The Utah Frontier Observatory for Research in Geothermal Energy (FORGE) said on May 23 it made a major geothermal breakthrough, having established enhanced connectivity, fluid flow and energy transfer between two enhanced geothermal system wells.

The project is part of a global field lab managed by the University of Utah’s Energy & Geoscience Institute and sponsored by the U.S. Department of Energy.

“These stimulations and the short-term circulation test are the culmination of more than two years of planning and in-depth data analysis,” John McLennan, the professor who oversaw the activities, said in a news release. “Enfranchising the knowledge gained from previous activities, and with advice from a diverse team of specialists from industry and academia, the Utah FORGE team was able to achieve outstanding results.”

The production well was hydraulically fractured in eight stages over a two-week period. Four stages were injected. To locate fractures intersecting the injection well, fiber optic cables were monitored. “The recorded fiber optic signatures highlighted intervals of fracture intersection or proximity,” Utah FORGE said. “These intervals were selected and perforated for subsequent stimulation. Stimulating both wells ensured connectivity.”

Connectivity was established with no induced seismicity greater than magnitude 1.9, according to the release.

A circulation test followed stimulation. Utah FORGE said water was injected—at up to 15 bbl per minute— into the well for nine hours. That led to up to 8 bbl per minute of production, with an efficiency rate of about 70% recovery. Hot water produced confirmed the potential of enhanced geothermal systems (EGS), Utah FORGE said.

Considered a form of next-generation geothermal technology, EGS has the potential to move the U.S. toward its emissions reduction goals. Harnessed heat can be used to generate electricity or for heating or cooling via direct use.

Next steps include more fieldwork, including a 30-day circulation test planned in July, according to a news release.

Here’s a look at other renewable energy news this week.

Biofuels

WM Opens Second RNG Site in Dallas-Fort Worth Area

Waste management company WM has opened a $55 million RNG site in Lewisville, Texas, near Dallas, where it plans to produce about 1.2 million MMBtu per year of RNG.

Called DFW RNG, the facility will process landfill gas captured at the company’s DFW Landfill, WM said in a May 22 news release.

The facility opening came about four years after WM opened its Skyline RNG facility in Ferris, Texas, south of Dallas.

The waste management company plans to invest more than $1 billion from 2022 to 2026 in renewable energy. The plan includes more than 20 RNG facilities, which could power up to 1.7 million homes, the company said.

Cresta Makes Investment in Alternative Energy Fueling Stations

California-based Ocean Pacific (OP) has landed private equity firm Cresta Fund Management as a controlling investor, allowing the company to expand its capabilities.

The backing will enable OP, which develops compressed natural gas and provides engineering, design and construction services to third-party CNG station operators, to begin commercialization and operation of fueling stations, Cresta said in a May 22 news release.

While CNG is an alternative lower-emission fossil fuel, RNG can used in CNG form to fuel CNG vehicles.

“Our investment in Ocean Pacific aligns perfectly with our strategy to seek opportunities to build low-carbon molecule infrastructure that provides a solution for the energy transition,” said Chris Rozzell, Managing Partner at Cresta. “OP's leadership in the CNG market, combined with our capital and both operational and development expertise, will significantly enhance the availability of clean fuel alternatives.”

OP has designed more than 400 CNG fueling stations, according to the release.

Energy storage

Tesla Breaks Ground on Battery Megafactory in Shanghai

U.S.-based Tesla reportedly broke ground this week on a megafactory in Shanghai, China, where it plans to begin mass producing batteries in 2025, according to Chinese state media.

The company plans to initially produce 10,000 Megapack units per year at the nearly 200,000-square-meter plant. The plant, announced in April 2023, is located in the Lin-gang Special Area of the China (Shanghai) Pilot Free Trade Zone.

“I believe the new plant is a milestone for both Shanghai and Tesla,” Tesla vice president Tao Lin told China’s Xinhua in an exclusive interview. She added, “In a more open environment, we can create a new Tesla speed at the Megapack factory, and supply the global market with large-scale energy-storage batteries manufactured in China.”

