U.S. grid-scale energy storage hit another record high for third-quarter installations as growth in renewable energy elevated storage needs to boost the reliability of electric grids.

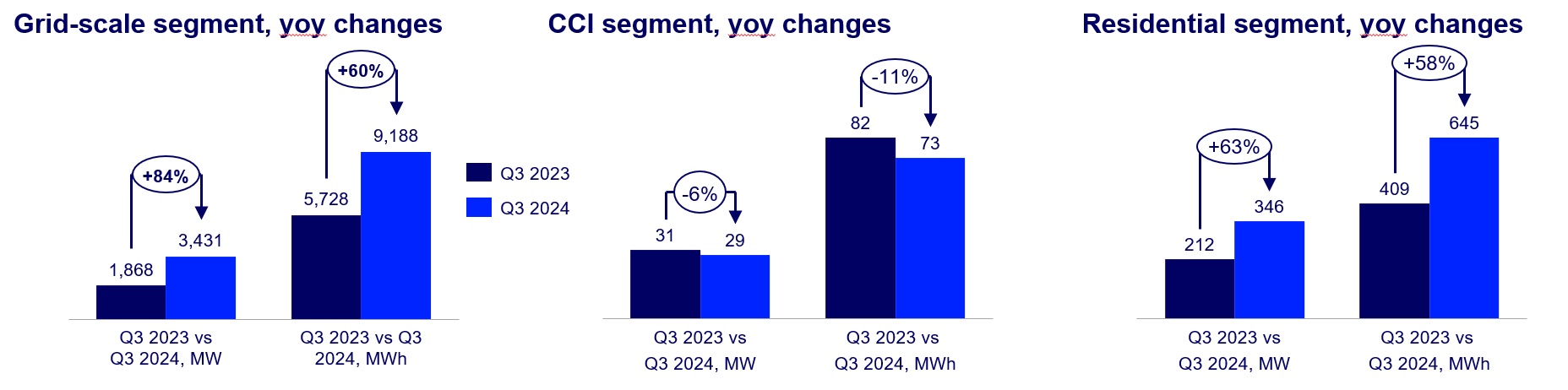

The latest U.S. Energy Storage and Monitor, a joint report of the American Clean Power Association (ACP) and Wood Mackenzie, show grid-scale energy storage installations hit a record 3.43 gigawatts (GW) for third-quarter 2024, a more than 80% jump compared to a year earlier.

“We are seeing the energy storage industry fill a real need across the country to provide reliability in an affordable and efficient manner for communities,” John Hensley, senior vice president of markets and policy analysis for ACP, said in a Dec. 12 news release. “With 64 GW of new energy storage expected in the next four years, the market signal continues to be clear that energy storage is a critical component of the grid moving forward.”

The increase came as power needs climb with more growth expected driven by data centers and manufacturing operations.

Installations in Texas skyrocketed to nearly 1.7 GW for third-quarter 2024, compared to the previous quarter, ACP said in the release. Looking at gigawatt hours (GWh) of installations, California topped other states with about 6 GWh added.

The residential segment also reported a record-setting 346 megawatts (MW) installed. That was a 63% increase compared with the last quarter.

“The grid-scale and residential segments will continue to lead the market, with grid-scale installations projected to more than double by 2028 to reach a cumulative volume of 63.7 GW, and residential installing 10 GW of storage in the same time period,” ACP said.

Tax credits, such as the Section 48 investment tax credit that was expanded under Inflation Reduction Act, have helped accelerate energy storage growth. The credit offers companies a 30% base tax credit if certain apprenticeship and wage requirements are met.

However, with a new administration set to take office, there is some uncertainty about the future of tax credits and how higher tariffs could impact the pace of growth.

“While there might be potential opportunities in a new pricing environment for domestic manufacturers in terms of competition, any major shifts in tax incentives or increased tariffs could outweigh benefits and have an impact on new project development,” said Allison Weis, global head of storage for Wood Mackenzie.

Here’s a roundup of some renewable energy news.

Bioenergy

Drax, Pathway Energy Enter Deal for Biomass Pellets for SAF Project

U.K.-based Drax Group on Dec. 12 said it will supply Pathway Energy with more than 1 million tonnes of sustainable biomass pellets annually for Pathway’s proposed sustainable aviation fuel (SAF) facility on the U.S. Gulf Coast.

