High interest rates, lingering supply chain issues and other uncertainty surrounding tariffs make for a challenging investment climate for the global solar sector, according to the Mercom Capital Group.

The Austin-based firm released on April 19 its first-quarter 2024 solar funding and M&A report. It showed total corporate funding for solar dropped by 4% to $8.1 billion raised in 41 deals compared to $8.4 billion raised in 42 deals a year earlier.

Quarterly data showed improvement, however, as funding jumped 47% compared to the $5.5 billion raised in fourth-quarter 2023.

Although demand for solar energy remains high, doubt about which way interest rates will swing — and the Biden administration’s next move on tariffs for imported solar panels— is causing investor angst in the U.S. as the November presidential election looms.

“The sector is grappling with multiple hurdles, including the likelihood of prolonged high-interest rates, higher labor and construction costs due to inflation and supply chain issues, coupled with trade disputes and tariffs,” Mercom Capital Group CEO Raj Prabhu said in a news release. “Although a crash in Chinese module prices has spurred demand, it has made investments in manufacturing projects unattractive, even with incentives.”

The firm reported venture capital funding for solar plummeted 81% in first-quarter 2024 to $406 million raised in 13 deals, compared to the $2.1 billion raised in 18 deals a year earlier.

Prabhu called M&A activity subdued.

At 21, the number of solar transactions for the first quarter was about the same as in fourth-quarter 2023, but down from the 27 transactions recorded in first-quarter 2023.

“Investment firms and funds were the most active acquirers in Q1 2024—with over 4.4 GW of projects being acquired—followed by project developers and independent power producers, which acquired 3.5 GW of projects,” according to the report.

Here’s a look at other renewable energy news this week.

Energy storage

North Carolina Grants Mining Permit to Piedmont Lithium

North Carolina regulators have given Piedmont Lithium a mining permit to proceed with construction, operation and reclamation of the company’s proposed Carolina Lithium project, according to an April 15 news release.

Located in Gaston County, North Carolina, the project is being designed to produce 30,000 metric tons of lithium hydroxide per year, which Piedmont said is more than double the 20,000 or so metric tons currently being produced in the U.S. Plans for the project are to fully integrate mining, spodumene concentrate and lithium hydroxide manufacturing operations at the site.

Approval of the company’s mining permit by the North Carolina Department of Environmental Quality’s Division of Energy, Mineral and Land Resources is the precursor for the county’s rezoning process.

“We plan to develop Carolina Lithium as one of the lowest-cost, most sustainable lithium hydroxide operations in the world, and as a critical part of the American electric vehicle supply chain,” said Piedmont Lithium President and CEO Keith Phillips. “The project is expected to contribute billions of dollars of economic output and several hundred jobs to Gaston County and North Carolina’s growing electrification economy.”

Following receipt of other necessary permits, rezoning approval and project financing, construction is expected to follow, Piedmont Lithium said.

Geothermal

Bedrock Completes Its First Geothermal Project in Texas

Bedrock Energy said on April 17 it has completed the design and construction of geothermal heating and cooling systems at a mixed-use complex in Texas, marking a company first.

Located at the Penn Field office and retail campus in Austin, the project involved installing a geothermal borefield and an HVAC system. The borefield was completed in three months, utilizing automated drilling and advanced subsurface modeling, the company said.

“This installation demonstrates how the energy beneath our feet offers not only comfort but also savings, reliability, and innovation,” said Bedrock Energy CEO Joselyn Lai. “Geothermal can strengthen our grid, support our businesses, create jobs, and help our communities thrive.”

Project partners included the CIM Group, a real estate owner, operator, lender and developer and Interface Engineering and Climate Solutions.

Geothermal Company GA Drilling Secures $15MM in Financing

Slovakia-headquartered GA Drilling has closed on its first $15 million in financing as the deep geothermal tech company looks toward commercialization after a series of successful tests.

“The excitement around deep geothermal is well placed given that our innovations have taken the estimates for the geographical availability of geothermal energy from 3% to 70+% of the planet,” GA Drilling CEO Igor Kocis said in an April 18 news release. “The demand for our technology picked up at an incredible rate.”

Its technologies include the Anchorbit drilling system and the Plasmabit drilling platform.

GA Drilling secured investments from Nabors, Christian Oldendorff’s new family office, alfa8, EQT’s former CEO Thomas von Koch, geothermal fund Underground Ventures and Slovakia-based Neulogy Ventures, according to a news release.

“Geothermal is the only game in town,” Von Koch said in the release. “Its potential to shift the energy industry is clear to those in the know, but now it’s about how we can access this natural battery beneath us.”