Portuguese Company Eyes Two Lithium Refineries in Iberia by 2030

A newly established Portuguese company backed by a wealthy business conglomerate hopes to build two lithium refineries in the Iberian Peninsula by 2030, its chief executive said on May 21.

Lifthium, helmed by CEO Duarte Braga, said the lithium refineries would be built in the northern Portuguese municipality of Estarreja, and in Torrelaverga, in the Spanish region of Cantabria.

With some 60,000 tonnes of known reserves, Portugal is already Europe’s biggest producer of lithium, traditionally mined for ceramics.

Along with neighboring Spain, the country wants to take advantage of local lithium deposits, aiming to cover the entire value chain from mining and refining to cell and battery manufacturing to battery recycling.

The plan is in line with Europe’s drive to reduce its dependence on countries such as China for key materials for the green transition.

“Almost 80% of lithium refining comes from China and what we want to try to do is to reverse (that trend),” Braga told members of Portugal's foreign press association.

E3 Lithium Unveils Resource Estimate for Estevan Lithium District

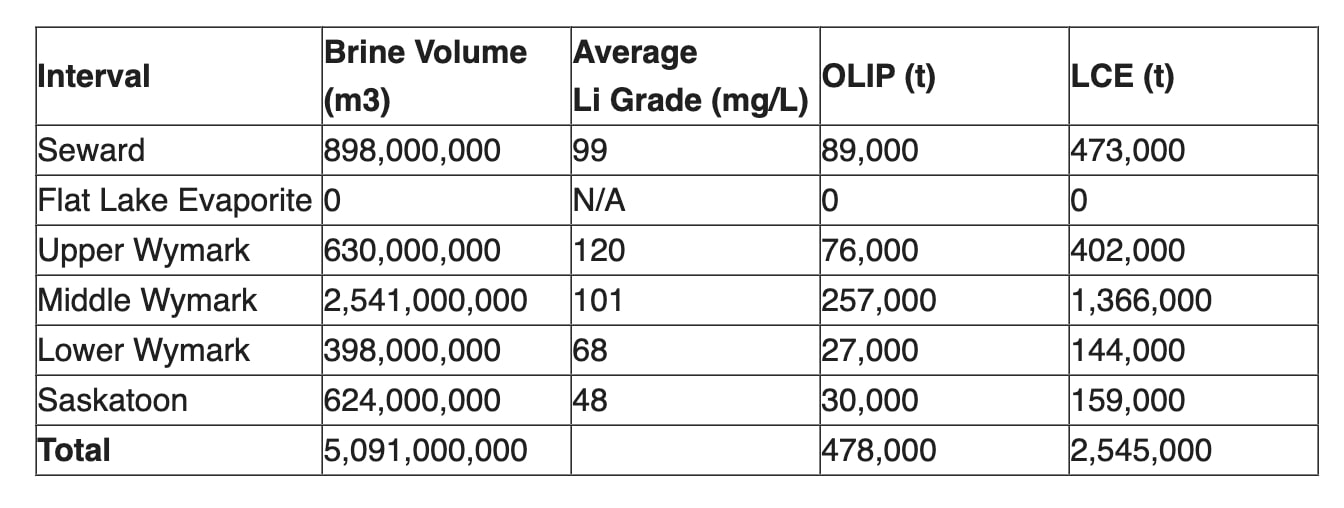

Canada-based E3 Lithium on May 23 said the Saskatchewan property it acquired in 2021 has inferred mineral resources of about 2.5 million tonnes of lithium carbonate equivalent.

The resource estimate is based on results of a technical report, the company said.

“The resource over our Saskatchewan Property represents an exciting development prospect for E3 Lithium and reinforces the company’s position for lithium development in Western Canada, adding to our globally significant lithium resources,” E3 Lithium CEO Chris Doornbos said in the release. “Saskatchewan is still maturing its resources base and this inaugural 2.5 Mt LCE resource adds to this new and developing lithium jurisdiction.”

The area covers about 67,000 hectares (about 165,560 acres) of crown mineral permits within the Estevan Lithium District in southeast Saskatchewan. E3 Lithium said elevated lithium concentrations of interest are in the Duperow Formation, which was broken into six zones based on geological characteristics. Lithium concentrations near E3’s land holdings have been as high as 259 mg/liter in the Duperow, the company said.

