A Phillips 66 midstream spin-off could command a $40 billion total enterprise value, with a share uplift for PSX ranging from $24 to $54, according to Elliott. (Source: Shutterstock)

Editor's note: This article has been updated with Phillips 66's response to Elliott Management's letter.

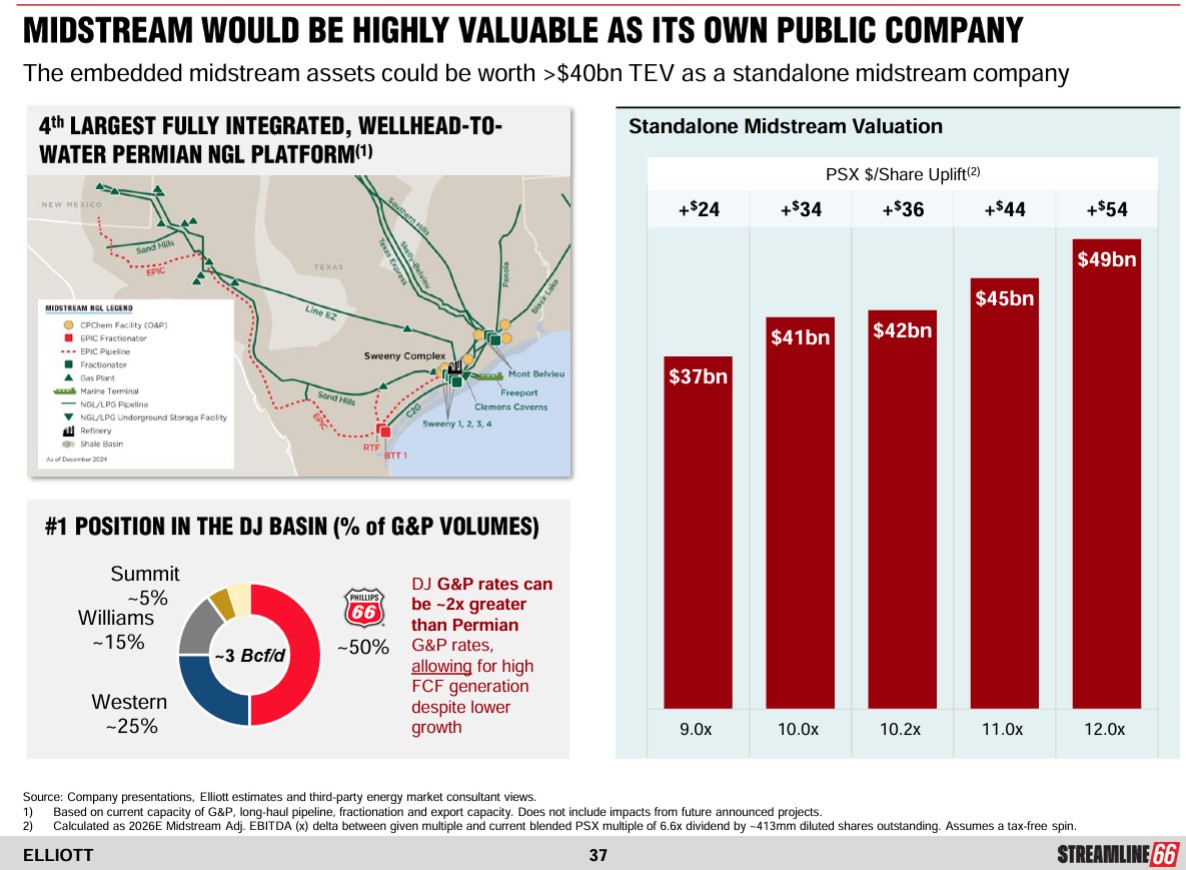

Activist investor Elliott Capital Management is pushing Phillips 66 (PSX) to sell or spin off its midstream business—with the firm saying a sale could generate in the neighborhood of $45 billion for shareholders.

