A study led by the U.S. Geological Survey (USGS) shows southwestern Arkansas may be home to up to 19 million tons (MMton) of lithium reserves, enough to meet the world’s projected 2030 electric vehicle (EV) battery lithium needs nine times over.

That is if it is commercially recoverable.

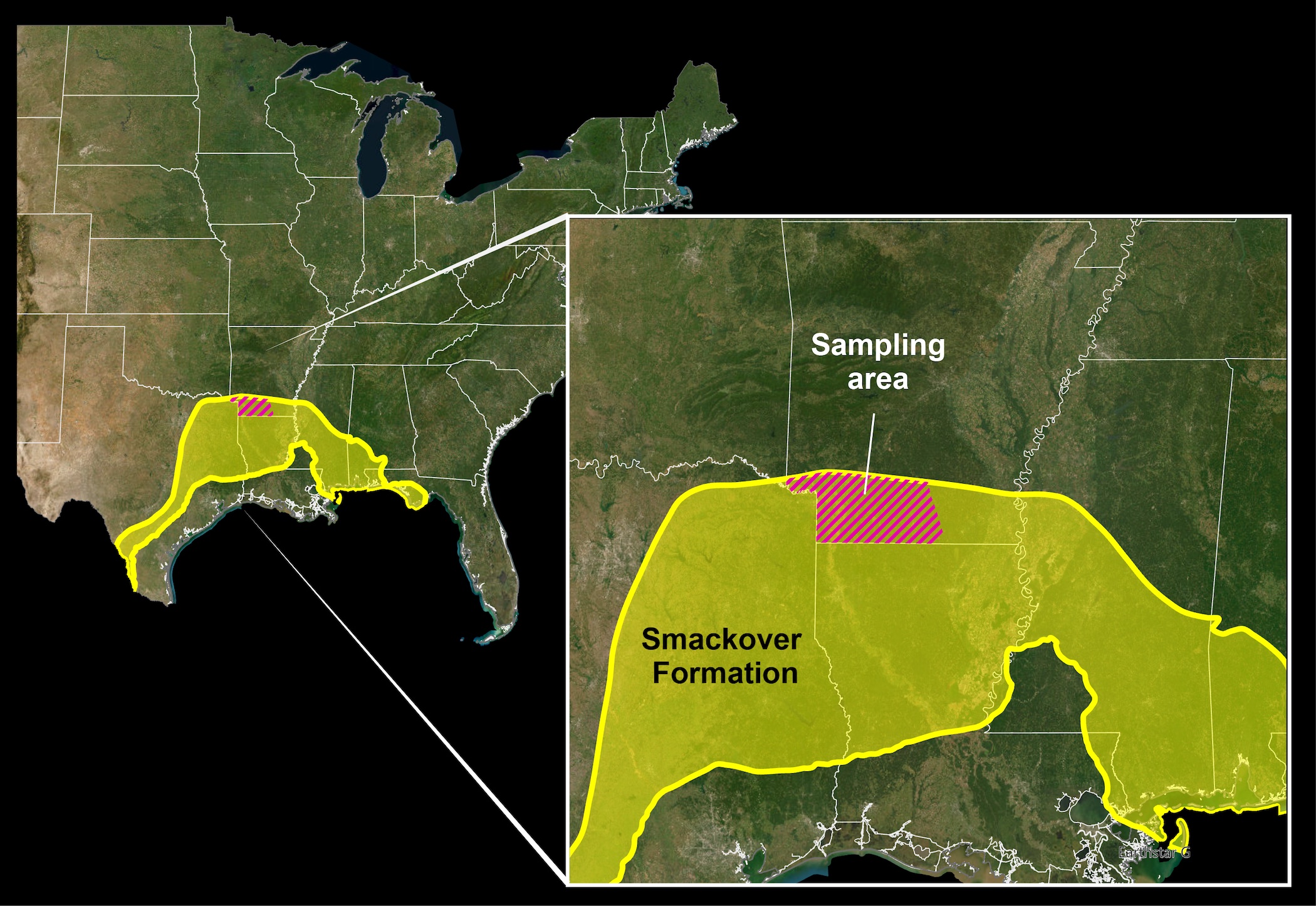

Working with the Arkansas Department of Energy and Environment’s Office of the State Geologist, USGS said it used machine learning and water testing to estimate potential resources that could be extracted from brines in the Smackover Formation, an area known for its oil and gas operations.

