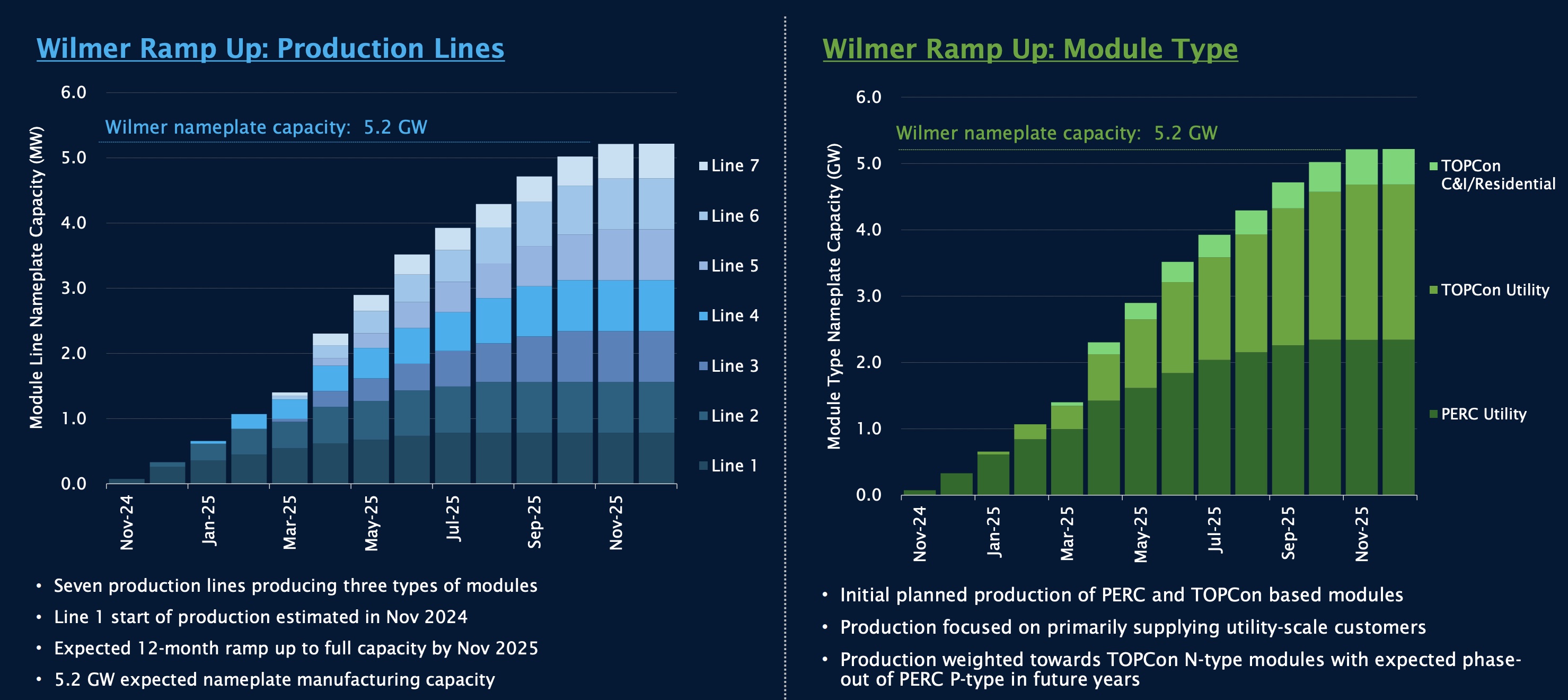

Norwegian battery cell maker Freyr Battery plans to acquire the U.S. solar manufacturing assets of China-based Trina Solar Co. Ltd., specifically its new 5-gigawatt (GW) solar module facility in Wilmer, Texas.

The $340 million deal announced Nov. 6 is expected to close by the end of 2024. The move by NYSE-listed Freyr was made as it aims to provide turnkey solar technology in the U.S., alleviating bottlenecks for solar project developers needing modules while creating jobs.