Hydrogen

Airbus Forms Partnerships Focused on Hydrogen at Airports

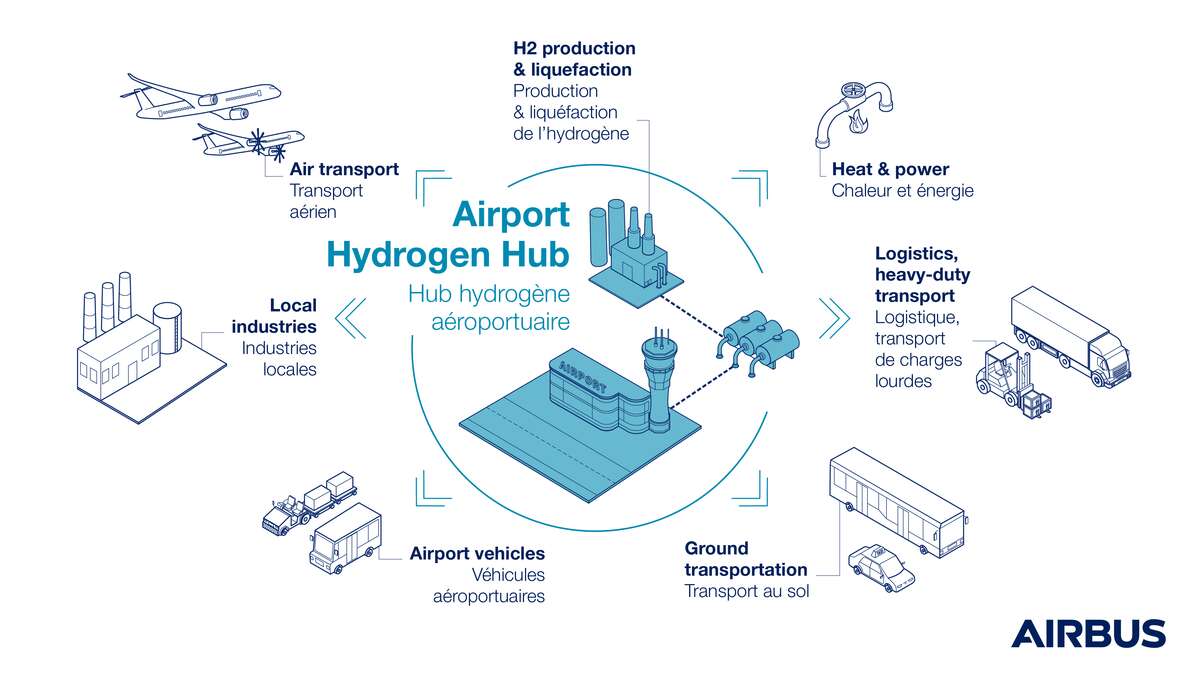

Aerospace corporation Airbus has formed partnerships in three cities—Atlanta, Houston and Vancouver— to launch studies focused on developing hydrogen hubs at major airports in North America, the company said May 21.

In Canada, Airbus and ZeroAvia signed a memorandum of understanding with the Montréal–Trudeau International Airport (YUL), Toronto Pearson International Airport (YYZ) and Vancouver International Airport (YVR) to study the feasibility of a hydrogen infrastructure at airports in Canada, according to a news release.

In Georgia, Hartsfield-Jackson Atlanta International Airport (ATL), Delta Air Lines and Plug Power agreed to study the feasibility of a hydrogen-based hub. Airbus said “the study will help define the infrastructure, operational viability and safety and security requirements needed to implement hydrogen as a fuel source for future aircraft operations at ATL.”

In Houston, Airbus has partnered with the Center for Houston’s Future (CHF) and Houston Airports to study the feasibility of a hydrogen hub at George Bush Intercontinental Airport. The focus will be on pinpointing opportunities and barriers, infrastructure development and usage at the airport.

Airbus, which launched its ZEROe hydrogen-powered aircraft project in 2020, aims to bring to market the world’s first hydrogen-powered commercial aircraft by 2035.

