(Source: Shutterstock.com)

Energy Transfer and Sunoco LP have entered in a joint venture agreement that combines some of their crude oil and produced water gathering assets in the Permian Basin, the companies said July 16.

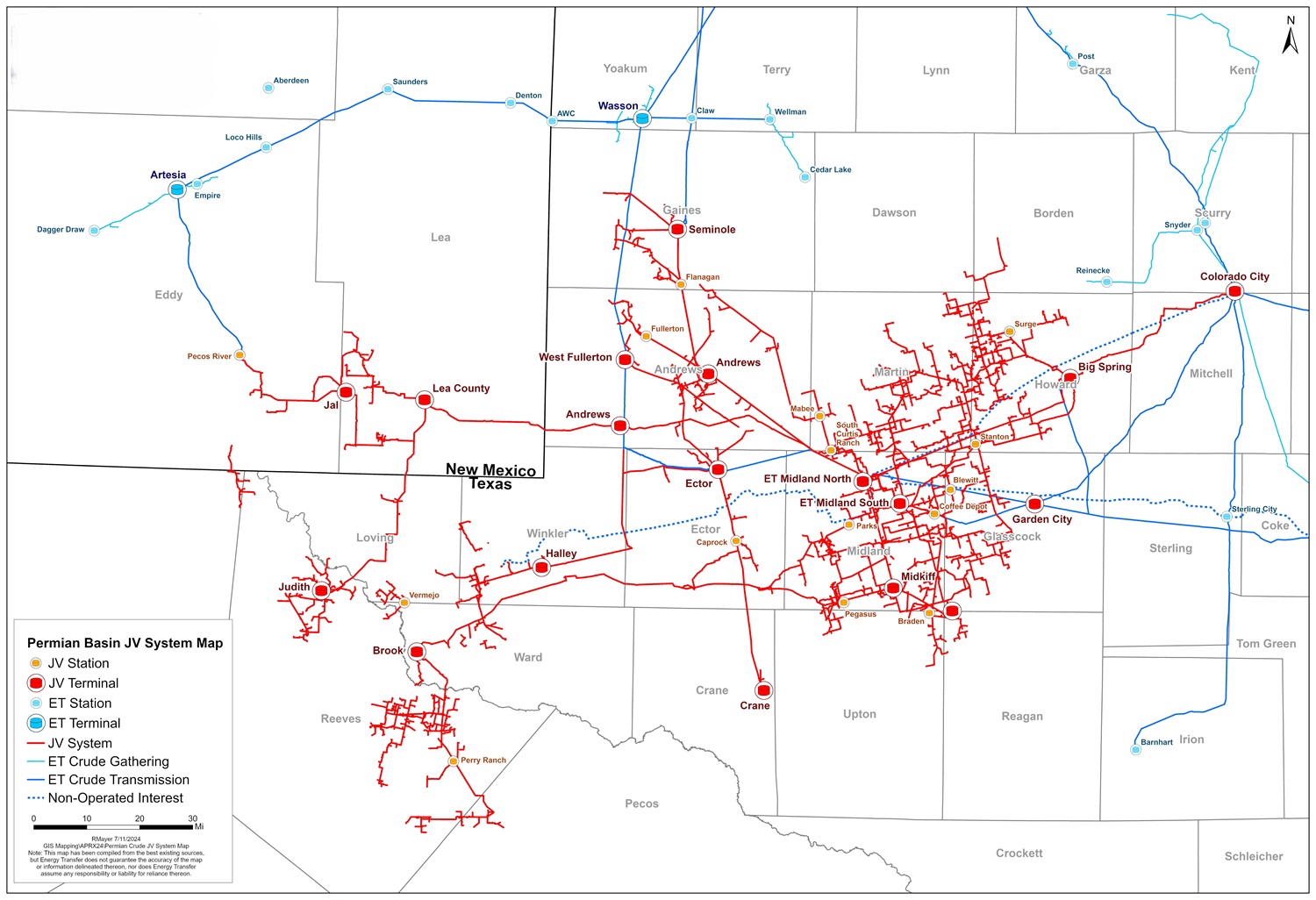

The JV will operate more than 5,000 miles of crude oil and water gathering pipelines with crude oil storage capacity in excess of 11 MMbbl. The JV’s reach will extend from Colorado City, Texas, in Mitchell County, through the Midland Basin and into the heart of the Delaware Basin, Lea County, New Mexico.

News of the comes a day after Energy Transfer completed its acquisition of WTG Midstream Holdings in a cash-and-stock trade valued at $3.18 billion.

Energy Transfer will serve as the operator of the JV and contribute its Permian crude oil and produced water gathering assets and operations to the partnership. Energy Transfer’s long-haul crude pipeline network provides transportation of crude oil out of the Permian Basin to Nederland, Houston and Cushing is excluded from the joint venture.

Sunoco, coming off its May deal to buy NuStar Energy for $7.3 billion, will contribute all of its Permian crude oil gathering assets and operations to the JV.

Energy Transfer will hold a 67.5% interest in the joint venture with Sunoco holding a 32.5% interest.

The formation of the joint venture has an effective date of July 1 and is expected to be immediately accretive to distributable cash flow per LP unit for both Energy Transfer and Sunoco.

Intrepid Partners LLC served as financial adviser to Energy Transfer’s conflicts committee, and Potter Anderson & Corroon LLP acted as Delaware counsel.

Guggenheim Securities LLC served as financial adviser to Sunoco’s special committee. Richards, Layton & Finger, P.A. acted as Delaware counsel for Sunoco’s special committee.

Vinson & Elkins LLP and Akin Gump Strauss Hauer & Feld LLP also acted as legal counsel to the partnerships on the transaction.

Recommended Reading

Amplify to Add D-J, Powder River Assets in Merger Agreement with Juniper Capital

2025-01-15 - Amplify Energy Corp. is combining with certain Juniper Capital portfolio companies in a merger agreement that adds 287,000 acres in the Denver-Julesburg and Powder River basins.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

Whitecap, Veren Enter $10.4B Merger of Western Canadian Basin E&Ps

2025-03-10 - Whitecap Resources and Veren Inc. will create the largest light oil and condensate producer in the Alberta Montney and Kaybob Duvernay in an all-share combination valued at CA$15 billion (US$10.43 billion).

Obsidian to Sell Cardium Assets to InPlay Oil for US$225MM

2025-02-19 - Calgary, Alberta-based Obsidian Energy is divesting operated assets in the Cardium to InPlay Oil for CA$320 million in cash, equity and asset interests. The company will retain its non-operated holdings in the Pembina Cardium Unit #11.

Diversified to Acquire Maverick, Enter Permian Basin in $1.3B Deal

2025-01-27 - Diversified Energy will acquire EIG’s Maverick Natural Resources, adding acreage that offsets Diversified’s core Western Anadarko position and Permian Basin assets in the northern Delaware.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.