The joint venture between midstream operators Sunoco and Energy Transfer’s crude gathering in the Permian Basin should prove mutually beneficial, analysts say. (Source: Shutterstock/ Energy Transfer)

The day after closing a $3.18 billion acquisition of WTG Midstream Holdings, Energy Transfer (ET) added another piece to its Permian Basin footprint in a joint venture agreement with Sunoco.

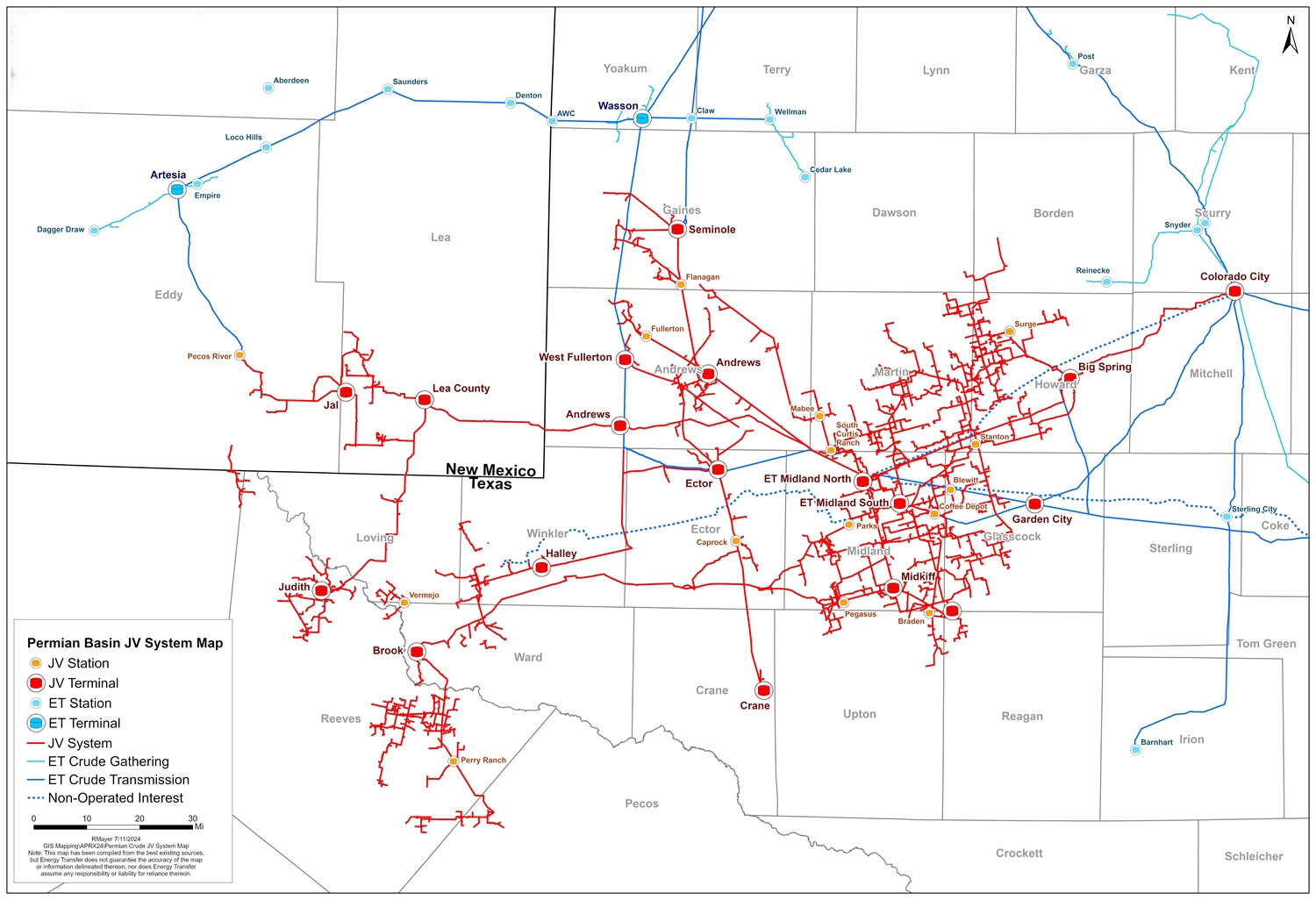

The agreement, unveiled by the companies on July 15, combines the companies’ Permian crude gathering assets, including ET adding its produced water assets.

