In 2023, natural gas production reached record-high average production levels of 125 Bcf/d. Producers or shippers flared or vented about 0.5%, according to the EIA’s estimate. (Source: Shutterstock)

The U.S. petrochemical industry cut the rate of natural gas lost to flaring and venting in 2023 over 2022, according to an early estimate released by the U.S. Energy Information Administration (EIA) on June 20.

“We estimate this percentage will be the lowest rate of venting and flaring recorded in 18 years,” the EIA published on its website. The agency will publish updated and final results in September.

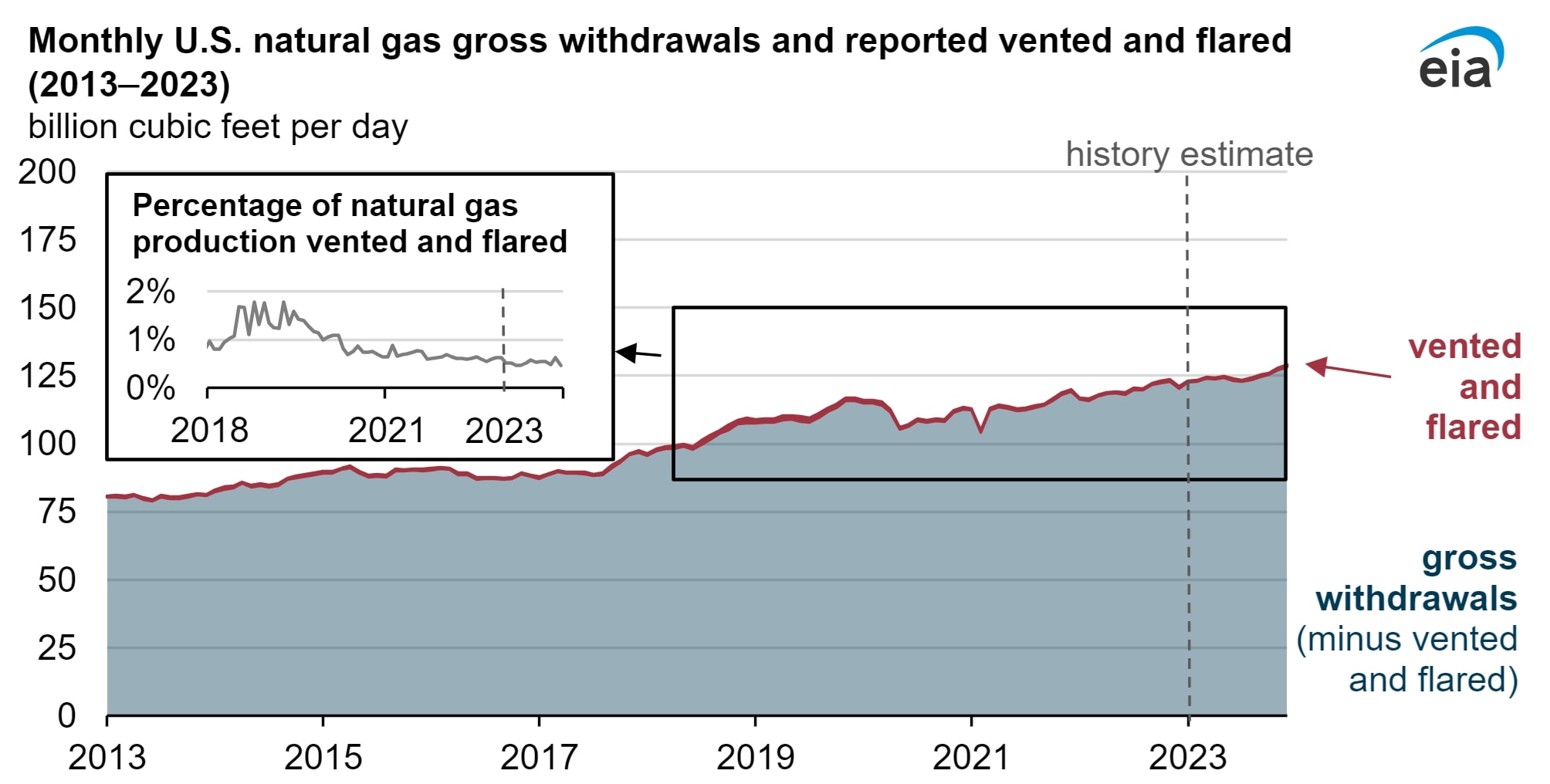

In 2023, natural gas production reached record-high average production levels of 125 Bcf/d. Producers or shippers flared or vented about 0.5%, according to the EIA’s estimate.

