ONEOK continues its climb to the top circle of midstream companies through aggressive dealmaking. The Tulsa, Oklahoma-based company has reached separate deals to acquire EnLink Midstream and Medallion Midstream for $5.9 billion, moving the needle in several ways.

ONEOK announced the EnLink and Medallion acquisitions in late August. The company signaled its intention to compete with top midstream companies like Energy Transfer and Enterprise Products Partners in 2023 when it brokered the $19 billion merger with Magellan Midstream. The latest transactions help round out ONEOK’s portfolio as a full-service midstream provider.

In the case of EnLink, ONEOK will acquire GIP’s 43% limited partner stake and 100% of the general partner interest for $3.3 billion. ONEOK intends to acquire the remaining public units of EnLink in a tax-free transaction.

East Daley projects EnLink to earn $1.48 billion for 2025, 5% above consensus estimates of $1.416 billion. That implies a pre-synergy multiple of 8.8x (vs. 9.2x consensus) and synergies of $100-$150 million. The clearest of those synergies is EnLink’s $120 million in annual selling, general and administrative (SG&A) costs and a reduction in its $100 million of interest and preferred distributions.

The EnLink purchase helps ONEOK in several ways. EnLink’s assets help ONEOK establish a gathering and processing presence in the Permian Basin, which in turn will support volumes on ONEOK’s West Texas NGL Pipeline as competitors fight over third-party barrels. In addition to the Permian, EnLink also brings exposure to Louisiana gas markets and bolsters its presence in the Anadarko Basin.

On the commercial side, the most obvious synergy is EnLink’s 150,000 bbl/d-200,000 bbl/d of Permian NGL that become uncontracted in three to four years. ONEOK is short NGL production and long pipeline capacity in the Permian, which means it relies on volumes from third-party processing plants to fill its West Texas NGL system. ONEOK already sources a significant chunk of NGL from EnLink’s gas processing plants in the basin, including Midmar, Deadwood, Phantom, Riptide and Bearkat. We expect EnLink already sends half of these NGL to ONEOK, but even the remaining 75,000 bbl/d uplift could result in an additional $50 million in annual EBITDA.

EnLink also gives ONEOK its first gathering and processing assets based in the Permian, filling a big hole in its midstream portfolio. East Daley has been tracking 17-21 rigs since August between EnLink’s Delaware and Midland gathering and processing systems.

Outside the Permian, EnLink boosts ONEOK’s position in the Anadarko Basin. We expect limited synergies on the NGL side as EnLink primarily ships on ONEOK’s pipelines already, but the additional scale in the basin could allow ONEOK to attract new customers and ship additional purity products on the refined products system it acquired via Magellan. EnLink’s Oklahoma assets also provide some upside if higher gas prices spark increased activity in the basin.

An underappreciated component of EnLink could be its Louisiana assets. EnLink helps position ONEOK to take advantage of higher Haynesville production and LNG demand growth on the Gulf Coast. Both companies are expanding natural gas storage, and rates on those assets have been increasing dramatically. EnLink also runs a carbon sequestration project using its pipeline network in the Mississippi River corridor, giving ONEOK exposure to an emerging area for investment.

