Energy Transfer entered a 20-year agreement to supply Chevron with 2 mtpa of LNG from its Lake Charles LNG export facility, which is awaiting a final investment decision. (Source: Shutterstock.com)

Energy Transfer LP has entered a 20-year LNG sale and purchase agreement with Chevron U.S.A. Inc. to supply 2 million tonnes per annum (mtpa) at its Lake Charles LNG project— a deal that brings the facility closer to a final investment decision (FID).

Under a sale and purchase agreement, the LNG would be supplied on a free-on-board (FOB) basis. The purchase price would consist of a fixed liquefaction charge and a gas supply component indexed to the Henry Hub benchmark. The offtake agreement is subject to Energy Transfer LNG taking an FID on the Lake Charles project, among other conditions.

The 16.45 mtpa Lake Charles project, granted approval by the Federal Energy Regulatory Commission in 2015, had been a source of frustration for Energy Transfer after the COVID pandemic brought everything to a “screeching halt,” co-CEO Mackie McCrea told Hart Energy in September.

But on a Nov. 6 earnings call, Energy Transfer co-CEO Tom Long said that election of Donald Trump to a new term would get “rational reasonable people running this country” and the company would reach FID.

“We’ve still got a lot of work to do. We got partners we’ll need to bring in and correspond answering, but we do have a lot of momentum,” Long said at the time. “We hope to announce some significant new markets that we signed up by the end of the year….So, yes, we are very bullish on getting LNG to baseline.”

Mason said in a Dec. 19 press release that Chevron, “one of the most prominent LNG industry participants” had selected Lake Charles LNG as a supplier. “We believe that Lake Charles is the most compelling LNG project on the Gulf Coast and we continue to make significant progress towards full commercialization of this project,” he said.

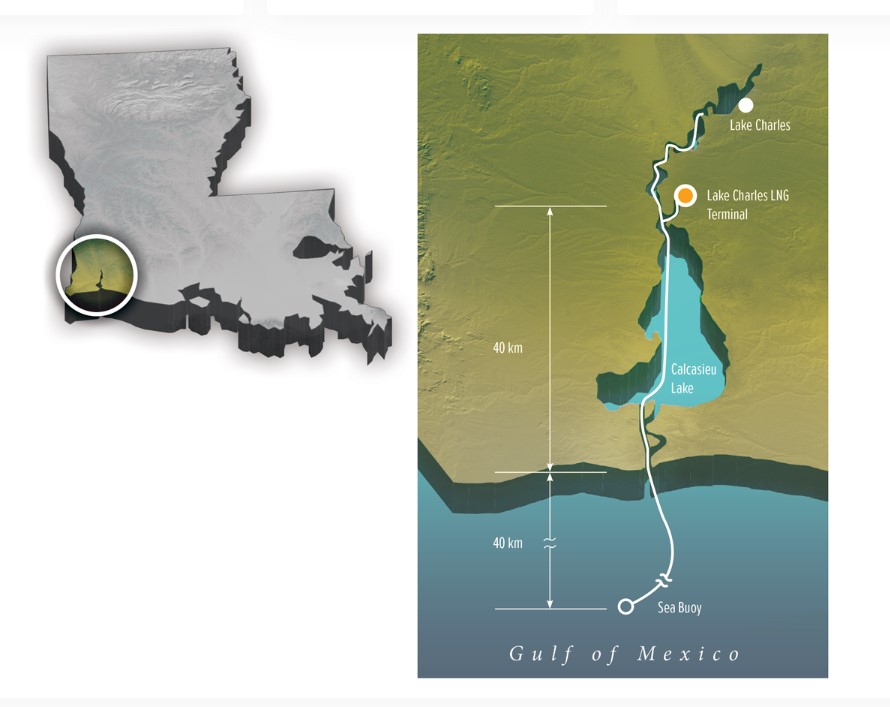

The Lake Charles LNG export facility would be constructed on the existing brownfield regasification facility site and will capitalize on four existing LNG storage tanks, two deep water berths and other LNG infrastructure, Energy Transfer said.

“Lake Charles LNG would also benefit from its direct connection to Energy Transfer's existing Trunkline pipeline system that in turn provides connections to multiple intrastate and interstate pipelines,” the company said in a press release. “These pipelines allow access to multiple natural gas producing basins, including the Haynesville, the Permian and the Marcellus Shale.”

“Chevron believes LNG plays an important role in meeting the world’s need for energy while helping advance lower carbon ambitions,” said Freeman Shaheen, President, Chevron Global Gas. “This new long-term agreement demonstrates our focus on increasing access to affordable, reliable, ever-cleaner energy supplies to meet growing global demand.”

Recommended Reading

Gradient: Geothermal Adds Value for Old, Existing Oil Wells

2025-03-27 - When geothermal piggybacks onto oil and gas operations, ‘the economics generally look really good,’ Gradient Geothermal CEO says.

BP to Sell Downstream Business in Austria

2025-03-27 - The sale, expected to be complete by year-end 2025, includes over 260 of BP’s retail sites across Austria.

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

Kissler: Gas Producers Should Still Hedge on Price

2025-03-27 - Recent price jumps and rising demand don’t negate the need to protect against future drops.

Prairie Operating Closes $600MM D-J Acquisition from Bayswater

2025-03-27 - Prairie Operating Co. has closed on its $602.75 million acquisition of Denver-Julesburg Basin assets from Bayswater Exploration and Production.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.