Despite projections to reach $65 billion in investments for offshore wind by 2030 with 56 gigawatts (GW) of capacity currently under development, the U.S. will fall short of its offshore wind capacity goal, according to a report released this week.

Analysis from the American Clean Power Association (ACP) projects there will be 30 GW of offshore wind deployed in the U.S. by 2033, three years later than what the Biden administration targeted. The industry group said offshore wind capacity will reach 14 GW by 2030, increasing to 40 GW online by 2035.

“After the successful start-up of the 132 [megawatts] MW South Fork wind farm earlier this year, and with 136 MW operational at Vineyard Wind, offshore wind is gaining momentum with three projects under construction and thirty-seven more in development,” ACP Chief Policy Officer Frank Macchiarola said in a news release. “Harnessing America’s offshore wind resources will boost economic activity, create jobs, reduce pollution providing environmental and public health benefits, and strengthen America’s energy security by enhancing grid reliability and energy independence.”

ACP said its offshore wind market report shows there are currently 56 GW of capacity under development across 37 leases. About 12 GW of projects— including Vineyard Wind, Revolution Wind, and Coastal Virginia Offshore Wind—have active offtake agreements.

The U.S. offshore wind sector has been regaining strength following a challenging 2023 marked by rising costs, inflation and higher interest rates. Since then, federal and state authorities have opened pathways to rebid contracts and improved processes.

“The momentum and investment are likely to continue with the Bureau of Ocean Energy Management (BOEM) planning to hold four lease sales in the second half of 2024 in the Central Atlantic, Oregon, the Gulf of Maine, and a second Gulf of Mexico lease sale,” APA said. “These four lease sales will open nearly 1.9 million acres of federal waters to offshore wind development, potentially paving the way to more than 20 GW of future clean power generation capacity.”

Here’s a look at other renewable energy news this week.

Energy storage

US Gives Arizona Lithium Green Light for Big Sandy Exploration Drilling

Arizona Lithium (AZL) said it plans to start exploration drilling at the Big Sandy Lithium Project in mid-July now that it has received approval from the U.S. Bureau of Land Management.

Located in Arizona northwest of Phoenix, the Big Sandy project has an exploration target of between 271 Mt and 483 Mt of lithium. Drilling operations will be managed by the Navajo Transitional Energy Co., AZL said in an investor presentation.

“Plans are well advanced to commence drilling later in July and the taking of a bulk sample of Big Sandy ore for processing at the Lithium Research Centre in Tempe, Arizona,” AZL Managing Director Paul Lloyd said. “This is a very exciting step for the company.”

Hydrogen

Spain’s Enagas Sells US Asset to Finance Hydrogen Plans

Spain’s Enagás said on July 10 that it would sell its 30.2% stake in Colorado-based Tallgrass Energy for $1.1 billion to Blackstone Infrastructure Partners.

Enagás said the deal allows it to focus on decarbonization efforts, though it will take an “accounting loss” of €360 million (US$389 million).

Blackstone and Enagás were part of a consortium that purchased interests in Tallgrass about five years ago. Blackstone purchased a controlling stake in Tallgrass in 2019 and took the infrastructure company private.

Though Enagás is selling at a significantly lower price than the $1.64 billion paid in 2019, the deal still makes sense because it allows Enagás to bring in capital and focus on its priorities, said Hinds Howard, an analyst with CBRE Investment Management.

“The stock reacted positively because it clears the overhang and gets cash in the door,” Howard said in an email.

Despite the accounting loss, Enagás stock traded higher in the U.S., jumping $0.41, to $7.20 per share from $6.83 as trading opened on July 10.

Howard said that the sale showed midstream stocks were stable overall.

“The transaction as a market for broader midstream valuation is fine and does not seem to indicate midstream stocks are overvalued,” he said.

In its release, Enagás described the sale as part of an “asset rotation process” that the company announced in 2022. The company created the plan to focus on decarbonization and supply security in Spain and the rest of Europe.