In 2018, about 1.3% of natural gas was vented or flared. In 2022, the rate was 0.62%, or an average of 742 MMcf/d. If the estimate for 2023 holds, the overall natural gas vented or flared in the U.S. will have decreased to about 625 MMcf/d, according to Hart Energy’s calculation using EIA figures.

Oil and natural gas producers vent or flare natural gas in response to emergencies, tests, maintenance or infrastructure constraints. Venting is the direct release of natural gas, primarily methane, during the oil and gas production process. Flaring is the burning of natural gas, which releases CO2 and a smaller amount of methane into the atmosphere. Both practices have come under stricter scrutiny from the federal government in recent years as greenhouse gas reduction is further emphasized.

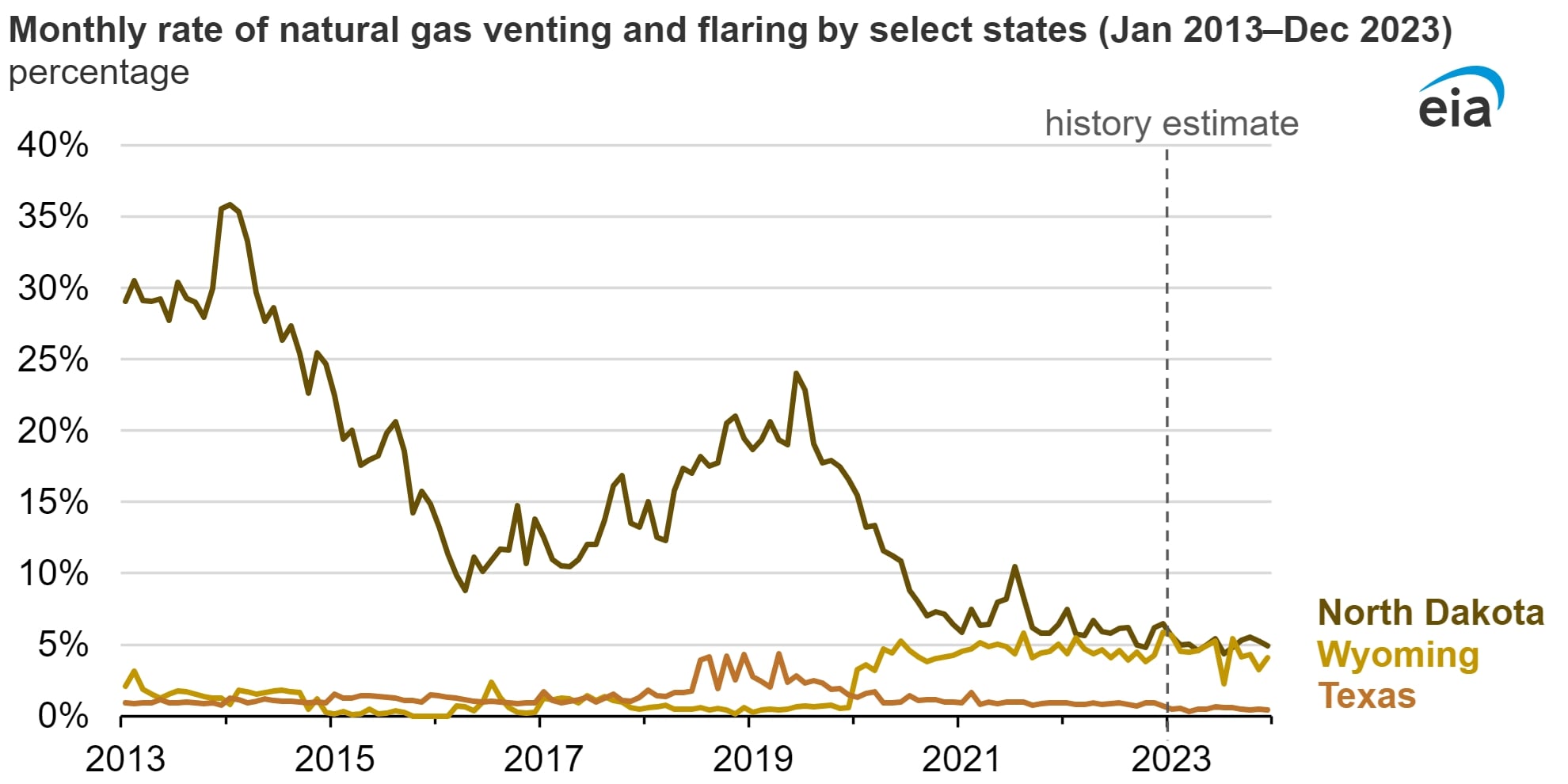

The rate of vented or flared natural gas varies a great deal across the country, thanks to either state regulations or the nature of the play. Three states, Texas, Wyoming and North Dakota, are responsible for the majority of flaring and venting operations in the U.S.

Texas’ rate of flaring and venting is 0.5%, matching the nation’s average. However, the state was the primary producer of released gas in 2022, thanks to Texas also being the overall largest producer of oil and gas in the U.S.

North Dakota has the worst rate, at 5.1% of gross withdrawals, while Wyoming vented and flared at a rate of 4.4%. The high rates, according to the EIA, are due to the nature of the Bakken Shale. Since 2006, the associated gas produced in the area rose rapidly—faster than infrastructure could be built to take it away. In 2011, North Dakota lost 31.6% of its natural gas.

In 2014, the North Dakota state government banned venting, leading the state to decrease its loss rates.

Texas may see an increase in flaring totals this year. In April, the Texas Railroad Commission saw a large increase in flaring requests over the same time frame from 2023. The requests followed natural gas prices dropping below zero at the Waha price hub near Pecos, Texas. Much of the natural gas from the Permian goes through the hub.

