(Source: Shutterstock.com)

U.S. natural gas storage withdrawals for the week ending Jan. 17 missed expectations by almost 20 Bcf, according to the U.S. Energy Information Administration’s weekly report.

Natural gas prices had reached above $4.02/MMBtu for front-month futures at the Henry Hub but fell to $3.90/MMBtu within an hour of the report’s release on Jan. 23.

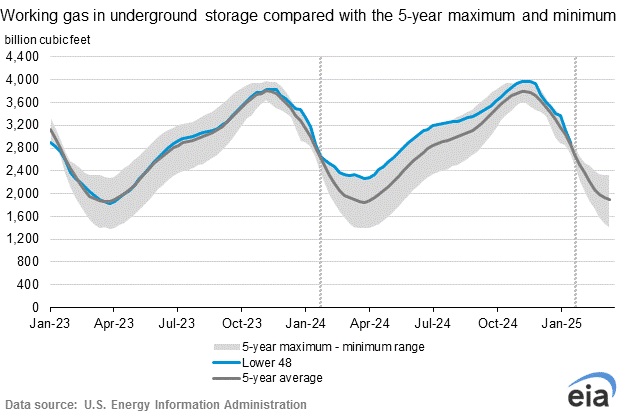

The EIA reported the U.S. had 2.892 Tcf in storage on Jan. 17, a drop of 223 Bcf from the week before. The amount in storage was just 21 Bcf more than the EIA’s five-year average.

Analysts had forecast a withdrawal of 242 Bcf.

The report did not reflect withdrawals from Winter Storm Enzo, which hit the U.S. beginning Jan. 19. The storm caused power demand to increase greatly, with some utilities resorting to burning oil to generate electricity.

A larger storage drop is expected next week, according to a recent report by East Daley Analytics.

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

DNO Makes Another Norwegian North Sea Discovery

2024-12-17 - DNO ASA estimated gross recoverable resources in the range of 2 million to 13 million barrels of oil equivalent at its discovery on the Ringand prospect in the North Sea.

Wildcatting is Back: The New Lower 48 Oil Plays

2024-12-15 - Operators wanting to grow oil inventory organically are finding promising potential as modern drilling and completion costs have dropped while adding inventory via M&A is increasingly costly.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.