Selling its Tallgrass stake allows Enagás to take a stronger financial position to fund green hydrogen projects. The company has also sold stakes in the GNL Quintero terminal in Chile and some natural gas infrastructure assets in Mexico.

The company plans to transition from operating a natural gas grid to taking a leading role in the Spanish government’s plans to develop green hydrogen production infrastructure.

In February 2023, the company presented plants for a $521.5 million renewable hydrogen plant in northern Spain.

Spain owns a 5% stake in Enagás, according to a Reuters report. On July 9, the government announced it had approved $865.5 million in subsidies for green hydrogen projects.

The Tallgrass transaction is expected to close at the end of July.

Cleanova Secures Filtration Contract for Louisiana Hydrogen Project

Industrial filtration company Cleanova said on July 9 it has secured a filtration contract for a blue hydrogen and ammonia project being built in Louisiana.

The company said it will supply a pair of three-stage filter modules to clean the intake air of the air separation unit, which separates oxygen and nitrogen. The blue hydrogen and ammonia project is expected to come online in 2026.

Formed in October 2023, Cleanova is owned by pan-European private equity firm Px3 Partners.

Solar

Avangrid Begins Solar Panel Installation at Ohio Solar Farm

Iberdrola subsidiary Avangrid has started installing solar panels at the 202-MW Powell Creek solar farm in Ohio, the companies said July 10.

With the so-called “Golden Row” in place, crews continue work on installing about 300,000 solar panels at the site location on Putnam County near Miller City. The site will generate enough energy to power at least 30,000 homes annually, Avangrid said.

“Powell Creek is another great example of Avangrid executing on its plan to grow renewable energy generation, help the country meet ambitious clean energy goals, and accelerate the clean energy transition,” Avangrid CEO Pedro Azagra said.

Powell Creek is Avangrid's second renewable energy project in Ohio following the 304-MW Blue Creek wind farm.

Canadian Solar’s e-STORAGE Lands Battery Storage Project in Texas

Blackstone portfolio company Aypa Power has selected Canadian Solar’s e-STORAGE to provide a 498-megawatt hour (MWh) battery storage system for the Bypass project being developed in Texas, the solar company said July 9.

Located in Fort Bend County, the Bypass project will use 106 units of e-STORAGE’s SolBank 3.0 paired with 65 power conversion systems and controllers. The units feature high-density lithium-iron-phosphate chemistry battery cells.

The project is expected to be complete in third-quarter 2025.

The contract represents the third between Aypa Power and e-STORAGE, which is part of Canadian Solar’s majority-owned subsidiary CSI Solar Co. Ltd.

“This brings our total commitment to providing Aypa with over 1.3 gigawatt hours of integrated energy storage capacity,” said Colin Parkin, president of e-STORAGE.

The company also said it will provide ongoing operational support for the project under a long-term service agreement.

Iberdrola Enters Deal to Power Burger King Restaurants in Spain

Iberdrola has signed a power purchase agreement (PPA) to supply fast food chain Burger King with 1,500 GWh of solar photovoltaic energy in Spain, the renewable energy company said July 11.

The PPA is enough to power to cover the annual demand of more than 750 BK restaurants as the company aims to completely power its restaurants with renewable energy. Iberdrola said the energy will come from the Francisco Pizarro photovoltaic plant (Cáceres), which has an installed capacity of 553 MW.

“Renewables have proven their ability to supply energy at affordable and stable prices and long-term PPAs have become a useful tool for managing the electricity supply of large consumers committed to green and sustainable consumption,” said David Martínez, director of customer business for Iberdrola España. “Such long-term agreements are increasingly important to enable progress in decarbonization and sustainability of the economy.”

In addition to the PPA, Iberdrola said it and BP Pulse are managing 154 charging points for electric vehicles, with 306 available spots, at 135 BK locations in Spain.

