Standard Lithium and partner Equinor could get up to $225 million in a financial boost for their South West Arkansas lithium extraction project after selection for award negotiations by the U.S. Department of Energy.

The company’s joint venture, SWA Lithium, must complete final negotiations to receive what could be one of the largest U.S. awards to a critical minerals project, Standard said in a Sept. 20 news release.

News of the award negotiations came as the U.S. continues its quest to increase domestic production of lithium, a critical material used for batteries.

“This decision by the Department of Energy validates the caliber of the project we are building through our de-risked approach to project development, strong partnerships, methodical testing, and purpose-built processes tailored to meet the specific demands of large-scale lithium production in the Smackover Formation,” Standard Lithium CEO David Park said.

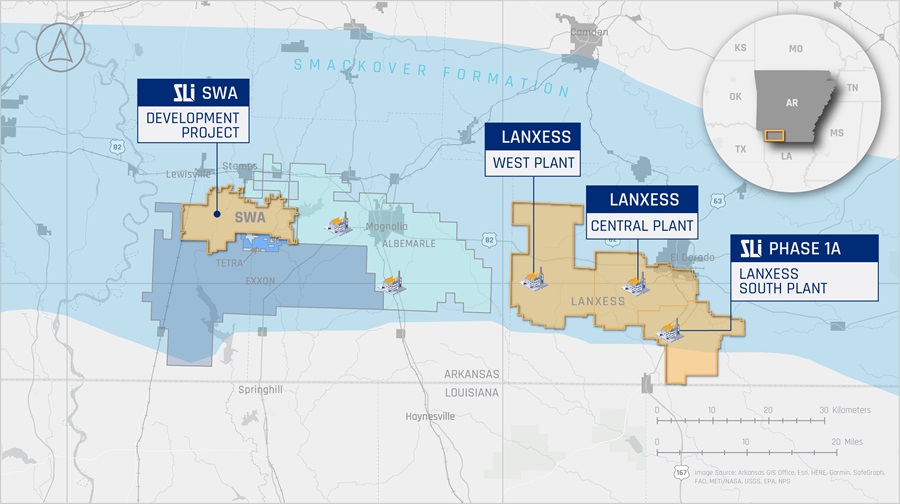

The funding will go toward construction of the central processing facility for the first phase of the South West Arkansas project, which is being designed to produce 22,500 tonnes of battery-quality lithium carbonate using direct lithium extraction (DLE) technology.

DLE, which separates lithium from brine, is considered a more efficient method of extracting lithium. It takes less time and requires less space than traditional methods involving mining and evaporation ponds. Brine for SWA will be sourced from land in Arkansas’ Lafayette and Columbia counties, Standard said. The DLE and lithium carbonate facilities will be located on a 118-site in Lafayette County. The two-phase project aims to develop a total of 45,000 tonnes per annum of lithium carbonate.

“The U.S. Department of Energy’s support for the South West Arkansas project demonstrates how important lithium is to America’s energy transition,” said Allison Thurmond, vice president of U.S. Lithium at Equinor. “This award underscores the commercial readiness of our projects and the strength of our partnership.”

Here’s a look at other renewable energy news.

Bioenergy

Woodland Biofuels Plans to Invest $1.35B for RNG, Hydrogen Plants

Ontario, Canada-based Woodland Biofuels said it plans to invest $1.35 billion at the Port of South Louisiana to establish a large-scale renewable natural gas plant and green hydrogen facility.

The renewable fuels company will utilize waste biomass to produce sustainable biofuel used in transportation, heating and electricity generation at the port’s Globalplex multimodal facility.

Phase 1 of the project will focus on developing the RNG facility and is expected to permanently remove 210,000 tonnes of CO2 annually, the company said in a Sept. 17 news release. Phase 2 will involve developing the so-called “ultra-green” hydrogen plant, which aims to remove about 660,000 tonnes of CO2 annually.

Details on the facilities’ RNG and hydrogen production capacity were not disclosed.

“Ultimately, the project is expected to be one of the largest carbon dioxide removal projects globally—permanently removing millions of tonnes of CO2 from the ecosystem,” Woodland Biofuels said.

The company plans to start commercial operations for the first phase in 2028.

To support the project, the Louisiana Economic Development offered Woodland more than $250 million in incentives, which includes performance-based grants and the comprehensive workforce development solutions, the company said.

Eneos Launches SAF Book, Claim Service with Shell’s Avelia

Japan’s Eneos said on Sept. 18 the company has launched a sustainable aviation fuel (SAF) book and claim service through Shell’s blockchain-powered Avelia.

