Enbridge is planning an open season to increase capacity on a full pipeline serving the Ingleside Energy Center on the Corpus Christi Bay. (Source: Shutterstock)

Calgary-based midstream company Enbridge is planning an open season to increase capacity on a full pipeline serving the Ingleside Energy Center on the Corpus Christi Bay.

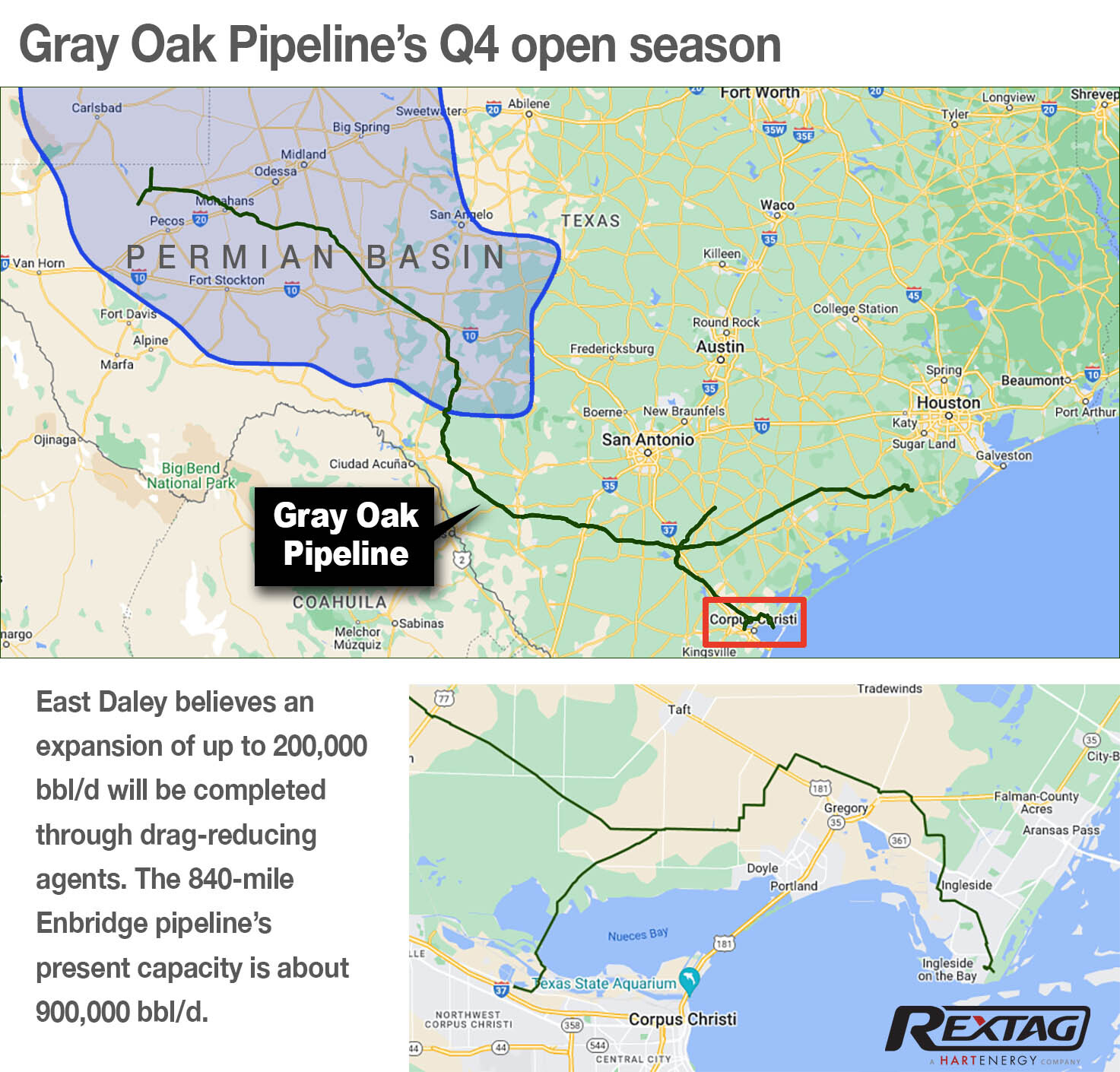

The Gray Oak Pipeline is an 840-mile line taking crude from the Permian Basin to Ingleside for export. The line currently has a capacity of 900,000 bbl/d. Enbridge estimated that an expansion of 200,000 bbl/d on Gray Oak is possible.

