Natural gas storage tanks. (Source: Shutterstock)

The U.S. Energy Information Administration (EIA) reported a 2 Bcf drop in U.S. storage levels for the week ending Nov. 20 as the injection season came to a close.

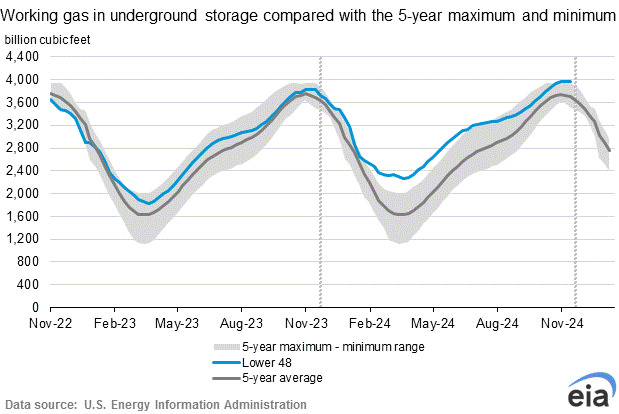

About 3.97 Tcf of natural gas is in storage, the EIA reported Nov. 27 ahead of the Thanksgiving holiday.

Stocks remain outside of the five-year high-and-low range and are 267 Bcf above the EIA’s five-year average. The level met market expectations, according to Natural Gas Intelligence, and did not change a bearish market that opened the day, though the overall outlook for natural gas has been positive for the fall.

Natural gas prices have moved in an upward direction for most of November, starting at $2.66/MMBtu on the Henry Hub front-month futures price on Nov. 1. Daily trading for the shortened holiday week saw prices flirting with $3.50/MMBtu for the first time in 2024.

The closing Henry Hub price on Nov. 26 was $3.47/MMBtu. The price fell more than $0.20 in trading before the storage report and fell about $0.07 afterwards, to $3.20/MMBtu at midday.

Recommended Reading

Baker Hughes Wins Contracts for Woodside’s Louisiana LNG Project

2024-12-30 - Bechtel has ordered gas technology equipment from Baker Hughes for the first phase of Woodside Energy Group’s Louisiana LNG development.

SM Energy Adds Petroleum Engineer Ashwin Venkatraman to Board

2024-12-04 - SM Energy Co. has appointed Ashwin Venkatraman to its board of directors as an independent director and member of the audit committee.

Gigablue Enters CCS Agreement with Investment Firm SkiesFifty

2025-01-14 - Carbon removal company and investment firm SkiesFifty have partnered to sequester 200,000 tons of CO2 over the next four years.

Chevron Names Laura Lane as VP, Chief Corporate Affairs Officer

2025-01-13 - Laura Lane will succeed Al Williams in overseeing Chevron Corp.’s government affairs, communication and social investment activities.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.