Jenny Gottschalk is a partner and Steve Simion is a vice president with EIV Capital.

The shale revolution brought tremendous change to the U.S. oil and gas industry in the 2010s. Domestic hydrocarbon production grew dramatically from 5.5 MMbbl/d and 73 Bcf/d in 2010 to 12.9 MMbbl/d and 125 Bcf/d in 2023, according to the U.S. Energy Information Administration (EIA).

During that timeframe, the midstream sector required and received historic investment to expand U.S. transportation, storage and processing infrastructure to accommodate the massive growth in production. Entrepreneurial midstream companies created value by commercializing and building greenfield systems to serve new and expanding market needs.

In EIV Capital’s portfolio, Bayou Midstream built and acquired assets in the western Bakken in anticipation of the growing market need for gathering and takeaway capacity. Bayou Midstream sold that system in early 2024.

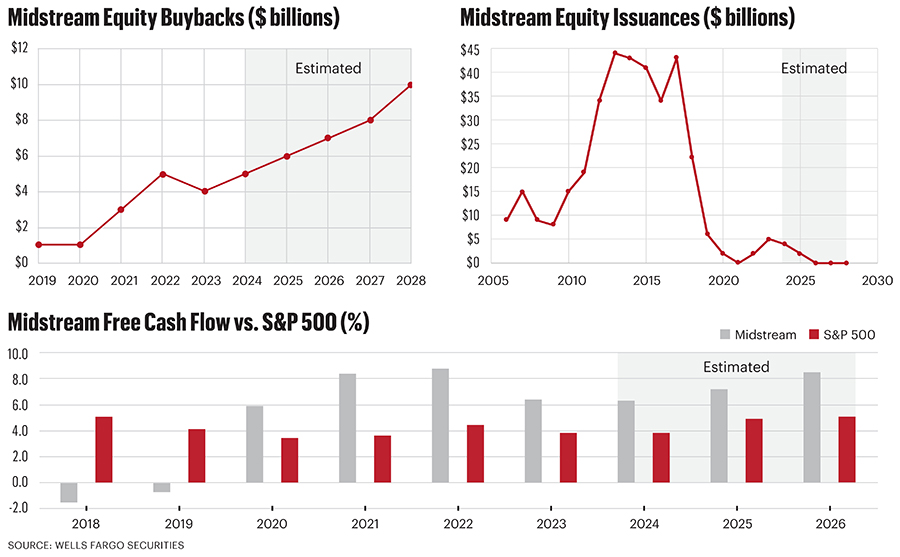

Now, with the “great plumbing” largely complete, the midstream sector is shifting its priorities from large-scale greenfield capital investment to maintenance and asset enhancement capital with a focus on generating and distributing cash flow. Public midstream companies made a dramatic turn this decade from outspending cash flow to yielding free cash flow well above the broader market rate.

As the industry matures, the public midstream sector has all but stopped issuing new equity. In fact, cash has begun to meaningfully flow back to investors through distribution programs and stock buybacks.

For the foreseeable future, midstream companies and their leaders will be evaluated on their ability to deliver returns to investors, which requires strong commercial outcomes and operational excellence.

Commercial arrangements protect the top line

Midstream infrastructure is vitally important to the producers and consumers of the commodity, and the commercial arrangements must meet the needs of both. Often the greatest contributors to enterprise value are the commercial structures that deliver top-line revenue.

Historically, many midstream investments were underpinned by take-or-pay contracts, minimum volume commitments or acreage dedications. As those arrangements expire, midstream companies must implement commercial arrangements that continue to work for all stakeholders. In practical terms, it means underwriting the producing resource and expected production, ensuring rate structures have appropriate inflation escalators, and that future regulatory burdens can be recovered in the rate structure.

Through the shale era, capital was destroyed by investment underpinned by commercial agreements disconnected from the reality of the resource—today, midstream investment focuses on downside protection from the potential underdevelopment and underperformance of the underlying resource.

Operational excellence improves cash flow

Operational excellence requires company executives to continuously improve their results in three broad areas: safety, efficiency and environmental performance. EIV Capital works with its portfolio companies in these areas; examples include Canes Midstream, Woodland Midstream, and H2O Midstream. High performance in these areas eliminates excess costs and drives meaningful improvements in cash flow.

Safety

EIV Capital expects its portfolio companies to begin every board meeting with a review of safety and environmental performance. Further, company bonus programs are expected to incorporate these metrics.