Enbridge CEO Greg Ebel broached an open season for the line during the company’s Nov. 3 third-quarter earnings call, saying Enbridge was set to initiate an expansion of the Gray Oak line by the end of the year, and would offer full-path Permian Basin service by exports through Ingleside, “in order to support further growth in the Permian and meet our customer needs.”

The company also plans to add 2 MMbbl of storage at the Ingleside facility by the end of 2024.

The exact timing of the open season, if it is initiated, has not been announced. Michael Barnes, spokesperson for Enbridge, said on Nov. 28 that the work on the open season for the pipeline is continuing.

Currently, Permian Basin crude has plenty of pipeline capacity to meet export demand at terminals in Houston and Corpus Christi. However, additional capacity at Ingleside could help the company’s current tariff schedule, according to East Daley Analytics.

Corpus Christi export docks have been the first choice for Permian production because of the relative uncongested harbor traffic for very large crude carriers and the more direct route for pipelines to the docks, said Kristine Oleszek, director of energy analytics at East Daley.

“Throughout 2023, the Permian to Corpus Christi pipelines have been at or above 85% utilization,” Oleszek said. “This is a critical mark as the FERC [Federal Energy Regulatory Commission] mandated ‘walk up’ kicks in at 90%.”

A "walk-up," or uncommitted rate, is for shippers that do not have a contractual obligation to a specific pipeline. The FERC mandates higher tariffs after pipeline capacity passes a certain threshold in order to reserve space for uncommitted customers.

“Due to the increased tariff structure of the markup rates, it becomes more advantageous to move barrels to the Houston shipyard,” she said.

Also, production going through the Enbridge Ingleside Energy Center (EIEC) has been at around 55% utilization, Oleszek said, “so it has plenty of room to handle more barrels.”

The EIEC, which Enbridge bought from Moda Midstream in 2021, is the largest crude oil storage and export terminal by volume in the U.S.

Starting last year, Enbridge has increased its holdings in the Gray Oak line. In August 2022, Enbridge became the majority owner in the line, increasing its stake from 22.8% to 58.5%. In February, the company acquired an additional 10% from Rattler Midstream. It currently holds a 68.5% stake in the line, while sharing ownership with partners Phillips 66 and Marathon Petroleum.

To fill the Gray Oak Pipeline after the proposed expansion, East Daley predicted Enbridge would divert some of the crude oil shipments from Houston and Cushing to Ingleside.

Enbridge has not announced how the Gray Oak pipeline expansion would be implemented. Oleszek said one option would be to use drag-reducing agents (DRAs). DRAs, often polymers, increase the capacity by reducing turbulence, causing more of the fluids in the pipeline to travel in the same direction. The reduced turbulence allows the fluid to move through more quickly, increasing capacity.

“The expansion could happen relatively quickly using DRAs,” she said, “but it also brings the added risk of making the expansion tariffs, with the added DRAs, cost uneconomical compared to a Houston-delivered barrel.”

Recommended Reading

What's Affecting Oil Prices This Week? (March 17, 2025)

2025-03-17 - The price of Brent crude could get a boost from Trump’s threats of sanctions on Russia, Iran and Venezuela, but it is doubtful it will break $72/bbl, Stratas Advisors says.

What's Affecting Oil Prices This Week? (Feb. 24, 2025)

2025-02-24 - Net long positions of WTI have decreased by 59% since Jan. 21 and are 61% below the level seen on July 16, 2024, when the price of WTI was $80.76.

Oil Dives More Than 6%, Steepest Fall in 3 Years on Tariffs, OPEC+ Supply Boost

2025-04-03 - Oil prices swooned on April 3 to settle with their steepest percentage loss since 2022, after OPEC+ agreed to a surprise increase in output the day after U.S. President Donald Trump announced sweeping new import tariffs.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

What's Affecting Oil Prices This Week? (March 24, 2025)

2025-03-24 - Oil demand will be picking up as we move into warmer months for the northern hemisphere. For the upcoming week, Stratas Advisors think the price of Brent crude will move higher and will test $73.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.