The Medallion impact

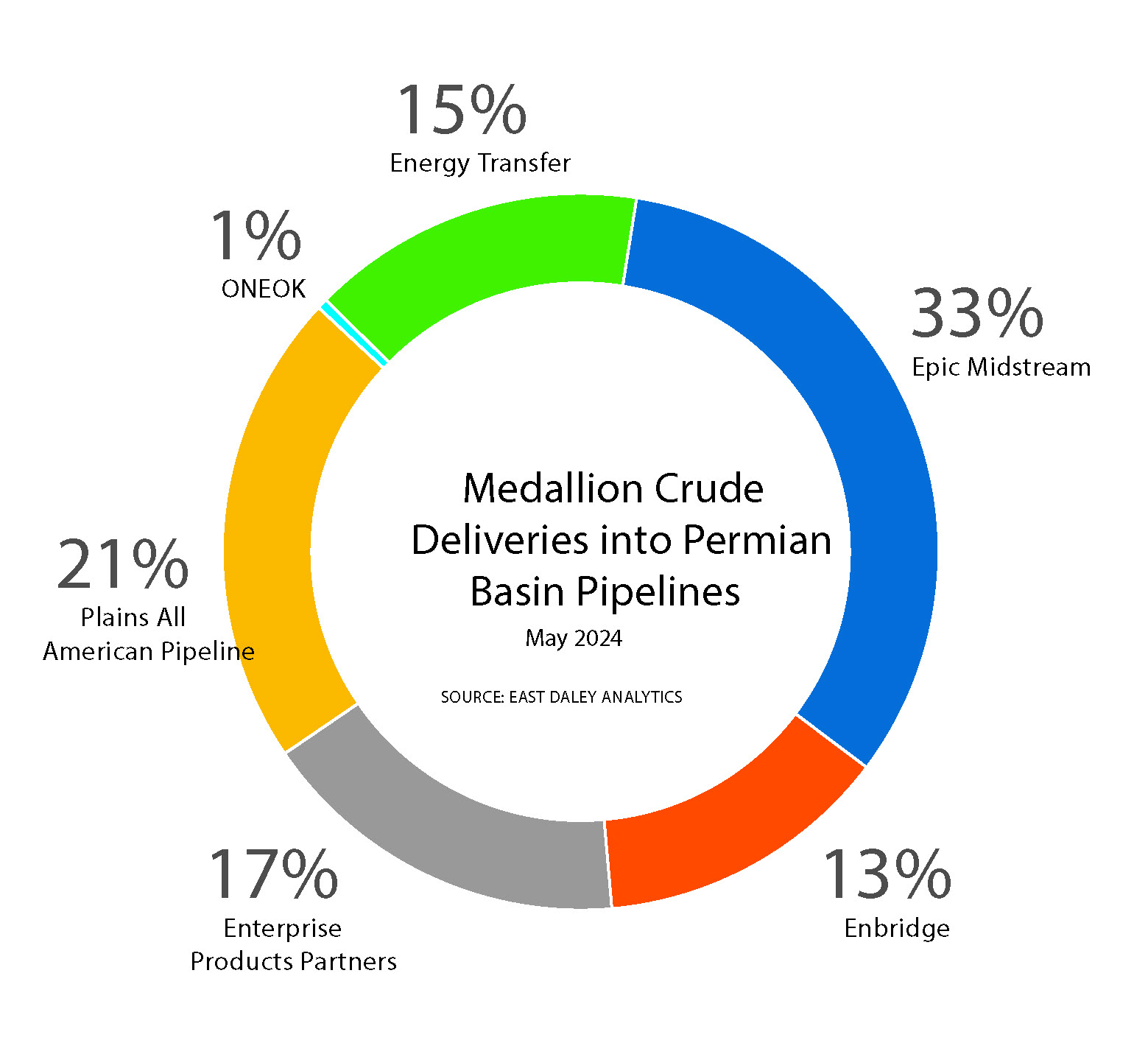

The $2.6 billion acquisition of Medallion Midstream expands ONEOK’s services into Permian crude gathering. Strategically, the move makes sense for ONEOK and follows a strategy we’re seeing with other gathering and processing and NGL asset deals: move closer to the wellhead to secure supply for downstream pipes and marketing.

Recent crude acquisitions have generally flown under the radar, yet the Medallion deal continues a trend: Plains All American and Oryx merged their Permian crude gathering assets in 2021, Energy Transfer acquired crude gatherer Lotus Midstream in 2023, and Energy Transfer recently merged its Permian crude gathering assets (including systems acquired via Lotus) with Sunoco’s NuStar Permian gathering system. Like these deals, the Medallion acquisition gives ONEOK the opportunity to leverage crude volumes to feed downstream pipelines, storage tanks, export terminals and marketing operations.

However, the multiple screens high for crude gathering assets, and implies a significant amount of synergies. Medallion’s trailing 12-month EBITDA from the first quarter only totals $275 million across its entities regulated by the Federal Energy Regulatory Commission. East Daley arrives at 9.5x multiple before synergies, much higher than our 7.5x multiple estimate for Energy Transfer’s acquisition of Lotus Midstream.

ONEOK cited a 6.3x multiple post-synergies, implying $100-$150 million of growth and synergies, which seems high on an EBITDA base of $275 million. That said, Energy Transfer’s acquisition of Lotus seems to have generated significant commercial synergies for the company, so it is not out of the question that ONEOK can do the same with Medallion, which is even bigger than Lotus.

Recommended Reading

GA Drilling Moves Deep Geothermal Tech Closer to Commercialization

2025-02-19 - The U.S. Department of Energy estimates the next generation of geothermal projects could provide some 90 gigawatts in the U.S. by 2050.

Black & Veatch to Build Two Battery Storage Projects in UK

2025-02-11 - Serving as the projects’ owner’s engineer and technical advisor, Black & Veatch will review and provide technical advice, construction monitoring and schedule tracking services.

Ørsted, PGE Greenlight Baltica 2 Wind Project Offshore Poland

2025-01-29 - Ørsted said Baltica 2 is expected to be fully commissioned in 2027.

Energy Transition in Motion (Week of March 21, 2025)

2025-03-21 - Here is a look at some of this week’s renewable energy news, including a move by U.S. President Donald Trump to boost domestic production of critical minerals.

TotalEnergies, STMicroelectronics Ink 1.5 TWh Renewable Power Deal

2025-01-28 - As part of the 15-year contract, TotalEnergies will provide solar and wind power to New York-based STMicroelectronics.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.