The JV allows Energy Transfer to drive more products to its network while expanding Sunoco’s operational experience, Ajay Bakshani, director of analytics at East Daley Analytics, told Hart Energy via email. Sunoco is an affiliate of Energy Transfer.

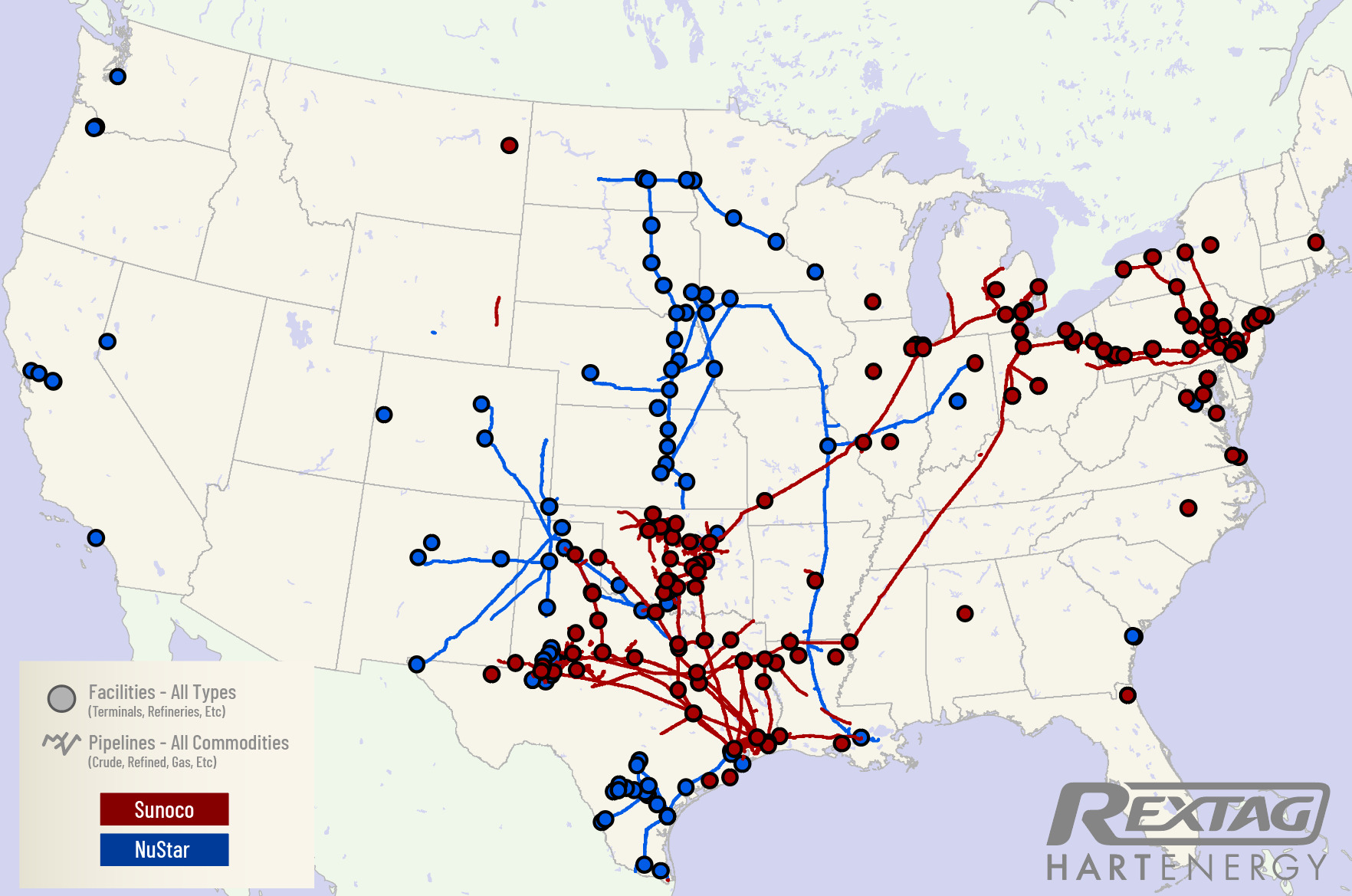

“Sunoco’s (SUN) contribution to the JV is primarily via its NuStar (NS) acquisition,” Bakshani said.

In May, Sunoco closed the acquisition of NuStar for $7.3 billion. NuStar owned a gathering system with a capacity near 550,000 bbl/d in the Midland Basin, which generated about $250 million in EBITDA annually, according to East Daley.

Sunoco, which has traditionally functioned as a fuel distribution company, can lean on ET’s midstream experience in the region.

“After the NuStar acquisition was announced, many in the market were wondering if the next step would be for Sunoco to contribute some of the crude oil pipeline assets of NuStar to Energy Transfer,” CBRE analyst Hines Howard told Hart Energy. “Instead, this joint venture situation seems to effectively transfer operatorship of the assets to Energy Transfer without having Energy Transfer acquire them outright.”

Under the JV, which has an effective date of July 1, Energy Transfer holds a 67.5% interest in the partnership while Sunoco has a 32.5% interest. ET will operate the network.

Energy Transfer benefits from adding a strong gathering system from the Midland Basin to its profile, although the company may have some difficulty adding the volumes from its new gathering system onto its crude pipelines that ship out of the region.

“Although it is harder to vertically integrate and push gathering volumes onto a company’s long-haul pipelines for crude than it is for NGLs, those opportunities still exist,” Bakshani said, noting that other midstream companies have been able to do so. “We have seen Plains (PAA) [Plains All American] do this with their Oryx JV: the increased strength in Permian crude gathering has kept their Permian-TX Gulf Coast pipelines relatively full.”