The solution provides fully traceable environmental attributes (EA) of SAF to customers, Eneos said. Environmental attributes are used to track the impact of benefits associated with renewable energy. Eneos said using pure SAF can reduce lifecycle emissions by up to 80% compared to conventional jet fuel.

SAF, which can be blended with conventional jet fuel, is produced using a variety of feedstock. These include used cooking oil, municipal solid waste, seaweed and captured CO2. Its lower lifecycle emissions are seen as a key lever for airlines looking to reduce carbon emissions.

“With Avelia, the EA of SAF can be decoupled from its physical form and claimed by airlines to reduce their direct Scope 1 emissions as well as by corporates engaging in air travel and/or air freight activities to reduce their indirect scope 3 emissions,” Eneos said in the release.

RELATED

RNG Producer OPAL Recovers 25% of Capex from Tax Credits Sale

Hydrogen

Shell Taps Advanced Ionics for Electrolyzer Pilot Project

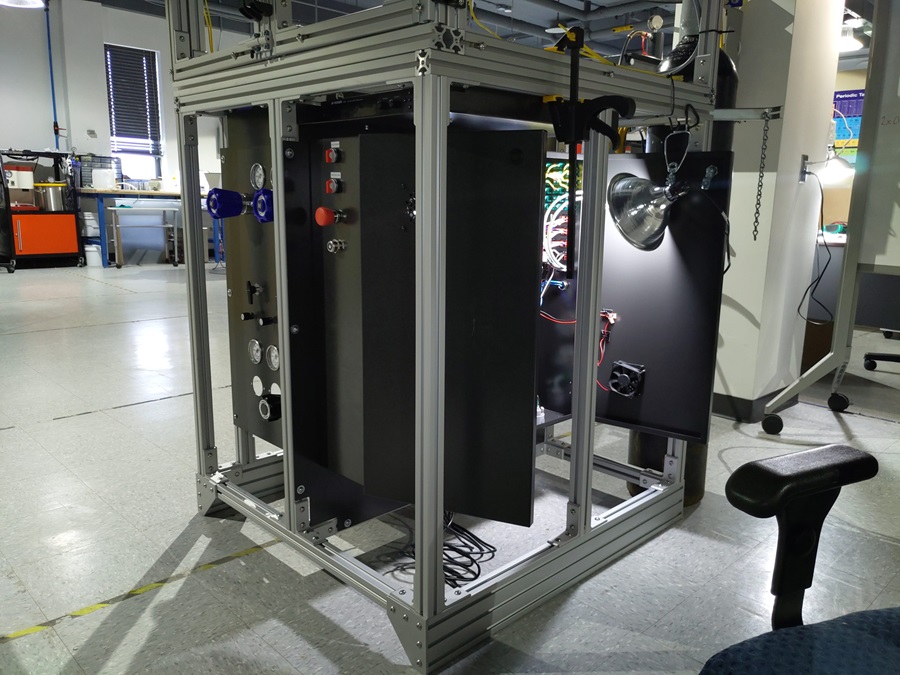

Oil giant Shell plans to test water vapor electrolyzer technology developed by Wisconsin-based Advanced Ionics, aiming to lower hydrogen production costs, the startup said Sept. 17.

Part of Shell’s GameChanger program, the pilot project is intended to help scale Advanced Ionics’ second-generation, 800 sq cm stack and move it toward commercialization. Shell plans to test this system to demonstrate the technology’s suitability and applicability for its renewable hydrogen needs and possibly for ammonia production, Advanced Ionics said in a news release.

“We’re excited to support Advanced Ionics through the Shell GameChanger program,” said Ed Holgate, principal for Shell GameChanger. “Their innovative intermediate temperature technology, which utilizes available steam to reduce electricity consumption, promises to potentially enhance efficiency and sustainability in the petrochemical sector.”

Advanced Ionics’ new class of electrolyzers uses process or waste heat already present at industrial facilities to help bring down costs. The water vapor electrolyzer, called Symbion, is made using materials and steel that are widely available.

The company says its technology enables the production of green hydrogen for less than $1 per kilogram (kg). By using process or waste heat, Advanced Ionics said it can produce hydrogen for 35 kWh/kg, up to 40% less electricity per kilogram of hydrogen produced than alkaline and proton exchange membrane electrolysis technologies.

“The petrochemical industry will struggle to decarbonize without an economic path to producing and selling green hydrogen and derivatives such as green ammonia,” said Advanced Ionics CEO Chad Mason. “Through our partnership with Shell GameChanger, we’re proving a new way to decrease the cost of green hydrogen through more efficient, symbiotic operations.”

