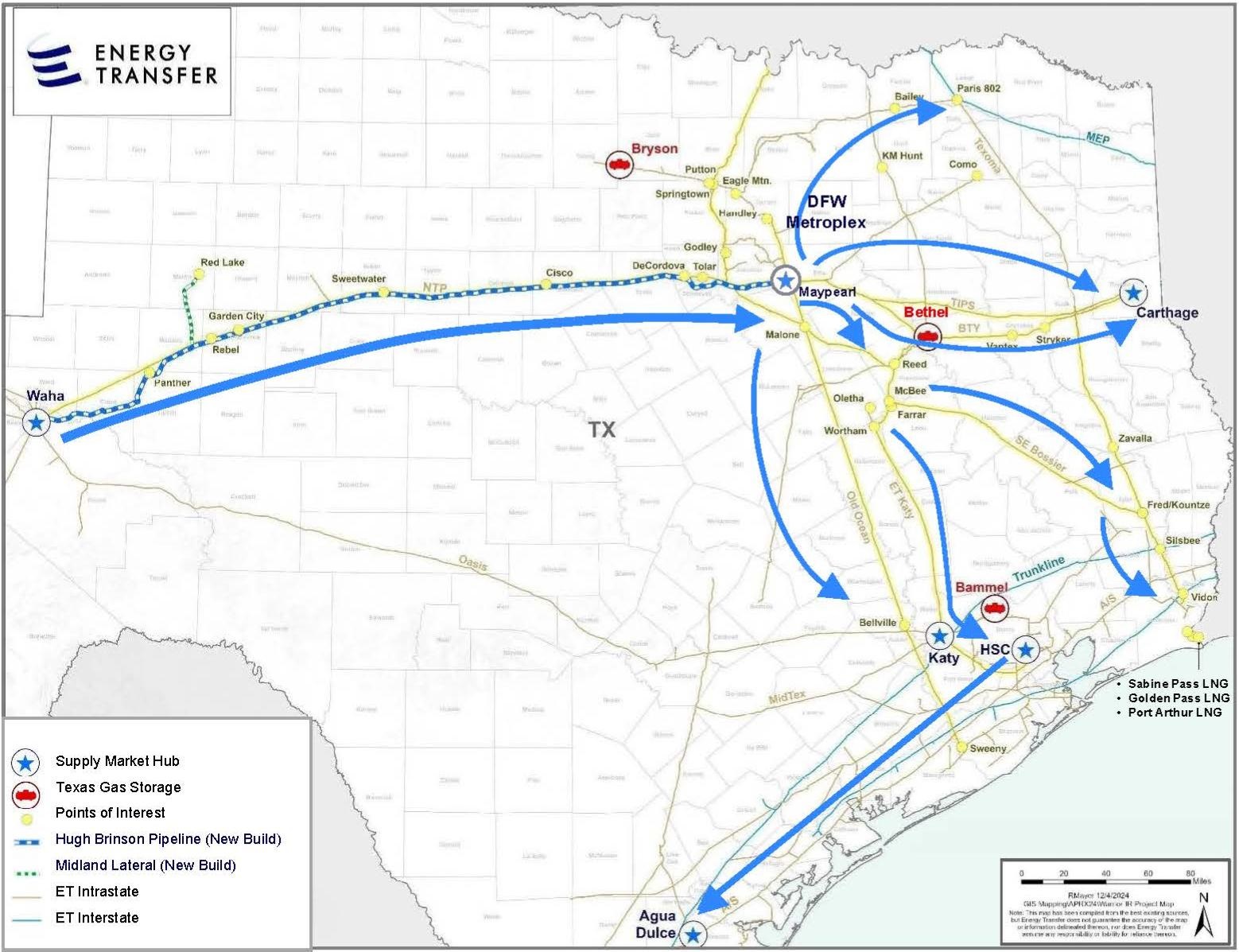

Energy Transfer said the newly renamed Hugh Brinson Pipeline—formerly known as Warrior—will deliver Permian Basin gas to the Dallas/Fort Worth market and beyond. (Source: Shutterstock.com)

Energy Transfer (ET) reached a long-expected final investment decision (FID) on a new natural gas pipeline project that will eventually deliver 2.2 Bcf/d to growing markets connected to the company’s network near Fort Worth, Texas.

Energy Transfer announced the FID on Dec. 6, though speculation that a decision was imminent had been building for months.

During the company’s third-quarter earnings call, executives indicated the project received a boost from investors interested in expanding the Texas power supply.

“This project is also expected to further establish Energy Transfer as the premier option to support power plant and data center growth in the state of Texas,” the company said in an afternoon press release.

The project was originally named Warrior, but the company changed it to the Hugh Brinson Pipeline, in honor of the father of Kelcy Warren, ET co-founder and executive chairman.

Energy Transfer plans to build the line in two phases. The first phase will include 400 miles of 42-inch with a capacity of 1.5 Bcf/d from Waha Hub to Maypearl, Texas, south of the Dallas. and Fort Worth. There, it will connect to Energy Transfer’s already existing pipeline and storage infrastructure.

Phase I is expected to be in service by the end of 2026. Phase II will include additional compression to increase capacity to approximately 2.2 Bcf/d. The company said Phase II could be built in conjunction with Phase I, depending on shipper demand.

The Hugh Brinson project in now the third major project announced in 2024 to move natural gas out of the Permian Basin.

The 2.5 Bcf/d Blackcomb project, led by WhiteWater Midstream, was announced in July. And Kinder Morgan announced FID on a 500 MMcf/d expansion of the Gulf Coast Express in November.

Recommended Reading

Fugro’s Remote Capabilities Usher In New Age of Efficiency, Safety

2024-11-19 - Fugro’s remote operations center allows operators to accomplish the same tasks they’ve done on vessels while being on land.

Halliburton Secures Drilling Contract from Petrobras Offshore Brazil

2025-01-30 - Halliburton Co. said the contract expands its drilling services footprint in the presalt and post-salt areas for both development and exploration wells.

TGS to Reprocess Seismic Data in India’s Krishna-Godavari Basin

2025-01-28 - TGS will reprocess 3D seismic data, including 10,900 sq km of open acreage available in India’s upcoming 10th Open Acreage Licensing Policy (OALP) bid round blocks.

Artificial Lift Firm Flowco Prices IPO Above Guidance at $427MM

2025-01-15 - Flowco Holdings priced its IPO at $24 per share, above its original guidance. The oilfield services firm will begin trading on the New York Stock Exchange on Jan. 16.

AIQ, Partners to Boost Drilling Performance with AI ROP Project

2024-12-06 - The AI Rate of Penetration Optimization project will use AI-enabled solutions to provide real-time recommendations for drilling parameters.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.