Tight oil is expected to continue steady growth, driven more by market forces and company strategy than by government policy. (Source: Shutterstock)

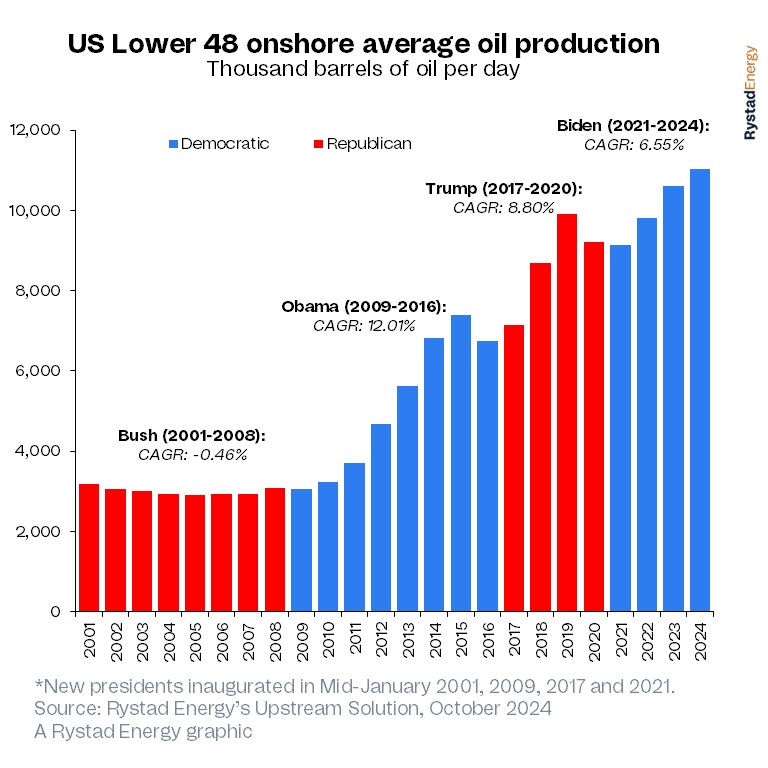

Regardless of who wins the Nov. 5 election, the shale industry is unlikely to see significant impacts—regardless of whether former President Donald Trump or Vice President Kamala Harris holds office, Rystad Energy said in an Oct. 9 report.

Tight oil is expected to continue steady growth, driven more by market forces and company strategy than by government policy.

The industry's focus on profitability and shareholder returns, rather than chasing production growth, means that operators are unlikely to be influenced by promises of support or potential regulations from either candidate.

"The US onshore industry has learned to live with a high degree of uncertainty, and the presidential election is just one of many factors on operators’ radars. Shale production has proven to be incredibly resilient, and we expect it to continue to play a major role in the global energy landscape for years to come. At the end of the day, the industry is driven by market fundamentals, not by politics," says Matthew Bernstein, senior analyst of upstream research at Rystad Energy.

Despite some tensions between the Biden administration and the industry, E&Ps have continued to thrive, Rystad said, driven by changing investor attitudes and financial pressures.

Trump has voiced strong support for the oil and gas industry, but it’s unclear whether a second term in office would actually alter the trajectory of U.S. shale production from its current path, Rystad said.

Potential risks exist under a Democratic administration, but “these seem highly unlikely for political and economic reasons,” Rystad said.

“Past administrations may have imposed stricter regulations, drilling restrictions and heightened scrutiny of mergers and acquisitions, but Harris has not communicated a desire to pursue these options,” Rystad said.

A ban on new permitting on federal land, “while unlikely, would have a significant impact on production in key basins such as the Permian's Delaware,” Rystad said.

The industry also faces concerns about accelerated investment in alternative energy projects, which could rapidly move the transition away from fossil fuels.

Regardless, the industry's shift towards prioritizing shareholder returns and long-term growth through acquisitions has led to a more disciplined investment approach, Rystad said. Even if prices rise, companies are unlikely to significantly increase spending, as production has somewhat decoupled from the oil and gas price.

“As a result, the traditional link between high prices and increased drilling activity has been weakened, with companies instead focusing on maintaining capital discipline and maximizing returns,” Rystad said.

Recommended Reading

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

Minerals M&A to Heat Up in ‘25 with $4B Diamondback Sale–KeyBanc

2025-01-21 - KeyBanc analysts expect an “imminent” Diamondback Energy dropdown to Viper Energy and at least a couple of $500 million deals by public mineral and royalty companies in 2025, with Sitio Royalties a likely acquirer.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.