In 2021, PAA and Oryx Midstream created a JV that merged most of the companies’ Permian assets.

Sunoco did not have any egress pipelines in its Permian network, and Energy Transfer did not include its long-haul systems in the JV. Bakshani said that the NuStar system delivers into the egress lines of several ET competitors.

With the Sunoco partnership, ET may drive more of the crude volumes onto its West Texas Gulf or Permian Express pipelines, thereby increasing its EBITDA.

Energy Transfer currently owns 1.3 MMbbl/d of Permian Basin crude egress capacity, about 16% of the total.

Recommended Reading

E&Ps’ Subsurface Wizardry Transforming Geothermal, Lithium, Hydrogen

2025-02-12 - Exploration, drilling and other synergies have brought together the worlds of subsurface oil drilling and renewable energies.

Energy Transition in Motion (Week of Feb. 14, 2025)

2025-02-14 - Here is a look at some of this week’s renewable energy news, including a geothermal drilling partnership.

GA Drilling Moves Deep Geothermal Tech Closer to Commercialization

2025-02-19 - The U.S. Department of Energy estimates the next generation of geothermal projects could provide some 90 gigawatts in the U.S. by 2050.

Geothermal Player Ormat Adds Capacity as Power Demand Rises

2025-02-28 - Ormat aims to grow its installed capacity to between 2.6 and 2.8 gigawatts by the end of 2028, CEO says.

Sage Geothermal, ABB Form Energy Storage, Power Partnership

2025-02-04 - In a memorandum of understanding, ABB said it would support Sage Geothermal on its energy project with Meta.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.