Wind

Atlantic Shores Submits Bid to Provide Offshore Wind in New Jersey

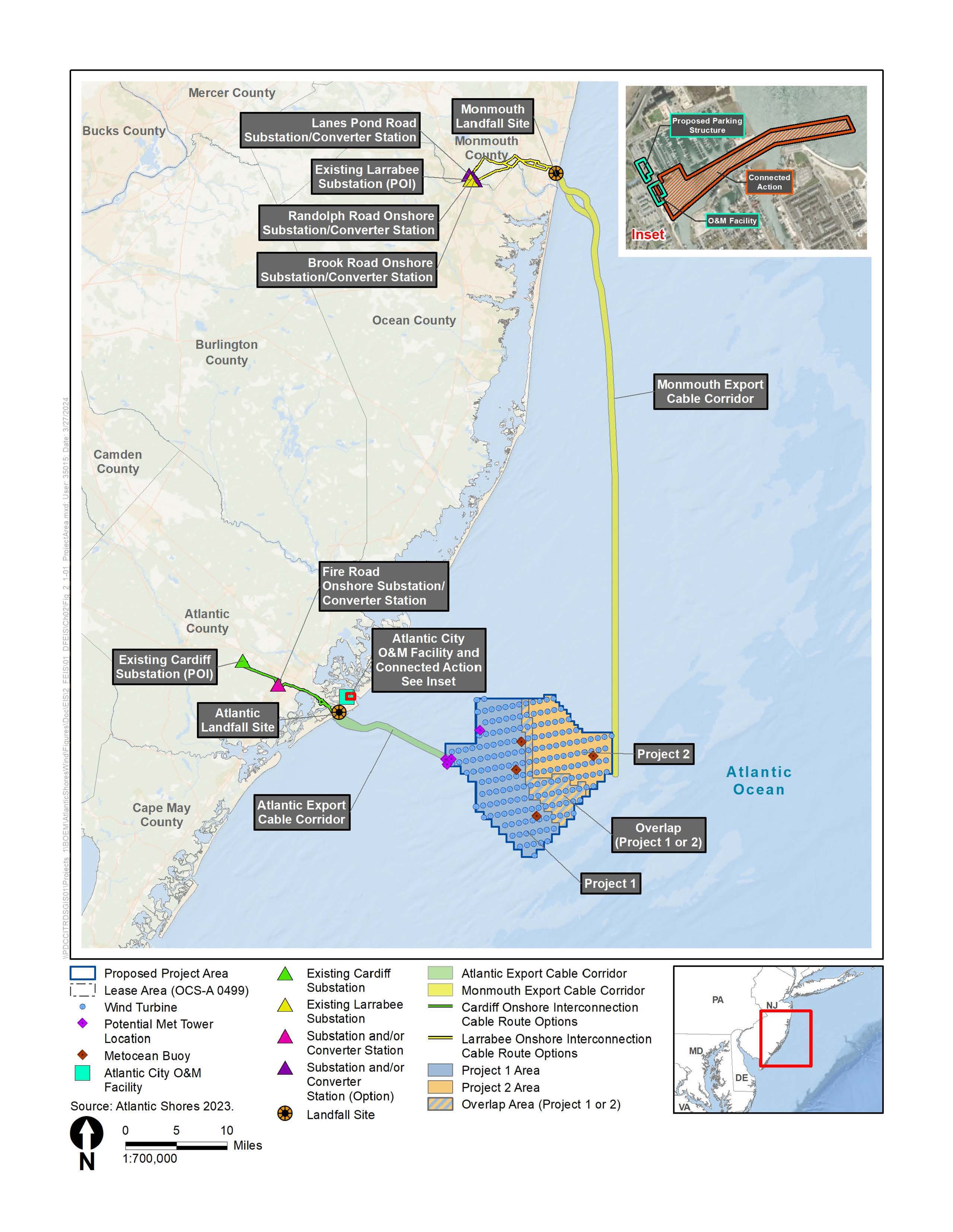

Atlantic Shores, a joint venture of Shell and EDF Renewables, has submitted a proposal into New Jersey’s fourth offshore wind solicitation offering to generate more than 2.8 GW of electricity.

The company would become the initial provider of offshore wind for the state, which intends to have 11 GW of offshore wind installed by 2040.

