Ajay Bakshani is Director of Midstream Equity, East Daley Analytics

Maria Paz Urdaneta is Lead Data Analyst, East Daley Analytics

Midstream is back in the Permian Basin. Following the start of Matterhorn Express, investors have pulled the trigger on several new greenfield pipelines to move natural gas away from West Texas. The investments stand to solve a longstanding bottleneck for operators and open the door to more energy production.

In early December, Energy Transfer (ET) announced a final investment decision (FID) on the Warrior Pipeline, renamed as the Hugh Brinson Pipeline. The 42-inch pipeline will span 400 miles from the Waha Hub in West Texas to Maypearl, south of Dallas/Fort Worth, where it will connect to other ET pipelines and storage infrastructure.

In Phase 1, ET will also build a 36-inch lateral for 42 miles in Martin and Midland counties to connect the mainline to third-party processing plants. Including a Phase 2 compression expansion, ET estimates a total project cost of about $2.7 billion.

ET executives had suggested a final project decision was close on the company’s third-quarter earnings call in early November. Including compression, the Hugh Brinson Pipeline will be able to transport up to 2.2 Bcf/d at an estimated $2.7 billion cost. ET plans to start Phase 1 of the project (1.5 Bcf/d capacity) by the end of 2026.

The go-ahead by ET follows the FID in July of another 42-inch greenfield project, the Blackcomb Pipeline. Led by WhiteWater Midstream, the Blackcomb group includes the Whistler Pipeline joint venture (50.6% WhiteWater, 30.4% MPLX, 19% Enbridge) and Targa Resources. Blackcomb will be able to transport up to 2.5 Bcf/d from the Permian Basin to the Agua Dulce hub in South Texas, sourcing supply from processing plants in the Midland and connections to the Agua Blanca Pipeline. Start-up is planned in the second half of 2026.

Adding to the midstream momentum, Kinder Morgan (KMI) is moving forward with an expansion of the Gulf Coast Express Pipeline (GCX). KMI will add compression to the 500-mile line to South Texas, taking its total capacity from the Permian to 2.57 Bcf/d. The GCX partners (KMI, ArcLight Capital Partners and Phillips 66 (PSX)) reached FID after obtaining binding long-term agreements, KMI said in its third-quarter earnings update.

RELATED

Phillips 66 Sells Stake in Gulf Coast Express for $865MM

These announcements follow the widely anticipated start of the Matterhorn Express Pipeline from the Permian. Led by WhiteWater Midstream, the 42-inch Matterhorn began delivering gas on Oct. 1 to the Katy Hub west of Houston. Volumes have ramped quickly on Matterhorn, climbing up to 1.4 Bcf/d in early November, thanks to multiple pipeline interconnects. In early December, Matterhorn was delivering about 1.3 Bcf/d to Katy on six interstate systems monitored by East Daley Analytics.

Long runway for Permian growth

The new pipelines are great news for producers in the Permian Basin. Including Matterhorn and ET’s decision on the Hugh Brinson line, Permian operators could see over 7.7 Bcf/d of new takeaway capacity added by the end of 2026.

Operators for years have contended with limited takeaway for their associated natural gas, slowing development and pressuring gas prices lower in the basin. During periods of pipeline maintenance, spot prices at the Waha Hub can trade for negative prices. But with the latest decision by ET, East Daley expects ample gas pipeline capacity out of the Permian to accommodate growth.