“Domestic manufacturing capacity for solar and batteries is essential for energy transition and job creation,” said Daniel Barcelo, Freyr’s newly appointed CEO. “The U.S. was once the global leader in solar, and it can be again.”

The company intends to further grow its U.S. footprint by constructing a 5-GW solar cell manufacturing facility. Though a site has not been selected for the facility, Freyr said it aims to begin construction in the second quarter of 2025 with solar cell production starting in the second half of 2026.

The acquisition is taking shape amid industry fears of higher tariffs under the returning Trump administration. The U.S., under the leadership of the Biden-Harris administration, has been working to strengthen domestic production of solar panels by encouraging development with tax credit incentives to reduce reliance on foreign nations—mainly China, which dominates the supply chain for many clean energy goods.

Though many believe any attempts to rollback the tax credits that played a role in adding manufacturing jobs across states, including Republican-led ones, will be thwarted, the tariff threat remains. Trump’s Agenda 47 includes ambitions to “make America the dominant energy producer in the world, by far!” and to “stop outsourcing, and turn the United States into a manufacturing superpower.”

The GOP Platform includes a commitment to “secure strategic independence from China” by revoking China’s most favored nation status, phasing out imports of essential goods and halting China from buying American real estate and industries.

As part of the deal with Trina Solar, Freyr’s transaction-related financing includes $100 million in cash, $50 million in repayment of an intercompany loan, a $150 million loan note and stock that amounts to 9.9% of Freyr’s shares along with a convertible loan note that would convert into an additional 11.5% of Freyr stock after certain conditions are met, Freyr said in a news release.

The company also said Freyr co-founder Tom Einar Jensen will step down from his seat on the board and take the role of FREYR Europe CEO. Joining the board is Coastline Exploration CEO W. Richard Anderson.

Upon the transaction’s closing, Mingxing Lin will become chief strategy officer, and Dave Gustafson will serve as COO.

Here’s a look at other renewable energy news.

Bioenergy

OPAL Begins Construction New RNG Facility at California Landfill

OPAL Fuels Inc. has commenced construction of its fully-owned new landfill gas-to-renewable natural gas (RNG) facility located in Clara County, California, according to a Nov. 6 press release.

The project, located at the Kirby Canyon Landfill, plans to capture biogas produced naturally from decomposed materials at the landfill. The materials will then be converted into RNG, which OPAL touted as a low-cost transportation fuel.

The facility has an initial annual design capacity of about 0.66 MMBtu.

Approximately 5.1 million gas gallons equivalent of RNG can be produced annually from the facility, which the company will distribute via its fueling station network to heavy-duty trucks running on natural gas instead of diesel.

OPAL said the project will help lower emissions from, and reduce fuel costs for, these fleets.

The project is OPAL’s 17th RNG project and its first in California, co-CEO Jonathan Maurer said in the press release.

Energy storage

Arizona Lithium Pauses Big Sandy Drilling After Court Decision

Arizona Lithium has temporarily stopped exploration drilling at its Big Sandy lithium project in Arizona after a federal court granted a preliminary injunction involving a complaint by the Hualapai Tribe.

The U.S. District Court for the District of Arizona on Nov. 5 said work must cease until the case against the U.S. Bureau of Land Management (BLM) is fully resolved. The Hualapai Tribe earlier this year filed a complaint against the BLM, claiming it violated legislation when it approved the Big Sandy project. It seeks to reverse the approval, according to a news release.

Arizona Lithium said it is evaluating the implications of the court’s decision and its next steps and will update the market.

In other news, the company said it has moved onto completion activities at Prairie Pad #3 in southeast Saskatchewan, Canada, having finished exploration drilling.

The company targeted the Souris River Formation and Dawson Bay Formations and aims to produce 2,000 tonnes per annum of lithium carbonate equivalent from the well.

