The U.S. Energy Information Administration’s storage report failed to lift natural gas prices, which have spent the week on a downturn. (Source: Shutterstock.com)

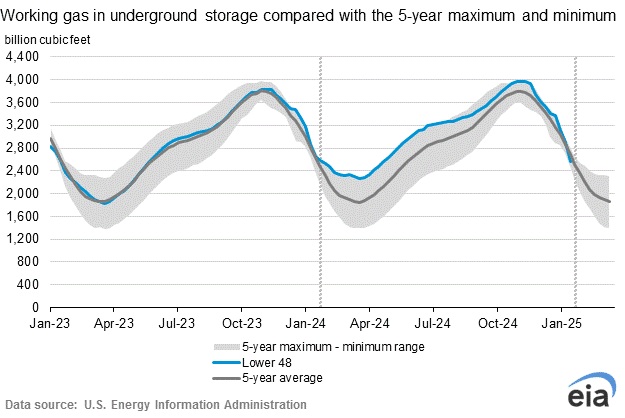

The amount of U.S. natural gas in storage dropped by 321 Bcf for the week ending Jan. 24, as a record cold snap caused gas customers to keep power running at high levels.

Natural gas prices, however, are currently under the influence of more recent events that have kept the market bearish.

According to U.S. Energy Information Administration, withdrawals have only surpassed 300 Bcf on three other occasions, going back to 2010. The largest-ever withdrawal was 359 Bcf in 2018.

With the withdrawal, the amount of gas in storage fell to 2.571 Tcf, a deficit of 111 Bcf to the EIA’s five-year average of 2.682 Tcf for this time of year. It’s the first time natural gas storage has been in a deficit relative to the five-year average in two years, according to an analysis by Mizuho Securities USA.

East Daley Analytics projected natural gas would remain in a deficit to the five-year average through the end of March.

A large storage withdrawal fell within the range (298 Bcf to 340 Bcf) of market expectations and, therefore, did little to stop natural gas prices' weeklong slide.

On. Jan 24, natural gas front-month futures prices closed over $4/MMBtu at the Henry Hub. After taking took two hits over the weekend, prices had declined by almost $1/MMBtu by Jan. 30.

Weather forecasts called for a warmer February than originally predicted, and Chinese company DeepSeek released on Jan. 26 an AI chatbot application that wreaked havoc on the tech sector and gassy E&P stock prices.

DeepSeek’s program, according to the company, costs much less to develop and runs and computer chips that require less electricity than current U.S. AI programs. Some tech analysts doubted DeepSeek’s claims.

The company’s announcement hit natural gas producers and midstream companies, which are considered the primary suppliers for the energy needed to fuel a growing AI data center sector in the U.S.

By Jan. 30, Henry Hub prices were trading below $3.08/MMBtu by mid-day.

Analysts have predicted a rebound in the natural gas market. Demand is expected to increase with more LNG export capacity scheduled to come online in 2025 and with other sectors of the U.S. economy requiring more electricity, with or without the expected boom in AI data centers.

Recommended Reading

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

Inside Ineos’ US E&P Business Plan: Buy, Build, Buy

2025-01-27 - The E&P chief of U.K.’s Ineos says its oily Eagle Ford Shale acquisition in 2023 has been a profitable platform entry for its new U.S. upstream business unit. And it wants more.

Darbonne: The Power Grid Stuck in Gridlock

2025-01-05 - Greater power demand is coming but, while there isn’t enough power generation to answer the call, the transmission isn’t there either, industry members and analysts report.

E&P Highlights: Jan. 6, 2025

2025-01-06 - Here’s a roundup of the latest E&P headlines, including company resignations and promotions and the acquisition of an oilfield service and supply company.

Perission Petroleum Extends Colombian Assets Sale

2025-01-22 - The sale was delayed due to pending formal confirmation regarding the extension of Perission Petroleum’s E&P license in Colombia, specifically for Block VMM-17.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.