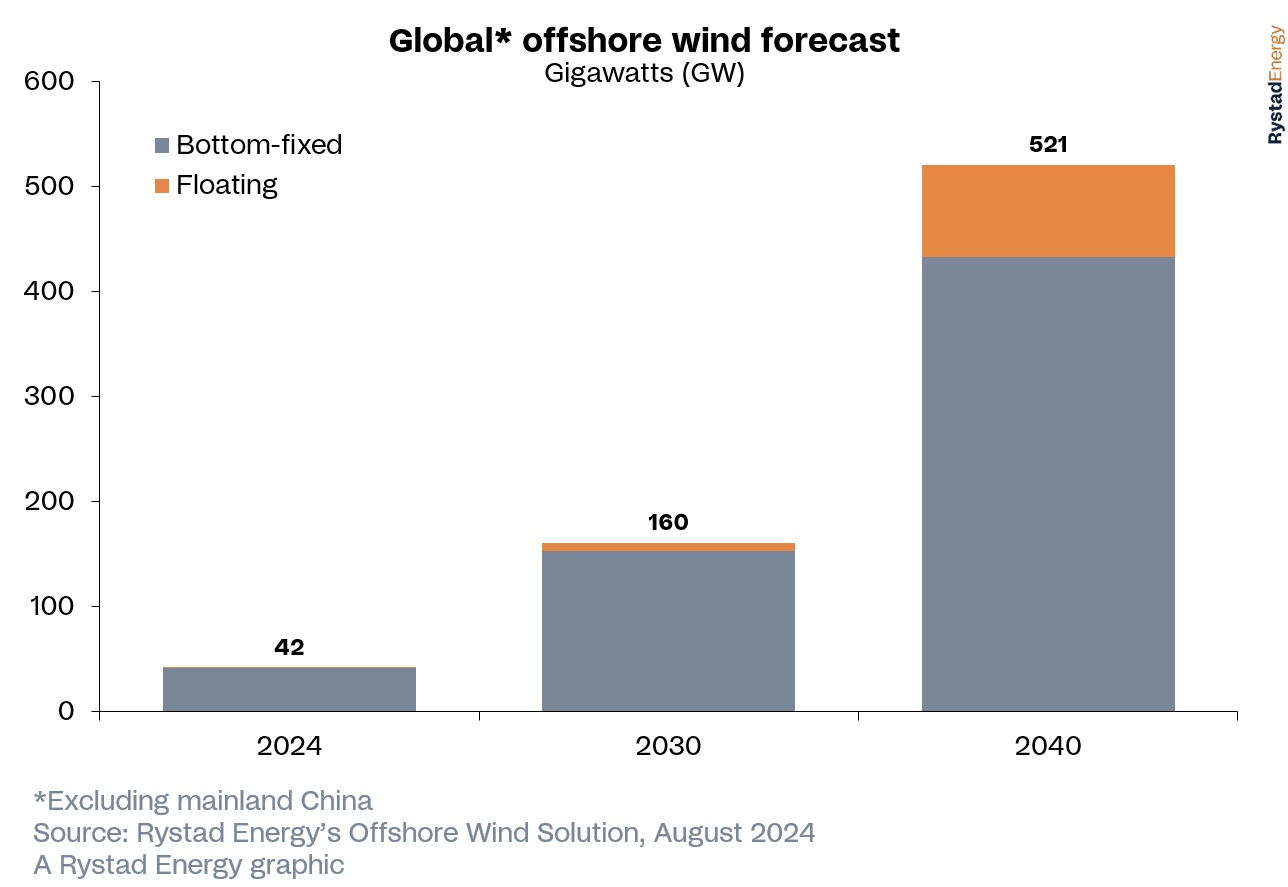

Global offshore wind capacity is forecast reach 42 gigawatts (GW) this year as wind players work to grow capacity by 9%, according to a report released this week by Rystad Energy.

The growth is expected follow a tumultuous 2023 when offshore wind players faced supply chain issues, inflationary pressure, delayed auctions and slow-moving permitting processes, but still managed to add 7% more capacity, compared to the year before.

If plans are successfully executed, logistical and other issues are addressed, floating wind technology advances and investment continues, global offshore wind capacity—excluding mainland China— could surpass 520 GW by 2040 with Europe leading the way, according to Rystad.

“While ambitious targets boost investor confidence, it is crucial to address logistical issues to ensure that offshore wind can successfully take a key role in the energy transition,” said Petra Manuel, senior analyst of offshore wind at Rystad Energy. “This will not only help the technology mature, but also foster a supportive ecosystem that inspires investor reliance.”