“This well drilled on Pad #3 represents the finality of our successful drilling program for 2024. Flow testing will continue across our wells on Pad #2 and Pad #3 as we finish up our remaining exploration field work for 2024,” said Arizona Lithium Managing Director Paul Lloyd. “Given the speed of development at the Prairie Project we are confident in hitting our goal of production of lithium products in 2025, which is now the company’s primary focus.”

Georgia Powers Cranks Up Its First Grid-Connected Battery Storage System

Southern Co. subsidiary Georgia Power has started commercial operations of its first grid-connected battery energy storage system (BESS), the company said Nov. 8.

The 65-megawatt (MW) Mossy Branch Battery Facility located in Talbot County, Georgia, is one of several BESS the company looks to bring online across the state. Georgia expects to procure an additional 1,000 MW of new battery energy storage in the coming years.

By installing battery energy storage systems, companies hope to improve the reliability of grids as more renewable energy is added.

“We know our customers depend on us to make the investments in our state’s power grid needed to deliver reliable energy to their homes and businesses around the clock,” Georgia Power CEO Kim Greene said. “Battery energy storage is an example of a new technology that will make our grid more reliable and resilient every day.”

Wärtsilä provided engineering, procurement and construction services for Mossy Branch.

Earlier this year, the company unveiled the locations of 500 MW of BESS projects it plans to build. Georgia Power’s 265-MW McGrau Ford Phase I BESS project in Cherokee County is expected to enter service by the end of 2026.

RELATED

DOE Closes $475MM Loan for Li-Cycle’s Lithium-Ion Recovery Hub

Hydrogen

Avina Clean Hydrogen Begins Building Hydrogen Plant in California

New Jersey-based Avina Clean Hydrogen has started construction of a green hydrogen facility in Vernon, California, the company said Nov. 2.

The facility is designed to use clean energy-powered electrolysis to produce up to 4 metric tons per day of compressed hydrogen. Located near the Port of Long Beach in southern California, the facility is expected to eliminate about 130,000 metric tons of CO2 emissions annually, Avina said in a news release.

“Our facility’s strategic location in Southern California allows us to serve critical transportation corridors and urban markets, helping meet the growing demand for clean hydrogen across the region,” Avina Clean Hydrogen CEO Vishal Shah said.

Commercial operations are set to commence in July 2025.

Uniper to Slow $8.7B Green Overhaul on Hydrogen Expansion Delay

(Reuters) German state-owned utility Uniper warned on Nov. 5 that it was likely to slow down a planned 8 billion-euro (US$8.7 billion) investment in cleaner fuels amid slower-than-expected demand for hydrogen from industry.

The comments reflect growing skepticism among German companies about whether long-standing government plans to rely more heavily on hydrogen to cut emissions are realistic and affordable.

Uniper, which was bailed out by Berlin during Europe’s energy crisis in 2022, recently reviewed its strategy targeting 8 billion euros in investments through 2030 with a focus on hydrogen and biomethane, finance chief Jutta Doenges said.

“We are now less optimistic about the timeline regarding the implementation of a green hydrogen economy,” she told analysts after presenting an expected two-thirds drop in nine-month core profit.

“We observe a mood of caution among potential B2B (business to business) customers to make a commitment for significant green hydrogen or ammonia supply offtake volumes.”

So-called green hydrogen is produced using renewable power, and Germany’s government has been betting on this fuel to help its economy become climate-neutral by 2045.

When asked about the impact of Uniper’s slowdown in its hydrogen plan on the country’s overall decarbonization ambitions, Germany’s economy ministry acknowledged that ramping up a completely new hydrogen market is fraught with uncertainties.

The ministry said it was, however, important to create the necessary framework to promote the ramp-up, highlighting recent progress in establishing necessary infrastructure, regulatory framework and funding programs, including the country’s core hydrogen network plans, officially approved last month.

“It is clear that we still have a lot of work ahead of us to further advance the ramp-up of the hydrogen economy,” a spokesperson for the ministry said Nov. 5.