“We estimate there is enough dissolved lithium present in that region to replace U.S. imports of lithium and more,” said Katherine Knierim, a hydrologist and the study’s principal researcher. “It is important to caution that these estimates are an in-place assessment. We have not estimated what is technically recoverable based on newer methods to extract lithium from brines.”

The U.S. has stepped up efforts to source its own lithium in looking to reduce reliance on foreign countries as it aims to lower global greenhouse-gas emissions. Lithium is a key ingredient for not only rechargeable batteries used to power items such as laptops and cell phones, but also for energy storage and EVs.

Currently, the U.S. depends on imports to meet more than 25% of its lithium needs.

Companies are already working to develop lithium resources in the Smackover, which spans from Texas to Florida. For the most part, efforts are focused in the Arkansas Smackover area where companies such as Standard Lithium and Exxon Mobil have projects underway.

In a news release Oct. 21, USGS described the Smackover Formation as “a relic of an ancient sea that left an extensive, porous and permeable limestone geologic unit that extends under parts of Arkansas, Louisiana, Texas, Alabama, Mississippi and Florida.” Dating back to the Jurassic period, the area is known for its rich deposits of oil and bromine.

As part of the study, an AI predictive model was used. Samples taken from Arkansas were analyzed by the USGS Brine Research Instrumentation and Experimental lab in Reston, Virginia. That data was then compared with data from historic samples within the USGS Produced Waters Geochemical Database of water from hydrocarbon production, the USGS said. Lithium concentrations in brines were combined with geological data, using the machine learning model, to create maps that predict lithium concentrations across the region.

Results reveal Smackover brines in southern Arkansas could contain from 5 MMton to 19 MMton of lithium reserves, the USGS said.

“Lithium is a critical mineral for the energy transition, and the potential for increased U.S. production to replace imports has implications for employment, manufacturing and supply-chain resilience,” said USGS Director David Applegate. “This study illustrates the value of science in addressing economically important issues.”

The study marked the first estimate of total lithium in the southern Arkansas Smackover Formation brines with USGS predictive modeling and machine learning, the agency said.

Here’s a look at other renewable energy news.

Bioenergy

SAF Company Universal Fuel Technologies Raises $3MM

California-based Universal Fuel Technologies (Unifuel) raised $3 million in seed funding for technology that the company says lowers production costs of sustainable aviation fuel (SAF) and related carbon emissions.

Led by TO VC, an early-stage decarbonization fund focused on climate technology companies, the round’s seed funding will go toward advancing Unifuel’s Flexiforming technology and to help establish lab space in Texas for SAF sample production, Unifuel said Oct. 22 in a news release. The technology converts renewable fuels such as ethanol and methanol into SAF, a lower carbon emissions alternative to conventional jet fuel.

The company said its Flexiforming’s aromatic SAF allows for a fully synthetic jet fuel that can be used without blending with conventional jet fuel once 100% SAF is approved by standards organization ASTM International.

“Unifuel has engineered a more efficient SAF production method that dramatically cuts costs while getting the most out of limited resources,” said Joshua Phitoussi, managing partner at TO VC. “The feedstock flexibility of Unifuel’s technology gives the company the ability to work in multiple SAF pathways, partnering with the best players of whatever pathway makes the most sense in a given geography. This ingenuity exemplifies the type of high-impact, scalable solution we believe is essential for reaching net-zero emissions by 2050, making them a strategic addition to TO VC’s portfolio of companies driving the transition to sustainable energy systems.”

Other companies that participated in the seed funding round included Alchemist Accelerator, Claire Technologies and World Star Aviation, according to the release.

RELATED

PE Firm KKR Buys Stake in Eni’s Biofuels Business for $3.2B

Energy storage

Enervest, Energy Vault Partner on 1-GWh Australian BESS Project

Australian-owned and operated Enervest Group is partnering with Energy Vault Holdings on a 1 gigawatt-hour (GWh) battery energy storage system (BESS) project being deployed in South Wales, Australia, according to an Oct. 21 news release.