“By embarking on these exploratory endeavors, we are taking proactive measures to understand the requirements for establishing hydrogen hubs at major airports across North America,” said Karine Guenan, Airbus vice president of ZEROe Ecosystem. “This strategic initiative reflects our dedication to driving innovation and shaping the future of air travel in a manner that is environmentally responsible and technologically advanced. Through collaboration with key stakeholders, we aim to pave the way for a future where hydrogen-powered flight becomes a tangible reality.”

Solar

Ørsted receives $650MM tax equity financing from J.P. Morgan

Danish company Ørsted has secured an investment of $680 million in tax equity financing from J.P. Morgan for a portfolio of solar and storage assets in Texas and Arizona, the clean energy developer said on May 23.

The tax equity allows for tax credit transferability under the Inflation Reduction Act, which corporate buyers can purchase to support clean energy storage projects in the U.S. Additionally, the Biden administration is undertaking a separate effort to identify areas in 11 western states best suited for solar energy development, which it expects to finalize by the end of the year.

European panel manufacturers are also looking to develop projects outside of the EU, as they are weighed by competition from China and the U.S. whose governments give more support to their producers.

The investment will help fund the completion of its Arizona project along with its 250-megawatt (MW) solar project in Texas, the company said.

Ørsted’s 300 MW Arizona facility will receive a one-time investment tax credit investment for its battery storage system, which has become a priority technology amid rising renewable energy capacity. Arizona's solar farm will generate production tax credits for the next decade.

J.P Morgan, before this deal, had investments in 1.8 gigawatts (GW) of Ørsted’s 5.7 GW onshore portfolio in the U.S.

The company expects commercial operations for both projects to begin in 2024.

Recurrent Energy Secures up to $1.4B Financing for European Projects

Recurrent Energy, a unit of solar technology firm Canadian Solar, said on May 23 it has secured multi-currency revolving credit facility of up to 1.3 billion euros (US$1.41 billion) with 10 banks.

The credit facility will be used for construction of renewable energy projects in several European countries. Recurrent Energy and the participating financial institutions signed the deal in Seville, Spain.

The facility will be available for three years with optional extensions. It is initially sized at 674 million euros but includes potential upsizing to about 1.3 billion euros.

“This agreement solidifies Recurrent Energy’s growth strategy and our transformation into one of the world's leading independent renewable energy producers and developers,” Recurrent Energy CEO Ismael Guerrero said.

Rising renewable energy capacity and the deployment of electric vehicles are expected to make energy storage a priority technology. The revolving credit facility will provide flexible financing for the construction of solar and battery energy storage projects across Spain, Italy, the United Kingdom, the Netherlands, France and Germany.

As renewable energy expands across Europe to meet decarbonization goals, battery usage needs to grow to smooth out the intermittent supply of renewable energy.

RELATED

Enbridge, EDF’s Fox Squirrel Solar Project Goes Online

Wind

Microsoft Taps RWE for Wind Energy in Texas

Microsoft Corp. has inked two 15-year power purchase agreements with RWE for power from two new wind farms in Texas, the renewable energy company said May 23.

The deals were reached as the tech company moves toward completely powering its operations with renewable energy by 2025.

As part of the PPA, electricity will come RWE’s 243-MW Peyton Creek II onshore wind farm and the 203-MW Lane City wind farm. Construction is underway for Peyton Creek II, which is near Peyton Creek I in Bay City, Texas, RWE said. The company recently made a final investment decision to construct Lane City, which will be located in Wharton County, Texas. Construction is set to start this summer.

The company said it plans to use Vestas’ V163 4.5-MW turbines. Wanzek and RES will lead construction activities for both sites, RWE said.

