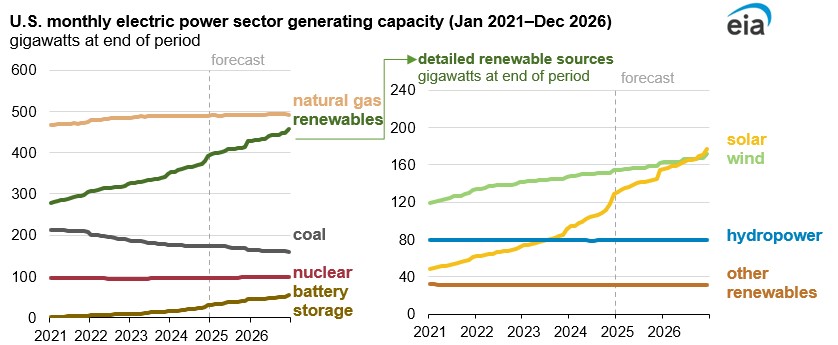

U.S. power generation growth will be driven mostly by new solar plants in the next two years, according to the U.S. Energy Information Administration (EIA), as utilities and independent power producers add capacity.

The EIA’s outlook forecasts 26 gigawatts (GW) of solar capacity to be added to power up the U.S. this year, with another 22 GW of additions expected in 2026. The anticipated growth, however, is down from the record 37 GW of solar power capacity that the sector added in 2024.

The positive outlook was delivered as electricity demand rises and solar developers step up to help meet demand as costs fall, technology improves and federal policies incentivize lower-carbon energy investments.

“We expect that planned renewable capacity additions will support most of the growth in U.S. electric power generation, which we expect will increase by 2% in 2025 and by 1% in 2026,” the EIA said. “The U.S. electric power sector produced a total of 4,155 billion kilowatt hours (kWh) of electricity in 2024, up 3% from 2023.”

The EIA also forecasts wind capacity additions will rise by 1 GW this year to about 8 GW, compared to 2024. Wind capacity additions are expected to reach 9 GW next year.

Natural gas-fired generation, however, continues to dominate the U.S. power supply mix, though its growth slowed in 2024.

Solar and wind capacity grew by 1 GW as natural gas-fired capacity growth slowed, EIA data show.

The push toward cleaner power sources also led to more coal retirements. The EIA expects 11 GW of coal-generating capacity will be removed from the power mix this year and 4 GW will be removed in 2026.

Here’s a roundup of some other renewable energy news.

Bioenergy

SkiesFifty, Frontline BioEnergy Form SAF Partnership

Investment fund SkiesFifty and Frontline BioEnergy will form a new company focused on sustainable aviation fuel (SAF) production, the companies said Jan. 23.

Iowa-based Frontline BioEnergy designs equipment for biomass gasification, converting biomass and waste into renewable fuels.

"Our proprietary technology creates clean, tar-free and particulate-free synthesis gas. It has huge potential for the generation of SAF,” Frontline BioEnergy CEO Jerod Smeenk said in a news release. “We have been looking for the right partner and investor to unlock this market for some time: SkiesFifty will now enable us to enter into SAF production and commercialize it on a global scale.”

SkiesFifty said the new venture will focus on scaling up green methanol and SAF production in the U.S. with potential for global expansion.

Energy storage

Brazil’s First Power Auction for Batteries Could Lead to $450MM in Investments

Brazil’s first-ever auction to add batteries and storage systems to its national power grid, scheduled for later this year, is seen generating $450 million in investments, according to an estimate by consultancy firm Oliver Wyman.

The batteries would be able to store energy from wind and solar power—renewable sources which, although growing in importance for Brazil’s power grid, remain limited as they are less predictable than thermoelectric or hydro power units.

Oliver Wyman estimates that, if the government purchases around 300 megawatts (MW) of energy capacity, the winners of the auction could spend $450 million to get their projects online. According to the consultancy firm, if Brazil were to have those batteries and storage power systems working already, the nation could have reduced the amount of fossil fuels burned by thermoelectric plants by 21% between April and December of 2024.

The estimated investments required could still change depending on details about the auction which have not yet been made public, said Rodrigo Borges, engagement manager of energy and natural resources for Oliver Wyman.

“One of the main doubts is regarding the size of power demand and its location,” Borges told Reuters. “This can create more bottlenecks or fewer bottlenecks, or encourage more or less investment,” he added.

According to the government’s proposal, the auction will take place in June and will offer 10-year contracts, with supply beginning in July 2029. The systems will have to deliver maximum power availability equal to four hours a day, receiving a fixed price for this. Power companies, such as Portugal’s EDP and Brazil’s ISA Energia, have indicated their interest in taking part in the auction.

Geothermal

BLM Schedules April Geothermal Lease Sale in Utah

The Bureau of Land Management’s (BLM) Utah state office will offer 15 parcels during a geothermal lease sale scheduled for April 8, according to a news release.

The parcels cover more than 50,800 acres on public lands in Utah’s Beaver, Iron and Sevier counties. The 10-year leases, which can be extended, allow companies to explore for and develop potential resources.

“For each parcel leased, 50% of the bid, rental receipts, and subsequent royalties go to the State of Utah, an additional 25% goes to the county where the lease is located, and the remaining 25% goes to the U.S. Treasury,” BLM said in the release.

The auction will be held online by EnergyNet.

SLB Enters Technology Collaboration with Indonesian Geothermal Firm

SLB and Star Energy Geothermal have agreed to work together on advanced technologies for geothermal asset development.

The collaboration aims to improve recovery rates of geothermal assets by combining Star’s knowledge of geothermal development with SLB’s experience in developing and deploying energy technology solutions.

SLB has worked with Star on optimizing well placement and improving the efficiency and economics of drilling geothermal wells. Under this agreement, SLB and Star will focus on technologies for subsurface characterization, drilling and production of geothermal assets.