Energy Vault will serve as the engineering, procurement, construction and commissioning partner and system integrator for the project. The companies are now finalizing development and grid application approvals to bring the project to a full final investment decision as part of the agreement, Energy Vault said in the release.

The Stoney Creek BESS project aims to bolster stability of the New South Wales power grid. The BESS will be built with Energy Vault’s proprietary X-Vault integration platform.

“Energy Vault’s leading integrated hardware and software solution coupled with their deep technology and system design expertise makes Energy Vault an ideal partner for the Stony Creek BESS,” said Enervest CEO Ross Warby. “We value strong partnerships such as the one we have with Energy Vault and consider such collaborations as cornerstone to accelerated, quality project development.”

The partnership takes shape as Energy Vault continues to expand its footprint in Australia. The company recently announced 400 megawatt-hours of BESS projects in New South Wales that it plans to deliver in 2025, the release states.

“With Enervest, we share a focus on large scale and financially attractive projects to enhance grid resiliency,” said Energy Vault CEO Robert Piconi, “and the Stoney Creek project is another example of executing to the growth plans that we have outlined for 2025 and beyond.”

Moment Energy Lands $20.3MM for EV Battery Repurposing Facility

Canada-headquartered Moment Energy has been awarded $20.3 million by the U.S. Department of Energy (DOE) for a repurposing facility for EV batteries, the company said Oct. 23.

The company said it will use the funding to build a gigafactory in Taylor, Texas, where it plans to produce battery energy storage systems from repurposed EV batteries. Moment is targeting annual production capacity of 1 GWh once the facility is fully operational.

“We are honored to be selected for this transformative initiative,” said Edward Chiang, CEO of Moment Energy. “Our mission to provide worldwide access to clean, affordable and reliable power aligns perfectly with the DOE’s goals, and this facility will be instrumental in our commitment to enable all retired EV batteries to be repurposed by 2030.”

Moment said the facility is the first UL1974 certified manufacturing facility in the U.S. dedicated to repurposing EV batteries.

RELATED

RWE Pushes 1 GW of US Battery Energy Storage Projects to Boost Grid

PE Firm KKR Buys Stake in Eni’s Biofuels Business for $3.2B

Hydrogen

Woodside, Keppel Ink Conditional Liquid Hydrogen Offtake Agreement

Global asset manager Keppel signed an agreement with Woodside to supply liquid hydrogen to power data centers in Singapore, according to an Oct. 21 news release.

The conditional offtake term sheet’s signing follows an initial nonbinding agreement the companies signed in April 2023. Keppel said it intends for the potential liquid hydrogen supply to part of its larger, long-term utility-scale lower carbon power portfolio.

“As a leader in data centers, Keppel is pleased to deepen our collaboration with Woodside through the signing of an offtake term sheet, which has the ability to provide a reliable and stable source of lower carbon energy to power our assets in Singapore,” said Wong Wai Meng, CEO of data centers at Keppel. “As the energy transition unfolds, Keppel will continue to innovate and seek out like-minded partners to enhance and future proof our data centers as we position ourselves to better serve our customers on their journeys to net zero.”

The term sheet is conditional on the negotiation and execution of a fully termed sales and purchase agreement and the receipt of all necessary approvals, among other conditions, the release stated.

Woodside’s proposed H2Perth would be among the liquid hydrogen sources. Located on the Gnaala Karla Booja region of the Noongar Nation in Western Australia, H2Perth would be developed in three phases. The company plans to make hydrogen at the site using both electrolysis and natural gas reforming.

Woodside CEO Meg O’Neill called the term sheet a significant milestone that underpins progress on hydrogen opportunities. “This opportunity builds on Woodside’s track record of being a safe and reliable supplier of energy to Asia for 35 years,” she said.

Electrolyzer Maker Hystar Lands $28MM Grant from EU

Norway-based electrolyzer manufacturer Hystar was awarded a €26 million (US$28 million) grant from the EU Innovation Fund, the company said Oct. 23.

The grant will go toward the installation and operation of Hystar’s automated gigawatt production line for the company’s PEM electrolyzer stacks at its Høvik, Norway site.

Hystar aims to rapidly scale its operations with automation and using existing supply chains for key components, it said. The company is targeting an annual capacity of 1.5 GW when the site starts operations in 2027 and to 4.5 GW of annual capacity in 2031.

