(Source: Shutterstock.com)

Editor's note: This article has been updated with additional deal details, charts and maps.

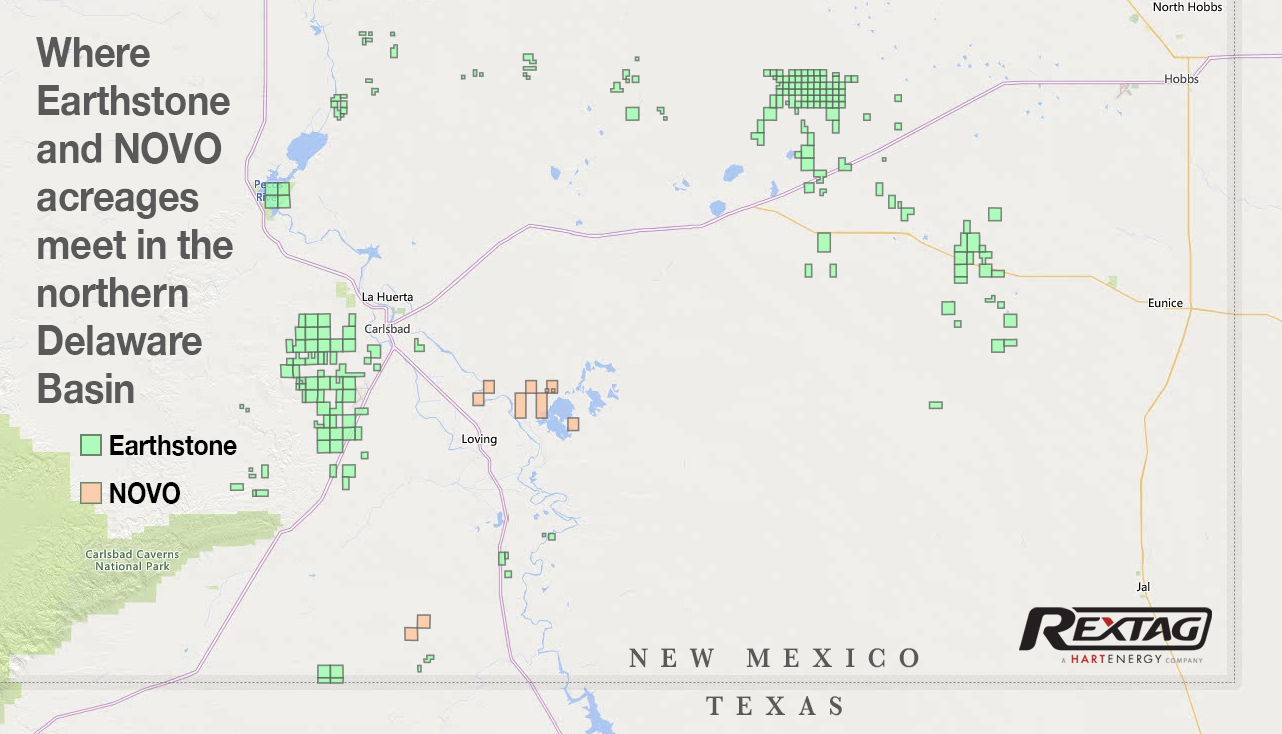

Earthstone Energy Inc. is expanding its position in the northern Delaware Basin with a $1 billion deal to acquire Novo Oil & Gas.

