Almost $20 billion worth of private equity funding—most of it targeting oil, gas and midstream development—was announced during the last 10 days of October, a sum that dramatically dwarfs the totals raised in previous post-pandemic years.

Indeed, the industry’s ability to access capital of any kind took a walloping from the demand decimation of COVID-19, combined with years of poor returns and a global anti-fossil fuel sentiment.

Between 2010 and 2019, some $21 billion in private equity was raised every year; since 2020, the annual figure is closer to $3 billion, said Quantum Capital Group founder and CEO Wil VanLoh.

But as the weather in Houston finally began to cool in October, the private equity news heated up.

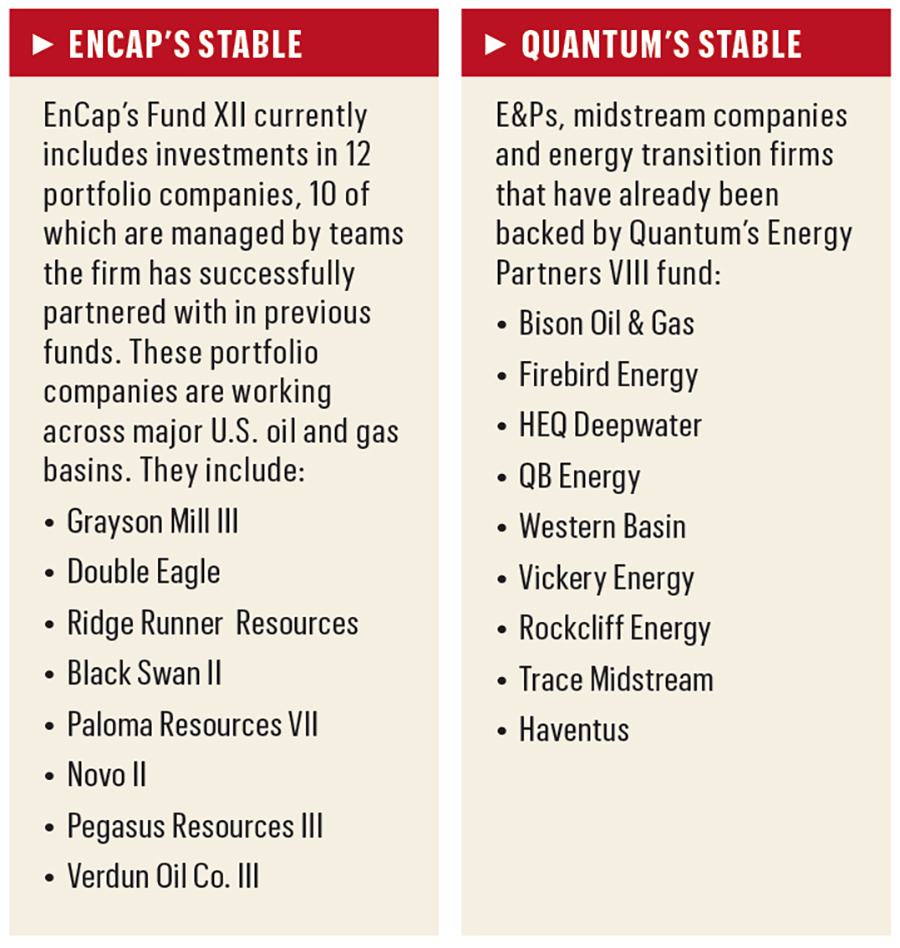

On Oct. 21, EnCap Investments revealed the successful closing of the EnCap Energy Capital Fund XII with commitments of $5.25 billion—a figure exceeding its initial target and hitting

its hard cap. Combined with $1.2 billion in co-investments, Fund XII raised a total of

$6.4 billion in funds. Including recently finalized fund raises for EnCap Energy Transition Fund II and EnCap Flatrock Midstream Fund V, the three EnCap platforms raised approximately $9 billion of capital.

In announcing the news, EnCap Managing Partner Doug Swanson called the fundraising a strong demonstration of support for its longstanding investment strategy. Interestingly, he added, about 40% of the capital commitments stemmed from new relationships with institutional investors and large family offices.

A week later, on Oct. 29, Quantum announced it had raised more than $10 billion in aggregate capital commitments for the energy industry. Of the total, $5.25 billion is in its private equity flagship, Quantum Energy Partners VIII.