“Our Høvik GW factory demonstrates our commitment to rapidly expanding our European operations and meeting the strong demand for our technology globally,” said Hystar CEO Fredrik Mowill. “The EU Innovation funding will enable us to drive unseen levels of cost and production efficiencies, which is particularly important across hard-to-abate sectors.”

Repsol Freezes Green Hydrogen Projects in Spain

(Reuters) Spanish oil major Repsol has put on hold planned green hydrogen projects in Spain with an electrolysis capacity of 350 megawatts (MW) due to an unfavorable regulatory environment, a spokesperson told Reuters on Oct. 21.

The company had already warned that regulatory uncertainty, including the possibility that a windfall tax on energy companies and banks could be redesigned and become permanent, could affect its investment in the nascent industry.

With Spain targeting 12 GW of green hydrogen production capacity by the end of the decade, Repsol's move may have broader implications for the country’s green agenda.

A 100-MW project in Cartagena, with a planned investment of more than 200 million euros ($217 million), is among those put on hold, along with a 150-MW capacity project in Tarragona and a 100-MW project in the Basque country.

Repsol’s next electrolyzer will be built in Portugal, the spokesperson said.

Green hydrogen—hydrogen produced using renewable electricity—is seen as key to decarbonizing Europe’s economy. However, given its cost, green hydrogen projects in general are not competitive without subsidies.

Neste Scraps Investment in Renewable Hydrogen in Tough Biofuel Market

(Reuters) Neste has withdrawn from an investment into renewable hydrogen production at its plant in Porvoo, Finland, the oil refiner and biofuel maker said after its third-quarter core earnings missed expectations on Oct. 24.

The Helsinki-listed group said it would need to re-evaluate any new investments due to the challenging market conditions, and added it was seeking alternative ways to utilize renewable hydrogen in Porvoo.

Neste’s decision seems like a typical re-evaluation of investment projects during harsh times rather than a sign of some bigger changes, Inderes analyst Petri Gostowski said.

“Given their financial situation and weakened earnings outlook, this kind of rethinking of investments is what one could expect,” he added.

The company, whose renewable diesel can substitute its fossil counterpart to cut emissions of existing vehicles, has been hit by falling prices for the fuel amid weak global demand and supply glut, while coping with consistently high input costs.

Its adjusted EBITDA slumped 66% to 293 million euros ($316 million) in the third quarter, missing analysts' average estimate of 348 million euros in a company-provided poll.

“The outlook for the global economy continues to be uncertain as a result of geopolitical and trade policy tensions,” CEO Heikki Malinen said in the statement.

Malinen, who officially took the top position last week, added that Neste had launched a group-wide potential analysis following “unsatisfactory” performance in recent quarters, including three outlook cuts so far this year.

He flagged uncertainties around the U.S. clean fuel production credit, which could lead Neste to adjust its production output and lower-than-expected voluntary demand for sustainable aviation fuel.

Neste’s Renewable Products unit’s comparable sales margin fell to $341 per tonne in the quarter from $912 last year, while analysts on average were expecting $360 per tonne.

Solar

BP Completes Acquisition of Solar, Storage Company Lightsource BP

BP on Oct. 24 said it completed the acquisition of the remaining 50.03% interest in utility-scale solar and battery storage developer Lightsource BP.

The acquisition was originally announced in November 2023 when BP said it agreed to take full ownership of the solar company by acquiring an additional stake in the company.

“While BP will take on full ownership, Lightsource BP will retain its standalone operating model and independent brand, delivering renewable and affordable energy to businesses and communities across the world. bp will look to unlock further value by bringing a strategic partner into the business in due course,” BP said in a news release Oct. 24.

The solar company has a 62-GW development pipeline and operations in 19 global markets.

BP said the acquisition is expected to help the company meet its power demand as well as its customers’.

“I’m excited to begin the next chapter, taking Lightsource BP to a new level of profitability, growth and performance,” said Joaquin Oliveira, Lightsource BP’s group chief executive. “We will continue to scale this successful business, and also apply its capabilities to support BP’s low carbon energy business.”

Wind

Equinor Nears Financial Close of Empire Wind Project

Equinor is approaching the financial close of its 2.1-GW Empire Wind project offshore New York, the Norway-based company said Oct. 24.