Located in Port Arthur, Texas, the $2 billion facility is expected to produce 30 million gallons of SAF per year, the equivalent of fueling for 5,000 long-haul flights per year, according to a news release.

The agreement between Drax and Pathway came as the aviation sector works to lower emissions by using sustainable fuels. SAF can lower carbon emission by up to 80% compared to traditional jet fuels, Drax said in the news release.

Pathway plans to begin constructing the facility in early 2026 with commercial SAF production beginning in 2029.

“This landmark deal has the potential to be the biggest third-party supply arrangement Drax’s pellet business has made,” said Drax Group CEO Will Gardiner. Demand for sustainable biomass is accelerating, with international businesses seeking long-term fuel supplies for a range of projects globally – including sustainable aviation fuel and bioenergy with carbon capture and storage.

In addition, Drax said it could become a partner in the project and potentially invest up to $10 million in the form of a convertible loan note.

RELATED

Ameresco, Republic Services Begin Operations at Illinois RNG Plant

Energy storage

Stellantis, CATL Invest $4B to Build EV Battery Factory in Spain

Car maker Stellantis and China-based battery maker CATL will jointly invest €4.1 billion (US$4.3 billion) to build a large-scale lithium iron phosphate (LFP) battery plant in Spain, according to a Dec. 11 news release.

The joint venture’s formation came after the two companies announced in November they signed a memorandum of understanding to supply LFP battery cells in Europe.

Located in Zaragoza, the facility will be development in several phases and could reach up to 50 GWh of capacity. Plans are to start production by year-end 2026, Stellantis said in a news release.

“This important joint venture with our partner CATL will bring innovative battery production to a manufacturing site that is already a leader in clean and renewable energy, helping drive a 360-degree sustainable approach,” Stellantis Chairman John Elkann said.

The Zaragoza plant will be CATL’s third in Europe. The company has an operating facility in Germany and it is building a 100 GWh battery plant in east Hungary

“The joint venture has taken our cooperation with Stellantis to new heights, and I believe our cutting-edge battery technology and outstanding operation knowhow combined with Stellantis’ decades-long experience in running business locally in Zaragoza will ensure a major success story in the industry,” said Robin Zeng, chairman and CEO of CATL. “CATL’s goal is to make zero-carbon technology accessible across the globe, and we look forward to cooperating with our partners globally through more innovative cooperation models.”

The transaction is expected to close in 2025, subject to customary regulatory conditions, according to the release.

Aypa Power Secures $398MM Financing for Arizona Energy Storage Project

Blackstone portfolio company Aypa closed a $398 million financing package for the 250-MW battery energy storage system project it is developing in Mesa, Arizona, the company said in Dec. 11 news release.

The Pediment Battery Energy Storage System project is scheduled to begin operations in 2026, helping to support the region’s data center market. The project also has sealed a 20-year tolling agreement with Salt River Project, a not-for-profit utility organization that provides water and power in central Arizona.

"The closing of this significant financing reflects Aypa Power's ability to execute on large-scale energy storage projects and is a testament to the quality of projects we are bringing to market," said Bill Nguyen, executive vice president of finance at Aypa Power. "The facility's innovative structure and backing from diverse, esteemed financial institutions reflect our capital partners' confidence and ensure the flexibility to advance Pediment's construction."

The financing package includes a construction-to-back-leverage loan, tax credit transfer bridge loan, and letters of credit, according to the news release.

The financing group was led by Société Générale, ING Capital LLC and Bank of America as the coordinating lead arrangers. Zions Bancorporation, Royal Bank of Canada and Desjardins Group acted as joint lead arrangers at financial close.

Energy Vault, RackScale Partner to Scale Up Data Centers by 2 GW

RackScale Data Centers has teamed up with Energy Vault Holdings for 2 GW of power for data centers, the energy storage company said Dec. 11.

Plans are to utilize Energy Vault’s multi-story B-Nest hyperscale battery energy storage systems at data center sites developed by RackScale. Construction at data sites is scheduled to begin in 2026.

The partnership emerged as hyperscalers continue to lock in electricity, including from renewables and energy storage systems, to meet growing power needs. The surge in demand is driven in part by the computational power needs of artificial intelligence systems. Data center power demand is expected to surge by 160% by 2030, according to Goldman Sachs Research estimates.

