Morgan Stanley raised its Henry Hub forecast from $3.75/MMBtu to $4.15/MMBtu for 2025 in its report. (Source: Shutterstock)

The U.S. Energy Information Administration (EIA) reported a massive 258 Bcf withdrawal from U.S. storage for the week ending Jan. 10 as frigid temps and growing demand continue to pull the natural gas market into bullish territory.

According to EIA data, the withdrawal was the largest in a year since Jan. 19, 2024, and within the top 10 largest withdrawals going back to 2010.

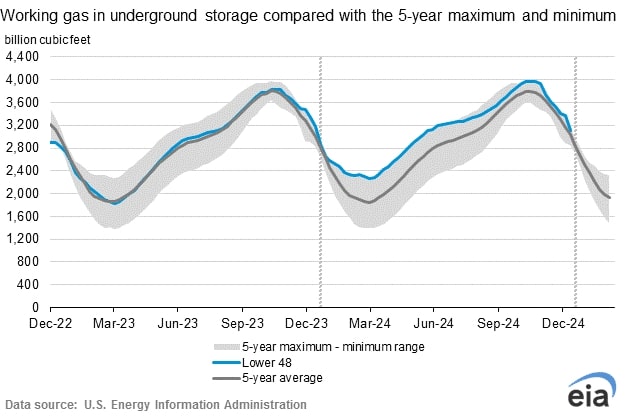

The EIA released the figures in its weekly report. Lower 48 states have 3.115 Tcf in storage, dropping about 3.4% from levels at the same time in 2024.

Large withdrawals from the U.S. storage usually happen in the winter months, typically in January. However, analysts pointed to the unusually cold temperatures, a growing LNG sector and lower production for the big drawdown.

Morgan Stanley noted production began at Corpus Christi LNG Stage III at the end of December, while Venture Global’s Plaquemines, which shipped its first cargo on Dec. 26, is now taking in 1 Bcf/d of natural gas ahead of original forecasts.

“LNG feed gas has averaged about 15 Bcf/d so far in January, a new monthly record for the U.S.,” Morgan Stanley analysts wrote in an analysis entitled “U.S. Natural Gas: Winter Wonderland” to describe the positive factors affecting natural gas supply.

U.S. dry natural gas production, meanwhile, averaged 102.5 Bcf/d so far in January, about 1.5 Bcf/d lower than December’s average.

Both events occurred while the country was experiencing its coldest January in a decade, according to the National Weather Service.

By March, Morgan Stanley forecasts natural gas in storage will fall to 1.55 Tcf, about 17% below the EIA’s five-year storage average. U.S. natural gas storage levels have not been below the five-year average since the spring of 2023.

The weather, production and demand factors have pushed natural gas to its highest price since December 2022. Henry Hub front-month futures prices hit $4.31/MMBtu during trading on Jan. 16, the first time the price had spent more than one day above $4/MMBtu since 2022.

Morgan Stanley raised its Henry Hub forecast from $3.75/MMBtu to $4.15/MMBtu for 2025 in its report.

Recommended Reading

Expand Lands 5.6-Miler in Appalachia in Five Days With One Bit Run

2025-03-11 - Expand Energy reported its Shannon Fields OHI #3H in northern West Virginia was drilled with just one bit run in some 30,000 ft.

EOG Ramps Gassy Dorado, Oily Utica, Slows Delaware, Eagle Ford D&C

2025-03-16 - EOG Resources will scale back on Delaware Basin and Eagle Ford drilling and completions in 2025.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

Sabine Oil & Gas to Add 4th Haynesville Rig as Gas Prices Rise

2025-03-19 - Sabine, owned by Japanese firm Osaka Oil & Gas, will add a fourth rig on its East Texas leasehold next month, President and CEO Carl Isaac said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.