Europe is forecast to lead in the bottom-fixed wind market with the U.K., Germany and the Netherlands dominating in the North Sea, fueled by net-zero ambitions. Together, the countries are expected to account for 150 GW of installed capacity by 2040, according to Rystad. The trio will be followed by the U.S. with less than 40 GW by 2040.

“The future of the U.S. market is contingent on its political landscape, with concerns that if presumptive Republican presidential nominee Donald Trump were to win, his administration might significantly impede offshore wind development,” Rystad said.

Forecast for global floating wind growth is not as robust as the more mature bottom-fixed market. Still considered nascent, floating wind technology is used for offshore wind projects in deepwater.

Rystad said it anticipates Europe will install over 65 GW of floating wind capacity by 2040, while installations in Asia, excluding mainland China, will have reached 17 GW.

Here’s a look at other renewable energy news this week.

Hydrogen

Element 1, TYCROP, H2 Portable Form Hydrogen Partnership

Hydrogen generation technology developer Element 1 Corp. on Aug. 21 said it signed an agreement with TYCROP Manufacturing Ltd. and H2 Portable Power Corp. to collaborate on developing and commercializing hydrogen fuel solutions.

Aiming to accelerate the design, manufacture and sales of hydrogen-based power generation technologies, Element 1 will provide its methanol-steam reforming and hydrogen purification processes, according to a news release. TYCROP and H2 Portable will contribute to the partnership by providing engineering, product development and manufacturing to integrate the technologies into portable and scalable power generation solutions.

The collaboration builds on an existing partnership between the three companies.

“By incorporating Element 1 Corp. technology, the collaboration will enable TYCROP to design and manufacture next generation hydrogen electric generators for H2 Portable, become a contract manufacturer under ‘preferred partner’ status to Element 1 Corp., as well as supplying other [third]-party customers,” the news release said.

Hystar Selects Thyssenkrupp to Engineer 4.5GW Electrolyzer

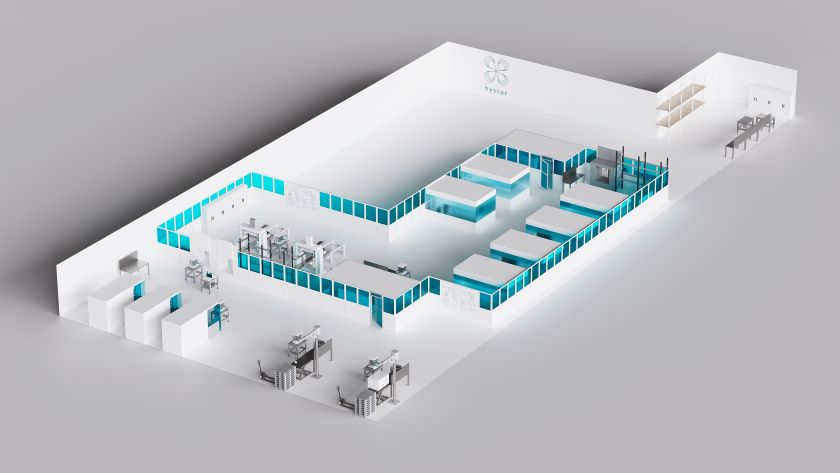

Hystar on Aug. 22 said it awarded Germany-based Thyssenkrupp Automation Engineering a FEED contract to design an automated 4.5-GW electrolyzer production line.

The manufacturing line is for an expansion of Hystar’s factory in Høvik, Norway, the company said. The factory’s current capacity is 100 megawatts (MW).

“Implementing our automated GW factory further strengthens Hystar’s ability to deliver competitive and efficient solutions to our customers for large-scale green hydrogen projects,” Hystar CEO Fredrik Mowill said.

The gigawatt eletrolyzer factory, which includes stack assembly, quality control and testing, requires just 2,500 sq m of space, Hystar said.

Air Products Reaches Deal to Acquire Hydrogen Assets in Uzbekistan

Pennsylvania-headquartered Air Products has agreed to acquire Saneg’s hydrogen production assets at the Fergana oil refinery for $140 million, the Uzbekistan-based company said Aug. 21.

The refinery, which is being modernized, plans to start industrial production of hydrogen by transferring its assets to Air Products, Saneg said.

“The acquisition includes a steam methane reforming (SMR) unit, capable of processing either 100% natural gas or LPG for high reliability operations.,” Saneg said in a news release. “These assets, combined with the two PSA units originally supplied by Air Products, will ensure a reliable source of hydrogen production that can fulfill the demand of the refinery as well as the merchant market.”

The acquisition is expected to close in fourth-quarter 2024.