Speaking during the company’s third-quarter 2024 earnings call, Equinor CFO Torgrim Reitan said 2024 is the year of de-risking Empire Wind. The project has in place a new price contract, which increased from $118 per megawatt hour (MWh) to $155/MWh, he said.

“We have completed permitting and are well on the way in sort of developing it,” Reitan told analysts. “We are now approaching financial close of the project. So, we expect that to be a few weeks down the road and happening before year-end as such. So then that asset will be derisked.”

The project is being developed as Empire Wind 1 and Empire Wind 2, with the first expected to be complete in 2026. Combined, the projects will have the potential to power about 1 million New York homes, the company has said. The site will include 147 turbines.

Reitan also reiterated Equinor’s plans to farm down Empire Wind, further lowering capex. Earlier this year, Equinor entered an agreement in which BP took full control of the Beacon Wind project, while Equinor took over the Empire Wind project.

Brazil’s Eletrobras, Ocean Winds Form Wind Partnership

Ocean Winds, the offshore wind joint venture of EDP Renewables and Engie, has formalized a partnership with Brazil-based Eletrobras to study development of offshore wind in Brazil, according to an Oct. 22 news release.

The alliance brings together Ocean Wind’s expertise in developing and operating offshore wind projects with the Brazilian electric utilities company’s experience in power generation and transmission. Ocean Winds said it is focusing on Brazil because of the country’s renewable energy demand growth potential among other reasons.

“Eletrobras aims to allocate its capital appropriately through the development of clean energy projects, contributing to the energy transition in Brazil and around the world,” said Leonardo Soares Walter, M&A and business development director for Eletrobras. “Today, 97% of the energy generated by the company already comes from clean and renewable sources, and we will quickly reach 100% through the sale of thermal power plants underway.”

Eletrobras also aims to become net zero by 2030.

GE Vernova to Remove Some Vineyard Wind Blades After Quality Checks

(Reuters) GE Vernova will remove some turbine blades installed at the Vineyard Wind offshore wind farm off the coast of Massachusetts following quality checks prompted by the failure of a blade in July, the company said Oct. 23.

Progress on the still-unfinished project is being closely watched since it was barred from producing power or completing construction after a turbine blade broke and sent debris into the water that washed up on nearby beaches during the peak summer tourist season.

The blade saga has been a blow to the nation’s budding offshore wind industry, which is regarded as critical to meeting U.S. President Joe Biden’s climate change goals. The turbine maker blamed a manufacturing flaw for the accident at the nation’s first major offshore wind farm and has spent months inspecting blades with ultrasound images and drones.

“Out of an abundance of caution, GE Vernova intends to remove some blades from the Vineyard Wind farm while strengthening other blades as needed to support the safety and operational readiness of this project,” GE Vernova and Vineyard Wind said in a joint statement.

The companies also said they were granted approval this week by federal safety authorities to resume installation of new blades at the project once certain safety and operational conditions are met. They did not give a timeline for when they expect those conditions to be met.

The Bureau of Safety and Environmental Enforcement confirmed that it would allow certain construction activities on a case-by-case basis. The agency is still investigating the incident, and said Vineyard Wind is required to provide a root cause analysis as soon as it is available.

“There is no timetable for the completion of the investigation, as BSEE focuses on ensuring that the investigation is thorough and complete,” a spokesperson said in an emailed statement.

Vineyard Wind is a joint venture between Avangrid and Copenhagen Infrastructure Partners. Avangrid is a unit of Spain’s Iberdrola.

RELATED

Dominion Energy, Stonepeak Close $2.6B Offshore Wind Deal

Reuters and Hart Energy Staff contributed to this report.

Recommended Reading

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-16 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Halliburton Secures Drilling Contract from Petrobras Offshore Brazil

2025-01-30 - Halliburton Co. said the contract expands its drilling services footprint in the presalt and post-salt areas for both development and exploration wells.

PrePad Tosses Spreadsheets for Drilling Completions Simulation Models

2025-02-18 - Startup PrePad’s discrete-event simulation model condenses the dozens of variables in a drilling operation to optimize the economics of drilling and completions. Big names such as Devon Energy, Chevron Technology Ventures and Coterra Energy have taken notice.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.