The Permian’s natural gas takeaway capacity has been at its maximum for most of 2024.

While the U.S.’ rate of venting and flaring declined in 2023, another report released June 20 saw an increase in the amount of CO2 released from the practice globally.

According to the Statistical Review of World Energy created by the Energy Institute, an energy trade organization focused on accelerating the transition to net zero, greenhouse gas emissions rose as energy demand increased from 2022 to 2023.

CO2 emissions from flaring increased by 7%; emissions from methane and industrial processes also increased by over 5%, according to the report.

And energy demand is only going to continue to grow as AI demand and U.S. LNG exports increase.

"In a year where we have seen the contribution of renewables reaching a new record high, ever increasing global energy demand means the share coming from fossil fuels has remained virtually unchanged," said report writer Simon Virley of consultancy KPMG.

Recommended Reading

Trio Chairman Robin Ross Named CEO Less Than a Month After Return

2024-07-15 - Robin Ross, who last month returned to Trio Petroleum as board chair, has been named CEO while predecessor Michael Peterson will remain as a consultant.

Upstream, Midstream Dividends Declared in the Week of July 8, 2024

2024-07-11 - Here is a selection of upstream and midstream dividends declared in the week of July 8.

Solaris Stock Jumps 40% On $200MM Acquisition of Distributed Power Provider

2024-07-11 - With the acquisition of distributed power provider Mobile Energy Rentals, oilfield services player Solaris sees opportunity to grow in industries outside of the oil patch—data centers, in particular.

Offshore Guyana: ‘The Place to Spend Money’

2024-07-09 - Exxon Mobil, Hess and CNOOC are prepared to pump as much as $105 billion into the vast potential of the Stabroek Block.

Pembina Completes Partial Redemption of Series 19 Notes

2024-07-08 - The redemption is part of Pembina Pipeline’s $300 million (US$220.04 million) aggregate principal amount of senior unsecured medium-term series 19 notes due in 2026.