RELATED

Pacific Northwest Hydrogen Hub Targets Hard-to-Abate Sectors

Solar

TMEIC Sets Sight on Texas for Facility Expansion, Headquarters

TMEIC Corporation Americas, a subsidiary of Japan-based TMEIC Corp., plans to build a 144,000-sq-ft photovoltaic (PV) manufacturing facility in Texas and relocate its headquarters to Houston.

The company, which specializes in making PV inverters and energy storage systems, said on Aug. 20 it will move its headquarters from Roanoke, Virginia, to Houston in March 2025. The move is expected to “foster innovation, accommodate TMEIC’s expanding team, and strengthen its ability to serve clients,” the company said in a news release. The company plans to keep its Roanoke office open.

The new utility-scale PV inverter manufacturing facility will be located in Brookshire, west of Houston and near the company’s existing uninterruptible power supply and medium voltage drive manufacturing plant in Katy, Texas. The facility will have an initial annual capacity of 9 GW. It is scheduled to begin operations in October 2024.

“These investments and expansions will potentially create up to 300 jobs in the local community," said Manmeet S. Bhatia, president and CEO of TMEIC Corporation Americas. “This strategic expansion underscores TMEIC’s dedication to the renewable energy industry, advancing clean energy technology, maintaining strong client relationships, and competing on a global basis while proudly manufacturing in the United States.”

TMEIC Group has more than 50 GW of renewable energy systems installed globally, the company said.

Swift Current Energy, Google Ink Solar Agreement

Swift Current Energy has closed on a tax equity investment from Google for the solar company’s 800-MW Double Black Diamond Solar project in Springfield, Illinois, according to an Aug. 20 news release.

The project, which is under construction, is expected to begin commercial operations by early 2025, said Swift Current, the project’s developer, owner and operator.

“As we work to responsibly grow our infrastructure, we need to partner with companies like Swift Current who understand the nuances of the energy markets where we operate and can help unlock new clean energy at a rate that matches the pace and scale of demand growth on electric grids today,” said Amanda Peterson Corio, global head of data center energy at Google.

The tax equity financing utilizes energy communities and domestic content adders provided in the Inflation Reduction Act.

The solar project will be capable of powering 100,000 each year and is expected to lower CO2 emissions by about 1 million tons per year, according to Swift Current.

Australia Approves $13.5B Project to Export Solar Power to Singapore

Australia said on Aug. 21 it had given the go-ahead for a AU$20 billion (US$13.5 billion) solar project that plans to ship energy from a giant solar farm in the country’s north to Singapore through a 4,300 km (2,672 miles) undersea cable.

Environment Minister Tanya Plibersek said SunCable’s flagship Australia-Asia power link project would help meet growing demand for renewable energy at home and abroad.

A final investment decision is expected in 2027 with electricity supply to begin in the early 2030s, according to SunCable.

The approval comes with strict conditions to protect nature and must avoid the habitat of the greater bilby, which are small rabbit-like marsupials with long floppy ears, Plibersek said.

Over two stages of development, the project aims to deliver up to 6 GW of green electricity to large-scale industrial customers in Darwin, the capital city of Australia's Northern Territory, and in Singapore.

Developer Alight, Swedish Forest Owner to Partner on 2 GW Solar

Solar developer Alight is partnering with Sweden’s biggest forest owner Sveaskog to develop solar energy projects totaling 2 GW over five years, the firms said Aug. 19.

“Investing in solar power on our land is natural for us as a large landowner and a way to contribute to the energy transition and the future need for fossil-free energy sources,” Sveaskog CEO Erik Brandsma said in a press release.

Under the agreement, Alight will develop, build and co-own solar parks on Sveaskog’s land, with the state-owned forest company to co-invest between 30% and 49% in the solar parks, they said.

Sveaskog owns 14% of Sweden’s forests, or about 3.4 million hectares.

If just 0.2%, or 10,000 hectares, of the land is converted into solar parks, it could generate around 5 GW of renewable energy, and would double Sweden's current solar output, the firms said.

Development has already begun for two projects—a solar park of approximately 150 hectares in central Sweden and another of 70 hectares in southern Sweden, they added.

Both regions need to increase renewable electricity production due to significant electricity deficits, they said.

Solar development in Sweden has picked up pace in recent years, with installed capacity growing by 1.5 GW in 2023 to 4.1 GW, according to SolarPower Europe.

RELATED

Google, Energix Seal Deal for 1.5 GW of Solar

Canadian Solar Plans to Issue $200MM in Notes to Investor PAG

NOVA Completes Acquisition of Solar Group UGE International

Wind

Asia’s First Offshore Wind Power Service, Operation Vessels Arrive

Shanghai Electric subsidiary Shanghai Electric Wind Power Group took delivery of Asia’s first offshore wind power service and operation vessels, the company said Aug. 21.