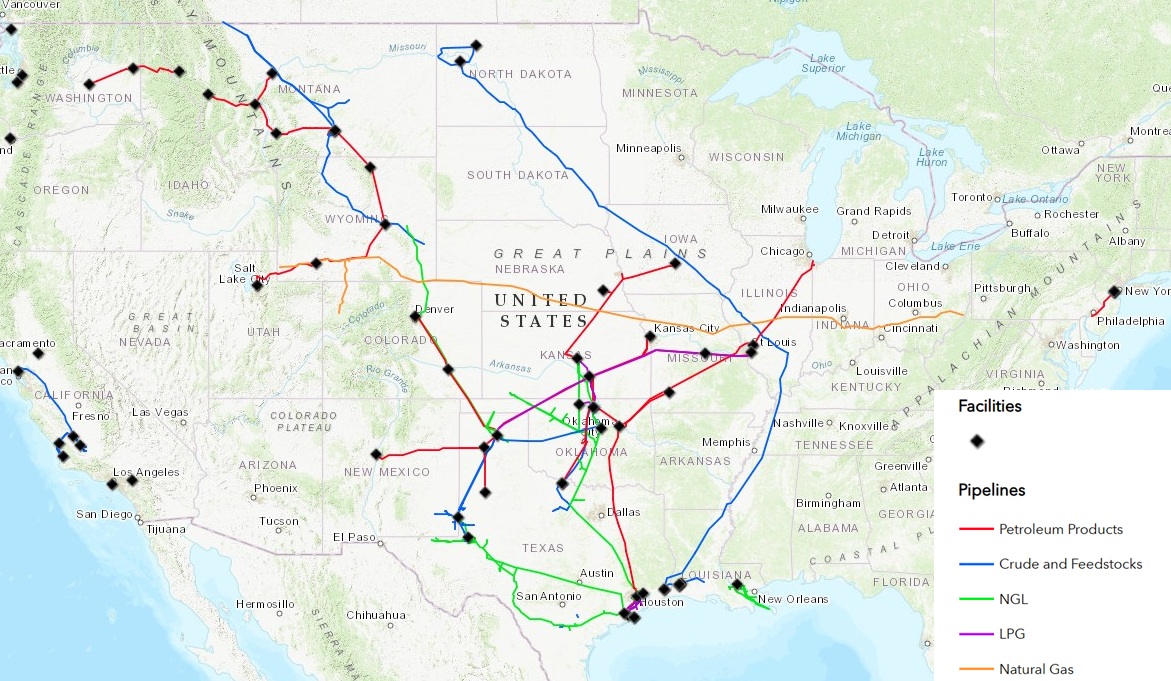

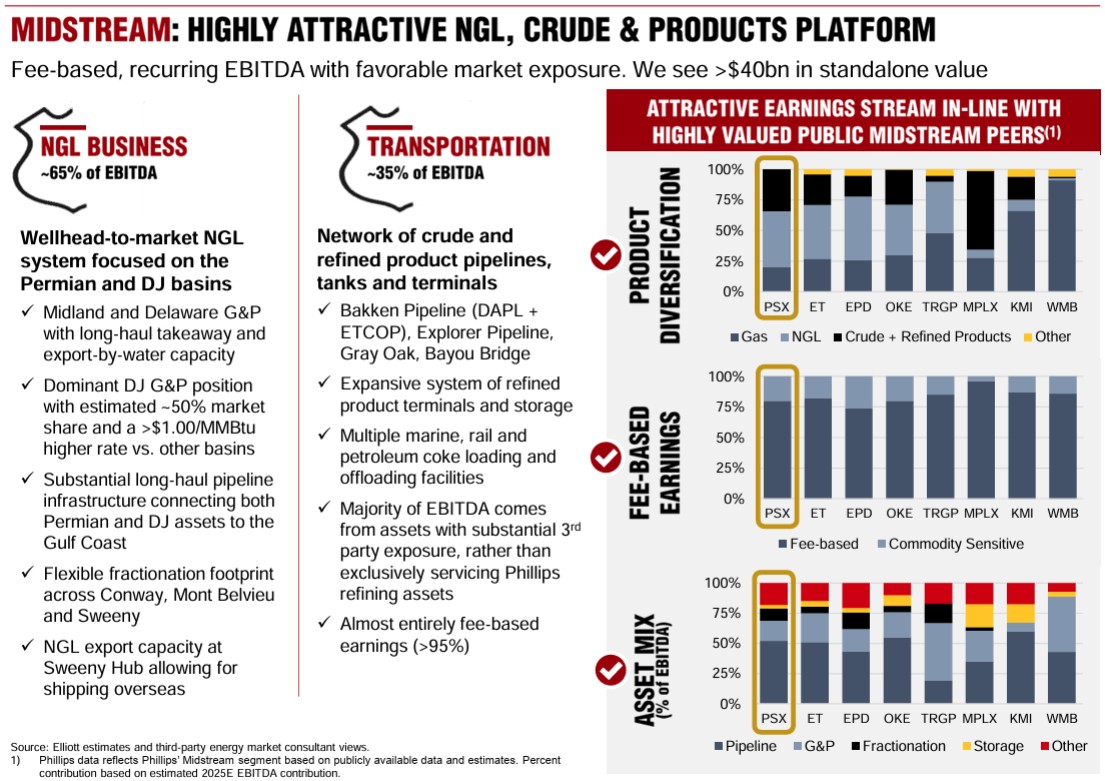

The value of a sale would depend on what premium a buyer is willing to pay for infrastructure that includes gathering and processing in the Midland, Delaware and Denver-Julesburg (D-J) basins, along with long-haul pipelines connecting the Permian and D-J to the Gulf Coast. Phillips 66’s midstream assets include pipeline systems, fractionation capacity and gas processing.

Likewise, a Phillips 66 midstream spin-off could command a $40 billion total enterprise value, with a share uplift for PSX ranging from $24 to $54, according to Elliott. TD Cowen analysts said the midstream assets market valuation would likely be near that of industry peers such as ONEOK, which has a market cap of about $58 billion.

In a Feb. 11 letter to Phillips 66’s board, Elliott disclosed it has taken a $2.5 billion stake in the company, “making us one of your top five investors.” The letter sets out a case for streamlining the company through changes in its structure and governance. The firm also launched a website called Streamline66.com to promote its goals.

“Phillips today trades at a substantial discount to a sum-of-its-parts valuation, and investors have plainly lost confidence in the company’s ability to unlock this value under its current structure,” the letter said.

Part of Elliott’s discomfit is related to multiple midstream acquisitions made by Phillips 66, including January’s $2.2 billion deal for EPIC’s Y-Grade Texas NGL assets. In 2024, PSX paid $550 million for Midland Basin gas and processing assets. And in 2023, the company bought various midstream assets from DCP Midstream for $3.8 billion.