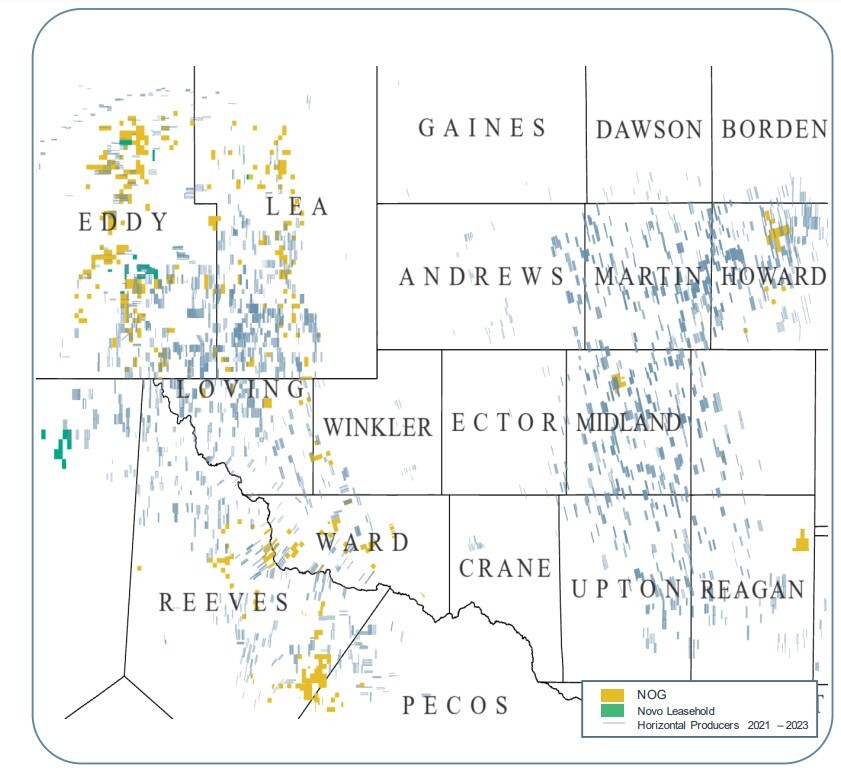

Northern Oil & Gas Inc. simultaneously announced it will acquire a 33.33% undivided stake in the Novo assets in partnership with Earthstone for an additional $500 million, bring the transaction value to $1.5 billion.

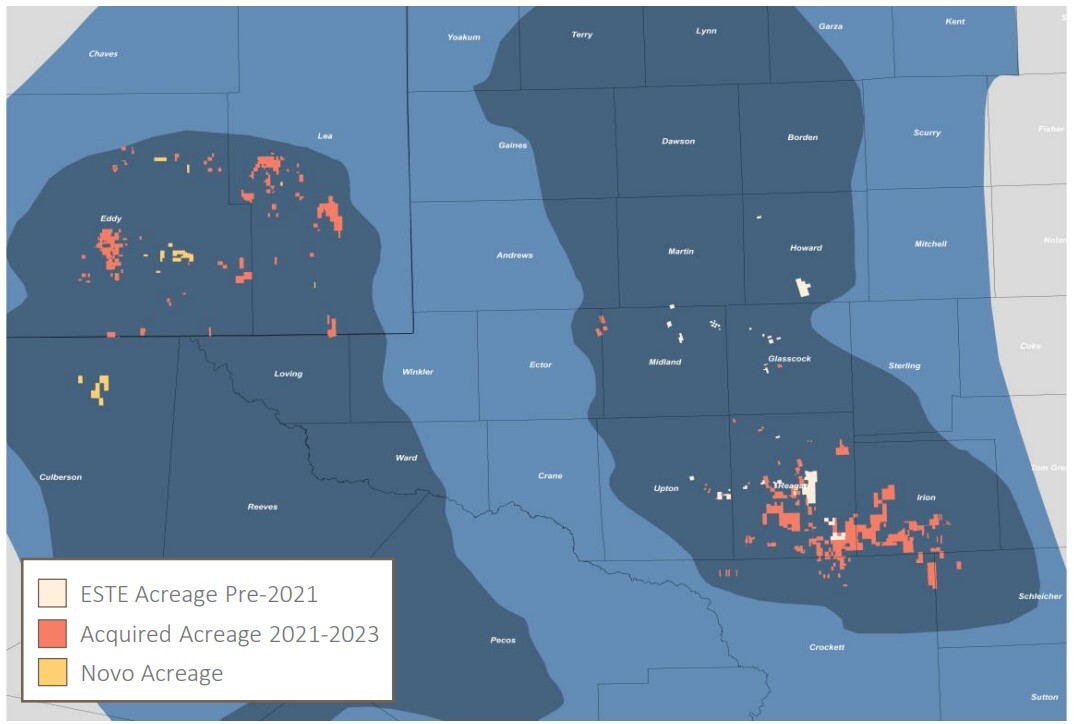

For Earthstone, the acquisition of Novo Oil & Gas Holdings, a private E&P backed by EnCap Investments LP, will add around 11,300 net acres in Eddy County, New Mexico, and Culberson County, Texas, to the E&P’s footprint, the company announced June 15.

Earthstone’s Delaware acreage position will grow to approximately 56,000 net acres after the deal closes, which is expected to occur during the third quarter.

The deal caps a first-half 2023 run for EnCap in which it has sold at least $7.5 billion in assets.

Earthstone’s Delaware acreage position will grow to approximately 56,000 net acres after the deal closes, which is expected to occur during third-quarter 2023.