RELATED

‘Hydrogen is Happening’: Chevron Pushes Ahead Despite Industry Doubts

Solar

Canadian Premium Sand Expands in US

Lured by incentives in the Inflation Reduction Act and the booming solar industry, Canadian Premium Sand (CPS) said it plans to open a solar glass manufacturing facility in the U.S.

The company on Nov. 4 said it intends to repurpose a former glass manufacturing facility to produce 4 GW per year of solar glass. It added the company is in talks with a potential partner to bring in glass manufacturing expertise, purchasing power for equipment and raw materials and in-house engineering capability.

The plans were announced alongside an update on its project in Selkirk, Manitoba, where it intends to manufacture ultrahigh-clarity, low carbon patterned solar glass. CPs said it has submitted a detailed application for $100 million in non-dilutive financial support and is entering the due diligence phase. CPS is seeking financial support from the province of Manitoba and government of Canada for the project.

“The company’s low-iron sand deposit in Manitoba can support capacity for both proposed facilities for over 20 years,” CPS said. “With both facilities providing a total of 10 GW of solar glass combined, the company is preparing to become the largest supplier of patterned solar glass and the only vertically integrated glass manufacturer in North America.

Solar Manufacturer Suniva Resumes Production of American-made Cells

(Reuters) U.S. solar company Suniva has started producing cells at its Georgia factory and is shipping them to customers, executives told Reuters, calling it a milestone in the effort to build a robust domestic solar supply chain.

U.S. manufacturing of solar cells, which convert sunlight into electricity and are assembled into solar panels, had vanished for years due to competition from low priced imports, and Suniva is the first to resume commercial U.S. production of the silicon-based components.

The company had filed for bankruptcy in 2017 but announced last year that it would restart its idled Norcross, Georgia factory thanks to incentives in President Joe Biden's landmark climate law, the Inflation Reduction Act.

“It’s an important step for the country,” Suniva CEO Cristiano Amoruso said in an interview. “We’ve been big believers that to have a thriving U.S. solar supply chain, you have to go deeper and further than just module assembly.”

The Biden administration has sought to support the development of a complete U.S. solar supply chain to compete with China and shore up supplies needed to decarbonize the nation’s power sector. President-elect Donald Trump has said he wants to repeal the IRA, but doing so would require an act of Congress and may face resistance from lawmakers in districts with new manufacturing plants.

Suniva began producing test cells over the summer and started commercial production a few weeks ago, the company told Reuters. Heliene, a Canadian panel maker with a plant in Minnesota, has started receiving Suniva cells as part of a $400 million deal announced in March, both companies said.

RELATED

SolarBank to Develop 3-MW Solar Plant in Canada

Wind

Prysmian Signs Deal with TechnipFMC for Floating Offshore Wind Facilities

(Reuters) Italy’s Prysmian and Britain’s TechnipFMC signed an agreement to strengthen the development of floating offshore wind facilities, the companies said Nov. 4.

The aim of the tie-up is to pioneer a subsea water column solution “from seabed to ocean surface,” combining TechnipFMC’s design and integration capacities with Prysmian’s submarine power cable systems, the groups said in a joint statement.

“The collaboration strengthens both companies' position in this emerging market by providing an integrated solution that accelerates time to first power and reduces cost,” TechnipFMC’s Chair and CEO Doug Pferdehirt said in the statement, which did not provide financial details of the deal.

RELATED

Wind Energy Developer Ørsted Sees Profit Rise, US Challenges Remain

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

USA Compression Names Chris Wauson as COO

2025-03-07 - Chris Wauson, currently the leader of natural gas compression company USA Compression Partners’ Permian office, has been chosen as the company’s new COO.

Elliott Nominates 7 Directors for Phillips 66 Board in Big Push for Restructuring

2025-03-04 - Elliott Investment Management, which has taken a $2.5 billion stake in Phillips 66, said the nominated directors will bolster accountability and improve oversight of Phillips’ management initiatives.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.