Named Zhizhen 100 and Zhicheng 60, the vessels feature an active wave compensation pier that mitigates hull displacement due to waves, which Shanghai Electric said enables efficient personnel and equipment transfer and wind farm maintenance—even in harsh sea conditions.

“The motherships can carry out continuous operation and maintenance operations in deep water and deep-sea wind farms, which largely alleviates pain points in China’s current mainstream marine transportation ships, including short window periods, the inability to hold continuous operations, frequent round trips, low efficiency, and poor functioning in severe sea conditions,” Shanghai Electric said in a news release.

Both vessels are also equipped with DP2 dynamic position systems, cargo space large enough to store wind turbine spare parts and are powered by a diesel-electric and lithium battery hybrid system. Additional features include a folding arm offshore crane, a workboat, a boarding frame and an aluminum alloy helicopter platform.

“These two offshore wind power service and operation vessels integrate efficient operation and maintenance, green and smart operations and maintenance, and are important carriers for the forward-looking structure of electric wind power in deep seas that will drive the high-quality development of China’s offshore wind power operation and maintenance capabilities,” said Liu Xiangnan, vice president of Shanghai Electric Wind Power Group.

The vessels were built by Zhenhua Heavy Industries and jointly developed by Shanghai Electric and Shanghai Zhenhua Heavy Industries.

US Gears Up for Second Central Atlantic Offshore Wind Sale

The U.S. Bureau of Ocean Energy Management (BOEM) is seeking public input on possible commercial wind energy development areas offshore New Jersey, Delaware, Maryland, Virginia and North Carolina.

The call for feedback was announced Aug. 21 as the U.S. continues to push toward goals of deploying 30 GW of offshore wind energy by 2030. The area spans more than 13 million acres in the Central Atlantic.

“Today’s announcement kicks off the process for a second potential auction in the Central Atlantic and provides an important avenue to solicit information as we identify potential areas that may be suitable for future offshore wind energy leasing,” BOEM Director Elizabeth Klein said.

BOEM said it will accept nominations and comments through 11:59 p.m. ET Oct. 21. In addition, BOEM will host several virtual and in-person public meetings in September and October, including a virtual Task Force meeting via Zoom on Sept. 10- Sept. 11.

For more information and to register, visit BOEM’s website.

Equinor Halts Vietnam Offshore Wind Plans, Plans to Close Hanoi Office

Norway’s state-controlled energy giant Equinor cancelled plans to invest in Vietnam’s offshore wind sector, a company spokesperson told Reuters, in a setback for the Southeast Asian country’s green power ambitions.

Vietnam has attracted international interest in its renewables plans because of its strong winds in shallow waters near coastal, densely populated areas, according to the World Bank Group, but delays in regulatory reforms have recently pushed some would-be investors to reconsider their plans.

“We have decided to discontinue our business development in Vietnam and to close our office in Hanoi,” an Equinor spokesperson said in an interview.

It is the first time Equinor has closed an international office focused on offshore wind development.

The company has previously exited more than a dozen countries where it had oil and gas activities over the last few years to focus on renewables and low-carbon systems.

Equinor’s exit deals a further blow to Vietnam after Danish offshore wind company Ørsted, another major player in the industry, said last year it would pause its plans to invest in large offshore wind farms in the country.

Vietnam has no current offshore wind projects but wants to install wind farms to generate 6 GW by 2030, equal to 4% of its planned capacity, as part of plans to reduce coal use and reach net zero carbon emissions by the middle of the century. Its plans, however, have been repeatedly delayed, as recent political turbulence in the country has paralyzed reforms and projects.

The industry is also considered sensitive by Vietnamese authorities because projects would be developed in the contested South China Sea, a crucial shipping waterway that Beijing claims almost in its entirety.

Fugro Lands Construction Support Contract for Offshore Wind Farms

Offshore construction company Van Oord has awarded geodata specialist Fugro a three-year contract to provide construction support to the company for offshore wind farms across Europe.

In a Aug. 22 news release, Fugro said it will assist with cable laying, trenching and survey operations throughout Europe, “providing vital geodata to inform positioning and construction of the resources to de-risk the projects and optimize future operations.”

Fugro said the remotely operated vehicle spreads it will provide will be

The contract, which includes an option to extend, permanently stationed on the vessels for three years, to provide support. The contract includes an option for an extension.

Reuters contributed to this report.

Recommended Reading

Expand Lands 5.6-Miler in Appalachia in Five Days With One Bit Run

2025-03-11 - Expand Energy reported its Shannon Fields OHI #3H in northern West Virginia was drilled with just one bit run in some 30,000 ft.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.