“With the rapid increase in power demand from the rise of the data center sector, it is absolutely essential that renewable energy generation and storage become key points of focus to power the AI data center boom,” said Marco Terruzzin, chief commercial and product officer for Energy Vault.

The company said its B-Nest system is capable of storing up to 1.6 GWh of energy per acre, and the system’s ultra-high energy density enables it to provide each data center with full primary power for more than 10 hours.

“The B-Nest system’s high energy density and advanced safety design are game-changers for our operations, enabling us to accelerate firm grid power interconnections and onsite generation to meet the needs of our data center sites,” RackScale Data Centers CEO Trent D’Ambrosio said.

RELATED

Enphase, NextEnergy Partner on Energy Management Services in the Netherlands

Geothermal

EU Looks to Geothermal in Drive for Energy Security, Document Shows

EU countries plan to promote geothermal energy as they hunt for ways to replace Russian gas and bring down energy prices, a draft EU document showed.

The 27 EU members will jointly endorse geothermal energy for the first time at a meeting of EU energy ministers in Brussels next week, according to a draft document seen by Reuters, and will ask the European Commission to come up with a bloc-wide plan to get projects off the ground.

The draft requests an EU strategy to reduce emissions from heating and cooling systems, and specific EU measures to speed up geothermal projects. Ministers will suggest this includes financial guarantees to de-risk investments and simpler permitting rules, the document showed.

Geothermal projects drill underground to access local subterranean heat, which is brought to the surface to provide a constant source of heating to buildings, or to generate electricity.

“The use of geothermal energy contributes to the strategic objectives of the European Union by decreasing energy dependence and fossil fuel imports,” the draft document said.

High energy prices for industries and households, and the loss of most Russian gas since Moscow’s 2022 invasion of Ukraine, have prompted European countries to speed up their expansion of renewable energy.

But while wind and solar capacity have jumped, geothermal energy—another renewable source which the EU hopes can help replace fossil fuels—remains much smaller. Projects still struggle with high upfront investment costs and complex regulations.

EU data show geothermal produced less than 3% of the bloc’s energy in 2022. That’s despite it having the potential to cover three-quarters of EU heating and cooling needs in residential and commercial buildings by 2040, according to industry group the European Geothermal Energy Council.

Most EU countries already have geothermal district heating systems, but only a handful—including France, Germany and Italy—use it to generate electricity.

Hydrogen

Bloom Energy Forms Project Funding Partnership

Fuel cell manufacturer Bloom Energy formed a project financing partnership for about $125 million of funds managed by infrastructure capital providers HPS Investment Partners and Industrial Development Funding (IDF), the company said Dec. 11.

As part of the agreement, HPS and IDF will acquire 19 MW of Bloom’s energy servers, including advanced on-site microgrid solutions. The funding will support the installation of Bloom equipment contracted under power purchase agreement structures, Bloom said in a news release.

“With growing demand for shorter contract lengths and larger-scale projects, this partnership enhances Bloom’s ability to provide financed solutions that address customers’ power supply and reliability needs without impacting their capital budgets,” said Aman Joshi, Bloom Energy’s chief commercial officer.

RELATED

US Hydrogen Concerns Linger as Next Administration Nears White House

Solar

Wisconsin Regulators Greenlight Doral Renewables’ Vista Sands Solar Project

Doral Renewables’ 1.3-GW Vista Sands Solar project in Wisconsin has been approved by the Public Service Commission of Wisconsin, according to a Dec. 12 news release.

The solar project is expected to be the largest of its kind when it begins operations, generating

enough electricity at full capacity to power more than 200,000 Wisconsin homes, the release states.

“This milestone marks an exciting new chapter for clean energy in Wisconsin, bringing us closer to a future where reliable, affordable, and sustainable power is available to all,” said Jon Baker, vice president of development at Doral Renewables and project manager for Vista Sands Solar.

The solar farm is located in the towns of Plover and Grant in Wisconsin’s Portage County.

Phillips 66 Taps NextEra Energy for Solar Power at Rodeo Renewable Complex

NextEra Energy Resources will develop a 30.2-MW solar facility to power Phillips 66’s Rodeo Renewable Energy Complex in California, the petrochemical company said Dec. 10.