Sage Explores Deploying Geothermal Tech at Fort Bliss

Sage Geosystems is pursuing a geothermal initiative at the U.S. Army’s Fort Bliss in El Paso, Texas, and the Defense Innovation Unit (DIU), where it may deploy its geopressured geothermal system (GGS) technology to supply the base with energy.

“Energy resilience for the U.S. military is essential in an increasingly digital and electric world and we are pleased to help the U.S. Army and DIU to support energy resilience at Fort Bliss,” Sage Geosystems CEO Cindy Taff said in an April 17 news release.

The initiative is being launched as the U.S. Army targets goals to reduce its greenhouse-gas emissions by 50% by 2030, reach net-zero emissions by 2050 and have a microgrid installed on every base by 2035, according to the release.

The DIU separately announced Sage was among the three additional companies seeking to deploy their geothermal technologies at U.S. military installations. The other two companies are Fervo Energy and GreenFire Energy.

Hydrogen

Mitsubishi, NGK to Jointly Develop Hydrogen Purification System

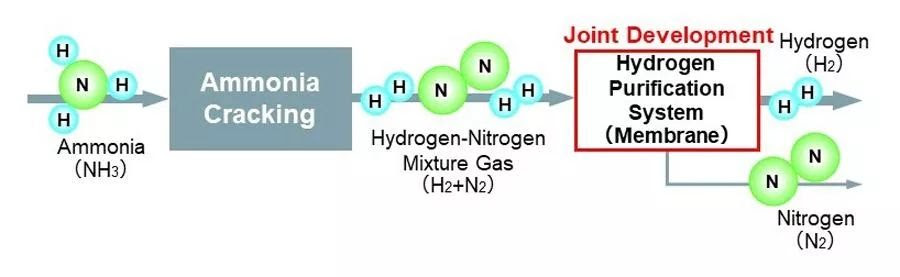

A hydrogen purification system aimed at creating a hydrogen and ammonia supply chain enabling high-volume transport is being jointly developed by Mitsubishi Heavy Industries and NGK Insulators Ltd., the companies said on April 18.

Mitsubishi and the Japan-based ceramic technology company said the system will use membrane separation to purify mixed hydrogen and nitrogen gas after ammonia cracking. Mitsubishi said it plans to contribute its expertise in delivering ammonia and other chemical plants along with its ammonia- and hydrogen-handling technologies. NGK will contribute its expertise in subnano ceramic membrane technology and unique film deposition technology, according to a news release.

“Plans to establish supply chains are underway worldwide, notably in Europe, while in Japan a ‘Fuel Ammonia Supply Chain Establishment’ project is in progress,” Mitsubishi said in a news release. “This market is expected to grow in the years ahead.”

The two companies said they aim to develop and commercialize a system that will contribute to a stable supply of hydrogen, a fuel that emits no CO2 when combusted. Ammonia is a hydrogen carrier that enables hydrogen to be transported and stored safely, the release states. Both companies have established carbon neutrality targets.

Air Products Lands Funding to Build Hydrogen Refueling Stations in Germany

Industrial gas manufacturer Air Products said on April 15 it has received funding to build two hydrogen refueling stations in Germany, which are capable of fueling a range of vehicles including trucks.

The Pennsylvania-based company said it will build, own and operate the two high-capacity stations.

The state of North Rhine-Westphalia, which is funding the project, plans to build 200 hydrogen fueling stations by 2030 and decarbonize heavy-duty transportation in the state.

Hydrogen is one of the most abundant elements in the universe, and many countries are betting on the element as they seek to make their economies carbon-neutral.

Linde Boosts Green Hydrogen Production in Brazil

Linde on April 18 said its White Martins subsidiary will build a second electrolyzer to produce green hydrogen in Brazil.

Located next to the company’s existing air separation facility in Jacareí, São Paulo, the 5-megawatt (MW) pressurized alkaline electrolyzer plant will be powered by solar and wind energy. Hydrogen produced at the plant will go to Cebrace, a glass manufacturer trying to lower emissions from its glass-melting furnaces in in Jacareí, Linde said in the release. Hydrogen will also be made available to other existing and new users.

The plant is expected to begin operations in 2025.

Solar

US Plans to Restore Tariffs on Dominant Solar Technology, Sources Say

The Biden administration is expected to grant a request by South Korea’s Hanwha Qcells to reverse a two-year-old trade exemption that has allowed imports of a dominant solar panel technology from China and other countries to avoid tariffs, two sources familiar with the White House plans said April 17.

