Total oil and gas production in the Lower 48 is slated to decrease next month, according to new data. (Source: Shutterstock.com)

Total oil and gas production in the Lower 48 is slated to decrease next month, according to new data.

Crude oil output from major Lower 48 basins—including the prolific Permian Basin—is forecast to decrease by about 18,000 bbl/d in August, the Energy Information Administration (EIA) reported in its latest Drilling Productivity Report released July 17.

Natural gas production is expected to fall by around 100 million cubic feet per day (MMcf/d) as U.S. E&Ps continue to weather a lengthy spell of low commodity prices.

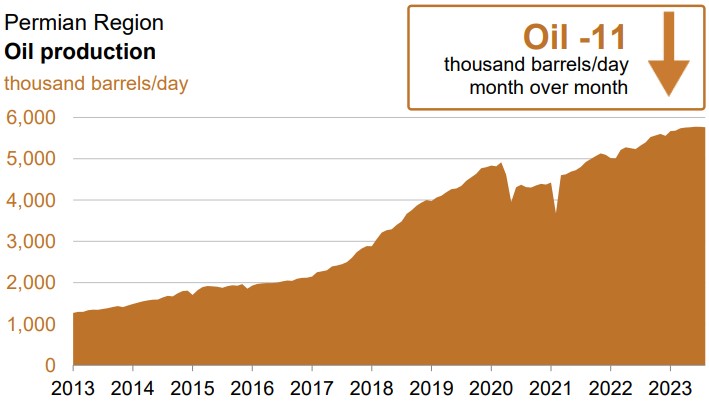

Oil production in the Permian Basin, the Lower 48’s top oil-producing region, is expected to drop by around 11,000 bbl/d to 5.764 MMbbl/d in August.

That’s down from record-setting levels earlier this summer when Permian crude output peaked at over 5.775 MMbbl/d in June, according to EIA figures.

Crude output is expected to fall faster in the Eagle Ford Shale of South Texas; Oil production out of the Eagle Ford is slated to drop by around 12,000 bbl/d next month.

The Anadarko Basin expects to see a more modest drop of about 2,000 bbl/d next month.

Production growth in the Bakken and Niobrara basins are expected to help offset declines in the Permian, Eagle Ford and Anadarko.

West Texas Intermediate (WTI) spot prices are forecast to average around $74/bbl in the second half of 2023—roughly flat with price levels in the first half of the year, according to the EIA’s latest outlook. WTI spot prices should rise to average around $78.51/bbl in 2024.

RELATED: EIA: U.S. Natural Gas Prices Expected to Rise in Back Half of ‘23

Production of natural gas is also slowing, or flat-out declining, in basins across the Lower 48.

Gas output from the Anadarko is expected to fall by around 64 MMcf/d from July to August. Production in the gassy Haynesville Shale is slated to drop by 50 MMcf/d over the same period.

Alongside the declines in oil production, Eagle Ford gas output will fall by around 42 MMcf/d month-over-month.

Associated gas production out of the Permian Basin will rise by about 36 MMcf/d next month to reach a record 23.38 MMcf/d. E&Ps primarily drill in the Permian for oil, but the region is getting gassier as the play matures over time.

Gas producers capitalized on high prices last year but have since faced an oversupply of gas in the market, soft demand and higher-than-average levels of inventory storage.

Henry Hub natural gas prices are expected to average $2.62/MMBtu, or $2.72 per thousand cubic feet, during 2023—down from an average of $6.42/MMBtu, or $6.67 per thousand cubic feet, in 2022, according to EIA estimates.

But prices are expected to get a lift in the back half of the year: Henry Hub gas spot prices are forecast to average more than $2.80/MMBtu in the second half of 2023, up from around $2.40/MMBtu during the first half.

RELATED: EIA: Lower 48 Oil, Gas Production Growth to Slow in July

Recommended Reading

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

BP Makes Gulf of Mexico Oil Discovery Near Louisiana

2025-04-14 - The "Gulf of America business is central to bp’s strategy,” and the company wants to build production capacity to more than 400,000 boe/d by the end of the decade.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Black Gold, LGX Find Multiple Pay Zones in Western Indiana

2025-04-04 - Black Gold Exploration Corp. and LGX Energy Corp. are working to start production at the Fritz 2-30 oil and gas well in Indiana within 60 days.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.