Energy Transfer has agreed to purchase WTG Midstream Holdings’ assets, including Midland Basin core infrastructure, from Diamondback Energy, Stonepeak and the Davis Estate in a cash and stock deal.

Energy Transfer LP has agreed to purchase WTG Midstream Holdings LLC from various parties, including Diamondback Energy, in a cash-and-stock deal valued at $3.25 billion, the companies said on May 28.

Under the terms of the transaction, Stonepeak, the Davis Estate and Diamondback will collectively receive $2.45 billion in cash and approximately 50.8 newly issued shares of Energy Transfer common units.

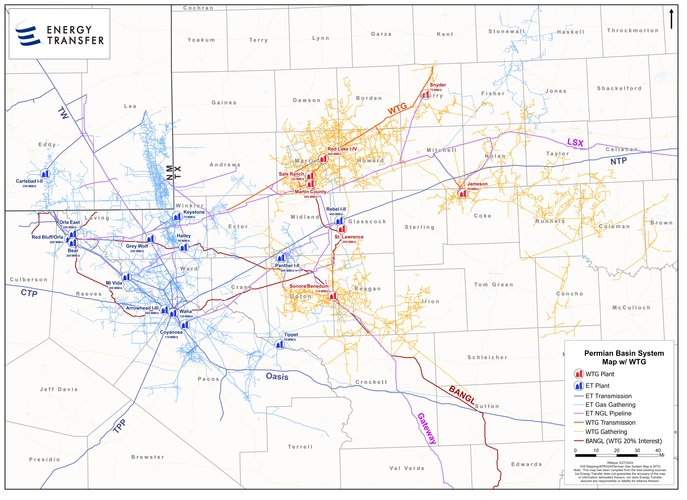

WTG owns and operates the largest private Permian Basin gas gathering and processing business, with assets in the core of the Midland Basin. That includes WTG’s 6,000-mile pipeline network, which serves operators in some of the most active areas of the Midland Basin including Martin, Howard, Upton, Reagan and Irion counties, Texas.

WTG also operates eight processing plants with a total capacity of approximately 1.3 Bcf/d. The company is constructing two new plants with an additional capacity of approximately 0.4 Bcf/d. The first new plant is expected to be in service in the third quarter of 2024 and the second plant the third quarter of 2025.

Energy Transfer’s purchase of WTG’s assets is expected to increase access to growing supplies of natural gas and NGL volumes that will enhance the partnership’s Permian operations and downstream businesses.

The acquisition also includes a 20% interest in 425-mile BANGL Pipeline, which has initial capacity to handle 125,000 bbl/d of NGL. The line, which can increase capacity to more than 300,000 bbl/d, connects the Permian Basin to markets on the Texas Gulf Coast.

Diamondback’s share

Diamondback’s stake in WTG Midstream will generate $375 million, pre-tax, Diamondback said in a separate release on May 28.

Proceeds from the sale will go towards debt reduction as Diamondback waits to complete its pending merger with Endeavor Energy Resources LP.

Through its wholly-owned subsidiary Rattler Midstream LP, Diamondback has owned a 25% stake in Remuda Midstream Holdings LLC (WTG Midstream) since October 2021, according to Diamondback.

"We would like to congratulate [investment firm] Stonepeak and the WTG team on this fantastic outcome," Travis Stice, chairman and CEO of Diamondback, said in the deal’s announcement. "Not only has our partnership generated an outsized economic return, but WTG's gas gathering and processing system continues to support Diamondback's substantial activity on our dedicated acreage. We are excited to further expand our relationship with Energy Transfer and expect a smooth operational transition."

Energy Transfer M&A and NGL

Energy Transfer’s deal with WTG is its second large-scale deal of 2024 since Sunoco, which the partnership controls, agreed to purchase NuStar Energy in January in an all-equity deal valued at $7.3 billion, including debt.

The May 28 WTG transaction will tap into the NGL markets, which many gas producers said during earnings season were lucrative even as natural gas prices fell.

For Energy Transfer, the transaction is expected to increasingly add incremental revenue from downstream NGL transportation and fractionation fees.

Energy Transfer expects the WTG assets to add approximately $0.04 of distributable cash flow per common unit in 2025 — growing to approximately $0.07 per common unit in 2027. WTG’s cash flows are supported by high quality customer base with an average contract life of more than eight years, according to the press release.

The transaction is expected to close in the third quarter, subject to regulatory approval and customary closing conditions.

RBC Capital Markets is serving as financial adviser to Energy Transfer, and Vinson & Elkins LLP is acting as Energy Transfer’s legal counsel on the transaction.

Jefferies LLC is serving as financial adviser to WTG, and Sidley Austin LLP is acting as WTG’s legal counsel.

Recommended Reading

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Momentum AI’s Neural Networks Find the Signal in All That Drilling Noise

2025-02-11 - Oklahoma-based Momentum AI says its model helps drillers avoid fracture-driven interactions.

Halliburton Secures Drilling Contract from Petrobras Offshore Brazil

2025-01-30 - Halliburton Co. said the contract expands its drilling services footprint in the presalt and post-salt areas for both development and exploration wells.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.