BOEM Releases Final EIS for Atlantic Shores Wind Off New Jersey

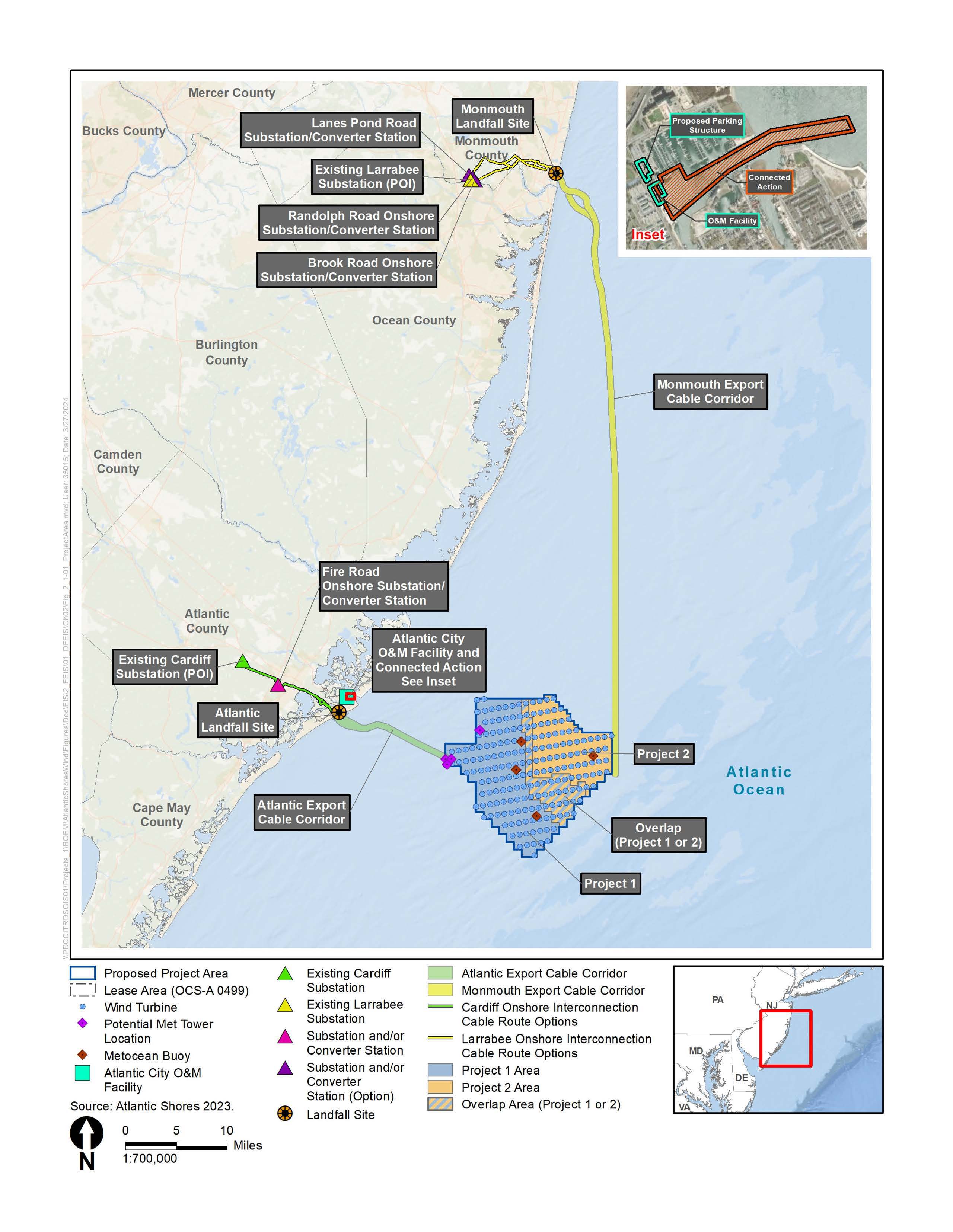

The final Environmental Impact Statement (FEIS) for the combined 2.8-GW Atlantic Shores Offshore Wind project has been released by the U.S. Bureau of Ocean Energy Management (BOEM).

Atlantic Shores Offshore Wind, a 50-50 joint venture between Shell New Energies and EDF Renewables Offshore Development, proposed developing the project in two parts. Combined, the development will include up to 200 wind turbines and up to 10 offshore substations. If approved by regulators, the development could generate enough power for about 1 million homes, according to the BOEM.

