Edge Petroleum Corp., Houston, (Nasdaq: EPEX) has amended its previously announced deal and plans to acquire additional properties in 13 counties in southeastern and South Texas from an undisclosed private company for $385 million in cash. Edge originally planned to acquire approximately 143 gross producing wells (72 net) and an ownership interest in approximately 17,000 gross developed acres (11,000 net) and 56,000 gross undeveloped acres (16,000 net) for $320 million. The additional interests will cost $65 million and will increase its net well count from 72 net wells to 84 net wells, increasing the company's average working interest from approximately 50% to 60%, and adding additional proved reserves of 21 billion cubic feet of gas equivalent. Estimated net production is approximately 31 million cubic feet equivalent per day (86% gas). Proved reserves with the additional properties are approximately 126 billion cubic feet equivalent, and possible reserves are 45- to 50 billion equivalent.

Recommended Reading

Quantum’s VanLoh: New ‘Wave’ of Private Equity Investment Unlikely

2024-10-10 - Private equity titan Wil VanLoh, founder of Quantum Capital Group, shares his perspective on the dearth of oil and gas exploration, family office and private equity funding limitations and where M&A is headed next.

ConocoPhillips Hits Permian, Eagle Ford Records as Marathon Closing Nears

2024-11-01 - ConocoPhillips anticipates closing its $17.1 billion acquisition of Marathon Oil before year-end, adding assets in the Eagle Ford, the Bakken and the Permian Basin.

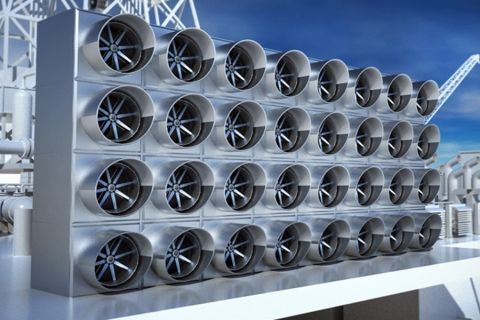

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Sheffield: E&Ps’ Capital Starvation Not All Bad, But M&A Needs Work

2024-10-04 - Bryan Sheffield, managing partner of Formentera Partners and founder of Parsley Energy, discussed E&P capital, M&A barriers and how longer laterals could spur a “growth mode” at Hart Energy’s Energy Capital Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.