Shortly after Canes Midstream acquired a Midland Basin G&P system, they recognized that the safety culture had room for improvement. EIV supported the company’s investment in implementing a top down, renewed focus on safety, which delivered measurable improvements. Canes was recognized by the GPA Midstream Association as an industry leader in safety in 2023 for having an exemplary safety record. Safety is simply non-negotiable.

Environmental

With the right team and incentives in place, the firm has seen teams deliver dramatic improvements in environmental performance. During the time that Woodland Midstream owned the James Lake gas plant, sulfur-oxide emissions declined by 75%.

Midstream operations that do not meet standards will be penalized by the methane tax, which is expected to be levied in 2025, directly tying emissions to cash flow. Attentive management, like Canes Midstream, routinely monitors methane emissions and quickly addresses issues to minimize gas loss and tax leakage. Canes Midstream ranks in the first quartile in Insight M’s ranking and expects to avoid the methane tax as a result. Companies that deliver top-tier environmental performance can be attractive acquisition targets poised to receive outsized valuations at exit, as their performance will be accretive to the emissions profile of an acquiring company.

Efficiency

Efficiency encompasses many aspects of operations, but fundamentally it means that revenues are delivered without excess costs. Although it is obvious, one of the biggest drivers of efficiency is simply plant uptime, which is a result of robust maintenance practices and operating procedures.

By directly addressing those two areas, the Woodland Midstream team reduced unplanned downtime at James Lake to less than 1%. The improved reliable operations led to several commercial wins as operators sought the most consistent midstream provider in the area. Higher throughput and improved efficiencies drove unit operating costs at James Lake down 32% over the same period.

Once a midstream company establishes a solid foundation for its operations, management teams should shift their focus to continuous improvement and optimization initiatives. To support those efforts, all EIV Capital portfolio companies are encouraged to invest in dashboards and tools to present valuable operational data in actionable ways.

H2O Midstream leverages real-time receipt information on its system to continually optimize the flow path of produced water to the most economic delivery points. The company also manages its cost structure by proactively curtailing its electricity demand during periods of high prices.

Opportunities to buy and transform

We continue to see opportunities for private equity-backed companies to acquire and optimize systems and assets which may be non-strategic to a divesting counterparty but can perform well in the hands of a focused management team.

As public companies expand and private funds mature, it is natural for segments of their portfolio to fall out of focus. In some cases, those systems may have opportunities to improve operational efficiencies or they may face capital constraints from their current ownership.

An acquiring team will often bring relationships, fresh capital and deep knowledge of the area along with experienced leadership to transform operational performance and increase commercial momentum. In cases in which sellers and acquirers have large discrepancies in valuation, private equity firms can help structure creative arrangements that bridge the gap and thus enable the transaction to close.

Energy transition is next frontier for midstream

Although the world will continue to rely on hydrocarbons for the foreseeable future, midstream companies have opportunities to be leaders in the energy transition. For example, there are numerous investment opportunities in infrastructure to handle CO2, renewable drop-in fuels and hydrogen. Many of those projects benefit from government programs that incentivize teams who are first to market. Veteran midstream teams have the experience to deliver and operate these types of energy transition projects.

Midstream infrastructure remains critically important to deliver reliable energy and meet the demand needs of today and tomorrow. Operational excellence helps ensure safe, responsible and profitable outcomes for all stakeholders

Recommended Reading

Improving Gas Macro Heightens M&A Interest in Haynesville, Midcon

2025-03-24 - Buyer interest for Haynesville gas inventory is strong, according to Jefferies and Stephens M&A experts. But with little running room left in the Haynesville, buyers are searching other gassy basins.

Permian to Drive Output Growth as Other Basins Flatten, Decline–EIA

2025-01-14 - Lower 48 oil production from outside the Permian Basin—namely, the Bakken and Eagle Ford shales—is expected to flatten and decline in coming years, per new EIA forecasts.

More Uinta, Green River Gas Needed as Western US Demand Grows

2025-01-22 - Natural gas demand in the western U.S. market is rising, risking supply shortages later this decade. Experts say gas from the Uinta and Green River basins will make up some of the shortfall.

In Inventory-Scarce Permian, Could Vitol’s VTX Fetch $3B?

2025-03-28 - With recent Permian bids eclipsing $6 million per location, Vitol could be exploring a $3 billion sale of its shale business VTX Energy Partners, analysts say.

Chord Drills First 4-Mile Bakken Well, Eyes Non-Op Marcellus Sale

2025-02-28 - Chord Energy drilled and completed its first 4-mile Bakken well and plans to drill more this year. Chord is also considering a sale of non-op Marcellus interests in northeast Pennsylvania.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.