Elliott said the acquisitions are part of the problem, both financially and in terms of the company’s credibility.

“Investors were excited about management’s divestiture program; but rather than retiring debt and increasing capital returns with proceeds, Phillips bought more midstream assets,” Elliott said in a presentation outlining its demands.

The company’s “recent $3 billion in promised divestitures, initially earmarked for shareholder returns or debt reduction, was immediately redeployed into a near equivalent amount of new acquisitions.”

RELATED

ArcLight Completes $865MM Deal for Phillips 66’s Stake in NatGas Line

However, Elliott also pointed out the value of the midstream infrastructure Phillips has bought, noting that its largest share of EBITDA comes from midstream (38%) with the next largest in refining (29%). The midstream assets also have a vertically integrated wellhead-to-water NGL business across the Permian and D-J that generates stable cash flow, according to Elliott.

RELATED

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

The activist firm said Phillips has also lost credibility on capital allocation with the company overpaying for assets.

“Phillips stretches when communicating multiples on acquisitions to sell transactions to the market as more accretive, and has been unable to deploy organic growth capital within budget,” according to an Elliott presentation.

Phillips on 'right path'

Phillips 66 told Hart Energy it had received Elliott’s letter and presentation and would review the recommendations. Phillips said it welcomes an ongoing dialogue with Elliott and other shareholders.

