After a drop off in the morning, prices had rallied by noon on Sept. 19, rising to $2.33/MMbtu, a 2% increase from the day before. (Source: Shutterstock)

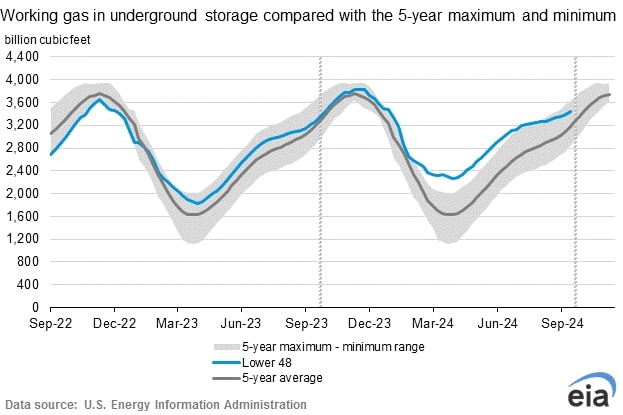

With much of the nation enjoying mild weather, the U.S. grew its natural gas storage levels to 3.445 Tcf during the week ending Sept. 13, according to the U.S. Energy Information Administration (EIA).

The weekly storage report, released Sept. 19, showed a 58 Bcf increase from the week before, missing consensus market expectations of 53 Bcf, according to East Daley Analytics. While slightly higher expected, the surplus to the five-year average shrunk by 22 Bcf to 274 Bcf.

East Daley predicted that Hurricane Francine, which swept through the Gulf of Mexico during the same week the storage report was released, may have caused demand destruction that will result in a higher storage addition in next week’s EIA report.

The Henry Hub Front Month Futures Price was unaffected by the news. After a drop off in the morning, prices had rallied by noon on Sept. 19, rising to $2.33/MMbtu, a 2% increase from the day before.

Recommended Reading

NGP Backs Wing Resources with $100MM to Buy Permian Mineral Interests

2025-04-02 - Wing Resources VIII, which is backed by NGP Royalty Partners III, will focus on acquiring “high-quality” mineral and royalty interests across the Permian Basin, the company said.

Exxon Mobil Vice President Karen McKee to Retire After 34 Years

2025-04-02 - Matt Crocker will succeed Karen T. McKee as vice president of Exxon Mobil and president of its product solutions company.

Double Eagle Team Re-Ups in Permian, Backed by EnCap’s $2.5B

2025-04-02 - The fifth iterations of Double Eagle Energy and its minerals subsidiary, Tumbleweed Royalty, have received a $2.5 billion equity commitment from EnCap Investments LP—the day the E&P finalized a $4.1 billion sale to Diamondback Energy.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Kissler: Gas Producers Should Still Hedge on Price

2025-03-27 - Recent price jumps and rising demand don’t negate the need to protect against future drops.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.