Star is a subsidiary of Barito Renewables, Indonesia’s largest renewable energy company.

Hydrogen

Petron Scientech Selects Verdagy for Electrolyzers

Biorefinery project developer Petron Scientech has tapped electrolyzer manufacturer Verdagy to deploy 320 MW of electrolyzers to produce hydrogen, according to a news release.

The hydrogen will be used at Petron Scientech’s first biorefinery project that will produce SAF, renewable diesel and e-methanol.

“We were seeking a green hydrogen and oxygen solution partner that integrates well with our biorefineries/renewable chemicals, has leading performance and the technology expertise to scale to multiple GWs in a capital efficient manner. Verdagy fits the bill perfectly, and we are pleased and look forward to collaborating with the company on several projects globally,” Petron Scientech’s CEO Yogi Sarin said.

Hydrogen Grid Project Garners Support from Italy, Germany, Others

Italy, Germany, Austria, Algeria and Tunisia signed a joint declaration Jan. 21 stating they would press ahead with a plan to build a hydrogen pipeline linking North Africa and Europe, Rome’s foreign and energy ministries said.

The so-called SouthH2 Corridor, which the countries discussed at a ministerial meeting in Rome, would allow the supply to Europe of green hydrogen produced on the southern shores of the Mediterranean.

The project, involving a group of companies including Italian gas grid operator Snam, has been included in a list of Projects of Common Interest (PCI) by the European Commission.

Solar

Solar Proponent Signs 1.6 GW of PPAs in Texas

EnCap Investments-backed Solar Proponent (SolarPro) has signed 1.6 GW of power purchase agreements (PPA) across four projects in Texas, according to a Jan. 22 news release.

“Strong corporate interest has been essential to enabling financing of new power capacity to meet growing demand,” said SolarPro CEO Cassandra Rinaldo. “These projects will provide needed energy capacity to support a growing ERCOT [Electric Reliability Council of Texas] power market and aid our counterparty in achieving its decarbonization goals.”

The PPAs were executed in December 2024, according to the release.

The Austin-based utility-scale solar power developer also said it recently sold a 780-MW project in ERCOT’s South zone that will begin construction in early 2025 and 1.6 GW of solar projects in the North zone that is under construction.

“Solar Proponent is now seeking partners to contract, finance and build its 2.2 GWAC portfolio of ERCOT North and South Zone development projects,” Rinaldo said.

SolarPro has six solar and storage projects underway, ranging in size from 165 MW to 600 MW, in ERCOT’s North and South zones, according to the company’s website.

Woodside Energy, Heliogen Scrap Capella Project

Woodside Energy and Heliogen have discontinued the Capella concentrating solar power (CSP) technology project due to costs, according to a Jan. 23 news release.

The companies were focused on advancing Generation 3 CSP technology as part of the project. The technology aimed to generate higher temperatures than traditional concentrated solar.

“The Capella project achieved several first-ever milestones in prototyping and design, unlocking key learnings critical to improving the techno-economics for Gen 3 CSP,” Heliogen CEO Christie Obiaya said.

The project, which targeted deployment of a 5-MW equivalent power plant, reached the FEED phase; however, costs deterred construction. Both parties continue to evaluate opportunities for further collaboration in deploying CSP technology, Heliogen said.

Wind

Prysmian Ditches Plan to Build US Plant for Offshore Wind Parks

Italy’s Prysmian will abandon a plan to build a plant in the U.S. to make cables for offshore wind parks, the group said in a statement seen by Reuters on Jan. 21, even as it expands its overall business in the country.

Prysmian, the world’s biggest cable maker and a major player in offshore wind transmission, does not see a strong enough market in the U.S. for wind farms, a source close to the company told Reuters.

“It is not a political decision,” a spokesperson for the company said. “The market for offshore wind is in Europe.”

On Jan. 20, President Donald Trump suspended new federal offshore wind leasing pending an environmental and economic review, saying wind mills are ugly, expensive and harm wildlife.

But the group, which is planning a potential dual listing in the U.S. after the recent acquisition of Encore Wire, added in the statement that opportunities in the country continued to show strong growth potential.

“We have all the requirements for a listing in the United States if we decide to go ahead with it,” the company spokesperson told Reuters. “The fundamentals are the same, nothing has changed.”

The cable maker’s decision not to build the Brayton Point plant in Somerset, Massachusetts, was taken before Trump’s inauguration, according to the group, which added that demand for its products will continue to grow under Trump.

“There will be giant investments related to data centers, giant investments related to upgrades to have a modern and future energy system, and this is in line with what Trump said,” the spokesperson said.

Prysmian announced the plan to build the Brayton Point plant in 2021, saying it would invest around 200 million euros ($207 million) in the project as part of two contracts worth a total of almost $900 million in the U.S.

BOEM Approves Ocean Wind’s SouthCoast Wind Project

The U.S. Bureau of Ocean Energy Management has approved the construction and operations plans for the 2.4-GW SouthCoast Wind project offshore Massachusetts and Rhode Island, according to a news release.

The project being developed by Ocean Winds, the EDP Renewables and Engie joint venture, is expected to produce enough electricity to power more than 840,000 homes.

The approved project includes up to 141 wind turbine generators, up to five offshore substation platforms and up to eight offshore export cables located in up to two corridors, potentially making landfall in Brayton Point or Falmouth, Massachusetts, BOEM said. The plan has six fewer wind turbine positions than originally proposed.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

BP Pledges Strategy Reset as Annual Profit Falls by a Third

2025-02-11 - BP CEO Murray Auchincloss pledged on Feb. 11 to fundamentally reset the company's strategy as it reported a 35% fall in annual profits, missing analysts' expectations.

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.