The two-part offshore wind project, known as Atlantic Shores 1 and Atlantic Shores 2, is expected to generate enough electricity to serve more than 1 million homes, the company said July 10 in a news release. The U.S. Bureau of Ocean Energy Management has already approved construction of up to 195 wind turbine generators for the projects. Developers say they anticipate having all required federal and state approvals by the end of this year.

“New Jersey is ready for offshore wind renewable power, and so is Atlantic Shores," said Atlantic Shores Offshore Wiind CEO Joris Veldhoven. “Our proposal serves to expand and enhance existing strategic partnerships while growing our portfolio of economic development initiatives across the Garden State.”

Dominion Buys Avangrid’s Kitty Hawk North Wind Lease for $160MM

Dominion Energy subsidiary Virginia Electric and Power Co. plans to purchase the Kitty Hawk North offshore wind lease off North Carolina and associated developments from Avangrid for about $160 million, the Virginia-based utility said July 8.

Avangrid will retain ownership of the Kitty Hawk South lease.

The 40,000-acre Kitty Hawk North lease could support 800 megawatts of offshore wind generation capacity in the 2030s, if approved by regulators and constructed. That would be enough capacity to serve about 200,000 homes and businesses, Dominion Energy said.

The lease site, which will be named CVOW-South, is located about 25 miles south of the 2.6-gigawatt (GW) Coastal Virginia Offshore Wind project that Virginia Electric and Power Co. is developing.

“This transaction gives our company another potential option to meet that growing demand in a size and on a timeframe that is consistent with the regulated business mix, credit, and risk profile objectives of the recently concluded business review,” said Dominion Energy CEO Robert Blue. “It also allows us to leverage the unique expertise we’ve gained during the very successful development and construction to date of the Coastal Virginia Offshore Wind (CVOW) commercial project, which reduces project risk to the benefit of customers and shareholders.”

CVOW is scheduled to begin operations in 2026.

The transaction is expected to close in fourth-quarter 2024, subject to required approvals.

The deal comes as Avangrid advances its strategic priorities and seeks capital for reinvestment.

“Executing this agreement allows us to move forward with our long-term plans for the development of Kitty Hawk South, further demonstrating our commitment to accelerating the clean energy transition in the United States,” Avangrid CEO Pedro Azagra said.

Kitty Hawk South could deliver up to 2.4 GW of power, according to Avangrid. The company is also developing Vineyard Wind 1 and New England Wind. Both are located offshore Massachusetts.

Eversource, Ørsted Close Sunrise Wind Sale

Ørsted said on July 9 it has assumed full ownership of the 924-MW Sunrise Wind project offshore New York, after closing the sale with Eversource Energy.

Completion of the deal, announced in April, came after the successful award of Sunrise Wind in the New York 4 solicitation for offshore wind capacity. Eversource sold its 50% stake in the project to Ørsted for $152 million. The purchase price was down from the $230 million at signing in January due to adjustments reflecting lower actual capex than forecast capex between signing and closing, according to Ørsted.

“The transaction is a value-accretive opportunity for Ørsted as we continue to develop the project,” said David Hardy, CEO of Ørsted’s Americas region. “As a centerpiece of New York’s clean energy economy, Sunrise Wind builds on our momentum from South Fork Wind, further expanding the local offshore wind supply chain and workforce.”

Eversource said it entered a separate amended and restated construction management agreement with Sunrise Wind to lead onshore construction for the project, serving as a service provider.

Sunrise Wind, which reached a final investment decision in March, will have up to 84 wind turbine generators. The project is expected to begin operations in 2026.

Reuters contributed to this report.

Recommended Reading

BlackRock’s Fink Calls for Reliable US Power Grid—Now

2025-03-31 - “That starts with fixing the slow, broken permitting processes in the U.S. and Europe,” Larry Fink, the co-founder, chairman and CEO of $12 trillion investment-management firm BlackRock Inc., told shareholders March 31.

E&P Highlights: March 31, 2025

2025-03-31 - Here’s a roundup of the latest E&P headlines, from a big CNOOC discovery in the South China Sea to Shell’s development offshore Brazil.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.