Solar

Doral Selects IPSC for Solar Project Asset Management

Philadelphia-based Doral Renewables has tapped IHI Power Services Corp. (IPSC) to provide asset management services for three major utility-scale solar projects in Starke County, Indiana, according to a Sept. 18 news release.

The projects are Mammoth South Solar, Mammoth Central I Solar and Mammoth Central II Solar.

The award follows Doral’s selection of IPSC to provide asset management services for the Great Bend Solar project and Mammoth North Solar project, which is the first phase of the Mammoth Solar project. Combined, the four-phase Mammoth Solar Project is expected to generate 1.3 gigawatts (GW) of energy, the release stated.

The first phase of the project is expected to begin operations in the coming weeks. Full construction on the other three phases are scheduled to begin in the first quarter of 2025.

Wind

US Sets Date for First Offshore Lease Sale in Gulf of Maine

The U.S. will have its first offshore wind lease sale in the Gulf of Maine on Oct. 29, offering eight areas offshore Massachusetts, New Hampshire and Maine, the Interior Department said Sept. 16.

The move, which came about a month after the Interior Department granted an offshore wind research lease to the state of Maine, is another step toward efforts to deploy 30 GW of offshore wind by 2030. The Gulf of Maine areas could deliver about 13 GW of offshore wind energy, if fully developed. That would be enough energy to power more than 4.5 million homes, the federal agency said.

“The upcoming Gulf of Maine offshore wind energy auction reflects our all-of-government approach for reaching the Biden-Harris administration’s energy goals while combatting the climate crisis,” said Bureau of Ocean Energy Management Director Elizabeth Klein. “Together, we can do our part to facilitate a new American industry while fostering job growth and promoting equitable economic opportunities for all communities.”

So far, the Interior Department has held five offshore wind lease sales, including offshore New York, the Pacific, Central Atlantic and the Gulf of Mexico. It has also approved 10 commercial-scale offshore wind projects.

BP to Sell its US Onshore Wind Business

BP plans to sell its U.S. onshore wind energy business, the company announced on Sept. 16, saying the assets were not aligned with its growth plans, Reuters reported.

BP said it will launch the sale process shortly for the wind assets, BP Wind Energy, which has interests in 10 operating onshore wind energy assets across seven U.S. states.

“We believe the business is likely to be of greater value for another owner,” William Lin, BP's executive vice president for gas and low carbon energy, said in a statement.

Several offshore wind companies have cancelled or sought to renegotiate power contracts for planned U.S. projects in the past year, citing soaring materials costs, high interest rates and supply chain disruptions.

BP Wind Energy’s assets, which have net total generating capacity of 1.3 GW, are not aligned with BP's plans for growth in Lightsource BP, the London-listed company said.

BP announced in November it would take full ownership of Lightsource BP, Europe’s largest solar energy developer. The deal to build up its renewable energy capacity is expected to be complete by the end of the year.

On Sept. 16, the company said it would integrate its onshore renewable power development into Lightsource BP.

The move also comes as BP’s new CEO Murray Auchincloss imposes a hiring freeze and paused new offshore wind projects as he places a renewed emphasis on oil and gas amid investor discontent over its energy transition strategy, sources at the company told Reuters in June.

Germany’s Onshore Wind Auction Sets Record with Nearly 3 GW in Bids

Germany’s Federal Network Agency said on Sept. 17 it awarded contracts for almost 3 GW of onshore wind energy in its latest auction, the highest volume ever, marking a significant step towards the country's renewable energy targets.

Germany aims to cover 80% of its electricity needs with renewables by 2030 in a step to become climate neutral by 2045.

“This auction is a record. The bid volume of almost 3 GW exceeds the required annual expansion target of 2.5 GW,” said agency President Klaus Mueller in a statement.

Some 239 bids totaling 2,961 megawatts (MW) were submitted for the Aug. 1 auction, exceeding the 2,709 MW on offer, making it the first oversubscribed auction since February 2022.

The agency attributed the oversupply to an unusually large number of bids with older permits submitted compared with previous rounds.

Bid prices in the auction ranged between 5.73 euro cents and 7.35 euro cents per kilowatt-hour (ct/kWh), with the average awarded price reaching 7.33 ct/kWh, just below the maximum permitted price of 7.35 ct/kWh, it added.

The agency said it will determine the volume of the next auction, due in November, by Oct. 18.

Reuters and Hart Energy Staff contributed to this report.

Recommended Reading

Inside Prairie’s 11-Well Program in the D-J

2025-04-08 - Prairie Operating Co.’s 11-well program in the Denver-Julesburg Basin is drilling horizontal 2-milers with a Precision Drilling rig.

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.