The A&D world has been slow and frustrating of late. These experts discuss recent deal metrics and what drivers might kick-start additional deal-making this year.

SPEAKER(S):

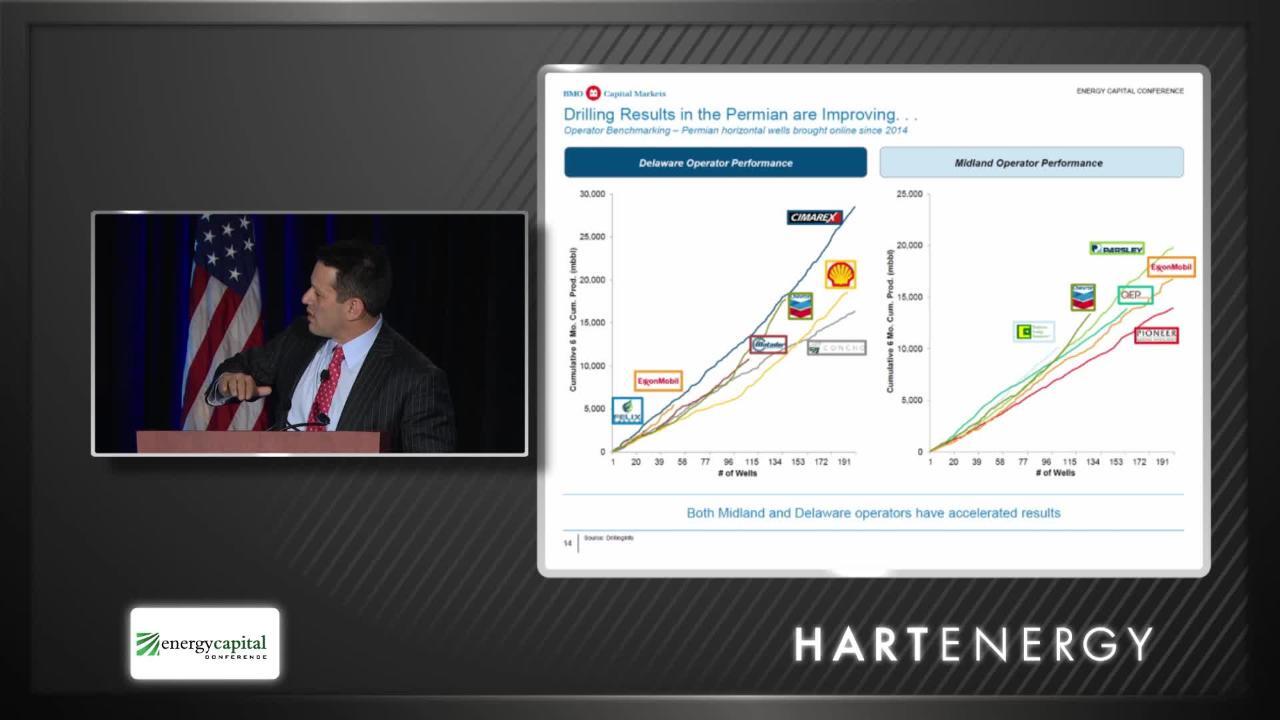

Jason Martinez, Managing Director & Co-Head A&D Group, BMO Capital Markets

Recommended Reading

Paisie: Uncertain Demand Roils Oil Market Outlook

2025-04-23 - Oil could range from sub-$50 to $75, depending on how tariffs shake out.

Kaes Van’t Hof: $60 Oil Threatens US Production, Permian Rig Activity

2025-04-16 - “I think before Liberation Day, there was a case towards being pretty bullish,” Diamondback Energy President Kaes Van’t Hof said April 15 at the World Oilman’s Mineral & Royalty Conference. “Unfortunately, it all feels a bit self-inflicted.”

EIA: Tariff Chaos, OPEC Output Increases Spell $57/bbl WTI in 2026

2025-04-10 - Energy Information Administration price estimates for 2025 and 2026 are bad news for producers—if they come to pass—as breakeven prices for operators, even in the Permian Basin, require between $61/bbl and $62/bbl to remain profitable.

Oil Dives More Than 6%, Steepest Fall in 3 Years on Tariffs, OPEC+ Supply Boost

2025-04-03 - Oil prices swooned on April 3 to settle with their steepest percentage loss since 2022, after OPEC+ agreed to a surprise increase in output the day after U.S. President Donald Trump announced sweeping new import tariffs.

Oil Falls More Than 4% as Investors Reassess Trump's Tariff Flip

2025-04-10 - Oil prices fell by nearly $3/ bbl on April 10, wiping out the prior session's rally, as investors reassessed the details of a planned pause in sweeping U.S. tariffs and focus shifted to a deepening trade war between Washington and Beijing.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.