However, the company is “on the right path,” a company spokesperson said.

“We are realizing our vision of being the leading integrated downstream energy provider.”

The spokesperson pointed toward the company’s 2024 results, which reflect “continued strong operating performance and success in achieving the strategic commitments we communicated in 2022 and 2023.”

“With these goals achieved and exceeded, we have set targets for our next phase through 2027, which are designed to drive even greater long-term shareholder value through strong operating performance and disciplined capital allocation,” the spokesperson said.

Analysts see merit

TD Cowen analyst Jason Gabelman said strong valuations—and the ability for a standalone PSX midstream company to better capture growth opportunities—make a midstream spin-off or sale appealing.

He noted that the midstream sector has outperformed the rest of energy since the beginning of 2023, with the Alerian Midstream index rising by 52% compared to the Energy Select Sector SPDR Fund, or XLE, which is up 3.5%.

Phillips’ conglomerate structure, which Elliott criticized in its letter, includes refining, which Gabelman said has lagged despite accomplishing several operational targets including opex, availability and clean yield.

The company’s refining segment has had the most negative surprise to investors, Gabelman said. “Moreover, differentiated Chemicals exposure has been a headwind due to the macro environment rather than anything PSX-specific.”

TPH & Co. analyst Matthew Blair, writing in a Feb. 11 report on refiners, noted that Phillips 66 finished last on margins. Valero Energy Corp. “re-took the crown as [the] most profitable large-cap refiner (and almost certainly most profitable independent refiner) in 2024 with refining EBITDA of $5.98/bbl, edging out [Marathon Petroleum Corp.] MPC (last year’s #1) at $5.33/bbl and well ahead of PSX at $2.13/bbl,” Blair said.

Gabelman posited that a sale/spinoff of Phillips’ midstream segment would leave the remaining Phillips 66 “ParentCo” with more volatile earnings.

“We suspect PSX would retain some midstream assets core to the refining and chemicals business, he said. “There is a question of how much synergy value exists from an integrated midstream business, which we will seek to evaluate.”

However, Gabelman mused on a different path, in which PSX could “shrink its refining business to eliminate weaker assets and improve the valuation multiple as midstream becomes a bigger part of the business.”

Elliott also called on Phillips to also sell its interests in its joint venture (JV), Chevron Phillips Chemical Co. (CPChem), saying the asset would likely attract significant interest from its JV partner or other potential buyers.

The company should also execute on the frequently discussed sale of its JET retail operations in Germany and Austria.

“Divesting non-core assets, such as CPChem and select European retail operations, would allow Phillips to increase capital returns to its shareholders and sharpen its focus on operational excellence within its core business,” Elliott’s letter said.

Finally, the company “should add new independent directors to bolster accountability and improve oversight of management initiatives,” the letter said.

Recommended Reading

Money Talks: First Horizon's Investment Thesis on Oil, Gas

2025-04-20 - Macro events must be part of the investment thesis in a global commodities business, says Moni Collins, senior vice president for energy lending at First Horizon Bank.

PE Firm Andros Capital Partners Closes $1 Billion Energy Fund

2025-04-07 - Andros Capital Partners maintains a flexible investment mandate, allowing the firm to invest opportunistically across the capital structure in both public and private equity or debt securities.

Money Talks: UMB Bank on Impacts of Upstream Consolidation

2025-04-21 - Guardrails in place allow banks to support energy businesses through all economic cycles, says Zachary Leard, vice president for the energy group at UMB Bank.

Money Talks: Texas Capital Bank on How to Deploy Capital Amid Shrinkage

2025-04-22 - In an uncertain macro environment, caution is necessary in deploying capital, says Marc Graham, managing director and head of energy at Texas Capital Bank.

Money Talks: Comerica Bank is ‘Hungry’ for Oil, Gas Business

2025-04-25 - Opportunities may be challenged in the near term, but Comerica Bank remains supportive of oil and gas, says Jeff Treadway, director of energy finance.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.