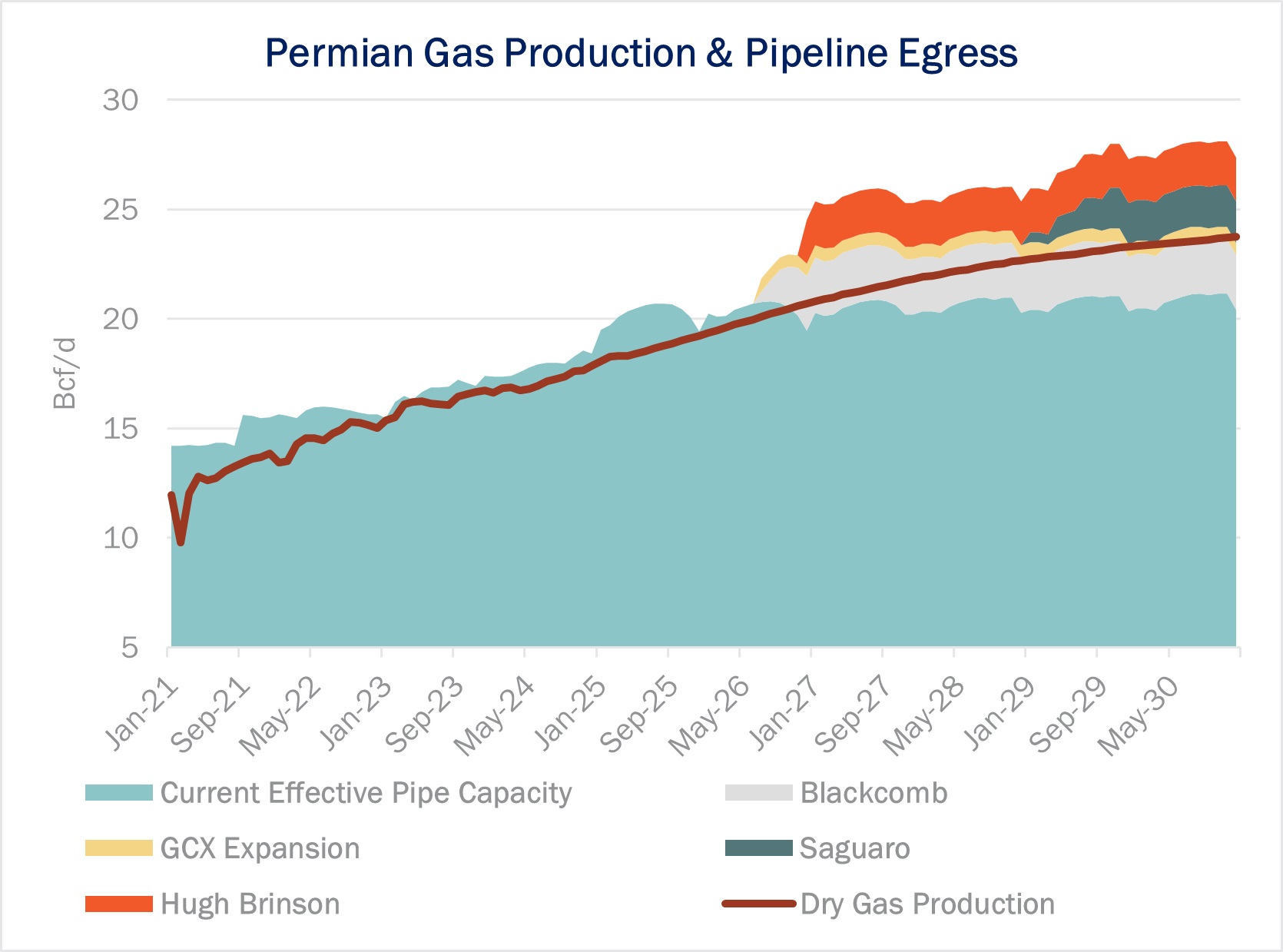

The chart compares East Daley’s latest Permian Basin gas production forecast with our outlook for pipeline egress through 2030, including ET’s Hugh Brinson pipeline. If Mexico Pacific LNG reaches FID (expected early this year), and thus ONEOK moves ahead with its Saguaro pipeline, the basin will have plenty of capacity through 2030.

East Daley expects a near-term boost in Permian oil and gas output thanks to Matterhorn as operators start more wells. We model average dry gas production to grow 1.5 Bcf/d to 18.6 Bcf/d in 2025.

Oil production also grows in our 2025 forecast. Permian oil production passed 6 MMbbl/d at the end of 2023 and was on pace to average 6.1 MMbbl/d in 2024. We forecast 300,000 bbl/d of growth in 2025. By the time Blackcomb and the ET line start at year-end 2026, Permian oil production reaches over 6.7 MMbbl/d in our outlook.

Expanding Texas demand

While great for producers, the overbuild of gas pipelines is likely to significantly narrow spreads from the Waha Hub, a source of profit for many midstream and marketing companies. Firms with marketing affiliates (including ET) can sell cheap gas bought in the Permian to higher-priced markets.

So, why would ET still build Hugh Brinson? One answer is data centers and increasing power demand in the Dallas-Fort Worth area, where Hugh Brinson terminates. ET’s management hinted as much in the third-quarter call, saying contracting is “weighted a little bit heavier towards market pool than it is on producer push.” Unlike producers, demand-pull customers like electric utilities do not care about overbuilding so much as securing supply.

With ever-increasing demand estimates from data centers and general population growth, Texas will need a lot of generation capacity, and natural gas plants will be a part of the solution.

The Electric Reliability Council of Texas (ERCOT) expects peak generation capacity will need to grow 72% by 2030 to meet demand, from 86 megawatts (MW) in 2024 to 148 MW. Those estimates are significantly higher than other independent system operator forecasts, and we would not be surprised if a more conservative outlook materializes. Nonetheless, we expect a large increase in power (and thus natural gas) demand ahead.

The theme of higher power demand is starting to crystalize into real investments, and ET looks to be an early winner with the Hugh Brinson project. It, along with the Matterhorn start, is one more reason to be bullish on the long-term outlook for the Permian Basin. With the Blackcomb and KMI expansions still ahead, the future is certainly bright.

Recommended Reading

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-16 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

New Era Helium, Sharon AI Cement Permian Basin Data Center JV

2025-01-21 - New Era Helium and Sharon AI have created a JV, Texas Critical Data Centers, and are working on offtake gas supply agreements and site selection.

Electron Gold Rush: ‘White Hot’ Power Market Shifts into High Gear

2025-03-06 - Tech companies are scrambling for electrons as AI infrastructure comes online and gas and midstream companies need to be ready, Energy Exemplar CEO says.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.