The Qcells request, which has not previously been reported, comes as the company is seeking to protect a pledged $2.5 billion expansion of its U.S. solar manufacturing presence against competition from cheaper Asian-made products.

The solar division of Korean conglomerate Hanwha Corp. outlined the request in a formal petition to the U.S. Trade Representative on Feb. 23. It included letters of support from seven other companies with billions of dollars combined invested in U.S. solar factories.

No decision has been made on the timeline of the expected reversal, the sources said.

Duties on imports of bifacial panels, the main technology in utility-scale solar projects, would be a boon to the more than 40 solar equipment factories planned since U.S. President Joe Biden signed his landmark climate change law, the Inflation Reduction Act, in 2022.

Those plants are critical to Biden’s plan to fight climate change, revitalize American manufacturing and create millions of union jobs.

Past trade remedies have sharply divided the U.S. solar industry, which is dominated by installers and developers who rely on cheap imports to keep their project costs low.

Recurrent Reels in Financing for 152-MW Solar Project

Recurrent Energy on April 15 said it has secured about $70 million in financing for its 152-MW Jaiba III solar project in Brazil.

The funds from Banco de Nordeste do Brazil (BNB) will span the project’s 22-year construction and operation phases and will be inflation adjusted, according to a news release.

“BNB’s enduring participation in our solar portfolio reinforces our confidence in the long-term potential of Brazil’s renewable energy sector,” Recurrent Energy CEO Ismael Guerrero said.

Operations at the solar project are expected to start in fourth-quarter 2024. The company has already signed an inflation-adjusted, 15-year power purchase agreement with flat steel company Usiminas for energy produced at Jaiba III.

Stellantis to Acquire Stake in Argentina Solar Power firm in Green Energy Push

Automaker Stellantis said on April 17 that it will pay $100 million to acquire 49.5% of 360 Energy Solar, one of Argentina’s leading solar power producers, in a push toward making its plants more energy self-sufficient.

Stellantis, which makes and sells Citroen, Fiat and Peugeot vehicles in the South American country, said in a statement the partners will develop additional solar plants, install large-scale solar storage systems and produce hydrogen energy.

The investment will allow the automaker to boost renewable energy at its Ferreyra and El Palomar plants in the provinces of Cordoba and Buenos Aires, respectively, Stellantis said. Both facilities are powered by 360’s La Rioja solar power plant.

360 Energy owns six photovoltaic plants in the provinces of San Juan, Catamarca and La Rioja, with an installed generating capacity of more than 250 MW.

Wind

Dominion’s Charybdis Vessel Moves to Water

The first Jones Act-compliant offshore wind turbine installation vessel, Charybdis, launched from land to water, Dominion Energy said, marking a milestone in its construction.

The launch of the 472-foot vessel followed the completion of welding of the ship’s hull and commissioning of the vessel's four legs and related jacking system. Its expected lift capacity is about 2,200 tons, according to Dominion. The ship is being constructed at Seatrium’s shipyard in Brownsville, Texas.

“The U.S.-built vessel will not only contribute towards reliable, affordable and clean energy, but also benefit local communities in creating a significant local know-how and job opportunities, paving the way for future growth in the U.S. offshore wind industry," said Seatrium CEO Chris Ong said in a news release.

Designed to handle turbines that are 12 MW or larger, the vessel’s hull and infrastructure was fabricated with more than 14,000 tons of U.S.-made steel. The completed vessel will be housed at a port in Hampton Roads, according to the news release.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

TotalEnergies, STMicroelectronics Ink 1.5 TWh Renewable Power Deal

2025-01-28 - As part of the 15-year contract, TotalEnergies will provide solar and wind power to New York-based STMicroelectronics.

GA Drilling Moves Deep Geothermal Tech Closer to Commercialization

2025-02-19 - The U.S. Department of Energy estimates the next generation of geothermal projects could provide some 90 gigawatts in the U.S. by 2050.

Black & Veatch to Build Two Battery Storage Projects in UK

2025-02-11 - Serving as the projects’ owner’s engineer and technical advisor, Black & Veatch will review and provide technical advice, construction monitoring and schedule tracking services.

Ørsted, PGE Greenlight Baltica 2 Wind Project Offshore Poland

2025-01-29 - Ørsted said Baltica 2 is expected to be fully commissioned in 2027.

TotalEnergies, Skyborn Commission Yunlin Wind Farm Offshore Taiwan

2025-03-04 - Located about 15 km off Taiwan’s west coast, Yunlin consists of 80 wind turbines.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.