The Hugh Brinson announcement, provides a fairly good tell that electrical and data center demand is solidifying, said Ajay Bakshani, director of analytics for East Daley. (Source: Shutterstock/ Energy Transfer)

Making a final investment decision (FID) on the $2.7 billion Hugh Brinson Pipeline signaled more than Energy Transfer (ET) moving forward on a major project.

The move showed that long hoped for market demand for natural gas could finally be materializing, an analyst said.

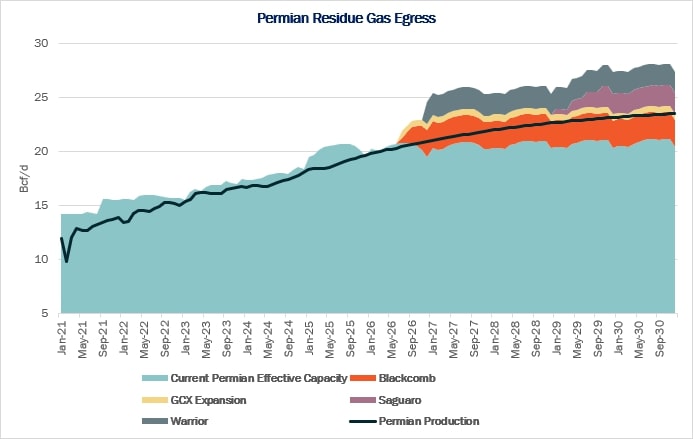

“Warrior (the former name for Hugh Brinson) overbuilds Permian gas egress,” said Ajay Bakshani, director of analytics for East Daley. “There is only one reason (Hugh Brinson) would still get built: Demand pull from the DFW [Dallas/Fort Worth] area from data centers and electric utilities.

For 2023 and most of 2024, a primary problem for Permian Basin operators has been too much natural gas in the system and not enough pipeline space to take it away.

Natural gas prices at the Waha Hub near Pecos, Texas, spent much of 2024 in negative territory. Associated gas-to-crude ratios continued to climb, and some E&Ps cut crude production since the only other option was flaring.

The situation changed with the opening of the 2.5 Bcf/d Matterhorn Express Pipeline, which started operations at the beginning of October and delivers natural gas to the Katy, Texas area near Houston. East Daley Analytics reported the new line ramped toward capacity faster than any other pipeline the firm had monitored before.

With the Matterhorn operating, most analysts believe another pipeline will not be needed until 2026.

RELATED

Midstreamers Say Need for More Permian NatGas Pipelines Inevitable

The Hugh Brinson line— a two phase project with a final projected capacity of 2.2 Bcf/d—is the third natural gas pipeline project to reach FID this year.

Before the Matterhorn started flowing, WhiteWater Midstream announced the 2.5 Bcf/d Blackcomb joint venture project. WhiteWater expects the line to be operational by the second half of 2026.

In mid-October, Kinder Morgan announced that it was moving forward on a 570 MMcf/d expansion on the Gulf Coast Express (GCX).

At that point, several analysts said the Permian egress problems were solved and that another pipeline would not be needed until 2028 or 2029.

Energy Transfer had said as recently as its third-quarter earnings call that the company was moving forward on the project, but the FID showed a strong demand is growing, Bakshani said.

One advantage ET’s pipeline has over the other projects is its planned termination near Dallas/Fort Worth. The Blackcomb and GCX take natural gas to processing and liquefication facilities on the Gulf Coast.

Hugh Brinson will be able to deliver natural gas to one of the more intensive tech centers in the country.

“DFW has the second-highest concentration of data centers outside of Northern Virginia,” Bakshani said. ET also noted in its third-quarter conference call that the project was weighted a little more on “market pull than it is on producer push.”

The Hugh Brinson announcement, provides a fairly good tell that electrical and data center demand is solidifying, Bakshani said.

“Unlike producers, demand-pull customers like electric utilities do not care about overbuilding the basin as much as securing supply,” Bakshani said.

Not all analysts agreed. One told Hart Energy the usual production scenario could still be in play.

“In general, natural gas pipelines only FID when they get customer commitments to build the pipeline,” said Hinds Howard of CBRE Investment Management.

“So, the takeaway from the (Brinson) FID is that producers are willing to commit to takeaway capacity because it is needed to avoid bottlenecks on the horizon.”

Howard said ET did call out that project’s advantageous position with power plants and data centers, but he believes the bulk of the commitment for the pipeline came from producers pushing for more egress instead of the pull from downstream customers.

Analysts can easily come to different conclusions about Texas production. Gauging the activity levels of the Permian always takes some guesswork.

Basin production numbers are a black box thanks to the Permian being in the same state where most of its crude and natural gas are shipped for refining and processing. Pipelines do not have to register the amount of product they ship unless they cross state lines or international borders. Therefore, analysts for the Permian have to rely on secondary indicators to determine production numbers.

In the meantime, other projects remain on the table. ONEOK has proposed and received permits for the Saguaro Pipeline, which would deliver gas to Mexico for an LNG project on country’s Pacific Coast. ONEOK is waiting for the LNG project to reach FID before moving forward.

Moss Lake Partners’ DeLa Express project, scheduled to be completed in 2028, continues to move forward. In September, Moss Lake Partners named engineering and project management firm Wood to build the line.

If all projects go forward, the Permian natural gas market, one of the cheapest in the U.S. for much of the 2020s, could become competitive by 2027, Bakshani said.

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.