“Completing this environmental analysis is a significant milestone in the administration’s drive to realize clean energy ambitions that will enhance the lives of Americans now and for generations to come,” BOEM Director Elizabeth Klein said in a news release May 23.

The Biden-Harris administration aims to deploy 30 GW of offshore wind energy capacity by 2030. So far, eight commercial-scale offshore wind developments with a combined capacity of over 10 GW have been approved since the administration’s start.

Atlantic Shores is located about nine miles offshore New Jersey on a more than 102,000-acre lease area. Developers are targeting first power in 2027.

Brazil’s Aliança Energia Brings Acauã Wind Complex Online

Brazil-based Aliança Energia has inaugurated the 109-MW Acauã Wind Complex, located in the state of Rio Grande do Norte, the company said May 21.

The wind complex is comprised of four wind farms in the municipalities of Santana do Matos, Lagoa Nova, São Vicente and Lieutenant Laurentino Cruz. The complex produces enough power for about 580,000 homes, according to Aliança Energia.

The complex features 26 wind turbines, a 17.7-km long transmission line and 53 galvanized steel towers, which connects to a substation integrating electricity into the National Interconnected System, the company said.

CIP Completes Construction Changfang-Xidao Wind Farms Off Taiwan

Copenhagen Infrastructure Partners (CIP) completed construction of the Changfang-Xidao offshore wind farms in Taiwan, the company’s first offshore wind project in the Asia-Pacific region.

“The inauguration of Changfang-Xidao is a landmark for CIP as well as for the offshore wind industry in Taiwan,” said Christina Grumstrup Sørensen, senior partner at CIP. “In the past seven years, the development and construction team, suppliers, partners and shareholders have demonstrated the power of close collaboration.”

Located 11 km off the west coast of Taiwan, the wind farms include 62 Vestas V174 turbines and jacket foundations supplied by Taiwan’s Century Wind Power. Changfang-Xidao is expected to generate enough power for about 650,000 households when the project becomes fully operational, CIP said.

CIP’s Flagship funds CI II and CI III are the majority owners in the project. Thailand-based Global Power Synergy Public Co. and Taiwanese life insurance companies Taiwan Life and Transglobe Life hold minority stakes.

Havfram Lands Contract for Iberdrola’s Windanker Project in Baltic Sea

Iberdrola has selected Havfram to install wind turbines at the Windanker project in the German Baltic Sea, according to a May 21 news release.

Havfram said it will use a newbuild NG20000X-HF jackup to install the 21 15-MW Siemens Gamesa wind turbines at the site. The contract, which covers transport and installation, begins in summer 2026.

Windanker will have an installed capacity of 315 MW. The wind farm will be Iberdrola’s third offshore wind farm in the Baltic Sea. The company is targeting commissioning in fourth-quarter 2026.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Belcher: Tariff Growing Pains Will Help US Achieve Energy Dominance

2025-04-03 - Tariffs may bring short-term pain, but Trump is aggressively pursuing goals that benefit the U.S., says Cornerstone Government Affairs’ Jack Belcher.

Exclusive: Tariff Agenda Forms Muddy Waters for Oil, Gas Decision-Makers

2025-03-20 - Paul Gruenwald, the global chief economist for S&P Global Ratings, discusses growing concerns with global demand and the impact of tariff uncertainties on the oil and gas industry, in this Hart Energy Exclusive interview.

Big Spenders: EPA Touts Billions in Clean Energy Spending

2025-01-15 - Nearly $69 billion in funding from the Inflation Reduction Act and Bipartisan Infrastructure Law has been dispersed by the Environmental Protection Agency in its clean energy push.

Paisie: Assessing an Uncertain Energy Future in Three Scenarios

2025-02-07 - Several years ago, Stratas Advisors developed three long-term energy scenarios. A scenario depicting greater market volatility in an increasingly unstable world is appearing more likely.

Chevron’s Wirth: Rapid Transitions in Energy Strategy ‘Not the Right Policy Approach’

2025-03-10 - Relying on the president, whoever it is, leads to a wildly inconsistent energy policy in the U.S., Chevron CEO Mike Wirth said at CERAWeek by S&P Global.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.