Novo’s assets include average production of about 38,000 boe/d (37% oil, 66% liquids) from 114 wells, as well as proved reserves of nearly 74 MMboe.

“I am pleased that we are continuing to further our consolidation strategy with today’s announcement of the Novo Acquisition as we further build our northern Delaware Basin asset base,” said Robert J. Anderson, president and CEO of Earthstone, in a press release. “With significant production volumes from the Novo Acquisition, we expect Earthstone’s near-term production levels to surpass 135,000 [boe/d].”

The deal will also expand Earthstone’s drilling inventory by 24% to 1,020 gross undeveloped locations, extending the company’s inventory life to around 13 years under a five-rig drilling program.

Under the acquisition agreement, Earthstone will pay $1.5 billion to purchase Novo Oil & Gas. Concurrently, Northern Oil & Gas Inc. will acquire working interests in about a third of Novo’s assets from Earthstone for $500 million. Earthstone will retain the remaining 66.66% interest for a net purchase price of $1 billion.

Earthstone expects to fund the deal with cash on hand and borrowings under its senior secured revolving credit facility. The company said it had secured $250 million of incremental commitments in conjunction with the Novo deal.

Earthstone’s plans for Novo

The Woodlands, Texas-based Earthstone plans to maintain its five-rig drilling program after closing the Novo deal. The company plans to shift one of its two drilling rigs currently operating in the Permian’s Midland Basin to the Delaware to focus on Novo’s assets.

After closing, Earthstone will have four rigs in the Delaware and one rig in the Midland.

Earthstone expects the addition of Novo’s assets to increase the E&P’s production by 30,000 boe/d to 35,000 boe/d in the fourth quarter.

As E&Ps in the Permian scramble for inventory runway, the Novo deal adds around 200 undeveloped drilling locations in the Delaware to Earthstone’s portfolio.

Despite acquiring the new assets, Earthstone left its capital spending guidance unchanged. The company’s 2023 capex remains at between $725 million and $775 million.

Earthstone also disclosed divesting non-core Midland Basin assets at the end of May for cash proceeds of about $56 million. The divested assets included production of around 530 boe/d (45% oil) and acreage with 32 “short lateral drilling locations,” the company said.

The company will continue to evaluate selling other non-core assets in its portfolio, according to its press release.

RELATED: Ovintiv Completes $4.2B Midland Basin Deal, Bakken Exit

NOG boosts Permian presence

For Minneapolis-based NOG, the deal to acquire a 33.33% undivided stake in Novo’s assets adds about 13,000 boe/d and 5,600 net acres to the E&Ps portfolio.

The deal includes 29.2 net producing wells and 59.9 net undeveloped locations in the northern Delaware. Novo’s assets in Eddy County, New Mexico, represent about 80% of the transaction’s value, NOG said.

“Novo is NOG’s largest transaction to date and is among the most accretive, with significant high-quality, long-dated inventory,” CEO Nick O’Grady said in a press release.

NOG expects production on its portion of the Novo assets to average approximately 11,500 boe/d during the second half of 2023.

Last month, NOG announced partnering with Vital Energy Inc. to jointly acquire Forge Energy II Delaware LLC’s assets in a $540 million deal. Under terms of that agreement, Vital will purchase 70% of Forge’s assets for $378 million. NOG will acquire a 30% undivided stake in the Forge assets for a purchase price of $162 million in cash.

With the acquisitions of Novo and Forge, another EnCap portfolio company, NOG will doubled its total Permian Basin acreage since the end of 2022—from 17,616 net acres to 35,350.

EnCap M&A on a roll

EnCap has seen a streak of sales in recent months as the private equity firm monetizes some of its upstream investments.

On June 12, EnCap closed a deal to sell three E&Ps in its portfolio—Black Swan Oil and Gas, PetroLegacy Energy and Piedra Resources—to Ovintiv Inc. in a $4.275 billion transaction. In a related but separate transaction, Ovintiv sold its entire Bakken position to EnCap portfolio company Grayson Mill Bakken LLC for $825 million.

Permian Basin E&P Matador Resources closed a $1.6 billion acquisition of EnCap portfolio company Advance Energy Partners Holdings LLC in April.

In May, Kimbell Royalty Partners closed a deal to acquire mineral and royalty interests in the northern Midland Basin from MB Minerals LP, a subsidiary of EnCap-backed Sabalo Holdings LLC, for approximately $140.8 million.

RELATED: NOG Joins Vital Energy in $540 Million Delaware Deal

Recommended Reading

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.