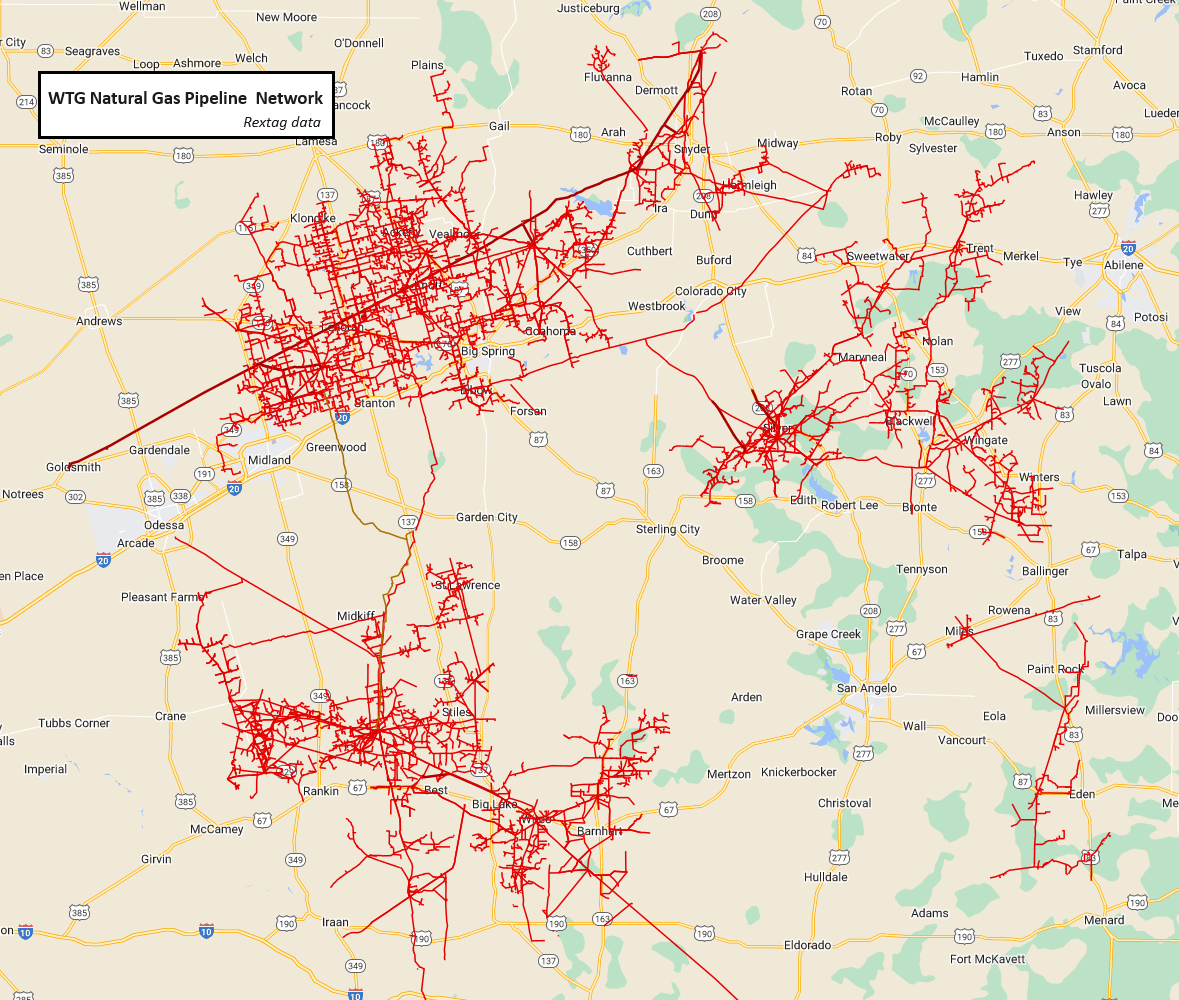

WTG’s facilities, which touch 25 counties in West Texas, include more than 1 Bcf/d of natural gas processing capacity and have more than 10 rigs operating in the system. (Source: Shutterstock)

Energy Transfer’s (ET) acquisition of WTG Midstream could be both a start and a finish for midstream M&A.

The $3.25 billion deal could mark the launch of a dealmaking spree for midstream companies that many analysts have predicted would kick into high gear this year.

The acquisition, if completed, would also mark the sale of the last large-scale midstream network in the Permian Basin.

“WTG was the last really large private G&P [gathering and processing] operator in the Permian,” Ajay Bakshani, director of midstream equity at East Daley Analytics, told Hart Energy. “We saw (Targa) take out Lucid and (Enterprise) take out Navitas. WTG was the only other one remaining that was of significant size.”

In 2022, Targa (TRGP) acquired Lucid Energy and Enterprise Product Partners (EPD) bought Navitas.

While there are still plenty of healthy private midstream outfits in the Permian, Bakshani said none match the scale of WTG’s network. WTG’s facilities, which touch 25 counties in West Texas, include more than 1 Bcf/d of natural gas processing capacity and have more than 10 rigs operating in the system.

For future Permian M&A activity, there is still a lot of “meat on the bone,” Bakshani said, especially on the private side. East Daley considers other private midstream companies with strong footings in the region—Canes, Brazos, Vaquero and Salt Creek—to be potential targets for M&A.

WTG’s network is primarily in the Midland Basin and some areas to the east, while ET’s network is largely in the western Delaware Basin. Analysts said, however, that the move was not all about territory.

“The more attractive reason, in our view, is not necessarily to get into the Midland but to capture the 150+ Mb/d [150,000 bbl/d] of NGLs that WTG’s plants produce,” Bakshani said. The deal includes eight online WTG natural gas processing plants with another two under construction.

The price of natural gas at the region’s Waha hub has often dipped into negative territory since February. On May 29, Piper Sandler analysts reported the Waha price for natural gas was $0.28 per MMBtu. By comparison, NGL prices have remained relatively stable since last year, trading at $7.47 per MMBtu in February, the last month for which the U.S. Energy Information Administration had data.

Bakshani said the pipeline network, located primarily in the Midland Basin, does provide some opportunities. Last year’s Exxon Mobil-Pioneer merger, which closed May 3, is expected to result in more regional production. Exxon is a major customer of both ET and WTG, so both systems will see more activity.

“With strong counterparties and a growing system (even if it isn’t growing as fast as the Delaware), that is a lot of NGLs ET can slowly shift over to its NGL egress pipelines, fractionators and export terminals,” he said.

TPH & Co. analysts noted that, along with a stronger position on NGLs, the move solidifies Energy Transfer’s overall position and increases the possibility of a major pipeline project in the company’s future.

“Overall, we view the transaction as a positive; once contracts start to roll on the NGL side, they will allocate those to their integrated system, and on the gas side, this should help their Warrior project gain momentum, all while diversifying their current footprint,” TPH analyst Zack Van Everen wrote.

The Warrior Pipeline is one of several proposed natural gas takeaways currently on the table for the Permian Basin. Energy Transfer’s proposal would take about 1.5 Bcf/d to 2 Bcf/d of gas from the Permian to network junctions southwest of the Dallas/Fort Worth area.

The company reported in February that the pipeline has commitments for 25% of its capacity but has not announced a final investment decision.

Recommended Reading

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

EON Deal Adds Permian Interests, Restructures Balance Sheet

2025-02-11 - EON Resources Inc. will acquire Permian overriding royalty interests in a cash-and-equity deal with Pogo Royalty LLC, which has agreed to reduce certain liabilities and obligations owed to it by EON.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.