’s Canadian and U.S. operations, CEO says.

Oil Prices Rise in Thin Pre-Holiday Trade

2024-12-24 - Supply and demand changes in December have been supportive of oil price's current less-bearish view so far, analysts say.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.