The solar facility, being called one of the largest on-site dedicated solar facilities in the U.S., will consist of more than 70,000 solar modules on about 88 acres of land adjacent to the complex in the San Francisco Bay area. It is designed to generate about 60,000 megawatt hours per year of electricity, Phillips 66 said in a news release.

“This project will not only benefit Phillips 66’s operations and the customers who rely on its renewable fuels but also demonstrates how renewable energy can integrate seamlessly into industrial operations,” said Rebecca Kujawa, president & CEO of NextEra Energy Resources.

The complex was previously known as the Rodeo Refinery, where products such as gasoline and jet fuel were produced. After completion of a four-year project called Rodeo Renewed, the complex now produces renewable diesel, SAF and other products.

Phillips 66 said the solar facility is expected to lower the complex’s grid power demand by 50% and avoid about 33,000 metric tons a year of CO2 emissions beginning in first-quarter 2025.

“We are excited to collaborate with NextEra Energy Resources on a project that aligns with our mission of providing energy and improving lives,” said Zhanna Golodryga, executive vice president of emerging energy and sustainability for Phillips 66. “This solar facility not only underscores our commitment to advancing a lower-carbon future but also enhances our energy infrastructure.”

The solar facility is owned and operated by NextEra Energy Resources.

RELATED

Altus Power Adds 13 MW to Clean Energy Portfolio in Maine

Wind

Germany Awards 4,098 MW Onshore Wind Power Capacity in Latest Auction

Germany’s network regulator on Dec. 11 said it approved 4,098 MW of new onshore wind power capacity in a quarterly auction held on Nov. 1, which was 1.5 times oversubscribed.

The Bundesnetzagentur, under a brief to ensure attractive returns for investors in low-carbon electricity systems while keeping a lid on costs for consumers, spoke of high interest in a statement.

“The extremely positive trend in bidding will be reflected in a significant commissioning number as from next year,” said Klaus Mueller, president of the authority.

The regulator will hold auctions for 10,000 MW each year up to 2028.

This happens under a remit to build up capacity successively on the way to meeting the country’s target of 80% of renewable power in the overall mix by 2030.

The price allotted in the November tender process arrived at 7.15 cents ($0.075 cents) per kilowatt hour (kWh), after bids ranged between 6.93 and 7.35 cents/kWh, and compared with a result of 7.33 cents in the last round in August.

Permits to build wind turbines were extended to 348 bidders, including big names such as RWE.

Ørsted Sells 50% Stake in Taiwan Wind Farm for $1.64B

Denmark’s Ørsted said on Dec. 11 it has agreed to sell a 50% stake in its Greater Changhua 4 offshore wind farm to Taiwan’s Cathay Life Insurance for about 11.6 billion Danish crowns (US$1.64 billion).

The site is part of Ørsted’s 920-MW offshore wind farms Greater Changhua 2b and 4, which the company is currently constructing and expects to finalize by the end of 2025.

The total sales price includes the 50% ownership share as well as a commitment to fund 50% of the cost of the wind farm, Ørsted said.

Battling to restore investor confidence, the offshore wind industry leader in February trimmed its investment and capacity targets and paused dividend payouts as part of a major review.

Ørsted will continue to own the remaining 50% ownership stake in the wind farm, Orsted said.

The transaction amount will be paid in 2024 and 2025, it added.

The Greater Changhua 2b and 4 offshore wind farms are located next to the 900 MW Greater Changhua 1 and 2a, which are in operation.

Together, the 1.82-GW Greater Changhua offshore wind cluster can produce enough energy to power nearly two million Taiwanese households, according to Ørsted.

RELATED

BP, Pulling Back from Renewables, Enters $5.8B JV with JERA

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

ZENRG Capitalizing on New Investments, Tech to Reduce Emissions

2025-01-07 - ZENRG Services recently secured funding from Chevron, BP Energy Partners and EIC Rose Rock to support its expansion of compression technology that keeps methane from being vented or flared.

Artificial Lift Firm Flowco Prices IPO Above Guidance at $427MM

2025-01-15 - Flowco Holdings priced its IPO at $24 per share, above its original guidance. The oilfield services firm will begin trading on the New York Stock Exchange on Jan. 16.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Trump Administration to Open More Alaska Acres for Oil, Gas Drilling

2025-03-20 - U.S. Interior Secretary Doug Burgum said the agency plans to reopen the 82% of Alaska's National Petroleum Reserve that is available for leasing for development.

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.