The funds were raised for its private equity, structured capital and private credit platforms. Quantum has a flexible mandate to invest where needed in the capital structure, and the firm invests across the entire energy value chain, including oil and gas, midstream, thermal and renewable power generation, energy infrastructure and the energy transition.

The total raised includes: $5.25 billion for the firm’s private equity flagship Quantum Energy Partners VIII; $2.8 billion for the firm’s structured capital fund Quantum Capital Solutions II; and approximately $2 billion for other associated funds on the Quantum platform.

For both firms, closing on more than $5 billion for oil and gas placements is a success. In recent years, as VanLoh said, there have been significantly fewer closings. And both took longer, too.

“We started raising our flagship fund a couple of years ago. [Pre-pandemic] these funds would take about six to 12 months,” VanLoh said. “This one took two years.”

At EnCap, the fund closing took about 18 months compared to the six months required in pre-pandemic years, said Mark Burroughs, managing partner at EnCap, during Hart Energy’s DUG Appalachia conference in November.

Some 40% of EnCap’s previous investors have exited oil and gas, Burroughs said. That includes college endowments and West Coast institutions, which won’t be back. Family offices are making the difference.

“We’ve partnered with a lot of just awesome families that want to be in oil and gas for many decades,” Burroughs said. “So net, it was a hard fund raise, but we are very happy and blessed that we got it done.”

Flexible structures

Investors now have specific areas within energy in which they want to invest, he said. Instead of one large fund, Quantum and similarly energy-focused firms raise multiple funds to give investors flexibility to choose where they want to participate.

“We raised almost a third more capital [with this closing] than we raised in our last fund-raise cycle, which was really—I’m not saying to toot our own horn—it was a huge accomplishment, given the commitments the institutional limited partners are making to private equity and structured capital funds today,” VanLoh said.

Compounding the investor flight in recent years was the lack of returns that many investors earned on their oil and gas investments between 2010 and 2020.

“The problem is a lot of investors around the world and in certain parts of the U.S. have basically taken the position that oil and gas is not an investable asset class,” VanLoh said.

“It was easy [for investors] to kind of walk away from oil and gas, actually, both in the public and the private markets, between 2010 and 2020. I think it was fair to say if it wasn’t the worst, it was in the bottom 10% of all performing asset classes in the investable universe,” he said. “Now, a few of us that have raised money, the reason we’ve been able to raise it is our returns were really good during that period of time.”

The ESG movement didn’t help. Many institutional investors discouraged by poor returns, along with the idea that fossil fuels were passé, fled the sector.

“It sounds ludicrous to you and I, but many investors who don’t know the space well and who don’t understand how ingrained energy is in every aspect of what we do in society and business, they were saying, ‘Well, if climate change is an issue and we got to go green, that means we’re going to move away from oil and gas and coal.’”

But VanLoh notes that throughout history, forms of energy haven’t gone away. More variety is simply added to the mix.

“We use more of all forms of energy today than we’ve ever used before. We use more coal today, more natural gas, more oil, more nuclear, more hydro, more wind, more solar,” he said. “And energy transitions take a really long time.”

Consequently, the success at Quantum and EnCap, VanLoh said, is the result of the broader industry making money again, and the realization that oil and gas isn’t a stranded asset class.

“The fundraising environment was really difficult in 2022 when we started, and in 2023. But I’d say it got much more favorable as we moved through 2024,” VanLoh said.

About 20% of its fund investors in the past were international. Most of those were European banks and, like the institutional investors in blue states like New York who moved to the sidelines, they won’t return to the space.

But for some limited partners (LPs), the pendulum is starting to swing back.

VanLoh declined to name specific LPs, but he said, “It’s a fair number of LPs that had hit the pause button a few years ago or are taken their finger off the pause button now.”

New investors are coming in the form of family offices, including European groups, a dynamic apparent throughout the oil and gas industry in 2024.

“The wealthiest families in Europe are actually coming in at scale. They look around Europe and realize, ‘We’ve got an energy crisis over here,’ which was really made evident when Russia went into Ukraine and energy prices went up,” VanLoh said. “We’ve doubled gas, tripled oil and liquids, and their same production has gone down by 40% during that period of time. So, that sums it up how the Europeans think about investing in energy.”

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.